For decades, Reliable banking has been a cornerstone of financial stability in Australia, and one institution has stood out for its commitment to serving the needs of Australians. With a long history of providing top-notch banking services, this institution has earned the trust of millions.

Westpac Altitude Black

As a leading Australian bank, it offers a comprehensive range of financial products and services, from everyday banking to loans and investments, all designed to meet the diverse needs of its customers. Its commitment to customer satisfaction and community involvement has made it a household name.

Key Takeaways

- Westpac is a trusted name in Australian banking.

- It offers a wide range of financial products and services.

- The bank is committed to customer satisfaction.

- It has a strong history of community involvement.

- Reliable banking services for individuals and businesses.

Anúncios

🇦🇺 AUSTRALIA: STEP-BY-STEP TUTORIAL – How to Apply for the Westpac Altitude Black Credit Card

Follow this guide to apply for the Westpac Altitude Black Credit Card, Westpac’s premium travel rewards option, ideal for frequent travellers seeking top-tier benefits.

Anúncios

Introduction: Why Choose the Altitude Black Card?

The Westpac Altitude Black is Westpac’s highest-tier rewards card. It offers high-value travel benefits, including:

- Earning Altitude Points (which can be transferred to frequent flyer programs like Qantas Frequent Flyer and Velocity Frequent Flyer).

- Airport Lounge Access (subject to eligibility and annual fee payment).

- A comprehensive complimentary travel insurance package.

- High Annual Fee and stringent Minimum Income Requirements.

Before You Start: Eligibility Checklist

To apply for this card, you must generally:

- Be 18 years of age or older.

- Be an Australian citizen, Permanent Resident, or hold an approved Australian visa with more than 12 months remaining.

- Meet the Minimum Annual Income Requirement (often above $75,000 or $120,000).

- Not have held an Altitude family card within the last 12 months to be eligible for welcome offers.

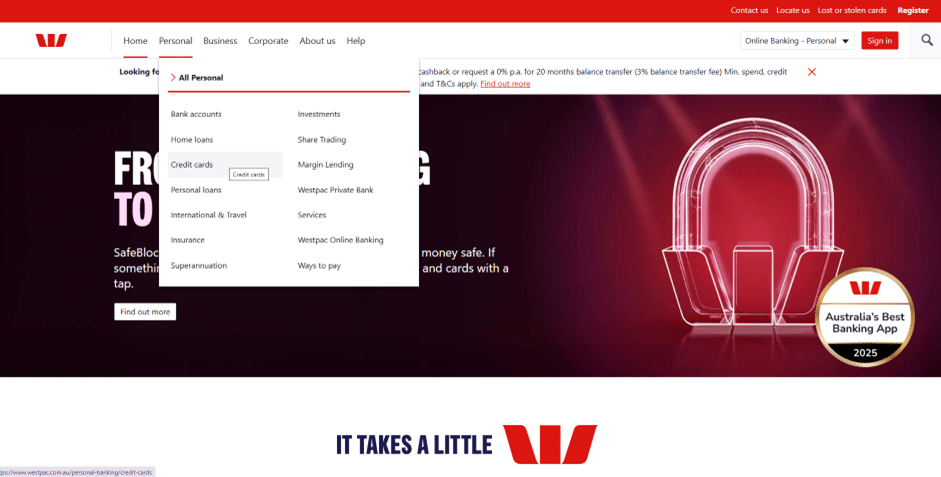

Step 1: Access the Credit Cards Section

Your application starts on the main Westpac website.

- Access the Westpac homepage:

https://www.westpac.com.au/ - In the main navigation menu, click the second option, “Personal”, and then select the third option, “Credit Cards”.

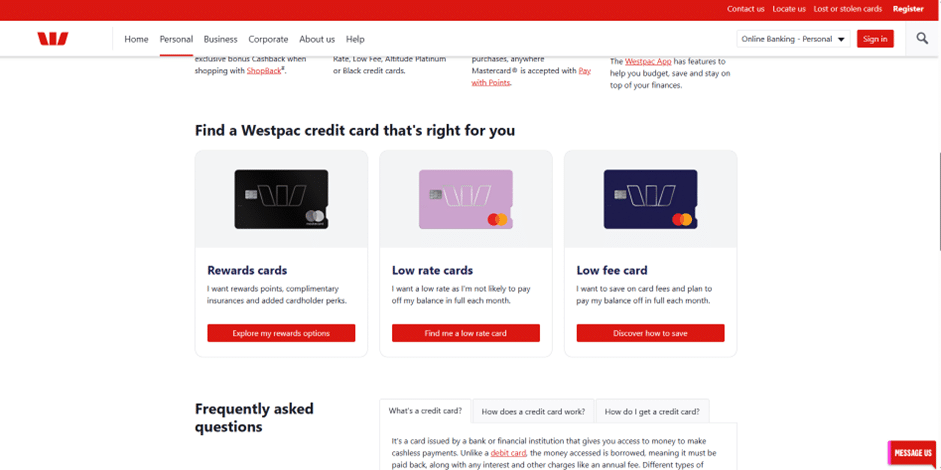

Step 2: Choose the “Reward Cards” Option

On the Credit Cards page, refine your search to rewards cards.

- At the top of the page, or among the first options, click on “Reward Cards”.

- Select the option “Explore my reward Options” to view all available points-earning cards.

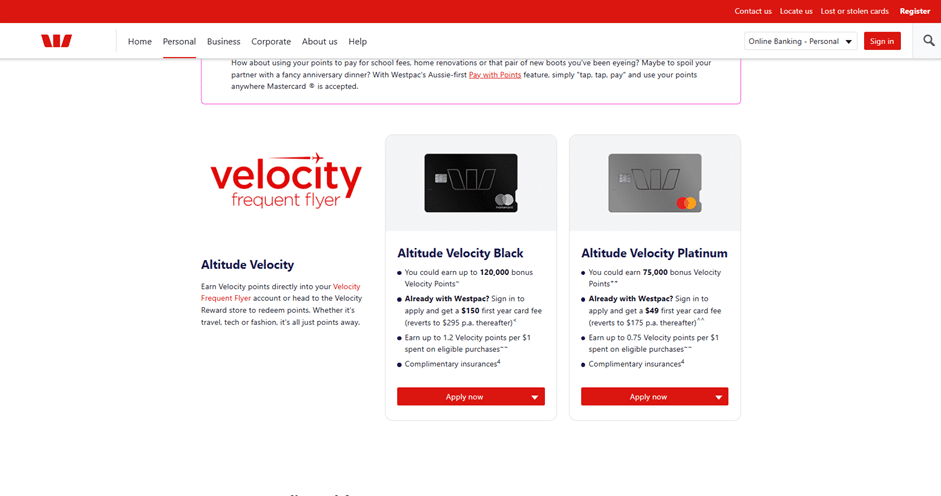

Step 3: Select the Altitude Black Card

On the rewards cards listing page, find the premium Altitude Black Card.

- Scroll down the page until you see the listing of all the cards (where you might also see options like Low Rate Lite or Low Fee).

- The Altitude Black is the top-tier rewards card.

- Click the red button “Apply now” associated with the Altitude Black.

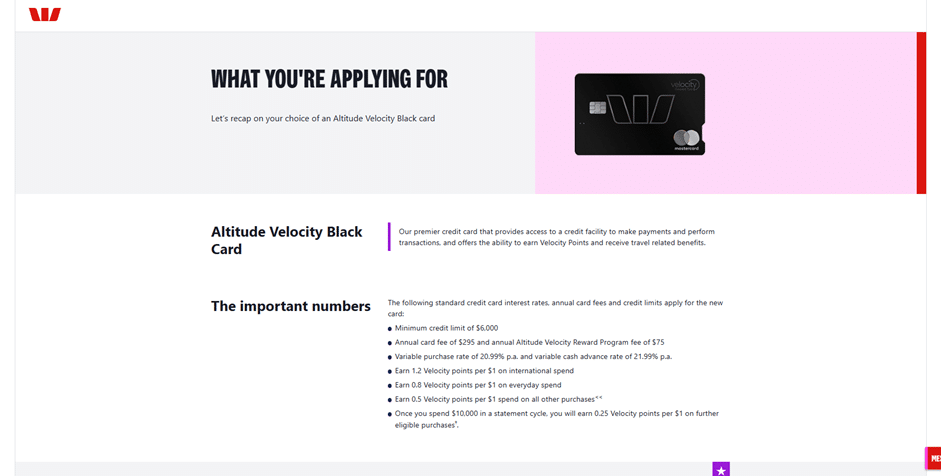

Step 4: Initiate the Online Application

You will be directed to the details and application initiation page.

- On this page, review all the card’s benefits (Annual Fee, Points Earning, Insurance, Lounge Access).

- Click the white button “Apply now”.

- Customer Choice: You will be presented with a page to select your customer status:

- “I’m a Westpac customer” – Log in with your details to speed up the process.

- “I’m new to Westpac” – Continue the application as a guest.

- Choose the appropriate option and follow the instructions to complete the detailed online form.

The Legacy of Westpac in Australian Banking

Westpac’s legacy in Australian banking is a story of resilience, innovation, and commitment to the nation’s financial well-being. With a history that spans over 200 years, Westpac has established itself as a cornerstone of the country’s financial system.

A 200+ Year History of Financial Service

Since its inception, Westpac has provided a range of financial services that have evolved to meet the changing needs of Australians. From humble beginnings to its current status as one of the Big Four banks, Westpac’s journey is a testament to its adaptability and commitment to customer satisfaction.

Westpac’s Role in Australia’s Economic Development

Westpac has played a significant role in Australia’s economic development, supporting growth through various economic cycles.

Supporting Growth Through Major Economic Periods

Some key ways Westpac has contributed include:

- Providing financial solutions to businesses and individuals during periods of economic expansion.

- Navigating the challenges of economic downturns, such as the Global Financial Crisis.

- Investing in initiatives that promote financial literacy and inclusion.

Through its long history, Westpac has demonstrated its ability to support Australia’s economic development, making it a trusted banking partner for Australians.

Westpac’s Position in Australia’s Banking Landscape

Westpac’s presence is deeply rooted in Australia’s financial history, positioning it uniquely within the banking landscape. As one of the Big Four Banks, Westpac has a significant impact on the country’s financial sector.

The Big Four Banks and Westpac’s Market Share

Westpac, along with the other Big Four Banks (Commonwealth Bank, ANZ, and NAB), dominates the Australian banking market. Westpac’s market share is substantial, with a significant portion of Australian households and businesses banking with them. The bank’s extensive range of financial products and services contributes to its strong market presence.

Regulatory Framework and Compliance

The Australian banking industry is heavily regulated, with institutions like the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC) overseeing banking practices. Westpac must comply with these regulations to maintain its operating license.

Response to Banking Royal Commission

In response to the Banking Royal Commission, Westpac has implemented several reforms to improve its compliance and governance practices. Key actions include:

- Enhancing customer due diligence processes

- Improving financial product design and distribution

- Strengthening risk management frameworks

These changes demonstrate Westpac’s commitment to regaining customer trust and adhering to the regulatory framework.

Everyday Banking Solutions from Westpac

Westpac offers a range of everyday banking solutions tailored to meet the diverse needs of its customers. These solutions are designed to simplify financial management, providing ease and flexibility in daily banking.

Transaction and Savings Accounts

Westpac’s transaction and savings accounts are designed to cater to various customer needs. The Choice and Everyday Banking options provide customers with flexibility in managing their finances.

Choice and Everyday Banking Options

The Choice account offers a range of benefits, including the ability to earn interest and access to a variety of banking services. The Everyday Banking account is designed for daily transactions, offering features such as unlimited transactions and easy access to your money.

Term Deposits and Investment Accounts

For customers looking to invest, Westpac offers term deposits and investment accounts. These products provide a secure way to save, with competitive interest rates and flexible terms.

Fee Structures and Account Benefits

Understanding the fee structures and benefits associated with Westpac’s banking products is crucial. The bank provides transparent fee structures, and many accounts come with benefits such as bonus interest rates for meeting certain conditions.

By offering a range of everyday banking solutions, Westpac enables Australians to manage their finances effectively. Whether it’s through transaction accounts, savings accounts, or term deposits, customers can choose products that best suit their financial goals.

Westpac Home Loan Products for Australians

Westpac’s home loan offerings are designed to cater to various needs, from first home buyers to seasoned investors. With a range of options available, Australians can find a home loan that suits their financial situation and goals.

First Home Buyer Solutions

Westpac understands the challenges faced by first home buyers and offers tailored solutions to help them get started. These include competitive interest rates and flexible repayment options.

Government Scheme Participation

Westpac participates in various government schemes designed to assist first home buyers, such as the First Home Owner Grant and the First Home Loan Deposit Scheme. These schemes can significantly reduce the financial burden of purchasing a first home.

Fixed and Variable Rate Options

Westpac offers both fixed and variable rate home loans, allowing customers to choose the option that best suits their financial plans. Fixed rates provide stability, while variable rates offer flexibility.

Investment Property Financing

For investors, Westpac provides competitive home loan options for investment properties. This includes loans for rental properties and other investment purposes, with flexible terms and competitive interest rates.

Refinancing Opportunities

Westpac also offers refinancing options for homeowners looking to switch their home loan to a different lender or to renegotiate their loan terms with their current lender. This can help in securing better interest rates or more favorable loan conditions.

By offering a wide range of home loan products, Westpac caters to the diverse needs of Australians, whether they are first home buyers or experienced property investors.

Credit Cards and Personal Financing Options

Westpac offers a diverse range of credit cards and personal financing options tailored to meet the varied needs of Australians. Whether you’re looking for a credit card with rewards or a personal loan to consolidate debt, Westpac has a solution for you.

Credit Card Range and Features

Westpac’s credit card offerings include a variety of cards with different features, such as low-interest rates, rewards programs, and balance transfer options. Some of the key benefits include:

- Rewards Programs: Earn points or cashback on your purchases with cards like the Westpac Rewards Credit Card.

- Low-Interest Rates: Cards like the Westpac Low Rate Credit Card offer competitive interest rates to help you save on interest charges.

- Balance Transfer Options: Take advantage of low or 0% interest rate balance transfer offers to consolidate your debt.

Personal Loans and Debt Consolidation

For those needing more substantial financing, Westpac offers personal loans with flexible repayment terms. These loans can be used for a variety of purposes, including debt consolidation.

Debt consolidation with Westpac can simplify your finances by combining multiple debts into a single loan with a potentially lower interest rate and a single monthly repayment.

Approval Processes and Eligibility

The approval process for credit cards and personal loans at Westpac involves assessing your eligibility based on factors such as your credit score, income, and financial history.

Australian Credit Scoring Considerations

Your credit score plays a significant role in determining your eligibility for credit cards and personal loans. A good credit score can improve your chances of approval and may qualify you for better interest rates.

To maintain a healthy credit score, it’s essential to:

- Make timely payments on your debts.

- Keep your credit utilization ratio low.

- Monitor your credit report for errors.

Business Banking with Westpac

For businesses across Australia, Westpac provides robust banking services designed to support growth and financial stability. With a deep understanding of the diverse needs of businesses, Westpac offers a comprehensive suite of financial solutions.

Small Business Banking Solutions

Westpac caters to the needs of small businesses with tailored banking solutions, including transaction accounts, savings options, and loan facilities. These products are designed to help small businesses manage their finances effectively and achieve their goals.

- Transaction accounts with flexible fee structures

- Savings accounts with competitive interest rates

- Loan facilities for business expansion

Corporate and Institutional Services

For larger corporations and institutional clients, Westpac provides sophisticated financial services, including cash management, trade finance, and treasury services. These services are designed to meet the complex financial needs of corporate clients.

Key Features:

- Advanced cash management solutions

- Trade finance options for international trade

- Treasury services for risk management

Merchant Facilities and Payment Systems

Westpac offers a range of merchant facilities and payment systems to help businesses process transactions efficiently. This includes EFTPOS terminals, online payment gateways, and other payment solutions.

EFTPOS and Online Payment Integration

With Westpac’s EFTPOS and online payment integration services, businesses can process transactions seamlessly, enhancing customer experience and improving cash flow management.

The Digital Banking Experience at Westpac

Westpac has been at the forefront of digital banking, providing Australians with convenient and secure financial management tools. The bank’s commitment to digital innovation is evident in its comprehensive range of digital banking services.

Enhancing Customer Experience

The Westpac mobile banking app is designed to offer customers a seamless and intuitive banking experience. With features such as account tracking, transaction history, and bill payments, customers can manage their finances on the go. The app is available for both iOS and Android devices, ensuring that a wide range of customers can access its benefits.

Key Features of the Mobile Banking App:

- Real-time account updates

- Secure login using biometric authentication

- Easy bill payments and transfers

- Customizable account alerts

Online Banking Platform Capabilities

Westpac’s online banking platform provides a robust and user-friendly interface for managing finances. Customers can perform a variety of tasks, including transferring funds, paying bills, and applying for loans. The platform is designed to be accessible and secure, ensuring a smooth banking experience.

Digital Payment Solutions

Westpac offers a range of digital payment solutions, making it easier for customers to make transactions. The bank supports various digital payment methods, including credit and debit cards, Apple Pay, Google Pay, and PayID.

Integration with Apple Pay, Google Pay, and PayID

Westpac has integrated its services with popular digital payment platforms. This allows customers to make payments using their mobile devices, enhancing convenience and security. As Westpac notes, “Our digital payment solutions are designed to provide a seamless and secure payment experience.”

“The integration of digital payment solutions like Apple Pay and Google Pay has transformed the way we make transactions, offering a more convenient and secure experience.” –

By embracing digital banking, Westpac continues to innovate and improve its services, providing Australians with reliable and efficient financial management tools.

Westpac’s Customer Service Network

Westpac prioritizes customer satisfaction through its comprehensive service network, designed to cater to the diverse needs of Australians. With a strong presence across the country, Westpac’s customer service is accessible through various channels.

Branch Locations Across Australia

Westpac operates numerous branch locations across Australia, ensuring that customers have access to face-to-face banking services. These branches are strategically located in metropolitan and regional areas, making it convenient for customers to manage their finances.

Telephone and Online Support Options

In addition to physical branches, Westpac offers robust telephone and online support options. Customers can access assistance via phone, online chat, or email, providing flexibility and convenience in managing their banking needs.

Specialised Advisory Services

Westpac also provides specialised advisory services to help customers achieve their financial goals. These services include expert advice on various banking products and financial solutions.

Financial Planning and Wealth Management

A key aspect of Westpac’s advisory services is financial planning and wealth management. Experts at Westpac help customers create personalized financial plans, ensuring they are well-equipped to manage their wealth and achieve long-term financial security.

By offering a multi-channel approach to customer service, Westpac demonstrates its commitment to meeting the evolving needs of its customers. Whether through branch visits, phone calls, or online support, Westpac’s customer service network is designed to provide reliable and efficient support.

Security and Fraud Protection Measures

Westpac’s dedication to security and fraud protection is evident in its multi-layered approach to online banking. The bank has implemented a range of measures to safeguard customer data and prevent fraudulent activities.

Online Banking Security Features

Westpac’s online banking platform is equipped with advanced security features, including two-factor authentication and encryption, to protect customer information. These features ensure that customer data remains secure during transactions.

Fraud Monitoring and Prevention Systems

The bank employs sophisticated fraud monitoring systems to detect and prevent suspicious activities. These systems are designed to identify potential threats and alert customers to take necessary actions.

Customer Education and Resources

Westpac provides various resources to educate customers on security best practices and how to avoid scams. This includes online guides, workshops, and alerts on emerging scams.

Scam Prevention Initiatives

As part of its scam prevention initiatives, Westpac has implemented measures to protect customers from falling victim to common scams. The bank works closely with law enforcement and other financial institutions to share intelligence on potential threats.

By combining advanced technology with customer education, Westpac creates a robust defense against fraud, ensuring a secure banking environment for its customers.

Rewards and Benefits for Westpac Customers

Westpac’s commitment to customer satisfaction is reflected in its diverse rewards and benefits programs. These initiatives are designed to enhance the banking experience, providing customers with added value for their loyalty.

Credit Card Rewards Programs

Westpac’s credit card rewards programs offer customers the opportunity to earn points or cashback on their purchases. With a range of credit cards available, customers can choose the one that best suits their spending habits and enjoy rewards such as flybuys points or cashback on eligible transactions.

Relationship Benefits and Bundling Discounts

Customers who hold multiple products with Westpac can benefit from relationship benefits, including discounts on loan interest rates or fee waivers. By bundling their banking products, customers can enjoy a more streamlined banking experience and reduced costs.

Special Offers and Promotions

Westpac regularly introduces special offers and promotions for its customers, providing exclusive deals on various products and services. These offers can range from discounted interest rates on loans to bonus rewards points on credit card purchases.

Partner Benefits with Australian Retailers

Through partnerships with popular Australian retailers, Westpac customers can enjoy partner benefits, such as discounts or bonus rewards points, when shopping at participating stores. This adds an extra layer of value to the Westpac banking experience, making everyday purchases more rewarding.

By leveraging these rewards and benefits, Westpac customers can maximize their banking experience, enjoying a range of perks that enhance their financial lives.

Westpac’s Community Engagement and Sustainability

Through its community engagement and sustainability programs, Westpac demonstrates its dedication to making a positive impact. Westpac’s initiatives in this area are multifaceted, focusing on enhancing the well-being of communities and promoting environmental sustainability.

The Westpac Foundation’s Impact

The Westpac Foundation plays a pivotal role in Westpac’s community engagement efforts. By supporting various initiatives and programs, the Foundation contributes significantly to the development of Australian communities. Its focus on education, health, and community development aligns with Westpac’s broader commitment to social responsibility.

Environmental Commitments and Initiatives

Westpac is committed to reducing its environmental footprint through various sustainability initiatives. These include efforts to reduce energy consumption, minimize waste, and promote sustainable practices across its operations. By adopting environmentally friendly practices, Westpac aims to contribute to a more sustainable future.

Support for Indigenous Communities

Westpac recognizes the importance of supporting Indigenous communities. Through targeted programs and partnerships, Westpac works to improve economic outcomes and enhance the well-being of Indigenous Australians. These initiatives reflect Westpac’s commitment to reconciliation and its role in promoting positive change.

Disaster Relief and Response Programs

In times of natural disasters, Westpac provides critical support through its disaster relief and response programs. These initiatives not only offer financial assistance but also help communities recover and rebuild. Westpac’s proactive approach to disaster relief underscores its commitment to community resilience.

Conclusion: Why Westpac Remains a Trusted Banking Partner for Australians

Westpac has established itself as a trusted banking partner for Australians, offering a comprehensive range of financial products and services. With a history spanning over 200 years, Westpac’s reliability is built on its commitment to customer service, community engagement, and financial stability.

The bank’s diverse portfolio includes everyday banking solutions, home loan products, credit cards, and personal financing options, catering to the varied needs of its customers. Westpac’s digital banking experience, coupled with its extensive customer service network, ensures that customers can manage their finances efficiently and effectively.

Westpac’s commitment to community engagement and sustainability is evident in its support for Indigenous communities, disaster relief programs, and environmental initiatives. As a result, Westpac continues to be a trusted banking partner, providing Australians with the financial solutions they need to achieve their goals.

FAQ

What is Westpac’s history in Australian banking?

What types of banking products does Westpac offer?

How does Westpac support first home buyers?

What digital banking services does Westpac offer?

How does Westpac protect its customers from fraud?

What rewards and benefits does Westpac offer to its customers?

How can I access Westpac’s customer service?

What is Westpac’s commitment to sustainability and community engagement?

How do I apply for a Westpac credit card or personal loan?

What are the eligibility criteria for Westpac’s home loan products?

Conteúdo criado com auxílio de Inteligência Artificial