Are you considering a credit card from African Bank? Understanding your options is the first step towards making an informed decision. With a range of benefits and flexible eligibility criteria, an Black Credit Card can be a valuable financial tool.

Applying for a credit card can seem daunting, but with the right guidance, it can be a straightforward process. This guide will walk you through the steps to understand African Bank’s credit card offerings, check your eligibility, and submit a successful application.

Key Takeaways

- Understand the benefits and features of Black Credit Cards.

- Learn about the eligibility criteria for applying.

- Discover the steps involved in the application process.

- Get tips on how to increase your chances of a successful application.

- Find out what to do if your application is denied.

Black Credit Card

Understanding Black Credit Card

African Bank offers a diverse range of credit cards tailored to meet the varied financial needs of South African consumers. This variety ensures that individuals can select a credit card that aligns with their financial situation, spending habits, and personal preferences.

Anúncios

Types of Credit Cards Available in South Africa

African Bank provides several types of credit cards, each designed with specific benefits and features. These include classic credit cards for everyday use, gold credit cards offering additional rewards and benefits for frequent users, and platinum credit cards that provide premium services and exclusive rewards for high-spending customers.

Anúncios

Features and Benefits for South African Consumers

The features and benefits of Black Credit Card are designed to enhance the user experience. These include cashback rewards, travel insurance, and purchase protection. Additionally, cardholders can enjoy benefits such as 24/7 customer support and online account management tools, making it easier to track spending and manage finances.

Current Interest Rates and Fee Structure

Understanding the interest rates and fee structure is crucial when choosing a credit card. African Bank’s interest rates vary based on the type of credit card and the customer’s creditworthiness. It’s also important to be aware of fees such as annual fees, late payment fees, and foreign transaction fees to avoid unexpected charges.

African Bank: Get to Know Its Services, Advantages, and Why It Stands Out in the South African Market

In an increasingly competitive financial landscape, African Bank has established itself as an institution that is redefining the banking experience, with a focus on inclusion and uncomplicated products. Known for its customer-centric approach, the bank offers a range of services that meet both basic and advanced financial needs.

If you are looking for an alternative to the major traditional banks or simply want to better understand what African Bank offers, this article is for you.

History and Mission of African Bank

African Bank has a notable history, born with the mission to provide access to quality financial services for all South Africans. Over the years, it has solidified its position as a bank that understands its clientele’s needs, offering flexible and transparent products. Its core philosophy is to empower people to achieve their financial goals, regardless of their income.

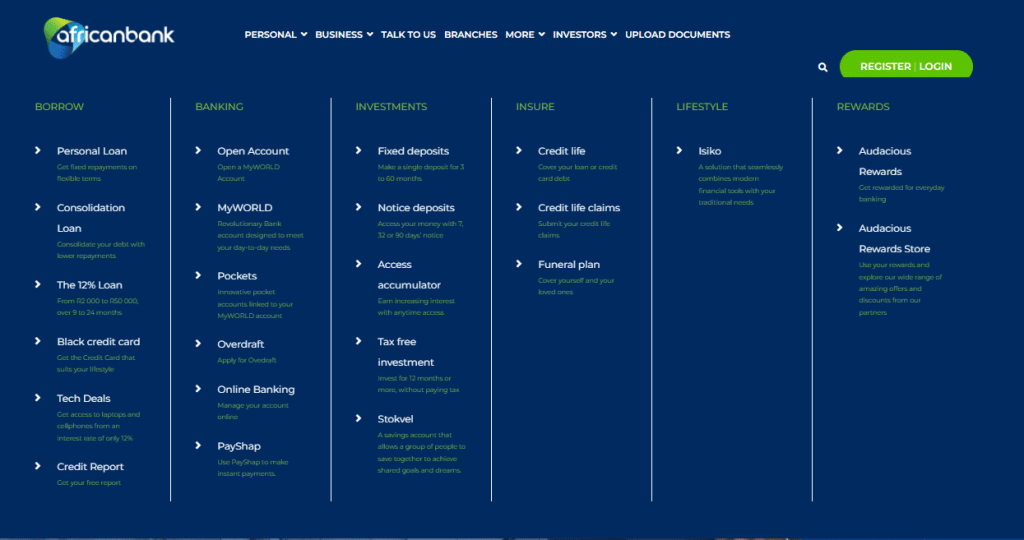

Products and Services Offered

The strength of African Bank lies in its product portfolio, which is both robust and easy to understand.

Current Accounts: The MyWORLD Account

The MyWORLD account is the bank’s main current account product. It was designed to be simple and affordable, allowing customers to manage their money smartly. One of its most innovative features is the “Pockets,” which allow you to separate money into different categories (like “bills” or “travel”) directly within the main account.

Personal Loans

African Bank is widely recognized for its personal loan solutions. It offers loans with flexible terms, competitive rates, and a surprisingly fast approval process. For many, it is the first choice when seeking credit to consolidate debt, carry out a project, or cover an unexpected expense.

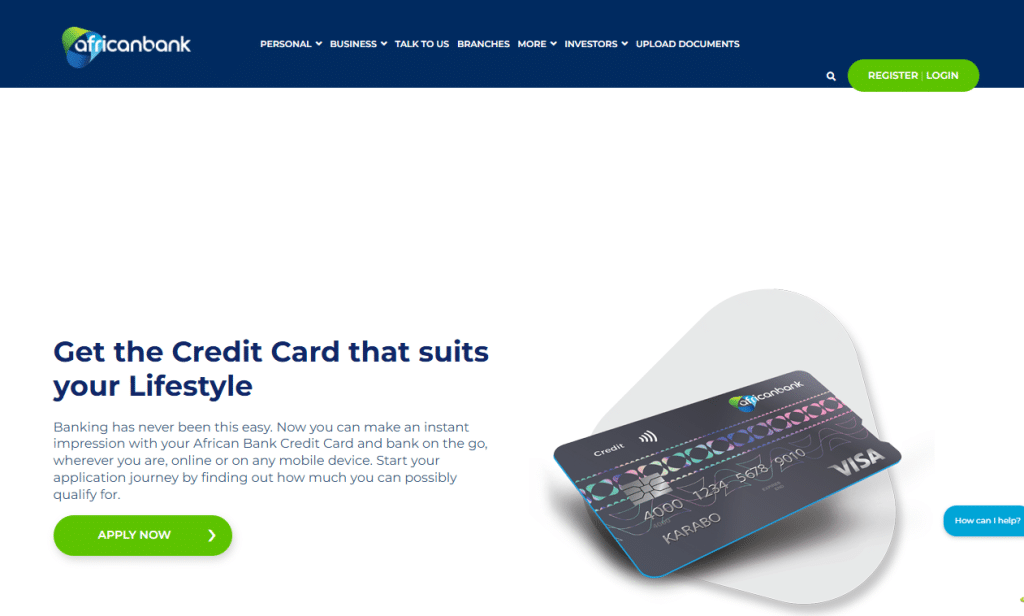

Credit and Debit Cards

In the card segment, the bank offers the African Bank Black Credit Card, a premium card with travel benefits and purchase protection, and the debit card linked to the MyWORLD account, ideal for daily use.

Savings and Investment Products

For those who want to grow their money, the bank provides various savings options with competitive interest rates, in addition to investment products that suit different risk profiles.

African Bank

Access and Convenience: Branches and Digital

African Bank balances its physical presence with a strong digital platform. You can find branches and kiosks across the country for in-person service, but most operations can be conveniently carried out through the African Bank mobile app or the online banking platform. This ensures you have access to your financial services anytime, anywhere.

Why Choose African Bank?

Choosing African Bank means opting for:

- Transparency: Clear products and fees, with no hidden costs.

- Financial Inclusion: A commitment to serving a wide range of clients.

- Innovation: A modern and efficient digital banking experience.

- Simplicity: Products that are easy to understand and use.

In a market dominated by giants, African Bank stands out for its customer-focused approach, proving that it is possible to offer high-quality financial services with a personal touch and a strong sense of purpose.

Eligibility Requirements for an Black Credit Card

To apply for an Black Credit Card, you must meet specific eligibility criteria. These requirements are designed to ensure that applicants have the financial stability and creditworthiness to manage their credit card accounts effectively.

South African Citizenship and Residency Requirements

Applicants must be South African citizens or residents with a valid ID or passport. This requirement is crucial for verifying the applicant’s identity and ensuring compliance with financial regulations.

Minimum Income Thresholds

African Bank has set minimum income thresholds that applicants must meet. This ensures that cardholders have a stable income to make payments on their credit card accounts. The specific income requirements may vary depending on the type of credit card applied for.

Credit Score Considerations in the South African Context

A good credit score is essential for credit card approval. African Bank evaluates an applicant’s credit history to assess their creditworthiness. A higher credit score indicates a better credit history and increases the likelihood of approval.

Tutorial: How to Apply for the African Bank Black Credit Card – Step-by-Step

The African Bank Black Credit Card is a great option for anyone looking for a credit card with premium benefits and a quick, digital application process. If you want to access this convenience, follow this simple and educational guide to start your application.

1- Access the official African Bank website

Go to the African Bank homepage to start your journey. The official URL is: https://www.africanbank.co.za/en/home/.

2- Navigate to the Credit Cards section

In the main menu, find and click the “Personal” option. Next, in the list of products, look for “Credit Cards” and click to access the page dedicated to cards.

3- Get to know all the card’s details

On this page, you’ll find complete information about the Black Credit Card, including its main benefits, fees, and application requirements. This step is essential to ensure the card meets your needs.

4- Download the app to complete the application

To ensure security and convenience, the card application is completed directly through the African Bank app. Download it from your phone’s app store and follow the instructions to securely start the process.

- Google Play Store: https://play.google.com/store/apps/details?id=za.co.android.africanbank

Documents Needed for Your Application

To successfully apply for an Black Credit Card, you’ll need to gather specific documents. Ensuring you have all the necessary paperwork will streamline the application process.

South African ID or Valid Passport

The first requirement is a valid form of identification. This can be either a South African ID book or a valid passport. Ensure your ID is not expired, as this is a critical document for verifying your identity.

Proof of Income Documentation

You’ll also need to provide proof of income. This can be in the form of your latest payslip or a letter from your employer. Self-employed individuals may need to provide additional financial documentation, such as audited financial statements.

Proof of Residence Requirements

African Bank requires proof of your residential address. This can be a utility bill, bank statement, or any other official document that shows your name and address. Ensure the document is recent and clearly displays your address.

| Document Type | Description | Example |

|---|---|---|

| ID or Passport | Valid identification | South African ID or valid passport |

| Proof of Income | Latest financial documentation | Payslip or employer’s letter |

| Proof of Residence | Recent utility or official document | Utility bill or bank statement |

African Bank: Practical Guide to Request Your Credit Card

The process of requesting an Black Credit Card is simple and can be done online, in-branch, or via telephone banking. This flexibility allows you to choose the method that best suits your needs and preferences.

Step-by-Step Online Application Process

Applying online is a convenient option. To do so, visit the African Bank website, navigate to the credit card section, and fill out the application form. Ensure you have your identification and financial documents ready to complete the process efficiently.

- Go to the African Bank website.

- Navigate to the credit card section.

- Fill out the online application form.

- Upload required documents.

- Submit your application.

Visiting an African Bank Branch in Person

If you prefer a more personal touch, you can visit an African Bank branch. The bank staff will guide you through the application process, answer any questions you may have, and help you complete the necessary paperwork.

Applying via Telephone Banking

Telephone banking is another convenient option. By calling the African Bank customer service number, you can request a credit card application form to be sent to you. Alternatively, the bank representative can guide you through the application process over the phone.

Tips for a Smooth Application Experience

To ensure a smooth application experience, make sure you have all required documents ready, including your ID, proof of income, and proof of residence. Double-check your application form for accuracy before submitting it.

| Application Method | Key Steps | Benefits |

|---|---|---|

| Online Application | Visit website, fill form, upload documents. | Convenient, quick, 24/7 access. |

| In-Branch Application | Visit branch, consult with staff, complete paperwork. | Personal assistance, immediate support. |

| Telephone Banking Application | Call customer service, request form or apply over phone. | Convenient, personalized service. |

Completing the Application Form Correctly

To ensure your Black Credit Card application is processed without delays, it’s essential to complete the form correctly. The application form is designed to gather both personal and financial information, which are crucial for the bank to assess your creditworthiness.

Personal Information Guidelines

When filling out the personal information section, ensure that you provide accurate details. This includes your full name as it appears on your South African ID or passport, your date of birth, and contact information such as your phone number and email address. It’s also important to provide a valid residential address.

Financial Details Required

The financial details section requires information about your income, employment status, and other financial commitments. Be prepared to provide your monthly income, the name of your employer, and details of any other credit cards or loans you have. This information helps African Bank assess your ability to manage credit responsibly.

Common Mistakes to Avoid

One of the most common mistakes applicants make is providing incomplete or inaccurate information. Ensure that all fields are filled out correctly and that you double-check your application before submitting it. Other mistakes include not signing the application form or failing to attach required documents.

By avoiding these common pitfalls and ensuring that your application form is complete and accurate, you can significantly improve your chances of a successful application.

Understanding the Credit Assessment Process

African Bank uses a comprehensive credit assessment process to evaluate the creditworthiness of applicants. This process is designed to determine the likelihood of an applicant repaying their credit card debt on time.

How African Bank Evaluates Credit Worthiness

African Bank considers several factors when evaluating an applicant’s creditworthiness, including their credit history, income level, and debt-to-income ratio. The bank uses this information to assess the risk of lending to the applicant.

Expected Timeframes for Application Review

The time it takes for African Bank to review a credit card application can vary depending on several factors, including the complexity of the application and the bank’s current workload. Typically, applicants can expect to hear back within a few business days.

Options If Your Application Is Declined

If your Black Credit Card application is declined, you will be notified of the reasons for the decision. You can use this information to improve your creditworthiness and reapply in the future.

| Credit Assessment Factors | Description | Importance |

|---|---|---|

| Credit History | Past borrowing and repayment behavior | High |

| Income Level | Current income and employment status | Medium |

| Debt-to-Income Ratio | Comparison of debt payments to income | High |

Receiving and Activating Your New Credit Card

Receiving and activating your Black Credit Card is a straightforward process that gets you ready to make purchases. Once your application is approved, your new card will be dispatched to you through a secure delivery method.

Delivery Methods Available in South Africa

African Bank offers secure and reliable credit card delivery methods to ensure your new card reaches you safely. You can expect to receive your card within 7-10 business days after approval.

Step-by-Step Card Activation Instructions

Activating your card is simple. You can activate it by:

- Calling the dedicated activation hotline provided with your card

- Using African Bank’s online banking platform

- Visiting an African Bank branch in person

Follow the prompts to complete the card activation process.

Setting Up Your PIN and Security Features

After activation, setting up your PIN is crucial for securing your transactions. You can set your PIN:

- At an African Bank ATM

- By contacting African Bank’s customer service

Ensure your PIN is unique and not easily guessable. This step is part of the PIN setup process, enhancing the security of your card.

| Delivery Method | Activation Method | PIN Setup Method |

|---|---|---|

| Secure Mail Delivery | Dedicated Hotline | ATM |

| Online Banking | Customer Service | |

| In-Branch Visit |

Managing Your Black Credit Card Card Account

Taking control of your Black Credit Card account is straightforward, thanks to the bank’s innovative digital solutions. With a range of tools and services available, you can easily monitor and manage your account to suit your financial needs.

Online Banking Portal Features

The online banking portal offered by African Bank is designed to provide a seamless user experience. You can view your account balance and transaction history, make payments, and update your account details all in one place. The portal is accessible 24/7, allowing you to manage your account at your convenience.

Mobile App Functionality for South African Users

African Bank’s mobile app is tailored to meet the needs of South African users, offering a range of features that make managing your credit card account on-the-go a breeze. You can check your balance, track your spending, and receive important account alerts. The app is available for download on both iOS and Android devices.

Customer Service Channels and Operating Hours

For any queries or concerns regarding your credit card account, African Bank offers multiple customer service channels. You can contact the bank via phone, email, or by visiting a branch in person. The customer service team is available during extended hours to accommodate your schedule.

Setting Up Alerts and Notifications

To stay on top of your account activity, you can set up alerts and notifications through the online banking portal or mobile app. This feature allows you to receive updates on large transactions, payment due dates, and other important account events. To set up alerts, simply:

- Log in to your online banking account or mobile app

- Navigate to the ‘Alerts’ or ‘Notifications’ section

- Choose the types of alerts you wish to receive

- Save your preferences

By staying informed, you can better manage your credit card account and maintain control over your finances.

Making Payments and Avoiding Penalties

Making timely payments on your Black Credit Card can save you from late fees and interest charges. It’s essential to understand the various payment methods available and how they can help you manage your credit card account effectively.

Payment Methods Available in South Africa

African Bank offers several payment methods for your convenience, including online banking, mobile banking, and in-branch payments. You can also set up debit orders to ensure that your payments are made on time.

Understanding Minimum Payments and Interest Calculations

The minimum payment is the smallest amount you can pay on your credit card bill without incurring late fees. However, paying only the minimum can lead to higher interest charges over time. Interest is calculated daily based on your outstanding balance. Understanding how this works can help you manage your payments more effectively.

| Payment Method | Processing Time | Convenience Level |

|---|---|---|

| Online Banking | Instant | High |

| Mobile Banking | Instant | High |

| In-Branch Payment | Same Day | Medium |

| Debit Order | Automatic | High |

Consequences of Late or Missed Payments

Missing a payment or paying late can result in penalties, including late fees and higher interest rates. This can also negatively affect your credit score. To avoid these consequences, set up reminders or automatic payments to ensure you never miss a payment.

Credit Card Security Best Practices

As a cardholder in South Africa, it’s essential to prioritize credit card security to protect your financial information. With the increasing number of digital transactions, the risk of credit card fraud has also risen. Therefore, understanding and implementing best practices for credit card security is crucial.

Protecting Your Card Information

To safeguard your credit card information, it’s vital to be cautious when sharing your details online or over the phone. Ensure that you’re dealing with reputable merchants and never store your card information on unsecured websites. Additionally, regularly check your card statements for any suspicious transactions.

- Keep your card details confidential and avoid sharing them with anyone.

- Use strong passwords and keep them confidential.

- Be cautious of phishing scams that ask for your card information.

Reporting Lost or Stolen Cards

If your credit card is lost or stolen, it’s crucial to report it to your bank immediately. Most banks, including African Bank, offer 24/7 customer service for such emergencies. Upon reporting, your card will be blocked to prevent any unauthorized transactions.

Immediate actions to take:

- Contact African Bank’s customer service at their dedicated hotline.

- Provide your card details and other required information to facilitate the reporting process.

- Request a replacement card and inquire about any temporary card limits.

Recognizing and Avoiding Common Scams

Being aware of common scams is key to protecting your credit card information. Be wary of unsolicited calls or emails asking for your card details. Legitimate banks will never ask for your PIN or card details over an unsecured line.

Tips to avoid scams:

- Verify the authenticity of any request for your card information.

- Avoid clicking on suspicious links sent via email or SMS.

- Regularly update your security software to protect against malware.

Maximizing Benefits of Your Black Credit Card

Maximizing the benefits of your Black Credit Card can enhance your financial flexibility and rewards. To get the most out of your card, it’s essential to understand the various benefits and services that come with it.

Current Rewards Programs and Earning Rates

African Bank offers competitive rewards programs that allow you to earn points or cashback on your purchases. The earning rates vary depending on the type of credit card you have, with some cards offering higher rewards in specific categories such as dining or travel.

- Earn points on every purchase with our rewards program.

- Enjoy cashback on select transactions.

- Redeem your points for rewards or statement credits.

Insurance and Protection Services Included

Your Black Credit Card comes with various insurance and protection services, including:

| Service | Description |

|---|---|

| Purchase Protection | Protects your purchases against theft or damage. |

| Travel Insurance | Covers unexpected travel-related expenses. |

Special Offers and Promotions for South African Cardholders

As an African Bank credit cardholder in South Africa, you can enjoy exclusive special offers and promotions, including discounts at partner merchants and limited-time offers on specific products or services.

Stay informed about the latest offers by visiting our website or mobile app.

Conclusion

Now that you’ve gone through this comprehensive credit card guide, you’re ready to take the next step. Applying for an Black Credit Card can be a straightforward process if you have the right information. By understanding the eligibility requirements, necessary documents, and application process, you’re well on your way to obtaining a credit card that fits your financial needs.

Remember, managing your Black Credit Card effectively is key to maximizing its benefits. Make timely payments, keep track of your spending, and take advantage of the rewards programs available. With the right approach, your Black Credit Card can be a valuable financial tool, helping you achieve your goals and enjoy peace of mind.

Whether you’re looking to build your credit history, finance a large purchase, or simply enjoy the convenience of a credit card, African Bank has a solution for you. Take the first step today by visiting the African Bank website or stopping by a local branch to explore your options.

FAQ

What are the eligibility requirements for an African Bank credit card?

What documents are needed to apply for an African Bank credit card?

How do I apply for an African Bank credit card?

How long does it take for African Bank to review my credit card application?

What happens if my African Bank credit card application is declined?

How do I activate my new African Bank credit card?

What payment methods are available for my African Bank credit card?

How can I protect my African Bank credit card information?

What are the benefits of using an African Bank credit card?

How can I manage my African Bank credit card account online?

Conteúdo criado com auxílio de Inteligência Artificial