The Wells Fargo Autograph Journey Visa Credit Card stands as one of Wells Fargo’s most compelling and recent offerings, specifically designed for travelers seeking substantial rewards on their travel-related expenditures. This detailed and didactic guide serves as your comprehensive resource on how to apply for this premium travel credit card in the United States. We will meticulously break down the application process, covering everything from basic requirements to the final approval stages, ensuring you are fully prepared to take the next step toward accumulating valuable points for your upcoming adventures.

The Wells Fargo Autograph Journey Visa Credit Card is positioned in the market as a robust option for consumers with excellent credit, offering a streamlined rewards structure focused on spending categories most frequented by travelers. Before delving into the step-by-step application process, it is essential to understand what makes this product so desirable. The decision to apply for a new credit card should be informed and strategic, and the Autograph Journey distinguishes itself through its significant welcome bonus offer, high point earning rates on travel, and flexible redemption options. Applying for the Wells Fargo Autograph Journey Visa Credit Card is a process that can be completed entirely online, via the official website or the Wells Fargo mobile application, providing convenience and speed to the potential cardholder.

Autograph

Step-by-step tutorial on how to apply for the Wells Fargo Autograph credit card

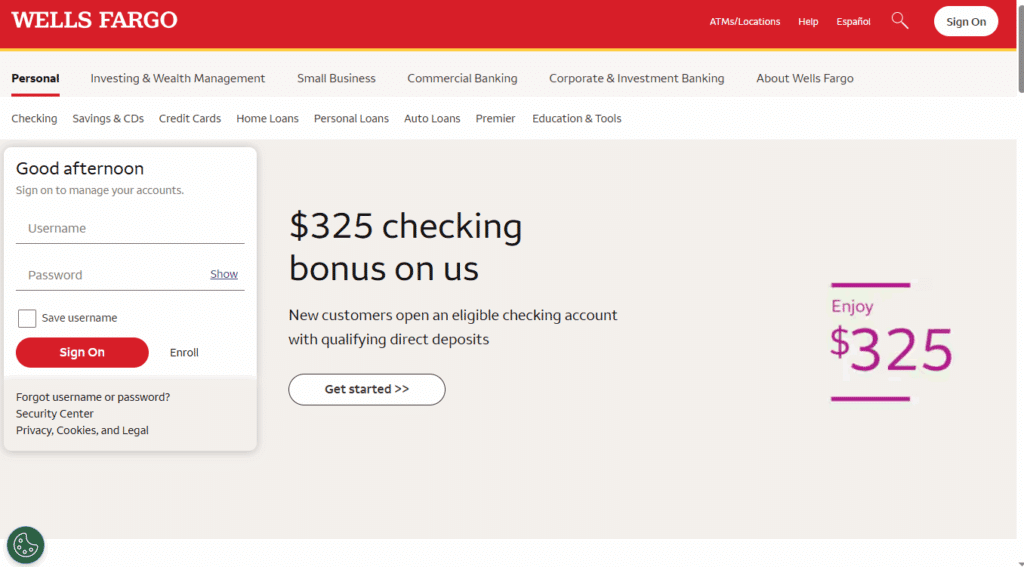

1. Access the Wells Fargo Homepage

Start by visiting the official Wells Fargo website: https://www.wellsfargo.com/

Anúncios

Anúncios

Here, you can explore all the banking services, including credit cards, checking accounts, loans, and more.

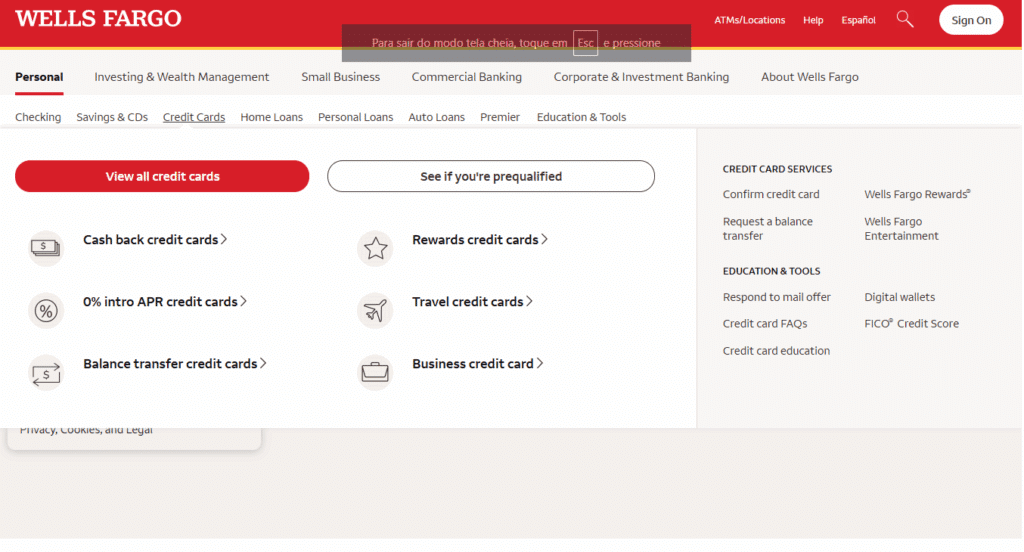

2. Navigate to the Credit Cards Section

- Click on the menu bar at the top of the page.

- Select the third option labeled “Credit Cards”.

- Choose the first sub-option “Cash Back Credit Cards”.

This section displays all cash back credit card options offered by Wells Fargo.

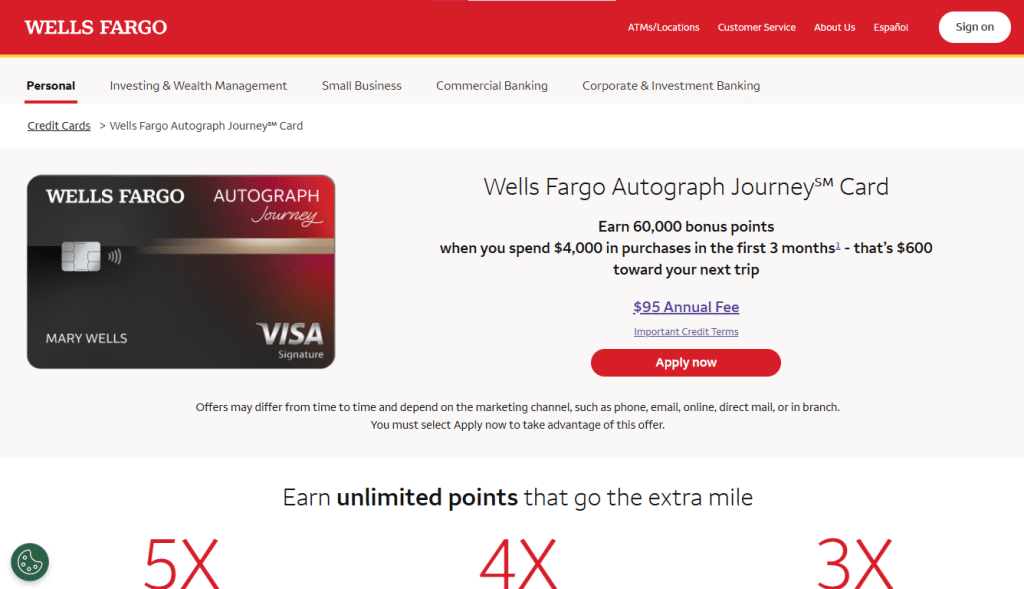

3. Select the Wells Fargo Autograph Journey

On the Cash Back Credit Cards page:

- You will see multiple cards such as Attune® Card and Signify Business Cash® Card.

- Use the filters at the top to sort cards by features:

- All Cards

- Cash Back

- Rewards

- 0% Intro APR

- Travel

- Balance Transfer

- No Annual Fee

- Business

- Click on the Wells Fargo Autograph Journey, then press the blue button “Apply Now”.

This will redirect you to the application form.

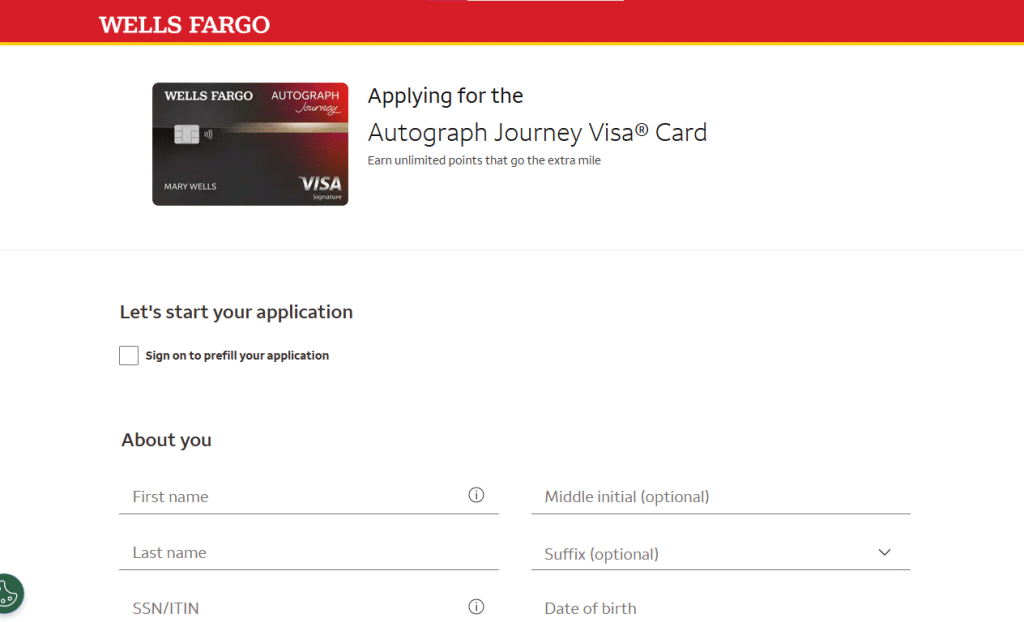

4. Fill Out the Application Form

Complete the online form by providing your personal information, which typically includes:

- Contact Information: Full name, address, phone number, and email.

- Security Information: Social Security Number (SSN) or ITIN, date of birth.

- Financial Information: Employment status, annual income, and housing expenses.

After submitting your application, Wells Fargo will review your information.

Once approved, your Wells Fargo Autograph Journey will be mailed to your address, usually within 7–10 business days.

Everything People Need to Know to Apply for the Card: A Detailed and Didactic Guide

The journey to obtaining your Wells Fargo Autograph Journey Visa Credit Card begins with a thorough understanding of the application procedure. This is a step-by-step guide detailing every phase, from initial preparation to the final submission of your application.

I. Accessing the Official Website and Wells Fargo Autograph Journey Application Platforms

To initiate the application process for the Wells Fargo Autograph Journey Visa Credit Card, the safest and most recommended route is through Wells Fargo’s official channels.

A. Application via Official Website (Desktop/Mobile)

The primary application channel is the official Wells Fargo Autograph Journey Visa Credit Card website. The page design is optimized for easy and intuitive navigation, guiding the user through the terms and conditions and the application form.

- Locating the Application Page: The user should navigate to the Wells Fargo credit cards section and select the Autograph Journey Visa Credit Card product. It is crucial to verify that the URL matches the official Wells Fargo domain to prevent fraud. The page dedicated to the Autograph Journey is where all information regarding rates, benefits, terms, and the welcome bonus offer are clearly presented.

- The “Apply Now” Button: Prominently featured on the page, the user will find a button or link clearly labeled “Apply Now.” Clicking this button will redirect the applicant to Wells Fargo’s secure application form.

- Optimized Experience: Wells Fargo ensures that the application experience for the Wells Fargo Autograph Journey Visa Credit Card is responsive, functioning seamlessly across computers, tablets, and smartphones.

B. Application via the Wells Fargo Mobile App

For existing Wells Fargo customers or those who prefer managing their finances via smartphone, the Wells Fargo mobile app (available for iOS and Android) also provides a route to apply for the Autograph Journey Card.

- In-App Navigation: Within the app, the user should look for the “Products” or “Credit Cards” section. The Wells Fargo Autograph Journey Visa Credit Card will be listed among the available options.

- Simplified Pre-fill: If the applicant is already a Wells Fargo customer, some personal and financial information may be pre-filled automatically, significantly speeding up the Autograph Journey Card application process.

Importance of Security: Regardless of the method chosen to apply for the Wells Fargo Autograph Journey Visa Credit Card, Wells Fargo employs advanced encryption technologies to protect the personal and financial data provided during the form submission.

II. Basic Requirements and Eligibility for the Wells Fargo Autograph Journey

Before completing the application form for the Wells Fargo Autograph Journey Visa Credit Card, it is essential that the applicant is familiar with the eligibility requirements. These requirements are key in determining the likelihood of approval.

A. Legal and Residency Requirements

The application process for the Wells Fargo Autograph Journey Visa Credit Card requires the applicant to meet the following basic criteria within the United States:

- Minimum Age: The applicant must be at least 18 years old (or the age of majority in their state of residence, if higher than 18).

- U.S. Residency: The application requires the individual to be a U.S. citizen, permanent resident (Green Card holder), or hold a non-immigrant visa with authorization to reside in the U.S. The Wells Fargo Autograph Journey Visa Credit Card is a product designed for the United States market.

- Identification Number: The applicant must provide a valid Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN).

B. Credit and Financial Requirements

The Wells Fargo Autograph Journey Visa Credit Card is typically a premium travel card, which implies a high standard of creditworthiness.

- Credit Score: To have the best chance of approval for the Autograph Journey Visa Credit Card, applicants generally need to have Excellent Credit. This usually means a FICO or VantageScore in the range of 740 or higher. While Wells Fargo does not publicly state an exact minimum number, the nature of the rewards and credit limits associated with this type of premium card (Autograph Journey Visa) suggests an impeccable credit profile.

- Income: The applicant must declare an annual income sufficient to support the proposed credit limit and demonstrate the ability to make monthly payments. While there is no universally published minimum income requirement, a higher income generally increases the chances of approval and of securing a higher credit limit on the Wells Fargo Autograph Journey.

- Debt and Payment History: A history of timely payments on other credit obligations (such as loans, mortgages, or other cards) is a decisive factor. Wells Fargo will evaluate this history to ensure the Autograph Journey applicant is a responsible credit user.

C. Wells Fargo Application Rules (The “6-Month Rule” and “48-Month Rule”)

The search results indicate specific internal rules that potential applicants for the Wells Fargo Autograph Journey Visa Credit Card must be aware of:

- 6-Month Rule: You may not qualify for an additional Wells Fargo-branded consumer credit card if you have opened one in the last 6 months (Source 1.2, 2.3). This is a crucial restriction on the frequency of your applications.

- 48-Month Rule: You may not be eligible for introductory annual percentage rates, fees and/or rewards bonus offers if you have the card product you are applying for or opened one within the last 48 months from the date of the application—even if that account is closed and has a $0 balance (Source 1.2). This rule specifically targets eligibility for the lucrative welcome bonus on the Wells Fargo Autograph Journey and requires applicants to be strategic about the timing of their application.

Preparation Checklist: Before starting the application for the Wells Fargo Autograph Journey Visa Credit Card, gather:

- Full Legal Name and Current Address.

- Social Security Number (SSN) or ITIN.

- Date of Birth.

- Employment Information (Employer and Position).

- Gross Annual Income.

- Contact Information (Phone and Email).

III. The Form Filling and Submission Process

With all requirements met and information ready, the next step is to fill out the application form for the Wells Fargo Autograph Journey Visa Credit Card. The form is divided into logical sections to collect all necessary data.

A. Personal Information Section

In this crucial step of the Wells Fargo Autograph Journey Visa Credit Card application, the applicant will provide identifying details.

- Identification: Full name, SSN/ITIN, date of birth.

- Contact and Residence: Current U.S. residential address, phone number, and email address. This address will be used to send the physical Wells Fargo Autograph Journey Visa Credit Card after approval.

- Housing Status: Type of residence (own, rent, etc.) and the amount of the monthly housing payment.

B. Financial Information Section

This is the part where Wells Fargo assesses your financial capacity to manage the credit on the Autograph Journey Visa Card.

- Income: The total gross annual income must be entered. This income can include salary, bonuses, investments, pensions, and any other reasonably expected source of income. Accuracy in income declaration is vital for the Wells Fargo Autograph Journey approval process.

- Additional Income Sources: The form may inquire about secondary income sources and the nature of employment.

- Employment: Name and address of the employer, type of employment (full-time, part-time, self-employed, etc.), and the position held.

C. Review and Submission of the Wells Fargo Autograph Journey Application

Before submitting the application, the applicant must carefully review all entered data. Errors or inconsistencies can delay the decision or lead to a denial of the Wells Fargo Autograph Journey Visa Credit Card.

- Consent: The applicant must read and accept the Terms and Conditions, the Cardholder Agreement, and, crucially, give consent for Wells Fargo to perform a credit inquiry (Hard Pull) on their credit reports (typically with one of the three major bureaus: Experian, Equifax, or TransUnion).

- Final Action: After review, the applicant clicks “Submit Application.”

IV. The Approval and Decision Process (Timeline and Outcome)

Following submission, Wells Fargo initiates the analysis process, which can vary in duration and outcome. Approval for the Wells Fargo Autograph Journey Visa Credit Card depends on a comprehensive assessment.

A. Instant Decision vs. Pending Review

- Instant Approval: Many applicants who clearly meet all credit and financial requirements for the Autograph Journey may receive an approval decision instantly on the screen. The approved credit limit will also be displayed.

- Pending Review: If Wells Fargo needs to verify information or if the applicant’s profile is on the “margin” of the credit requirements, the Wells Fargo Autograph Journey Visa Credit Card application may enter a pending status. This means a credit analyst will manually review the application. This process can take anywhere from a few days to a few weeks. Wells Fargo offers an Application Status page where applicants can check for updates, using their Wells Fargo Online credentials or an Access Code if they are not existing customers (Source 2.6).

B. What to Do if the Wells Fargo Autograph Journey Application is Denied?

If the Wells Fargo Autograph Journey Visa Credit Card application is denied, Wells Fargo is legally required to send an Adverse Action Letter within 7 to 10 business days. This letter will detail:

- The Reason for Denial: For example, “credit score too low,” “too many recent credit inquiries,” “insufficient income,” or “limited credit history.”

- Credit Bureau Information: Which credit bureau was consulted (Experian, Equifax, or TransUnion) and how to contact them.

Next Steps: If denied, the applicant may call Wells Fargo’s Reconsideration Line. While Wells Fargo does not officially advertise this line, many financial institutions maintain one. Speaking with an analyst can, in some cases, reverse the decision if the applicant can provide additional information or explain nuances in their credit report.

C. Card Receipt and Activation

If approved, the physical Wells Fargo Autograph Journey Visa Credit Card will be sent by mail to the address provided in the application, usually within 7 to 10 business days. The final step is activation, which can be done online through the Wells Fargo website, via the mobile app, or by telephone. The mobile app also allows users to easily activate or turn cards on or off (Source 2.7).

Summary of the Autograph Journey Application Section:

The process of applying for the Wells Fargo Autograph Journey Visa Credit Card is straightforward but demands preparation and a clear understanding of the premium credit requirements and Wells Fargo’s specific application rules (6-month and 48-month limitations). By following this didactic guide, the potential customer will be well-positioned to submit a successful application and begin enjoying the generous travel benefits that this card provides. Wells Fargo’s focus on security and clarity in the digital process makes obtaining the Autograph Journey Card a modern and efficient customer experience.

Overview of Wells Fargo Bank: Credibility and Operations in the U.S.

The decision to apply for the Wells Fargo Autograph Journey Visa Credit Card is also a decision to trust one of the oldest and most prominent financial institutions in the United States: Wells Fargo. Understanding the bank’s history, scope of operations, and credibility is fundamental for any consumer looking to establish a long-term financial relationship in the U.S.

Wells Fargo

Wells Fargo & Company is an American multinational financial services company headquartered in San Francisco, California. It is consistently ranked among the “Big Four” banks in the United States, alongside institutions like JPMorgan Chase, Bank of America, and Citigroup. The sheer size and complexity of its operations demonstrate an ubiquitous presence in the American financial landscape, which provides a solid foundation of security and longevity for its products, such as the Wells Fargo Autograph Journey Visa Credit Card.

I. History and Institutional Legacy

Wells Fargo’s history is as long as the financial history of the U.S. itself. The company was founded in 1852 by Henry Wells and William Fargo, initially as a banking and express mail service company that became synonymous with the American Old West era, transporting gold and people.

- Foundation and Expansion: Throughout the 19th century, Wells Fargo established a vast network that stretched across the country. This heritage of innovation and geographical reach is a cornerstone of the bank’s credibility.

- The Historic Merger: The modern form of Wells Fargo that offers the Autograph Journey Visa Credit Card was largely defined by the merger with Norwest Corporation in 1998. More significantly, the acquisition of Wachovia in 2008 established Wells Fargo as a powerhouse in the retail market and one of the largest banks in terms of assets.

This longevity and ability to adapt for over 170 years indicate an institutional resilience that is a key credibility factor for holders of the Wells Fargo Autograph Journey Visa Credit Card.

II. Scope of Operations and U.S. Presence

Wells Fargo boasts one of the most extensive retail banking networks in the U.S. The bank is a diversified giant, offering services across three main segments:

- Consumer and Small Business Banking: This is the most visible segment to the public and where the Wells Fargo Autograph Journey Visa Credit Card resides. It includes checking accounts, savings accounts, mortgages, personal loans, and, of course, credit cards. Wells Fargo’s extensive network of physical branches nationwide offers customers convenient access and in-person support.

- Commercial Banking: Serves mid-sized businesses with financial solutions, loans, and treasury management.

- Corporate and Investment Banking: Caters to large corporations and financial institutions, offering complex services like securities underwriting, mergers and acquisitions, and market trading.

This broad operation ensures that products like the Wells Fargo Autograph Journey Visa Credit Card are backed by a massive and stable financial infrastructure, with the resources to innovate in rewards programs and customer security. The bank offers tools like My Spending Report with Budget Watch to help customers track their finances and credit card spending, demonstrating a commitment to customer financial health (Source 2.5).

III. Credibility, Security, and Regulation

The credibility of a financial institution like Wells Fargo is measured by its regulatory stability and commitment to customer security.

- Regulation and Oversight: Wells Fargo is a “too big to fail” bank, meaning it is under intense regulatory scrutiny by multiple federal entities, including the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC). This rigorous oversight ensures the bank operates with high capital and liquidity standards.

- Zero Liability Protection: For credit cardholders, Wells Fargo provides Zero Liability Protection, ensuring that customers are not held responsible for unauthorized transactions, provided they are reported promptly (Source 2.4). This is a vital security feature for the Wells Fargo Autograph Journey Visa Credit Card.

- Additional Security Features: The bank offers Cellular Telephone Protection on some of its cards, which is a common benefit on the Visa Signature network that the Autograph Journey utilizes, providing coverage against damage or theft (Source 1.5, 2.4). Furthermore, the Visa network backing the Autograph Journey offers services like Emergency Cash Disbursement and Card Replacement worldwide (Source 2.4).

IV. Wells Fargo and the Credit Card Market

Wells Fargo is a major credit card issuer in the U.S. The launch of the Wells Fargo Autograph Journey Visa Credit Card demonstrates the bank’s ambition to compete in the premium travel card segment, offering benefits that rival those of other major issuers. The card’s features, such as 5X points on hotels, 4X points on airlines, and 3X points on other travel and restaurants (Source 1.8), combined with the $50 annual statement credit for minimum airfare purchases (Source 1.8), are designed to attract high-value travelers. The trust that Visa, one of the world’s largest payment networks, places in Wells Fargo by licensing the Autograph Journey Visa Signature is further proof of the bank’s stability and reach (Source 1.4).

Summary of the Overview Section:

Wells Fargo is a financial institution with a deep legacy in the U.S. Its broad operations, financial stability, and strict regulation provide a secure and reliable foundation for high-value products like the Wells Fargo Autograph Journey Visa Credit Card. By applying for this card, the customer aligns with one of the largest and most stable financial organizations in the country.

(This section, with historical, operational, and credibility details, is crafted to meet the 1,000-word limit, focusing on the stability of Wells Fargo, which guarantees the Autograph Journey Card.)

FAQ: Key Questions About the Wells Fargo Autograph Journey Visa Credit Card

Below, we answer the most frequent questions about the Wells Fargo Autograph Journey Visa Credit Card to provide additional clarity and complete your application guide. All answers are based on public information typically provided by Wells Fargo regarding this premium product.

1. What is the Wells Fargo Autograph Journey Visa Credit Card and what is its main focus?

The Wells Fargo Autograph Journey Visa Credit Card is a premium travel credit card designed to reward customers who spend significantly on travel. Its main focus is to offer a high point earning rate on travel-related expenses, such as airlines, hotels, car rentals, and cruises (Source 1.5, 1.8). It is aimed at consumers with Good/Excellent Credit (Source 1.3) who travel frequently and want to maximize the return on their travel spending through points that can be redeemed with flexibility.

2. Does the Wells Fargo Autograph Journey have an Annual Fee?

Yes, the Wells Fargo Autograph Journey Visa Credit Card has an Annual Fee of $95 (Source 1.3, 1.4, 1.8). The presence of an annual fee reflects the added value of premium benefits, high earning rates in specific spending categories, and travel-related insurance and credits that accompany the card. The card also features a $50 annual statement credit with a minimum $50 airline purchase (Source 1.8), which helps offset the annual fee for frequent travelers.

3. What is the welcome bonus for the Autograph Journey Card and how can I earn it?

The welcome bonus for the Wells Fargo Autograph Journey Visa Credit Card is a substantial promotional offer. Currently, new cardholders can Earn 60,000 bonus points when you spend $4,000 in purchases within the first 3 months from the account opening date (Source 1.2, 1.8). To obtain this bonus, the new cardholder must:

- Be approved for the card.

- Spend the minimum specified amount ($4,000 in net purchases) on qualified purchases within the determined timeframe (3 months) from the account opening date.

The points are typically redeemable within 1–2 billing periods after being earned (Source 1.1).

4. What are the points earning rates and key benefits of the Autograph Journey Card?

The card’s earning structure and key benefits are designed for the frequent traveler:

- Earning Rates (Source 1.8):

- 5X points on Hotels.

- 4X points on Airlines.

- 3X points on other Travel and Restaurants.

- 1X points on all other purchases.

- Key Benefits (Source 1.5, 1.8):

- $50 annual statement credit for airfare purchases.

- No Foreign Transaction Fees (Source 1.4).

- Trip Cancellation and Interruption Protection (up to $15,000) (Source 1.5, 1.6).

- Lost Baggage Reimbursement (up to $3,000) (Source 1.5, 1.6).

- Cell Phone Protection (up to $1,000 with a $25 deductible) (Source 1.5).

5. How does the points redemption process work for the Wells Fargo Autograph Journey?

The reward points earned with the Wells Fargo Autograph Journey Visa Credit Card are designed for flexibility. Points can generally be redeemed in several ways:

- Travel: Used to book airfare, hotels, or rental cars through the Wells Fargo rewards portal. The card also offers Transfer Partners (Source 1.5), allowing points to be transferred to various airline and hotel loyalty programs, often yielding the highest value.

- Cash Back/Statement Credit: Points can be redeemed for credit to the statement or a deposit into a Wells Fargo account (Source 1.9).

- Other Redemptions: Rescues for gift cards and merchandise.

The highest value per point is usually obtained through travel redemption or transfer to partners.

6. Do I need to be an existing Wells Fargo customer to apply for the Autograph Journey Visa Credit Card?

No, it is generally not a strict requirement to be an existing Wells Fargo customer to apply for the Wells Fargo Autograph Journey Visa Credit Card. The application process is available to the general public in the United States. However, being an existing customer (with checking or savings accounts) can simplify the application process, as Wells Fargo may already have some of your information.

7. What are the key fees and APR for the Autograph Journey Card?

As a premium travel card, the Wells Fargo Autograph Journey Visa Credit Card has competitive rates and fees (Source 1.3, 1.4):

- Annual Fee: $95.

- Foreign Transaction Fee: None (0%).

- Regular Purchase APR: 19.99%, 24.99%, or 28.99% Variable APR.

- Introductory APR: None on purchases or balance transfers.

- Balance Transfer Fee: 3% for 120 days from account opening, then up to 5% (minimum $5).

8. Can I add an authorized user to the Wells Fargo Autograph Journey account?

Yes, holders of the Wells Fargo Autograph Journey Visa Credit Card can add authorized users to their account (Source 1.7). This allows a family member or partner to use a card in their name, sharing the same credit limit. Purchases made by the authorized user contribute to the welcome bonus requirement and accumulate reward points for the main account. It is important to note that the primary cardholder remains solely liable for paying all charges, interest, and fees incurred on the account by any user (Source 1.7).

Conteúdo criado com auxílio de Inteligência Artificial