Anúncios

The Bank of Ireland Aer Credit Card, issued in partnership with Aer Lingus, is one of Ireland’s premier travel rewards cards. It is specifically designed for frequent travellers and those looking to maximize their spending by earning Avios and accessing exclusive travel benefits.

Aer

This comprehensive, article is based solely on the official information provided by Bank of Ireland and Aer Lingus, detailing the application process, costs, and the substantial travel rewards that distinguish the Aer Credit Card.

Anúncios

🇮🇪 IRELAND: STEP-BY-STEP TUTORIAL – How to Apply for the Bank of Ireland Aer Credit Card

Are you looking for a travel-rewards credit card in the Republic of Ireland? Follow this guide to apply for the Aer Credit Card, a partnership between Bank of Ireland and Aer Lingus.

Introduction: Why Choose the Aer Credit Card?

The Aer Credit Card allows you to collect Avios (travel rewards) on your spending. It’s ideal for frequent travellers and comes with benefits like two return flights to Europe (when you spend €5,000 annually), Fast Track/Priority Boarding passes, and worldwide multi-trip travel insurance.

Anúncios

Before you start: What you need

- You must be over 18 years of age.

- You must be a resident in the Republic of Ireland for 6 months or more.

- You need to join AerClub (Aer Lingus’s loyalty programme) if you haven’t already.

- Proof of identity and address (for verification purposes).

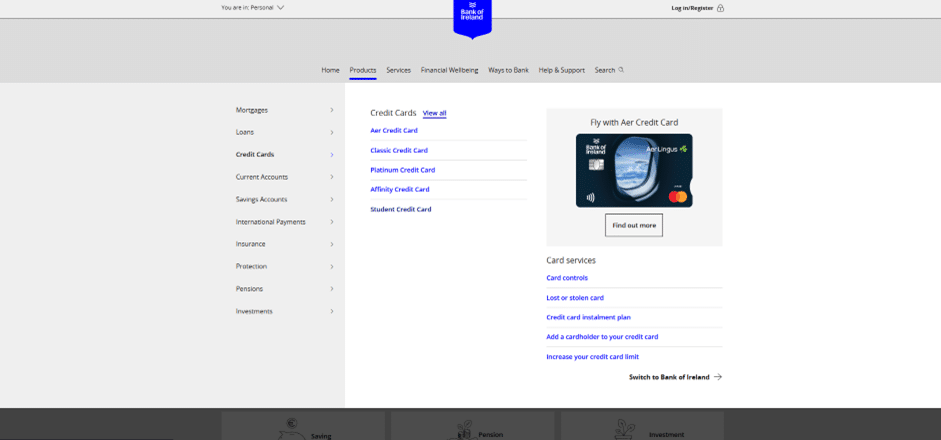

Step 1: Access the Bank of Ireland Credit Cards Page

Your application starts on the main Bank of Ireland website.

- Access the Bank of Ireland Personal Banking homepage:

https://personalbanking.bankofireland.com/ - In the main menu, click the second option: “Borrow” (or “Products” if the menu layout has changed).

- In the ensuing submenu, select the third option: “Credit Cards”, and then click on “View all” (or “Compare Credit Cards”).

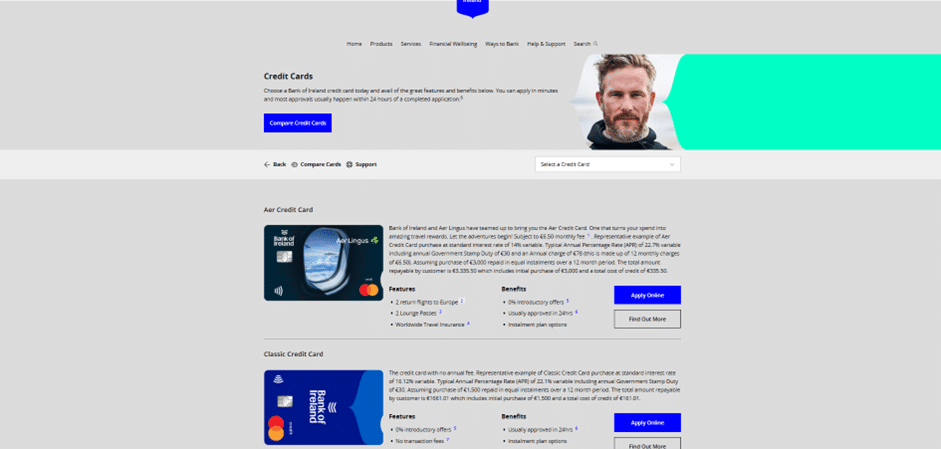

Step 2: Select the Aer Credit Card

On the Credit Cards comparison page, locate and select the Aer Credit Card.

- On this page, you will see various credit card options, such as the Classic, Platinum, and Student Cards.

- Choose the Aer Credit Card, typically the first option, by clicking the “Find out more” button.

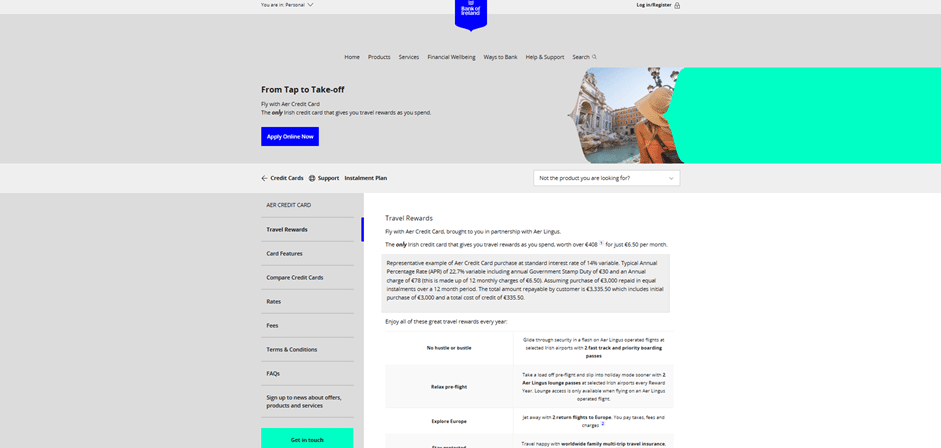

Step 3: Begin the Online Application

You are now on the detailed product page for the Aer Credit Card.

- On this page, you will find all essential information about the card, including the travel rewards, fees (e.g., €6.50 monthly fee), and the Representative APR (typically $\mathbf{14\%}$ variable).

- Click the distinctive blue button, usually labelled “Apply Online Now” or “Apply for an Aer Credit Card”.

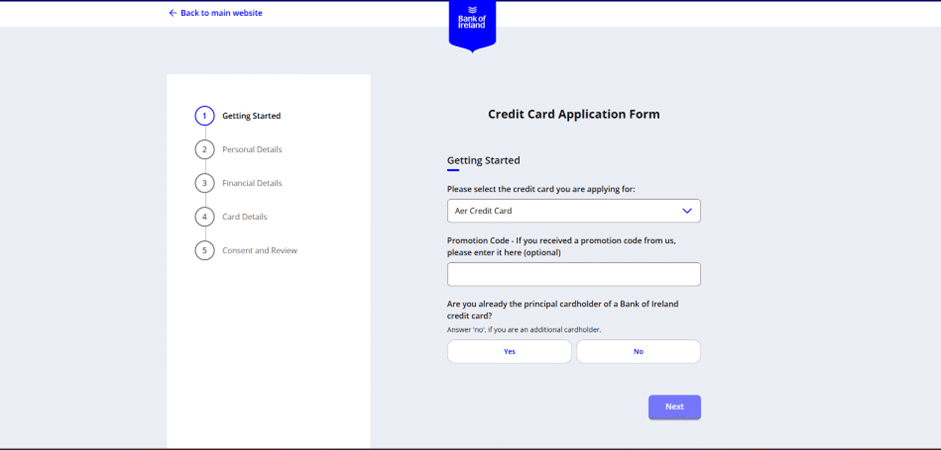

Step 4: Complete the Application

You will be redirected to the dedicated online application portal (often hosted in partnership with Aer Lingus).

- If you are an existing Bank of Ireland customer, the process may be faster (often approved within 24 working hours if documentation is complete).

- You will be asked to fill in your personal, financial, and AerClub details.

- Follow the on-screen instructions, submit the required documentation (electronically or otherwise), and you will soon receive confirmation regarding your Aer Credit Card application status.

Overview of the Bank of Ireland: Credibility and Travel Partnership

The Aer Credit Card is issued by the Bank of Ireland, one of the leading financial institutions in the Republic of Ireland. Understanding the bank’s profile is key to appreciating the card’s standing.

The Bank and the Aer Lingus Partnership:

- Established Institution: The Bank of Ireland is a large, fully regulated financial services group with a significant presence across Ireland, offering a broad range of personal, business, and corporate banking services. This long-standing presence provides a high degree of security and confidence for cardholders.

- AerClub Loyalty: The card is built around a powerful partnership with Aer Lingus, leveraging the AerClub loyalty programme (which uses Avios) to offer tangible and valuable travel rewards. The card effectively transforms everyday spending into flights, lounge access, and insurance.

Bank of Irland

- Regulatory Oversight: As a regulated Irish bank, all lending criteria, including the issuance of the Aer Credit Card, are subject to Central Bank of Ireland regulations, ensuring responsible lending practices and consumer protection.

- Focus on Rewards: The card is strategically positioned within the Bank of Ireland’s portfolio to appeal to a premium travel segment, offering benefits that significantly enhance the overall customer travel experience.

- Conclusion: The Aer Credit Card is a robust financial product backed by a major Irish bank, providing both the security of a traditional lender and the high-value rewards of a dedicated travel card.

Everything People Need to Know to Apply for the Card

The Aer Credit Card is a premium product and, as such, carries specific costs and a rigorous application process focused on financial stability.

1. Key Features and Elite Travel Benefits

The value proposition of the Aer Credit Card lies in its extensive suite of travel rewards, which cardholders can enjoy every year:

| Feature | Details | Value & Conditions |

| Two Return Flights to Europe | Available after reaching €5,000 in eligible spend within 12 months of card issuance. | Cardholder only pays taxes, fees, and charges. Can be gifted to a friend or family member. |

| Avios Collection | Collect 1 Avios for every €1 spent on Aer Lingus products and services. Collect 1 Avios for every €4 spent on all other transactions. | Avios can be redeemed for flights, upgrades, and more within the AerClub programme. |

| 2 Lounge Passes | Access to Aer Lingus lounges at selected Irish airports (Dublin, Cork, Shannon). | Available annually. Must be linked to an AerClub account and used with an Aer Lingus flight. |

| 2 Fast Track & Priority Boarding Passes | Expedite security clearance at selected Irish airports (Dublin, Cork, and Shannon – Fast Track facility varies). | Available annually. For use on Aer Lingus operated flights. |

| Worldwide Multi-Trip Travel Insurance | Comprehensive cover, including Winter Sports, for the Principal Cardholder and their immediate family (underwriting, terms, and conditions apply). | Provides year-round protection, eliminating the need to purchase separate cover for each trip. |

| Introductory Offer | New credit card customers may choose from 0% interest on purchases for the first 6 months or 0% interest on balance transfers for the first 7 months (conditions apply). | A strong incentive for managing initial costs or transferring existing debt. |

2. Fees, Rates, and Costs to Consider

Due to its extensive benefits package, the Aer Credit Card has a distinct fee structure that must be carefully considered:

- Monthly Account Fee: €6.50 per month (total of €78 annually).

- Government Stamp Duty: An annual charge of €30.00.

- Total Annual Cost (Fees): €108.00 (€78.00 + €30.00).

- Typical APR (Variable): A Representative Annual Percentage Rate (APR) of 22.7% (variable). This includes the annual charges (€108.00) and an assumed purchase of €3,000, repaid over 12 months at the standard interest rate of 14% variable.

- Non-Euro Transaction Fee: A 2.25% Cross Border Handling Fee applies to all transactions not conducted in Euro.

3. Application Requirements and Process (A Step-by-Step Guide)

The application for the Aer Credit Card is a standard credit application and requires applicants to demonstrate their creditworthiness and ability to manage the associated fees.

Step 1: Eligibility and Preparation

- Age and Residency: You must be aged 18 or over and a resident of the Republic of Ireland.

- AerClub Membership: Applicants must either already be a member of AerClub or sign up for AerClub before applying, as the rewards system is linked to this account.

- Documentation: Be prepared to provide standard identification (Photo ID, Proof of Address) and financial information (Proof of Income/Repayment Capacity).

Step 2: Application Submission

- Online Portal: The Bank of Ireland provides an application process for the Aer Credit Card, often directing customers to a dedicated Aer Credit Card portal, or through the main Bank of Ireland Personal Banking section.

- Existing Customers: Existing Bank of Ireland customers may find the application process quicker, especially if the bank already holds verification documents.

- New Customers: New customers will be required to complete a full identity and verification process, which may involve providing multiple documents.

Step 3: Approval and Linking Your Card

- Assessment: The bank will perform a full credit check and affordability assessment. Approval is subject to status and terms and conditions.

- Card Issuance: Upon approval, the card will be issued and sent to your address.

- Linking to AerClub: It is essential to link your new Aer Credit Card to your AerClub account via the dedicated Aer Credit Card portal. Failing to do this will prevent you from accessing and redeeming the valuable travel rewards (Fast Track, Lounge Passes, Avios).

Step 4: Redeeming Your Rewards

- Redemption Portal: Rewards like Fast Track and Lounge Passes are redeemed through the Aer Credit Card portal after the card has been activated and linked.

- Free Flights: The two free return flights are unlocked once the minimum spend of €5,000 is reached within the first year. The bank will notify you of your eligibility.

FAQ – Frequently Asked Questions about the Aer Credit Card

Q: How much does the Aer Credit Card cost annually?

A: The total annual cost is €108.00, comprising a monthly account fee of €6.50 (€78 annually) plus the Government Stamp Duty of €30.00.

Q: What is the Representative APR?

A: The Representative APR is 22.7% (variable), which includes the annual fees. The standard purchase interest rate is 14% variable.

Q: How do I get the two free return flights?

A: You must spend a minimum of €5,000 in eligible transactions on the card within the first 12 months.

Q: Do I need to be an AerClub member to apply?

A: Yes, you must be a member of AerClub and link your card to your AerClub account to receive and redeem the travel rewards.

Q: Does the worldwide travel insurance cover my family?

A: Yes, the Worldwide Multi-Trip Travel Insurance typically covers the Principal Cardholder and their immediate family, including winter sports, subject to underwriting, terms, and conditions.

Q: Are there any fees for spending outside the Eurozone?

A: Yes, a 2.25% Cross Border Handling Fee is applied to the Euro converted amount of all transactions made in non-Euro currencies.

Q: How do I redeem my Lounge Passes and Fast Track Passes?

A: These passes are redeemed via the Aer Credit Card portal after the card has been activated and linked to your AerClub account.

Conteúdo criado com auxílio de Inteligência Artificial