Want a card for every moment?

It’s key to grasp how New Zealand’s interest rates change for those dealing with its finances. The Official Cash Rate (OCR) set by the Reserve Bank affects many things. These include mortgage rates and the wider money markets.

We will explore current trends and look back at past changes. We’ll also see how interest rates and inflation connect. This will help you understand how these rates impact your money choices in New Zealand.

ANZ Visa Credit Card

Understanding the Official Cash Rate (OCR)

The Official Cash Rate, or OCR, is key for New Zealand’s Reserve Bank to shape its monetary policy. It directly changes the rates at which banks lend money. This has a big effect on all kinds of interest rates. The Reserve Bank aims to keep inflation between 1-3% by adjusting the OCR. This helps keep the economy stable, touching on everything from home loans to savings.

The Role of the Reserve Bank

The Reserve Bank of New Zealand handles the OCR carefully. It aims for stable prices to help the economy grow well. When needed, it changes the OCR to meet new economic situations.

For example, the OCR was lowered from 5.5% to 3.75%. This shows the Bank’s effort to keep the economy strong despite changing inflation.

How OCR Influences Interest Rates

The OCR’s changes greatly affect interest rates. When the OCR goes down, lending rates usually do too, making it cheaper to borrow money. This affects many financial products, making them more accessible to people. A smartly managed OCR helps New Zealand’s economy by encouraging both spending and saving.

Current Trends in New Zealand’s Interest Rates

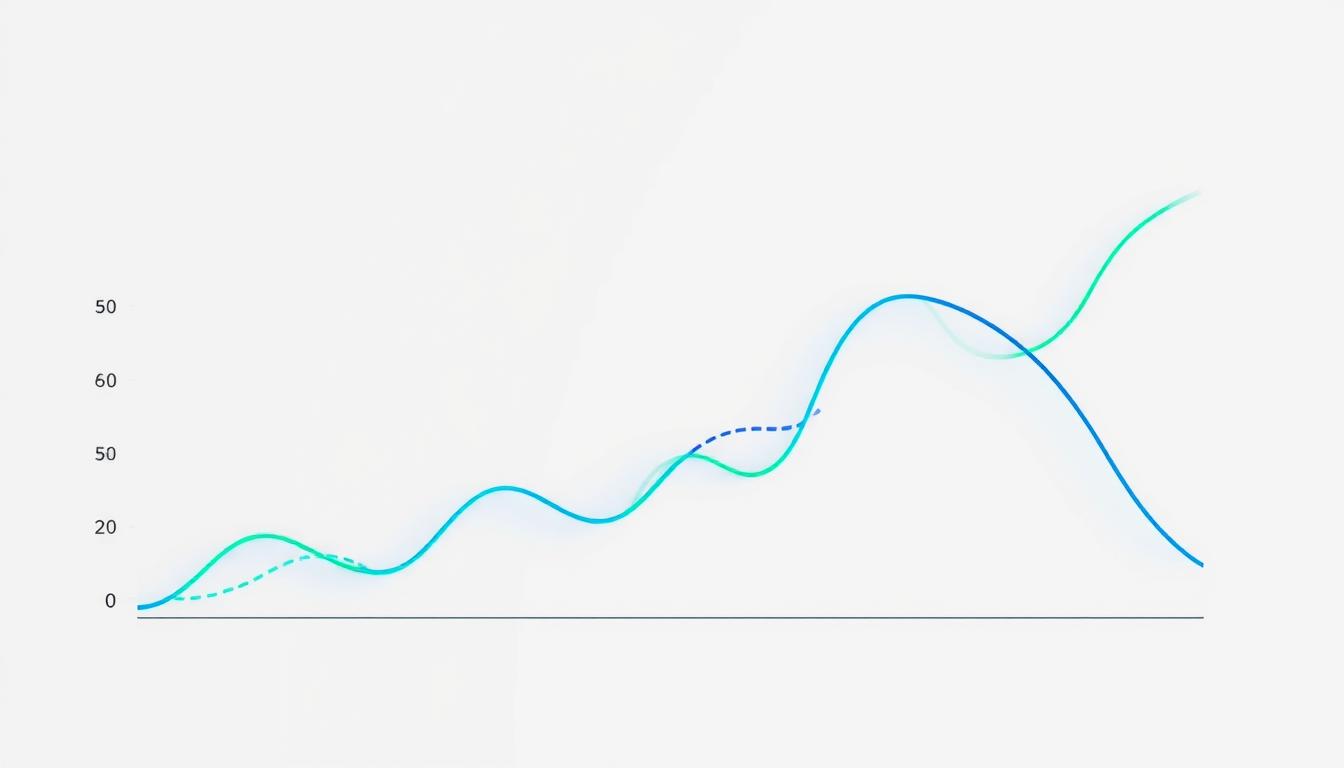

In recent years, New Zealand’s interest rates have seen big changes. This is due to the economy going up and down. Looking back at old rates, especially during times when prices were rising fast, helps us understand the new rates. The cuts to the Official Cash Rate (OCR) show efforts to keep rates stable as the economy changes.

Historical Overview of Rate Changes

Historically, New Zealand’s interest rates have had their ups and downs. Rates were once over 5.0% before dropping to as low as 3.25%, with eyes on what might happen by 2025. These changes are closely tied to inflation, which hit 7.3% in 2022 but is now around 2%. This shows how economic stress leads to changes in rates.

Recent Cuts and Future Expectations

Recently, the Reserve Bank made several cuts to the OCR. This points to lower borrowing costs ahead. Rates are expected to stay between 3.00% and 4.00% in the near future. This plan aims to boost the economy and control inflation. Many believe that by 2025, rates will drop more, affecting mortgages and lending.

Interest Rates and Mortgage Markets

The current state of interest rates affects homeowners and borrowers in New Zealand a lot. The drop in the Official Cash Rate (OCR) has made mortgage rates more attractive. This allows homeowners to benefit from better borrowing conditions.

This flexibility lets many people look at options that suit their financial needs.

Impact on Homeowners and Borrowers

Lower mortgage rates mean homeowners can afford more. This shift helps borrowers manage their money better, as borrowing costs fall. Many are now seeing how these lower rates can reduce their monthly payments.

Some are even thinking about refinancing their loans to get better terms.

- Higher borrowing capacity for first-time buyers.

- Opportunities for refinancing among existing homeowners.

- Enhanced financial stability with more favorable loan terms.

Predictions for Fixed and Variable Rates

Experts think 1-year fixed mortgage rates might be between 4.5% and 6.0% by the end of 2025. They believe there will be a move towards shorter fixed rates. Homeowners want to quickly adjust to changing interest conditions.

This way, they can take advantage of possible future drops in borrowing costs.

- Shorter fixed terms favored for maximum adaptability.

- Increased interest in variable rates amidst uncertainty.

- Households adjusting strategies based on rate predictions.

Effect of Interest Rates on Inflation

Interest rates and inflation closely affect New Zealand’s economic balance. The Consumer Price Index (CPI) is about 2.2%, meeting the Reserve Bank’s goal of 1-3%. Looking at how the Official Cash Rate (OCR) impacts inflation helps us see how money policies change price levels and how people spend.

Understanding CPI and its Relationship to Rates

The CPI shows how the prices of goods and services change. When the Reserve Bank changes the OCR to keep inflation in check, it’s key for keeping the economy steady. High interest rates reduce too much spending, and low rates boost the economy when inflation is low. Knowing this helps us guess how people will respond to new monetary policies.

Inflation Forecasts for 2025 and Beyond

Experts think inflation in New Zealand will stay stable until 2025. They expect a slight increase from local and global economic pressures. This outlook means it’s important to keep a close eye on the OCR. It has a big role in setting inflation expectations and keeping the economy healthy.

Consumer Behavior and Interest Rate Changes

Interest rate changes greatly affect how people spend and save money. When rates change, individuals adjust their money management plans based on what they think will happen in the economy. Usually, low interest rates make people want to spend more since loans are cheaper. High rates, on the other hand, encourage saving for better returns on savings.

Impact on Spending and Saving

Lower interest rates often lead people to buy big items or invest more. This increase in spending helps different parts of the economy to grow. It benefits businesses and stimulates economic expansion. When rates go up, saving becomes a priority. People aim to secure their finances for the future.

Public Perception of Rate Fluctuations

How people view interest rate changes greatly impacts their financial decisions. They change their plans based on expected rate movements. They might save more expecting harder times, or spend more when rates are low. This shows how people adapt to economic conditions, linking interest rates directly to their actions.

The Correlation Between Interest Rates and Real Estate Prices

The way interest rates and real estate prices connect is key in the housing market. It’s very important to understand this link. Changes in interest rates directly affect how much people want houses and how they view investing.

How Rates Affect Housing Demand

When interest rates go down, it gets easier for people to get loans for homes. This makes more people able to buy houses, making prices go up. As competition increases, real estate prices tend to rise.

Also, when it’s cheaper to borrow money, the economy grows. This growth makes even more people want to buy houses.

Long-Term Effects on Property Investment

In the long term, steady interest rates make it easier for buyers and investors to see what’s ahead. With lower rates, more people want to put their money into houses, hoping prices will go up. Still, it’s smart to watch out for changes in the economy. These changes can affect property values and how good an investment will be, even when rates are low.

Comparing Interest Rates Across Financial Products

Different financial products react in their own ways to interest rate changes. For those navigating mortgages, saving options, credit, and loans, knowing these differences is key. This knowledge helps make smart choices that fit with the economy’s flow.

Mortgage vs. Term Deposits

Mortgage rates often change fast with the Official Cash Rate (OCR). With OCR moves, mortgage rates shift, affecting monthly payments. Meanwhile, term deposit reactions to OCR changes are slower. This makes the impact on interest less immediate, helping savers to be more cautious.

Credit Cards and Personal Loans

Credit card and personal loan rates respond differently to the OCR. Credit card rates stay around 20%, not quickly changing with OCR movements. This makes them a stable yet pricey way to borrow. Personal loans also keep their rates fairly steady against rapid OCR changes. When considering financial options, it helps to look at each one’s fit with your long-term financial plans and the current rates.

Future Outlook for New Zealand’s Interest Rates

New Zealand’s economic scene is changing. Experts think interest rates will stabilize between 3% and 4% by the end of the decade. This expected range is key for both consumers and investors. It shows why keeping an eye on future predictions is crucial.

Predictions for 2025 and 2026

As the economy changes, the Official Cash Rate (OCR) will too, but slowly. For 2025 and 2026, experts see:

- Slow but steady reductions in OCR.

- Potential impacts of global geopolitical tensions.

- Domestic developments influencing borrowing costs.

Expert Insights on Long-Term Trends

Looking ahead, New Zealand will adjust its money policies as the economy shifts. Keeping track of interest rates will be important because of:

- Unpredictable stimulants to inflation.

- Variability in consumer behavior.

- Global financial market reactions.

Conclusion

Knowing how New Zealand’s interest rates work is key for smart money choices. The Official Cash Rate (OCR) plays a big role in changing loan costs and how much you earn from savings. This affects things like house buying and how much people spend. Recently, rates seem to be going down, which means people borrowing or saving money should think about their plans again.

The changing economic scene makes the OCR’s role more important. With rates moving, people owning homes and those investing need to keep up. Being aware helps avoid problems and find good chances to improve financially.

Looking closely at what experts think about New Zealand’s rates helps you get ready for what’s coming. Being one step ahead is crucial for money matters. It leads to lasting financial health and winning in the long run.

FAQ

What is the Official Cash Rate (OCR) in New Zealand?

How do interest rates impact mortgage rates in New Zealand?

What is the current Consumer Price Index (CPI) in New Zealand?

How do interest rates affect consumer spending and saving behavior?

What are the implications of interest rate changes on real estate prices?

How do different financial products respond to changes in the OCR?

What do experts predict for New Zealand’s interest rates over the next few years?

How should consumers prepare for potential fluctuations in interest rates?

Conteúdo criado com auxílio de Inteligência Artificial