The Bank of Ireland Classic Credit Card stands out as a foundational financial tool for individuals seeking a dependable, no-annual-fee credit solution in the Republic of Ireland. It is specifically designed for everyday spending and managing cash flow, offering attractive introductory interest rates and flexible features for new cardholders.

This comprehensive, guide provides all the necessary details on the application process, essential requirements, and key features of the Classic Credit Card, based exclusively on information from the official Bank of Ireland sources.

Classic

Certainly! Here is the English translation of the tutorial for applying for the Bank of Ireland Classic Credit Card.

Anúncios

🇮🇪 IRELAND: STEP-BY-STEP TUTORIAL – How to Apply for the Bank of Ireland Classic Credit Card

Are you looking for a simple, no-annual-fee credit card in the Republic of Ireland? Follow this guide to apply for the Bank of Ireland Classic Credit Card.

Anúncios

Introduction: Why Choose the Classic Credit Card?

The Bank of Ireland Classic Credit Card is a standard, popular option, ideal for everyday spending. Its main benefits include No annual fee (only the statutory Government stamp duty of $\mathbf{€30}$ applies) and attractive introductory offers with $0\%$ interest on purchases or balance transfers.

Before You Start: What You Need

- You must be over 18 years of age.

- You must be a resident in the Republic of Ireland.

- You must have a minimum annual income of €16,000.

- Proof of identity and address for verification purposes.

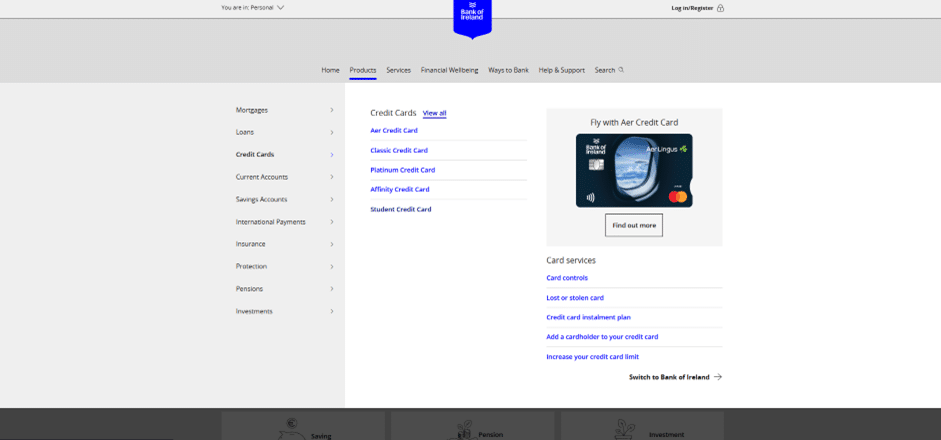

Step 1: Access the Bank of Ireland Credit Cards Page

Your application starts on the main Bank of Ireland website.

- Access the Bank of Ireland Personal Banking homepage:

https://personalbanking.bankofireland.com/ - In the main menu, click the second option: “Borrow” (or “Products” if the menu layout has changed).

- In the ensuing submenu, select the third option: “Credit Cards”, and then click on “View all” (or “Compare Credit Cards”).

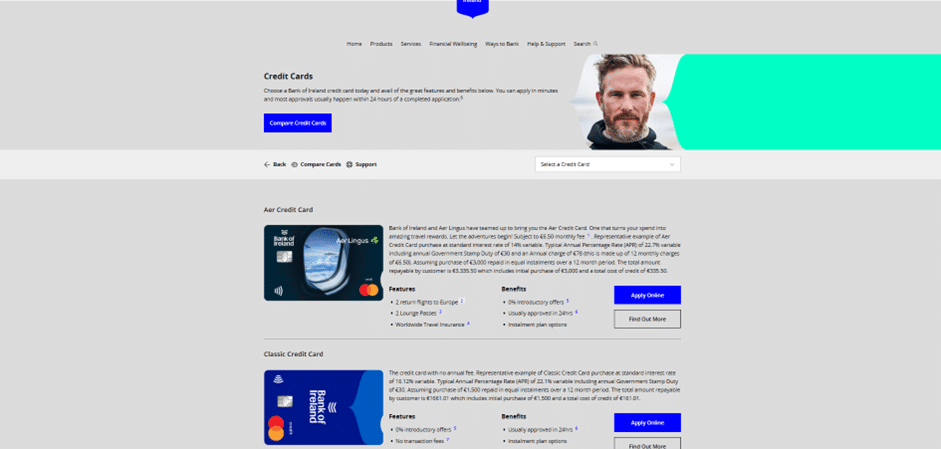

Step 2: Select the Classic Credit Card

On the Credit Cards comparison page, locate and select the Classic option.

- On this page, you will see various credit card options, such as Aer, Platinum, and Student.

- Choose the Classic Credit Card, which is typically the second option, by clicking the “Find out more” button associated with it.

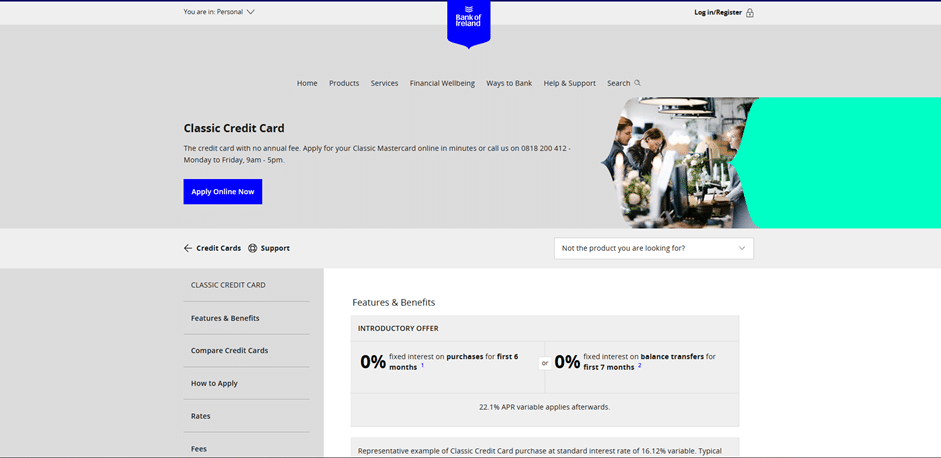

Step 3: Begin the Online Application

You are now on the detailed product page for the Classic Credit Card.

- On this page, you will find all the important information about the Classic Card, including the Representative Annual Percentage Rate (APR) of $\mathbf{22.1\%}$ variable and the introductory offers (usually $\mathbf{0\%}$ interest for 6 months on purchases or 7 months on balance transfers).

- Click the distinctive blue button, usually labelled “Apply Online Now” to proceed with the application.

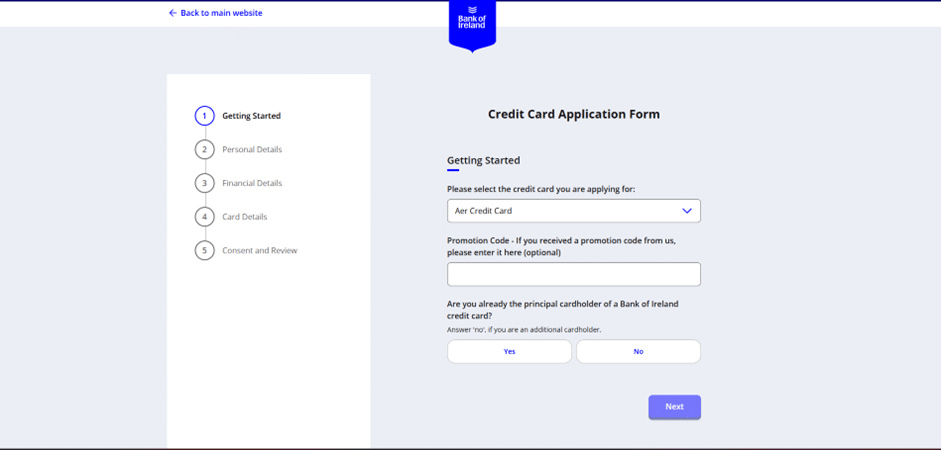

Step 4: Complete the Application Form

You will be redirected to the Bank of Ireland’s online application platform.

- If you are an existing Bank of Ireland customer with access to 365 Online, the process will be faster. You may be approved within 24 working hours, provided your documentation is in order.

- Fill out the application form with the required details (personal data, income, residential history) and follow the instructions for uploading or providing the necessary documents.

- After completing the information and following all instructions, you will submit your application for review and will soon receive a response regarding your Classic Credit Card.

Overview of Bank of Ireland: Credibility and Trust in the Irish Market

When choosing a credit card, the credibility of the issuing institution is paramount. The Bank of Ireland (BOI) is one of the largest and most established financial services groups in Ireland, with a history spanning centuries.

Key Highlights of the Institution:

- Pillar of Irish Banking: As a leading financial institution, BOI holds a central and trusted position in the Irish banking landscape, providing security and stability for its millions of customers.

- Comprehensive Service: The bank offers a full spectrum of personal, business, and corporate banking solutions, making it a convenient choice for customers who prefer to manage all their finances under one roof.

- Regulation and Security: BOI is strictly regulated by the Central Bank of Ireland, ensuring adherence to rigorous consumer protection and lending standards. This oversight guarantees the security and compliance of products like the Classic Credit Card.

- Focus on Accessibility: The Classic Credit Card reflects the bank’s commitment to providing accessible, low-cost credit options for a wide segment of the general population in the Republic of Ireland.

Bank of Irland

- Conclusion: Choosing the Bank of Ireland Classic Credit Card means partnering with a reputable, regulated, and long-standing institution deeply rooted in the Irish market, which instils confidence in the financial product.

Tudo o que as Pessoas Precisam Saber para Solicitar o Cartão

The Bank of Ireland has made the application process for the Classic Credit Card streamlined and efficient, particularly for its existing customers. Understanding the eligibility criteria and the steps involved is essential for a fast and successful application.

1. Essential Eligibility Requirements

Before starting the process, potential applicants must ensure they meet the bank’s fundamental criteria:

- Age Requirement: The applicant must be over 18 years of age.

- Residency: You must be a resident in the Republic of Ireland for 6 months or more.

- Financial Status: All applications are subject to the bank’s strict lending criteria, terms and conditions, and an underwriting assessment of the applicant’s financial status and repayment capacity. While no specific minimum income is published, the approval process hinges on demonstrating financial stability.

2. Key Features and Financial Details of the Classic Card

The Classic Credit Card is a versatile product characterised by its lack of an annual fee and attractive introductory offers for new cardholders.

| Feature | Detail |

| Representative APR | 22.1% variable Typical Annual Percentage Rate (APR) (includes annual Government Stamp Duty of €30). |

| Standard Purchase Rate | 16.12% variable standard interest rate. |

| Annual Fee | No annual fee from the bank. (Note: The annual Government Stamp Duty of €30 is mandatory and charged separately). |

| Interest-Free Days | Up to 56 days interest-free credit on purchases, provided the full statement balance is paid on time every month. Interest is charged on cash advances from the date of the transaction. |

| Introductory Offer (For New Customers) | 0% fixed interest on purchases for the first 6 months or 0% fixed interest on balance transfers for the first 7 months from account opening. The 22.1% APR variable applies afterwards. |

| Instalment Options | Available to spread the cost of larger purchases using the bank’s instalment plan options. |

| Additional Cards | Option to add extra cardholders for free. |

3. Step-by-Step Guide: How to Apply for the Classic Credit Card

The Bank of Ireland offers multiple, convenient channels for initiating the credit card application, with digital applications being the fastest method.

Step 1: Document Preparation

Gather all necessary documentation to support your identity, address, and income claims. This may include:

- Valid Photo Identification: Passport or driver’s licence.

- Proof of Address: Recent utility bill or bank statement (dated within the last six months).

- Proof of Income/Financial Status: Recent payslips or other evidence of income to support the affordability assessment.

Step 2: Choosing the Application Channel

You can apply via three primary methods:

- Online Application (Recommended): The fastest and most convenient method. The bank states that existing customers registered for its 365 online banking service may complete the process quickly.

- Access: Navigate to the Bank of Ireland official website, select the Classic Credit Card page, and click the “Apply Online Now” button.

- Process: The online form will guide you through entering your personal and financial details. The bank may be able to verify your identity and existing details electronically.

- By Phone: You can call the dedicated credit card team (available Monday to Friday, 9 am – 5 pm) to apply over the phone. A bank agent will walk you through the application and inform you if further documentation is needed by post.

- In Branch: New customers or those who prefer in-person service can call into their local Bank of Ireland branch to complete the application form with the help of a consultant and submit all documentation directly.

Step 3: Credit Assessment and Approval Timeline

- Submission and Underwriting: Once the complete application is submitted, the bank initiates a mandatory credit check with relevant credit reference agencies and conducts its full underwriting assessment to determine your final credit limit.

- Quick Approval: The bank often promises quick approval—within one working day—if all necessary information and documents are readily available. Note that if you are not an existing Bank of Ireland customer or if the application requires manual referral to the underwriting team, the process may take longer.

Step 4: Card Receipt and First Use

- Delivery: Upon approval, the credit card and the Personal Identification Number (PIN) will be mailed to your registered address separately for security.

- Activation: The card must be activated before first use, typically through the bank’s mobile app, online banking portal, or by following the instructions provided with the card.

- Responsible Usage: To take full advantage of the up to 56 days interest-free credit, always pay the full outstanding balance by the payment due date. If you only pay the minimum repayment, interest will be charged on the remaining balance from the date of the transaction, making the debt more expensive.

The Bank of Ireland Classic Credit Card provides a straightforward and cost-effective entry point into managing credit, supported by one of Ireland’s most trusted financial institutions. Its 0% introductory offers make it particularly attractive for customers looking to manage an initial large purchase or transfer a high-interest balance from another provider.

FAQ – Frequently Asked Questions about the Bank of Ireland Classic Credit Card

Q: Is there an annual fee for the Bank of Ireland Classic Credit Card?

A: There is no annual fee charged by the bank. However, the mandatory annual Government Stamp Duty of €30 is charged to the account.

Q: What is the Typical APR for this card?

A: The Typical Annual Percentage Rate (APR) is 22.1% variable, which includes the annual Government Stamp Duty. The standard purchase interest rate is 16.12% variable.

Q: How long are the introductory interest-free offers?

A: New customers can choose between 0% fixed interest on purchases for the first 6 months or 0% fixed interest on balance transfers for the first 7 months.

Q: Do I have to be a Bank of Ireland customer to apply?

A: While you don’t need to be an existing current account holder, the bank states that applications from existing customers, especially those registered for 365 online banking, can be approved much quicker. New customers can apply but may face a longer processing time.

Q: How quickly can I get approved?

A: The bank often targets approval within one working day if all necessary documents and information are provided, especially for existing customers.

Q: Does the card offer any interest-free period?

A: Yes, you can get up to 56 days interest-free credit on purchases if you pay the full statement balance on time every month.

Q: Can I use the Classic Credit Card to spread the cost of large purchases?

A: Yes, the card offers instalment plan options to spread the cost of larger purchases over a fixed period at a specific rate.

Q: Can I add another person to my card account?

A: Yes, you have the option to add extra cardholders for free.

Conteúdo criado com auxílio de Inteligência Artificial