For anyone living in Canada looking to optimize daily expenditures by turning them into tangible rewards, the TD CashBack Credit Card is one of the most popular and efficient solutions on the market. Offered by the TD Bank, this card allows users to accumulate Cash Back Dollars on essential spending categories such as groceries, gas, and recurring bill payments.

TD Cash Back Visa Infinite* Card

This article serves as a detailed, guide focusing on how to apply for the TD CashBack Credit Card in Canada, covering eligibility requirements, the different products within the CashBack line, and the approval process. It ensures the reader has all the information needed to make an informed financial decision.

🇨🇦 CANADA: STEP-BY-STEP TUTORIAL – How to Apply for the TD Cash Back Visa Infinite* Card

Follow this guide to apply for the TD Cash Back Visa Infinite* Card, a popular cash back card in Canada known for its high earning rates on groceries and gas.

Anúncios

Introduction: Why Choose the TD Cash Back Visa Infinite* Card?

The TD Cash Back Visa Infinite* Card is a top-tier rewards credit card that offers competitive cash back rates, often including a higher percentage return on everyday spending categories like gas and groceries. It also comes with comprehensive travel and purchase insurance and usually has an introductory welcome offer.

Anúncios

Before You Start: What You Need

- You must be a Canadian resident and have reached the age of majority in your province/territory.

- Minimum Annual Income Requirement: This card typically requires a minimum personal income of $60,000 or a household income of $100,000.

- You should be ready to provide your Social Insurance Number (SIN) and employment/income details.

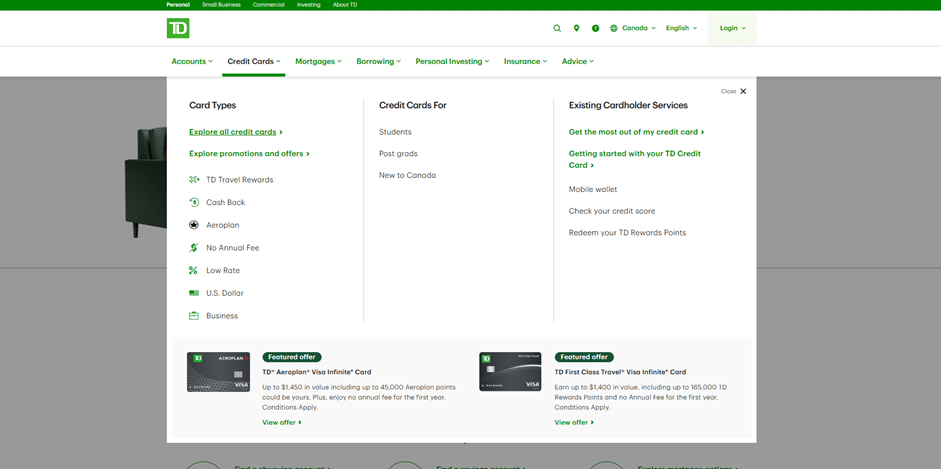

Step 1: Access the TD Credit Cards Section

Your application begins on the main TD website.

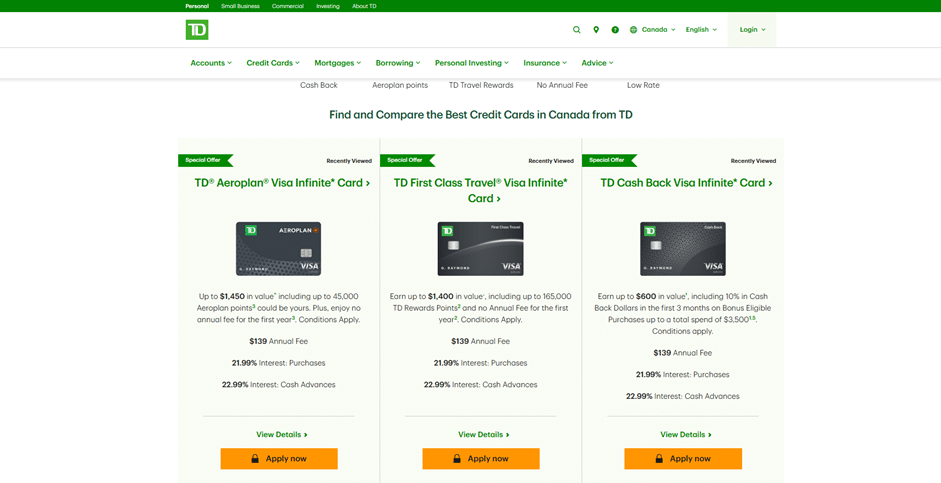

Step 2: Select the TD Cash Back Visa Infinite* Card

On the Credit Cards comparison page, locate and select the desired card.

- On this page, you will see various TD cards, such as the TD First Class Travel® Visa Infinite* Card and the TD® Aeroplan® Visa Infinite* Card.

- Locate the TD Cash Back Visa Infinite* Card, which is generally prominently featured among the rewards cards.

- Click on “See details” or “Learn more” to access the specific product page for the Cash Back Visa Infinite* Card.

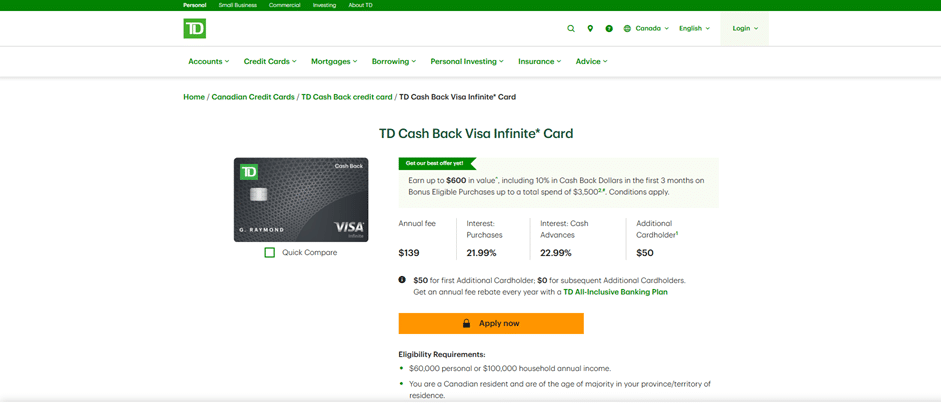

Step 3: Initiate the Online Application

You are now on the detailed product page for the Cash Back Visa Infinite* Card.

- Here, you can review all features, including the current cash back percentages, the annual fee, and the welcome offer.

- To start your application, click the distinct orange button, labelled “Apply now” or “Apply Online”.

Step 4: Complete the Application

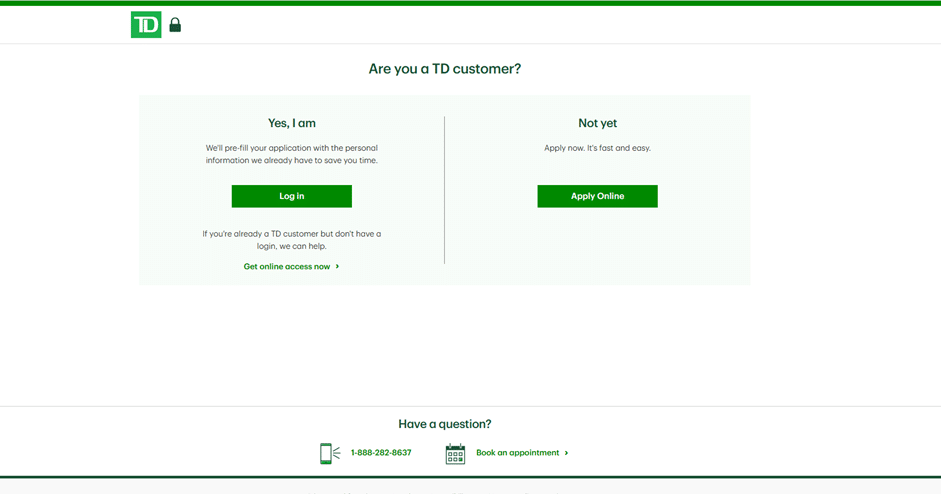

You will be redirected to the secure TD application portal.

- Identity Verification: The portal will ask if you are an existing TD customer. If you are, you can often log in to pre-fill much of your information. If you are new, you will proceed as a guest.

- Fill in Details: Complete the multi-step form, providing your:

- Personal Information (Name, Address, Phone, SIN).

- Employment and Income Details (to verify the income requirement).

- Financial Details (to confirm other bank accounts/loans).

- Review and Consent: Review the final terms, conditions, and rate disclosure.

- Submit: Submit your application.

- The TD will process your request, often providing an instant decision. Shortly after approval, you will receive your TD Cash Back Visa Infinite* Card in the mail.

Overview of TD Bank (Toronto-Dominion)

The TD Bank Group (Toronto-Dominion) is one of the largest financial institutions in Canada, recognized as one of the country’s “Big Five” banks. With an extensive branch network and a significant presence in the United States (as TD Bank, America’s Most Convenient Bank), TD enjoys unquestionable credibility and a stability that positions it as a leader in the Canadian banking sector.

Toronto-Dominion Bank

Credibility and Operations in Canada

- Customer Focus: TD is known for its convenience, offering extended operating hours at its branches (TD Canada Trust).

- Digital Innovation: The bank invests heavily in digital platforms, such as EasyWeb (online banking) and the TD App (mobile application), allowing customers to manage their accounts and cards securely and efficiently anytime, anywhere.

- Product Diversity: TD’s credit card offerings are vast, covering everything from no-annual-fee and cashback cards (like the TD CashBack) to premium travel rewards cards (TD Aeroplan) and high-tier products (TD Visa Infinite).

By choosing a TD CashBack card, the customer partners with an institution that offers security, daily convenience, and robust rewards.

Everything You Need to Know to Apply for the TD CashBack Credit Card

The TD CashBack card lineup is diverse, with options tailored to different income profiles and reward needs. The two main offerings are the TD Cash Back Visa* Card (no annual fee) and the TD Cash Back Visa Infinite* Card (premium card with an annual fee).

1. Choosing the Right CashBack Card for Your Profile

The application process begins with selecting the most appropriate card, as income requirements vary significantly.

| Feature | TD Cash Back Visa* Card | TD Cash Back Visa Infinite* Card |

| Annual Fee | $0 | $139 (Often waived for the first year as a welcome offer) |

| Income Requirement | No minimum annual income requirement published. | $60,000 CAD minimum required personal annual income OR $100,000 CAD minimum required household annual income. |

| Reward Rates | Variable, with higher rates (e.g., 1%) on essential categories, subject to spending caps. | Higher reward rates (e.g., 3%) on high-spend categories (Groceries, Gas, Recurring Bill Payments), subject to higher spending caps. |

| Additional Benefits | Purchase Security and Extended Warranty Insurance. | Comprehensive Travel Insurance package (Emergency Travel Medical, Delayed/Lost Baggage), Deluxe TD Auto Club Membership, Visa Infinite Benefits (Concierge, Luxury Hotels). |

2. Basic Eligibility Requirements

Eligibility for any TD credit card is subject to standard Canadian criteria, which include proof of residency and credit history.

Personal Requirements:

- Canadian Resident: The applicant must be a resident of Canada (citizen, permanent resident, or eligible temporary resident with a valid permit).

- Age of Majority: Must have reached the age of majority in their province or territory of residence (typically 18 or 19 years old).

- Income Requirement: For the Visa Infinite version, meeting the minimum personal or household income requirement ($60,000 or $100,000 CAD, respectively) is mandatory.

Required Documentation and Information:

For the application (whether online or in-branch), TD requires the following mandatory information, which will be used for identity and financial profile verification:

- Full Identification: Full legal name and Date of Birth.

- Contact Details: Current Canadian residential address, phone number, and email.

- Employment and Income Status: Detailed information about employment status (employed, student, self-employed), employer’s name and address, and gross annual income.

- Social Insurance Number (SIN): Required for the bank to perform a credit check.

- Residency Status: For new residents in Canada (Newcomers), valid immigration documentation is necessary for status verification.

3. The Application Process: Step-by-Step Guide

TD provides a convenient application process, both digitally (online or App) and in-person.

Option A: Online Application (Recommended)

The online application is the fastest method, especially for existing TD customers (EasyWeb).

- Access the Website: Visit the official TD Bank CashBack credit cards page.

- Compare and Select: Compare the available CashBack cards (Visa and Visa Infinite) to ensure you choose the one that aligns with your income profile and reward needs.

- Fill out the Application: Click “Apply Now” and complete the secure online form. You will be asked for your SIN to enable the instant credit check, which is crucial for the decision.

- Consent and Submission: Review the terms and conditions (including the Purchase Annual Percentage Rate (APR) of 21.99% and Cash Advance APR of 22.99%) and submit the application.

- Instant Decision: Many applicants receive an almost immediate approval or rejection decision (instant approval).

Option B: In-Branch Application (Recommended for New Residents)

If you are new to Canada and have a limited credit history, applying for the card in-person at a TD branch is often the best approach.

- Book an Appointment: Schedule a meeting with a TD Banking Specialist at the most convenient branch.

- Meeting and Documentation: Bring your identification (passport and Canadian driver’s license, if applicable) and immigration documents. The specialist will complete the application with you and can advise on specific newcomer programs, which may offer more flexible credit criteria.

4. Credit Analysis and Approval

Approval is primarily determined by your credit score (typically checked with Equifax or TransUnion in Canada) and meeting the income requirements.

- Credit History: A good credit history is vital in Canada. If you are a newcomer, TD has specific programs designed to help establish credit.

- Final Decision: If approved, your credit limit will be set based on your repayment capacity and the chosen card’s profile.

- Receipt and Activation: The physical card is mailed to you. Activation can be done through the TD App or by calling the provided activation number.

❓ FAQ – Frequently Asked Questions about the TD CashBack Credit Card in Canada

Q: How long is the interest-free grace period on the TD CashBack Card?

A: The TD CashBack Card offers an interest-free grace period of 21 days for new purchases, provided you pay the total outstanding balance by the payment due date.

Q: How and when can I redeem my Cash Back Dollars?

A: Cash Back Dollars do not expire as long as the account is active. You can redeem them at any time, on-demand, through the TD App or EasyWeb, provided you have a minimum accumulated balance (usually $25, but can be redeemed annually in full without a minimum).

Q: What are the standard Annual Percentage Rates (APR) applied?

A: The standard APRs are typically 21.99% for purchases and 22.99% for Cash Advances (cash withdrawals against the credit limit).

Q: Can I get the TD CashBack Card if I am a newcomer to Canada?

A: Yes. TD Bank offers specific credit card programs for new residents in Canada, recognizing they may have a limited credit history. It is highly recommended to book an in-branch appointment to discuss your options.

Q: Does the TD Cash Back Visa Infinite Card include travel insurance?

A: Yes. The Visa Infinite version includes a comprehensive travel insurance package, specifically Emergency Travel Medical Insurance (up to $2 million in coverage for the first 10 days of travel, subject to age limitations) and Delayed/Lost Baggage Insurance.

Q: What is the annual fee for the TD Cash Back Visa Infinite Card?

A: The annual fee is $139 CAD, but TD often offers an annual fee rebate for the first year as part of a welcome bonus.

Conteúdo criado com auxílio de Inteligência Artificial