Exploring loan options in the US can feel like a big task. There are so many choices out there. This guide aims to make things clearer, helping you find the right loan for your needs.

We’ll cover the basics and dive into specific financial products. This will help you make smart borrowing choices. By the end, you’ll know more about your options and be ready to reach your financial goals.

Chase Freedom Unlimited®

Types of Loans Available in the US

In the United States, people looking for financing have many choices. These choices fall into three main categories: conventional loans, government loans, and special programs. Knowing the differences helps you pick the right one for your needs.

Conventional Loans

Conventional loans come from private lenders and don’t have government backing. They often need a high credit score and a big down payment. These loans are great for those with strong finances and offer various terms.

Government Loans

Government loans are backed by the government. They include FHA, VA, and USDA loans. Each has special benefits for different people. For example, FHA loans help first-time buyers, while VA loans are great for veterans. USDA loans are for those buying homes in rural areas, offering low rates and help.

Special Programs

There are also special programs for different borrowers. These might include help with down payments, education courses, or loans for low-income or underserved communities. Looking into these can reveal options that match your financial situation.

Understanding Loan Terms

It’s key to know about loan terms if you’re thinking about borrowing money. The loan’s length affects your monthly payments and interest rates. Knowing the difference between short-term and long-term loans helps you make a smarter choice.

Short-Term vs. Long-Term Loans

Short-term loans last from a few months to a couple of years. They often have higher interest rates than long-term loans. People choose short-term loans for quick cash without a long-term commitment.

Long-term loans, however, last several years. They let you pay over a longer time, making payments easier.

- Benefits of short-term loans:

- Faster repayment

- Less interest paid overall

- Quick access to funds

- Benefits of long-term loans:

- Lower monthly payments

- Wider acceptance for larger purchases

- Stable payment plans

Implications of Loan Terms on Payments

The loan’s length affects your payments. Short-term loans mean higher monthly payments. Long-term loans make payments easier to handle.

It’s important to think about your finances before choosing. Make sure you can afford the payments without stress.

Interest Rate Types for Loans

Choosing the right interest rate is key to a good loan experience. Knowing the difference between fixed-rate and adjustable-rate loans is important. Each has its own benefits and downsides that affect your payments and financial plans.

Fixed Rate Loans

Fixed-rate loans give you a steady interest rate for the loan’s life. This makes your monthly payments the same, helping with budgeting. They’re great when interest rates are going up because your rate stays the same.

Many homebuyers choose fixed-rate mortgages. It helps them avoid big risks over time.

Adjustable Rate Loans

Adjustable-rate loans have rates that change with the market. They often start with a lower rate, which can save money in the short term. But, after a fixed period, the rate can change, affecting your payments.

It’s important to understand how these changes can impact your finances. This is especially true for those considering adjustable-rate loans.

Mortgages: A Deeper Dive

Mortgages are special loans for buying property. They have a specific structure and require choosing the right lender. It’s also important to know the costs involved.

How Mortgages Work

Mortgages let people borrow money to buy real estate. The property is used as collateral. Each month, borrowers pay both principal and interest.

The loan term can last from 15 to 30 years. Knowing how mortgages work is key for those entering the housing market.

Choosing the Right Mortgage Lender

Finding the right mortgage lender is crucial for your financial health. Compare services, rates, and terms from different lenders. Getting recommendations or reading reviews can help.

A good lender should be clear about fees and terms. This transparency is important for mortgage loans.

Understanding Mortgage Costs

Mortgage costs include more than just principal and interest. There are closing costs, insurance, and property taxes. Buyers should plan for these expenses early.

This helps in making smart choices when looking at different lenders. It ensures you understand the costs involved.

Secured vs. Unsecured Loans

It’s important to know the difference between secured and unsecured loans. Each has its own benefits and risks. Your choice depends on your financial situation and how much risk you’re willing to take.

What are Secured Loans?

Secured loans need collateral to secure the loan. This can be a house, car, or even a savings account. If you can’t pay back the loan, the lender can take the collateral.

Secured loans usually have lower interest rates. This is because the lender has less risk.

Benefits of Unsecured Loans

Unsecured loans don’t need collateral. This makes them easier to get for many people. They often get approved faster because there’s no need to check the collateral.

These loans are flexible and can be used for many things. You can use them to pay off debt or fund personal projects. This way, you don’t have to risk your assets.

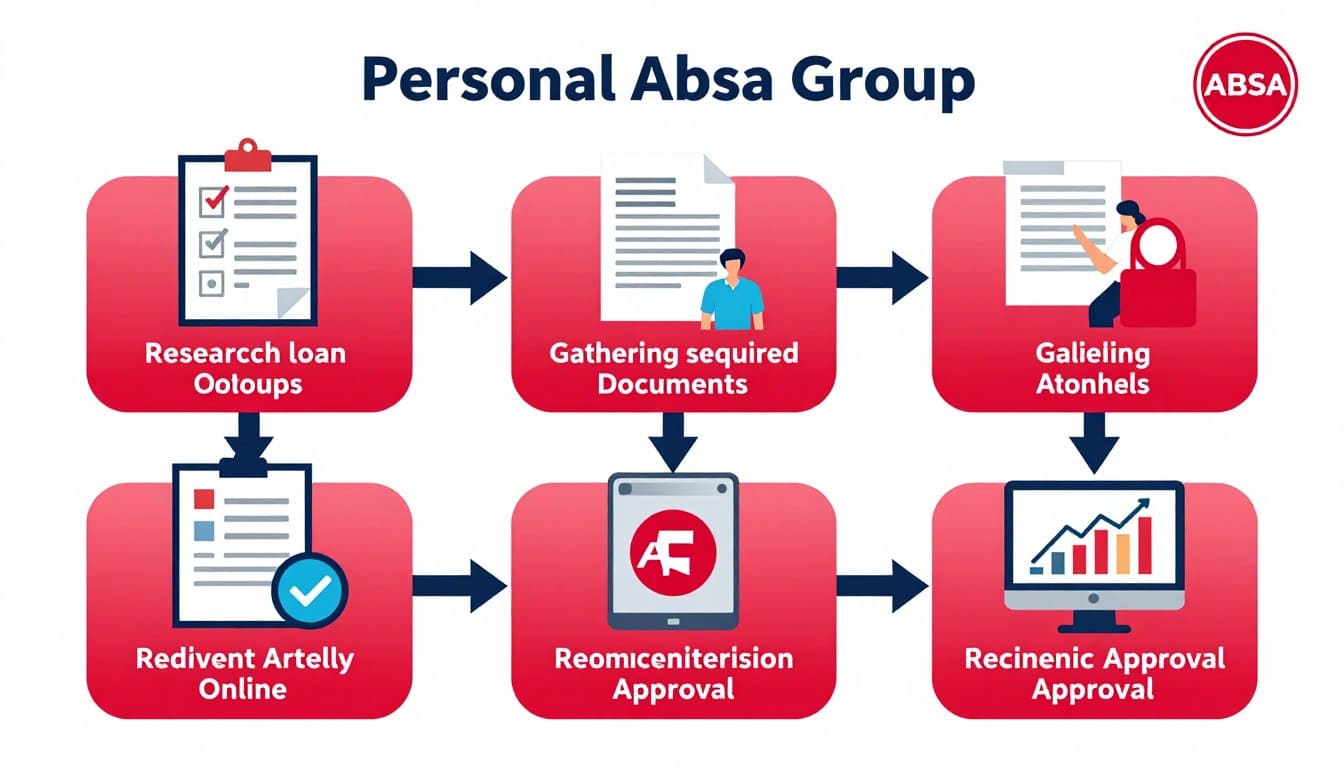

The Loan Application Process

Getting through the loan application process takes careful planning and focus. To boost your loan chances, knowing what documents you need and how to read loan estimates is key.

Gathering Necessary Documentation

Your first move is to collect all needed loan documents. You’ll need:

- Proof of income, such as pay stubs or tax returns

- Credit history report

- Bank statements

- Identification, like a driver’s license or Social Security card

Having these documents ready makes your application smoother. It also helps lenders understand your financial status.

Understanding Loan Estimates

Once you apply, you’ll get a loan estimate. This shows the loan’s proposed terms, like interest rates and monthly payments. It’s important to review these estimates carefully. Look for:

- The annual percentage rate (APR)

- Loan fees and other costs

- Estimated timeline for the loan process

Understanding these details helps you choose the best loan for your needs and goals.

Comparing Loans: Finding the Best Option

It’s important to understand the different loan offers available. This helps borrowers choose the best loan for their needs and financial situation. They need to look at terms, interest rates, and fees from different lenders.

Evaluating Loan Offers

Looking closely at loan offers helps find the best terms. Important things to check include:

- Interest rates: Compare both fixed and variable rates.

- Loan terms: Find options that match your repayment ability.

- Fees: Check for origination fees, prepayment penalties, and closing costs.

- Monthly payments: Make sure payments fit your budget.

By paying attention to these details, borrowers can make a smart choice.

Consulting Multiple Lenders

Talking to several lenders gives a wider view of loan options. This can lead to better rates. Here are some tips:

- Get quotes from at least three lenders to see the market rate.

- Ask each lender about their loan products and any special deals.

- Find out what qualifications are needed for different loans.

Talking to many lenders helps borrowers make a well-informed choice. They can pick the best loan for their financial needs.

Understanding Personal Loans

Personal loans are a flexible financial option. They help people cover many needs. This includes medical bills, home upgrades, and paying off other debts. It’s key to know how rates and repayment terms work to make smart choices.

Uses of Personal Loans

Personal loans can help with many financial needs. Here are some examples:

- Emergency medical expenses

- Home renovation projects

- Education costs

- Debt consolidation

- Travel and vacation financing

Interest Rates on Personal Loans

Interest rates on personal loans depend on several things. This includes your credit score and financial situation. People with better credit scores usually get lower rates. It’s wise to compare rates from different lenders.

Repayment Terms for Personal Loans

Repayment terms for personal loans vary. They can last from a few months to years. It’s important to pick a term that fits your financial situation.

Shorter terms mean higher monthly payments but less interest. Longer terms have lower payments but more interest over time.

Conclusion

The US has many loan options for different financial needs. Knowing about personal loans, mortgages, and more is key. This knowledge helps you make smart choices.

It’s also important to understand loan terms and interest rates. This affects how much you’ll pay back. Looking at different offers can help you save money.

To find the best loan, you need to be informed and careful. By exploring all your options, you can get a loan that fits your needs. This way, you can secure a good financial future.

FAQ

What are the main types of loans available in the US?

How do I know which loan type is right for me?

What is the difference between fixed-rate and adjustable-rate loans?

What documents are required for the loan application process?

How can I improve my chances of loan approval?

What should I consider when comparing loan options?

What are personal loans used for?

What are the repayment terms typically associated with personal loans?

How do I choose the right mortgage lender?

Conteúdo criado com auxílio de Inteligência Artificial