Choosing the right credit card can be a game-changer for your finances. In South Africa, the Gold Credit Card stands out as a popular choice, but how does it stack up against the competition? This guide breaks down the features, benefits, and requirements of a Standard Credit Card, with direct comparisons to other leading cards in the market, helping you make an informed decision.

Key Takeaways

Gold Credit Card

The Standard Bank Credit Card is designed to offer a balance of everyday convenience and valuable rewards. Here’s a closer look at its core features:

1. UCount Rewards Programme

One of the standout benefits of a Standard Bank Credit Card is the UCount Rewards programme. Cardholders earn points on qualifying purchases, both in-store and online. These points can be redeemed for various rewards, including:

Anúncios

- Fuel Rewards: Get up to R2 back per litre of fuel at participating Caltex service stations.

- Retail Vouchers: Use your points to shop at popular retailers like Checkers, Clicks, and Incredible Connection.

- Travel and Lifestyle: Redeem points for flights, accommodation, and a wide range of products.

This programme is particularly beneficial for those who frequently spend on fuel and groceries, as the rewards can quickly add up, effectively giving you a discount on everyday expenses.

Anúncios

2. Up to 55 Days Interest-Free

Standard Bank offers an up to 55-day interest-free period on all purchases. This is a standard but crucial feature. By paying your full statement balance on or before the due date, you can avoid paying any interest. This allows you to manage your cash flow effectively and use the card as a budgeting tool without incurring extra costs.

3. Travel and Security Benefits

For South African travellers, the Standard Bank Credit Card offers significant value. Cardholders get comprehensive travel insurance and a range of security features, including:

- Chip and PIN technology and fraud detection to protect your account from unauthorised transactions.

- Zero-liability protection means you aren’t held responsible for fraudulent charges if your card is lost or stolen.

- Global acceptance, making it easy to use your card at millions of merchants worldwide.

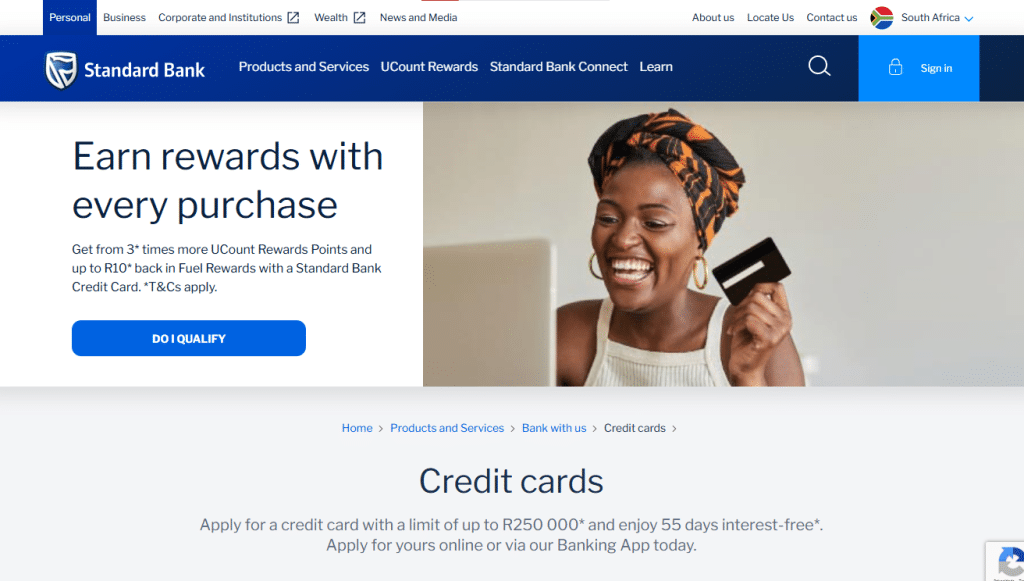

Step-by-Step Guide: How to Apply for a Standard Bank Credit Card

Applying for a Standard Bank credit card is a straightforward process. Follow this simple, step-by-step guide to get started:

Step 1: Go to the Cards Page

First, go to the official Standard Bank credit cards page.

You can do this by using the following link in your browser:

https://www.standardbank.co.za/southafrica/personal/products-and-services/bank-with-us/credit-cards/our-cards

There, you will find a variety of Standard Bank credit cards and can choose the one that best suits your needs and goals.

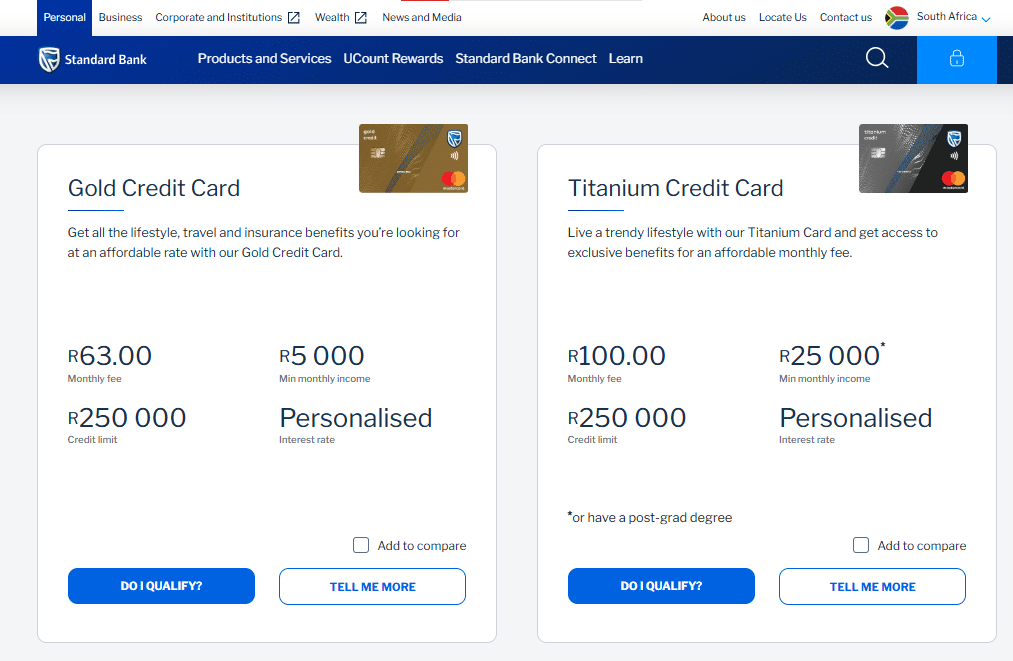

Step 2: Choose the card you would like to apply for:

Gold Credit Card, Titanium Credit Card, Platinum Credit Card, World Citizen Credit Card, Diners Club Platinum Credit Card, Diners Club Shari’ah Credit Card, Diners Club Beyond Credit Card, or the Blue Credit Card.

Then, click on the blue button “DO I QUALIFY?”

Step 3: Fill Out the Online Form

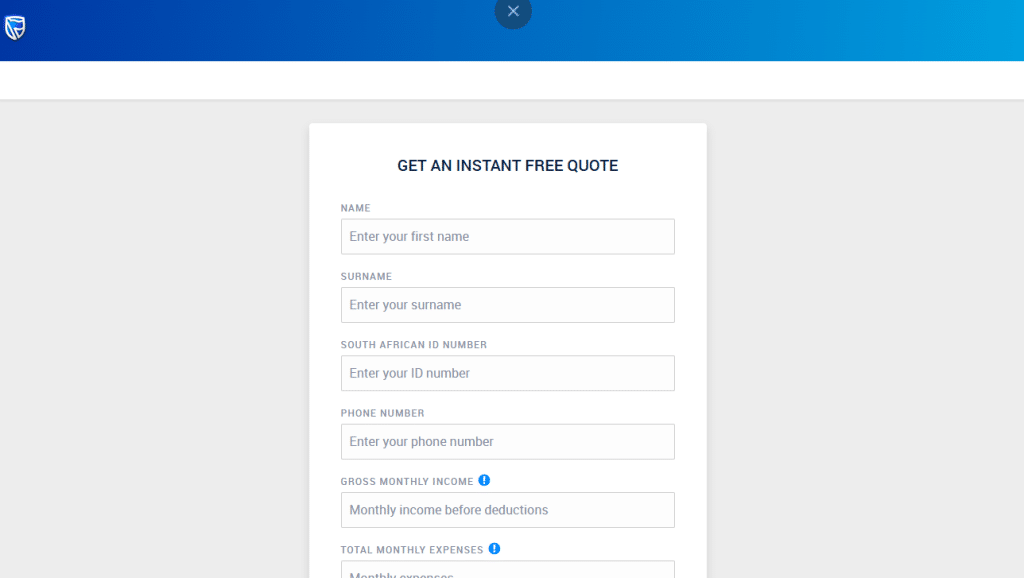

Clicking the button will open a small window or form. You’ll need to provide some basic information so the bank can check if you meet the minimum requirements.

- Fill in the fields with your details.

- Once you’re done, click the “Submit” button.

After you submit, Standard Bank will perform a quick assessment to let you know if you pre-qualify. If you are pre-approved, the next step will be to provide the necessary documents and continue with the full application.

South African Standard Credit Card: A Detailed Guide

Choosing the right credit card can be a game-changer for your finances. In South Africa, the Standard Bank Credit Card stands out as a popular choice, but how does it stack up against the competition? This guide breaks down the features, benefits, and requirements of a Standard Credit Card, with direct comparisons to other leading cards in the market, helping you make an informed decision.

Key Features of the Standard Bank Credit Card

The Standard Bank Credit Card is designed to offer a balance of everyday convenience and valuable rewards. Here’s a closer look at its core features:

1. UCount Rewards Programme

One of the standout benefits of a Standard Bank Credit Card is the UCount Rewards programme. Cardholders earn points on qualifying purchases, both in-store and online. These points can be redeemed for various rewards, including:

- Fuel Rewards: Get up to R2 back per litre of fuel at participating Caltex service stations.

- Retail Vouchers: Use your points to shop at popular retailers like Checkers, Clicks, and Incredible Connection.

- Travel and Lifestyle: Redeem points for flights, accommodation, and a wide range of products.

This programme is particularly beneficial for those who frequently spend on fuel and groceries, as the rewards can quickly add up, effectively giving you a discount on everyday expenses.

2. Up to 55 Days Interest-Free

Standard Bank offers an up to 55-day interest-free period on all purchases. This is a standard but crucial feature. By paying your full statement balance on or before the due date, you can avoid paying any interest. This allows you to manage your cash flow effectively and use the card as a budgeting tool without incurring extra costs.

3. Travel and Security Benefits

For South African travellers, the Standard Bank Credit Card offers significant value. Cardholders get comprehensive travel insurance and a range of security features, including:

- Chip and PIN technology and fraud detection to protect your account from unauthorised transactions.

- Zero-liability protection means you aren’t held responsible for fraudulent charges if your card is lost or stolen.

- Global acceptance, making it easy to use your card at millions of merchants worldwide.

Eligibility and Requirements

To apply for a Standard Bank Credit Card, you need to meet a few key criteria. The process is straightforward, but it’s essential to have the following ready:

- Age and Residency: You must be a South African resident, aged 18 or older.

- Proof of Income: A minimum monthly income is required. While this varies by card type, it generally starts at around R5,000 for a basic card. You’ll need to provide a recent payslip or bank statement.

- Proof of Identity and Residence: A valid South African ID or passport, along with a recent utility bill or bank statement (not older than three months), is necessary.

- Credit Score: Your credit score is a major factor in the approval process. A good credit history improves your chances of getting a higher credit limit and a more favourable interest rate.

Standard Bank: Everything You Need to Know About One of South Africa’s Largest Banks

Standard Bank is one of the largest and most respected banks in South Africa and across the African continent. With over 160 years of history, the bank has established itself as a leader in comprehensive financial services, offering solutions for individuals, businesses, and corporations.

Discover Standard Bank and transform your finances!

In this article, you will learn more about Standard Bank South Africa, its main products, benefits, and how to open an account.

What is Standard Bank?

Founded in 1862, the Standard Bank Group is now one of Africa’s leading financial institutions. Operating in over 20 countries, the bank is known for its stability, technological innovation, and wide range of financial services.

In South Africa, Standard Bank serves millions of customers and is a top choice for those seeking secure and reliable banking solutions.

Main Services Offered by Standard Bank

The bank provides modern financial solutions, both in-branch and digitally. Key services include:

- Current and digital accounts: accessible options for individuals and businesses.

- Credit cards: from entry-level cards like the Blue Credit Card to premium options like the Titanium Credit Card and Diners Club Beyond.

- Loans and financing: personal loans, vehicle financing, and home loans.

- Investments: savings, retirement, and investment funds.

- Digital services: a full mobile app for transfers, payments, and real-time financial management.

Benefits of Banking with Standard Bank

Choosing Standard Bank comes with several advantages:

- Security: one of the most financially stable banks in South Africa.

- Advanced technology: user-friendly and secure mobile app.

- Branch and ATM network: extensive coverage nationwide.

- Exclusive perks: reward programmes like UCount Rewards, earning points on everyday spending.

- Comprehensive customer support: financial solutions for all life stages, from students to investors.

How to Open a Standard Bank Account

Opening a Standard Bank South Africa account is simple and can be done online or at a branch. You generally need:

- A valid ID document.

- Proof of residence in South Africa.

- Proof of income (depending on the type of account or credit card requested).

Within minutes, you can access digital services and start using your account.

Conclusion

Standard Bank is more than a bank: it’s a complete financial partner for those seeking convenience, security, and exclusive benefits. Whether you want to open your first account, apply for a credit card, or invest, Standard Bank South Africa offers solutions tailored to your needs.

If you are looking for a reliable and innovative bank, Standard Bank is one of the best options in South Africa.

FAQ

What are the eligibility requirements for a Standard Bank credit card?

How do I apply for a Standard Bank credit card?

What documents do I need to provide for a Standard Bank credit card application?

How long does it take to receive a decision on my Standard Bank credit card application?

What are the fees associated with a Standard Bank credit card?

Can I check my credit score before applying for a Standard Bank credit card?

How do I activate my new Standard Bank credit card?

What are the benefits of using a Standard Bank credit card?

Can I apply for a Standard Bank credit card if I’m not a South African citizen?

How do I contact Standard Bank if I have questions about my credit card application?

Conteúdo criado com auxílio de Inteligência Artificial