Anúncios

The Bank of Ireland Student Credit Card is a specialised financial tool designed to meet the unique budgetary and lifestyle needs of students in full-time third-level education. It serves as an excellent way to cover unexpected expenses, manage cash flow between student loan payments, and responsibly build a healthy credit profile.

Student

This detailed, guide is based strictly on the information provided by the official Bank of Ireland website, outlining the comprehensive eligibility criteria, step-by-step application process, and core benefits of this student-focused credit card.

Anúncios

🇮🇪 IRELAND: STEP-BY-STEP TUTORIAL – How to Apply for the Bank of Ireland Student Credit Card

Are you a student in the Republic of Ireland seeking a credit card? Follow this guide to apply for the Bank of Ireland Student Credit Card.

Introduction: Why Choose the Student Credit Card?

The Bank of Ireland Student Credit Card is tailored for full-time students who need a flexible payment method and a low-interest introductory offer to help manage their finances during their studies. It provides an opportunity to build a solid credit history responsibly.

Anúncios

Before you start: What you need

- You must be over 18 years of age.

- You must be a resident in the Republic of Ireland.

- You must be in full-time education.

- Proof of identity, address, and student status (e.g., student ID or acceptance letter).

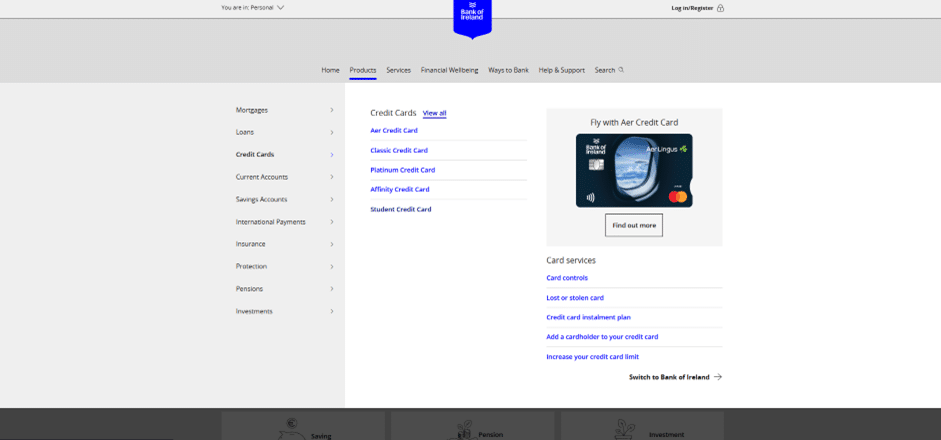

Step 1: Access the Bank of Ireland Credit Cards Page

Your application starts on the main Bank of Ireland website.

- Access the Bank of Ireland Personal Banking homepage:

https://personalbanking.bankofireland.com/ - In the main menu, click the second option: “Borrow” (or “Products” if the menu layout has changed).

- In the ensuing submenu, select the third option: “Credit Cards”, and then click on “View all” (or “Compare Credit Cards”).

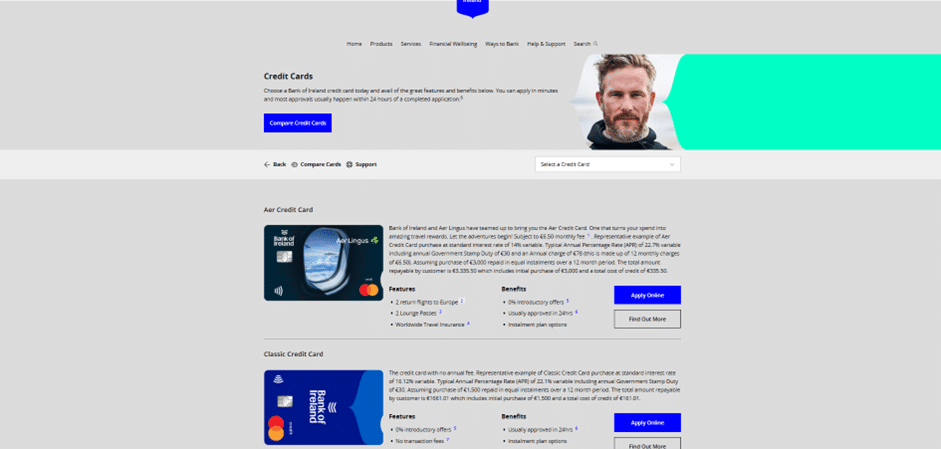

Step 2: Select the Student Credit Card

On the Credit Cards comparison page, locate and select the student option.

- On this page, you will see a list of available credit cards, such as Classic, Platinum, and Aer.

- Choose the Student Credit Card (which may be listed first, last, or elsewhere depending on the current promotions) by clicking the “Find out more” button associated with the Student Card.

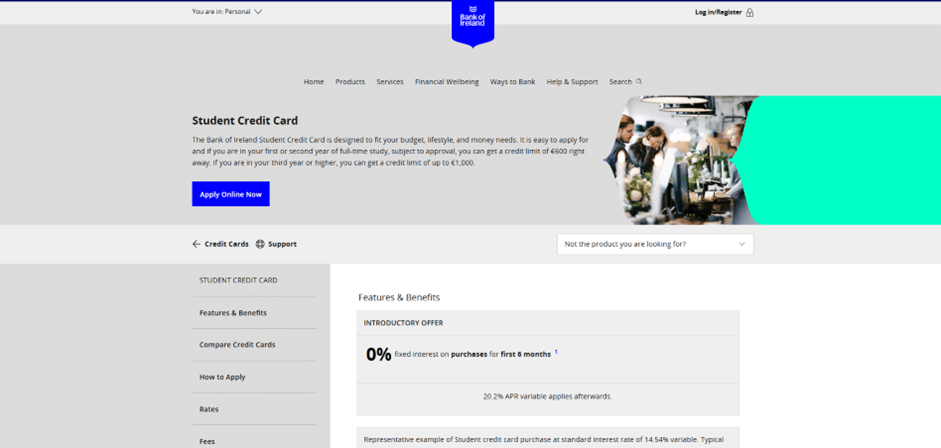

Step 3: Begin the Online Application

You are now on the detailed product page for the Student Credit Card.

- On this page, you will find all essential information about the card, including introductory offers, fees (e.g., Government stamp duty), and the Representative APR.

- Click the distinctive blue button, usually labelled “Apply Online Now” to proceed with the application.

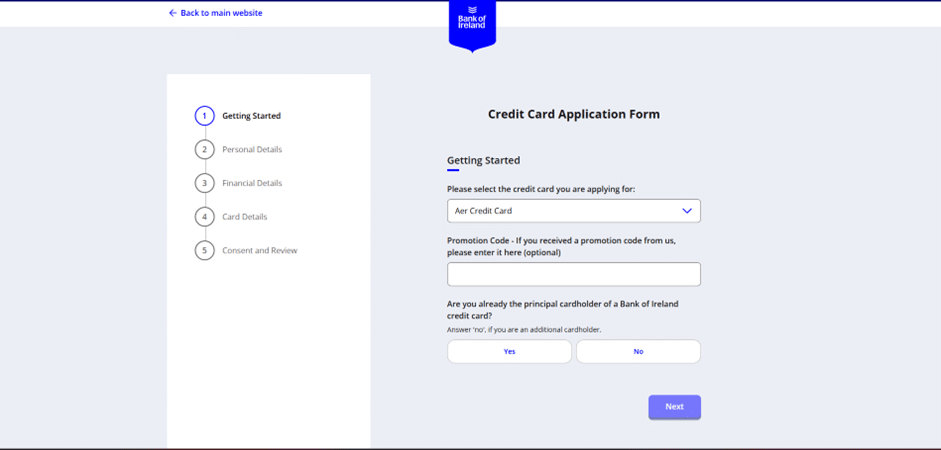

Step 4: Complete the Application

You will be directed to the Bank of Ireland’s online application system.

- The Bank of Ireland generally allows existing customers to apply through their 365 Online banking portal, which speeds up the process.

- Fill in the application form with your personal and financial information.

- Follow the instructions for submitting any required documents (proof of identity and student status). Once complete, you will receive an application status update.

Overview of Bank of Ireland: Supporting Student Finance

The Bank of Ireland (BOI) is one of the oldest and largest financial institutions in Ireland, providing a comprehensive range of personal, business, and corporate banking services. Its operations and reputation are built on a long history of stability and extensive market reach, particularly in the Republic of Ireland.

The Institution’s Commitment to Students:

- Established Credibility: BOI is a well-recognised and trusted brand, offering reassurance and security to customers, including the student demographic.

- Dedicated Student Products: The bank actively supports students with tailored products, such as the Student Current Account, which forms the basis for eligibility for the Student Credit Card.

- Financial Oversight: As a regulated institution, the Bank of Ireland adheres to strict financial lending criteria, ensuring responsible lending practices and consumer protection.

Bank of Irland

- Gateway to Future Banking: Acquiring a student credit card with BOI establishes a relationship that can mature into other banking products needed after graduation, such as graduate accounts or personal loans.

- Conclusion: The Bank of Ireland Student Credit Card is issued by a major financial entity, offering students a secure, regulated, and convenient path to accessing essential credit.

Everything People Need to Know to Apply for the Card

The Bank of Ireland Student Credit Card is specifically for its existing student and graduate customers, simplifying the initial application and offering structured credit limits to match a student’s financial stage.

1. Mandatory Eligibility Requirements

To ensure responsible credit access, the Bank of Ireland has clear, mandatory criteria for applicants:

- Age: You must be over 18 years of age.

- Education Status (Essential): The applicant must be able to show proof of studying full-time or be a recent graduate.

- Bank of Ireland Customer (Crucial): You must already be a Bank of Ireland customer with either a Student Current Account or a Graduate Current Account held for at least 6 months. This is a non-negotiable requirement.

- Credit Assessment: All credit is subject to the bank’s lending criteria, terms and conditions, and a credit assessment (underwriting) to determine the applicant’s repayment capacity and financial status.

2. Credit Limits and Core Financial Features

The card offers structured credit limits that increase with the student’s progression through their course, alongside transparent and competitive financial terms:

| Student Status | Maximum Credit Limit (Subject to Approval) |

| 1st or 2nd year of full-time study | €600 immediately available (subject to approval) |

| 3rd year or higher of full-time study | Up to €1,000 |

Key Features and Rates:

- No Annual Account Fee: There is no annual account fee charged by the bank. However, note that the annual Government stamp duty of €30 is charged per credit card account.

- Typical APR: The Typical Annual Percentage Rate (APR) is 20.2% variable, which includes the annual Government stamp duty of €30. The standard purchase interest rate is competitive.

- Interest-Free Period: Cardholders can benefit from up to 56 days interest-free credit on purchases if the full balance is paid on time each month.

- Introductory Offer (For New Customers): New credit card customers may be eligible for an introductory 0% fixed interest rate on purchases for the first 6 months, or 7 months on balance transfers, from the date of account opening.

- Payment Flexibility: You can choose your monthly payment amount, but it must be at least the greater of 2.5% or €5.

3. Step-by-Step Guide to the Application Process

The Bank of Ireland offers an efficient application process, with the potential for fast approval for existing customers.

Step 1: Preparation

Ensure all eligibility criteria are met and gather necessary documents. This typically includes:

- Valid Photo ID: Passport or Driving Licence.

- Proof of Address: Recent utility bill or bank correspondence (if not using your Bank of Ireland student account details).

- Proof of Student/Graduate Status: Documentation from your university or college.

Step 2: Choose Your Application Channel

The Bank of Ireland provides several convenient ways to apply for the Student Credit Card:

- Online Application (Fastest Option): The bank provides an easy-to-use online application form that takes approximately 5 minutes to complete. This is the recommended route for speed.

- By Phone: You can call the dedicated credit card team for assistance and to apply over the phone.

- In Branch: Visit your local Bank of Ireland branch to apply in person and have a representative verify your documents.

Step 3: Quick Approval Process

- Submission: Submit your application through your chosen channel.

- Approval Timeline: The bank aims for quick approval—often within one working day—provided all necessary information and documentation are received.

- Credit Review: A full credit and affordability check will be performed to finalise the approval and confirm your credit limit (either €600 or up to €1,000, based on your year of study).

Step 4: Card Receipt and Usage

- Delivery: Once approved, you can typically expect to receive your new credit card within one week.

- Managing Payments: Remember that failing to pay the full balance by the due date will incur interest charges. Only making the minimum monthly repayment will significantly increase the overall cost and the time required to clear the balance.

- Foreign Usage: A cross-border handling fee of 2.25% applies to non-Euro transactions, so be mindful of this when using the card outside the Eurozone.

FAQ – Frequently Asked Questions about the Bank of Ireland Student Credit Card

Q: What is the Typical APR for the Bank of Ireland Student Credit Card?

A: The Typical Annual Percentage Rate (APR) is 20.2% variable, which includes the annual Government stamp duty of €30.

Q: Is there an annual fee for this card?

A: There is no annual account fee charged by the bank. However, a mandatory Government stamp duty of €30 is charged annually per credit card account.

Q: What is the maximum credit limit for a final year student?

A: Students in their third year or higher of full-time study can get a credit limit of up to €1,000, subject to approval.

Q: Do I need to have a Bank of Ireland account to apply?

A: Yes, you must be an existing Bank of Ireland customer with a student or graduate current account for at least 6 months.

Q: How quickly can I get approved for the card?

A: Approval can often be granted within one working day if the bank receives all necessary information and documentation with your application.

Q: What is the fee for using the card outside the Eurozone?

A: A cross-border handling fee of 2.25% applies to non-Euro transactions.

Q: Does the card offer any introductory interest rates?

A: New credit card customers may receive an introductory 0% fixed interest rate on purchases (6 months) or balance transfers (7 months).

Conteúdo criado com auxílio de Inteligência Artificial