The Bank of Ireland Platinum Advantage Card is the bank’s premium credit product, designed for customers seeking a low interest rate combined with a range of benefits and a more substantial credit limit. It is an excellent choice for those with a solid credit history looking for a long-term, low-cost financial tool for major purchases or everyday expenses.

Platinum Credit Card

This informative and article provides a detailed guide on how to apply for this card in Ireland, covering the requirements, the process, and the benefits, exclusively using official information from the Bank of Ireland sources.

🇮🇪 IRELAND: STEP-BY-STEP TUTORIAL – How to Apply for the Bank of Ireland Platinum Credit Card

If you are looking for a lower interest rate and additional insurance benefits, follow this guide to apply for the Bank of Ireland Platinum Credit Card.

Anúncios

Introduction: Why Choose the Platinum Credit Card?

The Bank of Ireland Platinum Credit Card is often promoted as the bank’s card with the lowest standard interest rate. It is a premium option that includes benefits such as worldwide multi-trip travel insurance and offers a lower standard purchase interest rate (APR) than the Classic Card.

Anúncios

Before You Start: What You Need

- You must be over 18 years of age.

- You must be a resident in the Republic of Ireland.

- You must meet the bank’s lending criteria, which includes proof of income.

- Documentation for identity, address, and proof of income.

- Note: The Platinum Card has an Annual Account Fee (currently around $\mathbf{€76.18}$) in addition to the statutory Government stamp duty of $\mathbf{€30}$.

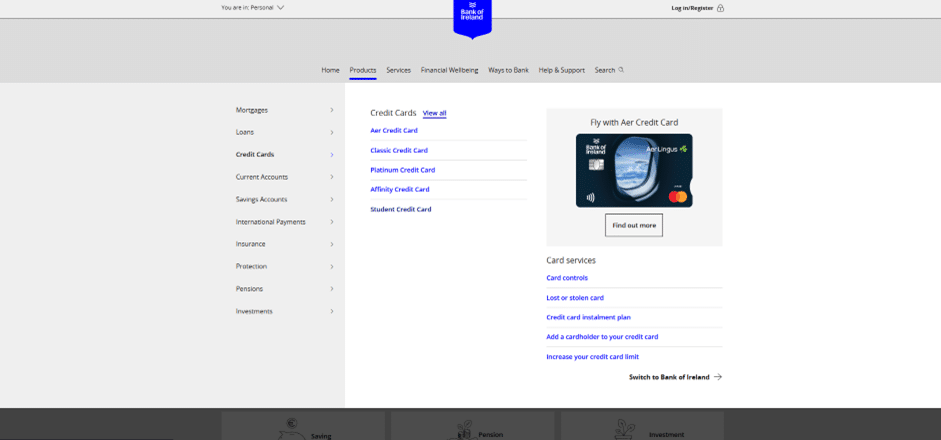

Step 1: Access the Bank of Ireland Credit Cards Page

Your application starts on the main Bank of Ireland website.

- Access the Bank of Ireland Personal Banking homepage:

https://personalbanking.bankofireland.com/ - In the main menu, click the second option: “Borrow” (or “Products” if the menu layout has changed).

- In the ensuing submenu, select the third option: “Credit Cards”, and then click on “View all” (or “Compare Credit Cards”).

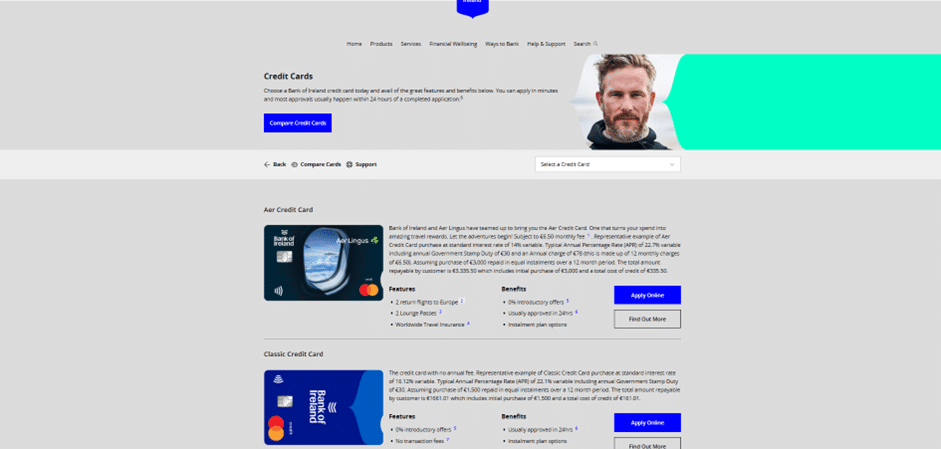

Step 2: Select the Platinum Credit Card

On the Credit Cards comparison page, locate and select the Platinum option.

- On this page, you will see various credit card options, such as Classic, Aer, and Student.

- Choose the Platinum Credit Card (often the third option) by clicking the “Find out more” button associated with it.

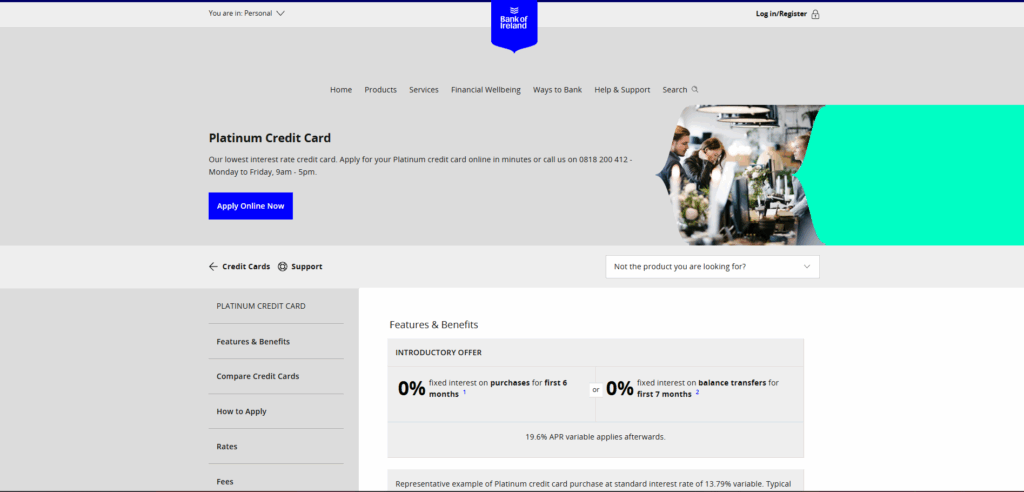

Step 3: Begin the Online Application

You will be directed to the detailed product page for the Platinum Credit Card.

- On this page, you will find all the important information about the Platinum Card, including the Representative Annual Percentage Rate (APR) of $\mathbf{19.6\%}$ variable and the introductory offers ($\mathbf{0\%}$ interest, generally for 6 months on purchases or 7 months on balance transfers).

- Click the distinctive blue button, labelled “Apply Online Now” to proceed with the application.

Step 4: Complete the Application Form

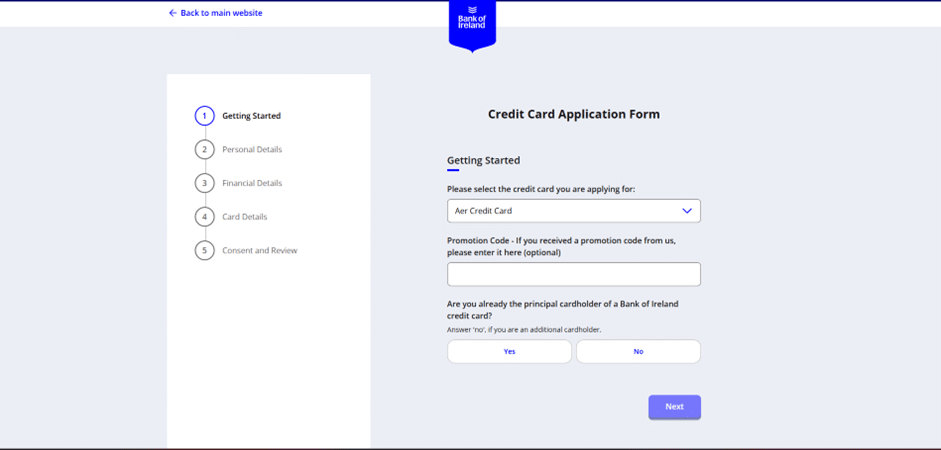

You will be redirected to the Bank of Ireland’s online application platform.

- If you are an existing Bank of Ireland customer with access to 365 Online, the process will be simpler. The bank states that most approvals for existing customers happen within 24 working hours.

- Fill out the required information (personal details, income, financial details) and follow the instructions for submitting documents.

- After completing the information and following all instructions, you will submit your application for review and will soon receive a response regarding your Platinum Credit Card.

Overview of Bank of Ireland: A Foundation of Trust in the Irish Financial Sector

The Bank of Ireland (BOI) is one of the oldest and most influential banks in Ireland, maintaining a leading position in the country’s financial market.

Bank of Irland

Why BOI’s Credibility Matters:

- Stability and History: With a history spanning centuries, BOI is synonymous with stability. Being a customer of a large, regulated bank provides a layer of security and confidence in the management of your financial products.

- Strict Regulation: The bank operates under the supervision of the Central Bank of Ireland, ensuring that all its products, including the Platinum Advantage Card, comply with rigorous consumer protection and responsible lending standards.

- Comprehensive Offering: BOI offers a wide range of services, from current and savings accounts to loans and mortgages, making it a convenient “one-stop shop” for customers’ complete financial needs.

- Platinum Card Profile: The Platinum Advantage Card reflects the bank’s commitment to providing high-quality products for customers with a strong credit profile, who benefit from more competitive interest rates compared to standard offerings.

Everything People Need to Know to Apply for the Card

The Bank of Ireland Platinum Advantage Card is aimed at individuals with an excellent credit history and financial capacity. While the application process is streamlined, compliance with eligibility requirements is rigorous.

1. Essential Requirements and Applicant Profile

Due to its more favourable financial terms, the Platinum Card requires applicants to meet specific criteria:

- Minimum Age: The applicant must be over 18 years of age.

- Residency: It is mandatory to be a resident in the Republic of Ireland for at least 6 months or more.

- Rigorous Credit Assessment: Approval is subject to the bank’s lending criteria, terms and conditions, and a stricter underwriting assessment of the applicant’s financial status and repayment capacity. The candidate must demonstrate solid financial standing and an excellent credit history to qualify for the lowest interest rate.

- Documentation: As with all credit products, you will need to provide documentation to prove:

- Identity: Valid Passport or Driving Licence.

- Address: Proof of address (e.g., recent utility bill or bank statement).

- Income/Financial Capacity: Proof of income to support the affordability assessment.

2. Financial Features and Exclusive Benefits

The Platinum Advantage Card stands out for its low interest rate and benefits designed for regular and high-volume use.

| Financial Feature | Detail |

| Standard Purchase Rate | 14.57% variable (BOI’s lowest purchase rate). |

| Representative APR | 20.2% variable Typical Annual Percentage Rate (APR) (Includes the annual Government Stamp Duty of €30). |

| Annual Fee (Account Charge) | The card has an Annual Account Fee of €76.18 – a premium cost that unlocks the benefits and the low interest rate. |

| Government Stamp Duty | The Annual Government Stamp Duty of €30 is charged (mandatory for all credit cards in Ireland). |

| Interest-Free Period | Up to 56 days interest-free credit on purchases, provided the full statement balance is paid in full and on time every month. |

| Minimum Credit Limit | The minimum credit limit is €2,500 (subject to approval). This card is aimed at customers who require greater purchasing power. |

| Flexible Payment Options | The card allows for Instalment Plan Options, enabling the cost of large purchases to be split into monthly payments. |

| Additional Cards | Option to add extra credit cardholders to the main account. |

3. Introductory Offers (For New Customers)

New credit card customers can choose between two introductory 0% interest rate offers:

- 0% Interest on Purchases: 0% fixed interest on purchases for the first 6 months from account opening.

- 0% Interest on Balance Transfers: 0% fixed interest on balance transfers for the first 7 months from account opening.

- Note: The 20.2% variable APR applies after the promotional period ends.

4. Step-by-Step Guide: The Application Process

The Bank of Ireland simplifies the application, allowing customers to choose the most convenient method for them.

Step 1: Document Collection and Self-Assessment

- Confirm that your income and credit history are strong enough to justify the minimum credit limit of €2,500 and the low interest rate.

- Gather all necessary identification documents, proof of address, and proof of income.

Step 2: Choosing the Application Channel

The Bank of Ireland offers the following options to start your application:

- Online Application (The Fastest): This is the preferred method. Go to the official Bank of Ireland website, navigate to the Platinum Advantage Card page, and click “Apply Online Now”. The online process is the fastest and may take less time for customers registered for the bank’s 365 online service.

- By Phone: Call the dedicated BOI credit card line (available Monday to Friday, 9 am – 5 pm). An agent will help you complete the application and advise if any additional documents are required by post.

- In Branch: Visit your local Bank of Ireland branch. Consultants can guide you through the application form and receive your documents directly.

Step 3: Approval and Card Issuance

- Quick Assessment: BOI strives to offer quick approval, often within one working day, if all documents and information are complete. However, due to the premium nature of the card, the credit assessment may be more detailed.

- Card Receipt: Upon approval, the Platinum Advantage Card will be mailed to your registered address. Activation can be done through 365 online or the mobile app.

- Responsible Use: To maintain the benefit of the low interest rate, it is crucial to manage the card responsibly, avoiding interest charges by paying the full balance on time.

The Platinum Advantage Card is more than just a payment method; it is a low-cost financial management tool for those with the responsibility and profile to use it effectively.

FAQ – Frequently Asked Questions about the Bank of Ireland Platinum Advantage Card

Q: What is the Annual Account Fee (Annual Charge) for the Platinum Advantage Card?

A: The card has an Annual Account Fee of €76.18. In addition, the mandatory Annual Government Stamp Duty of €30 is charged.

Q: What is the Representative APR for this card?

A: The Representative APR is 20.2% variable, which is the lowest rate among Bank of Ireland’s credit card offerings.

Q: Is there a minimum credit limit for the Platinum Advantage Card?

A: Yes. The minimum credit limit that may be granted is €2,500, subject to approval and the applicant’s financial capacity.

Q: What is the 0% introductory interest rate offer?

A: New customers can choose between 0% fixed interest on purchases for 6 months or 0% fixed interest on balance transfers for 7 months.

Q: Does the card have an interest-free period?

A: Yes, you can enjoy up to 56 days interest-free credit on purchases if you pay the full monthly statement balance on time.

Q: Can I apply for this card if I am not an Irish resident?

A: No. It is a mandatory requirement to be a resident in the Republic of Ireland for 6 months or more to be eligible.

Q: Why is the interest rate lower on this card?

A: The lower interest rate (14.57% standard) is one of the main benefits of the Platinum Card, which is offered to customers with a stronger and more stable credit profile.

Conteúdo criado com auxílio de Inteligência Artificial