Are you looking for a reliable and rewarding credit card? The Nedbank credit card is an excellent choice, offering a range of benefits and a straightforward application process. With a Nedbank credit card, you can enjoy flexibility and security in your financial transactions.

Applying for a Nedbank credit card is simple and can be completed in just three easy steps. This process is designed to be user-friendly, ensuring that you can quickly and easily start enjoying the benefits of your new credit card.

Key Takeaways

- Simple application process for a Nedbank credit card

- Three easy steps to get approved

- Range of benefits associated with the Nedbank credit card

- Flexibility and security in financial transactions

- Reliable customer service support

Nedbank

Understanding Nedbank Credit Cards

For individuals seeking a credit card in South Africa, Nedbank presents a compelling choice with its array of card options. Nedbank’s credit cards are designed to cater to a wide range of financial needs and preferences.

Anúncios

Types of Nedbank Credit Cards Available in South Africa

Nedbank offers several types of credit cards, each with its unique features and benefits. The Nedbank Greenbacks card, for instance, is popular among those who value rewards. Other cards, like the Nedbank Credit Card, offer competitive interest rates and flexible repayment terms.

Anúncios

The variety of Nedbank credit cards ensures that consumers can find a card that suits their lifestyle and financial goals. Whether you’re looking for a card with a low interest rate, a high credit limit, or a robust rewards program, Nedbank has options to consider.

Features and Benefits Overview

Nedbank credit cards come with a range of features and benefits designed to enhance the user experience. One of the standout benefits is the Greenbacks rewards program, which allows cardholders to earn points on their purchases. These points can be redeemed for a variety of rewards, including travel, merchandise, and statement credits.

As Nedbank’s website states, “With Greenbacks, you earn points on every purchase, and you can redeem them for rewards that matter to you.”

“The flexibility to earn and redeem rewards makes our credit cards an attractive option for many South Africans.”

Additionally, Nedbank credit cards offer robust security features, including fraud protection and zero-liability policies, to safeguard cardholders’ accounts.

Complete Guide: How to Apply for a Nedbank Credit Card (Step-by-Step)

Applying for a credit card with Nedbank is a simple and practical process that can be started online and completed securely through the bank’s app. If you’re looking for a card for your purchases, travels, or exclusive benefits, this guide will show you the step-by-step process for your application.

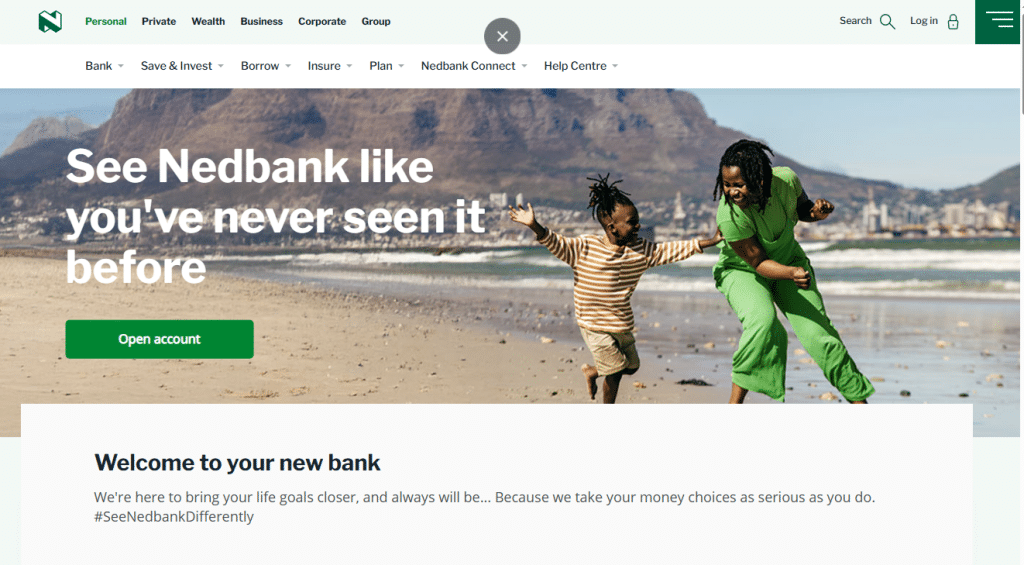

Step 1: Access the Nedbank Homepage

To get started, open your internet browser and go to the official Nedbank website.

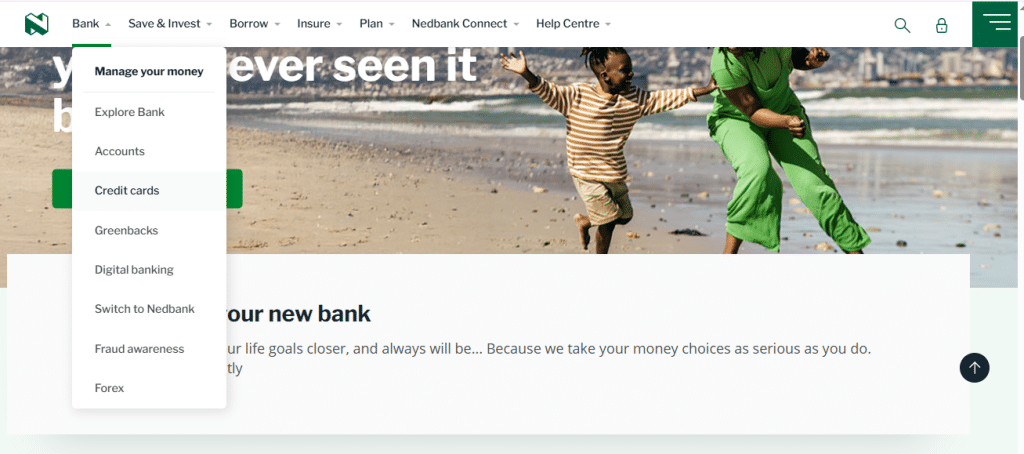

Step 2: Navigate to the Credit Cards Section

On the homepage, in the main menu or the top navigation bar, find and click the “bank” option. A dropdown menu will then appear. Select the third option, which is “credit cards”.

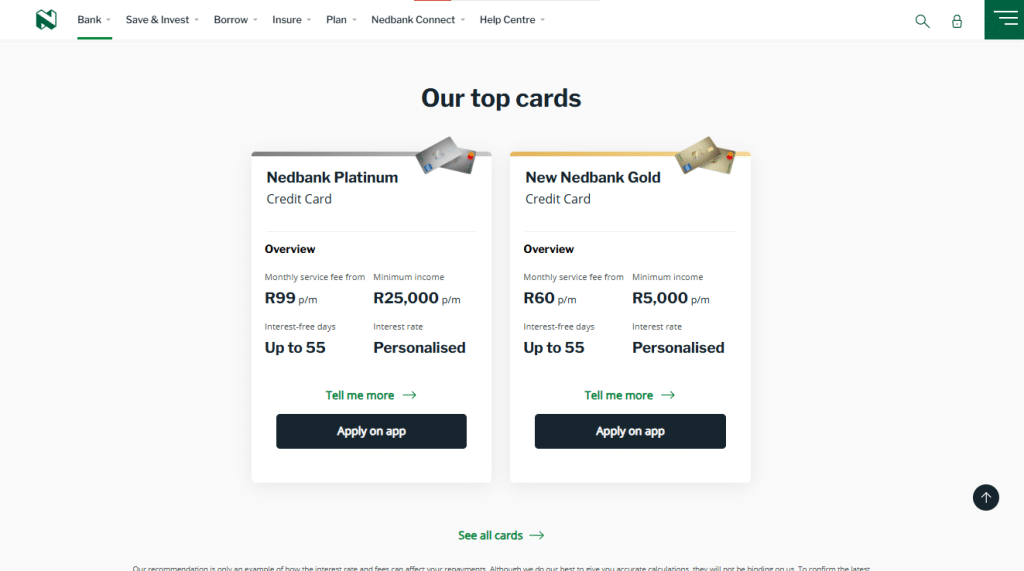

Step 3: View All Available Cards

On this new page, you’ll see an overview of the cards. To get access to the complete list and all their features, scroll down the page and click the highlighted green button: “see all cards”.

Step 4: Explore the Variety of Options

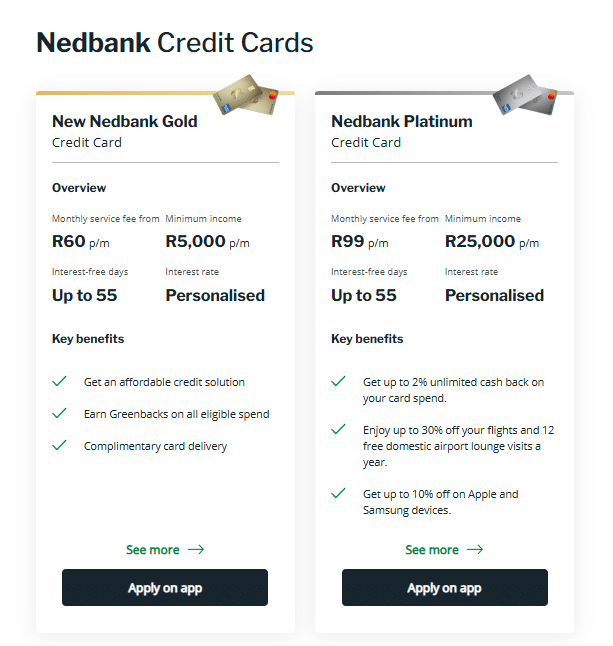

You are now on the page that shows all the credit cards Nedbank offers. The bank separates the cards by category to make your choice easier. You’ll find:

- Nedbank Credit Cards (like the Gold and Platinum cards)

- Private Clients Credit Cards

- American Express Credit Cards

- SAA Voyager Credit Cards

On this screen, you can compare the features of each card to decide which one best fits your profile.

Step 5: Start Your Application on the App

Once you’ve chosen the card you want, it’s time to begin the application process.

- On the description panel for the selected card, find and click the black “Apply on app” button.

This is a secure and efficient method to continue.

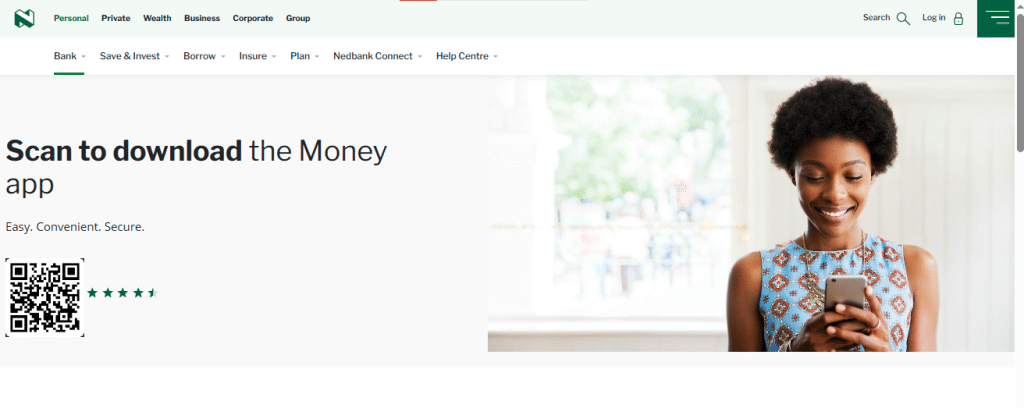

Step 6: Complete the Application with a QR Code

After you click the button, a new screen will appear with a QR code. Use your phone’s camera to scan the code. This will redirect you to the Nedbank app, where you can securely fill in the application form, with all your details already pre-filled.

You’re done! You’ve completed the process of how to apply for a credit card with Nedbank.

Benefits of Choosing a Nedbank Credit Card

Nedbank credit cards are designed with the user in mind, offering a suite of benefits that enhance the overall banking experience. Whether you’re looking for rewards, security, or global acceptance, Nedbank has a credit card that fits your needs.

Greenbacks Rewards Program

One of the standout features of Nedbank credit cards is the Greenbacks Rewards program. This program allows cardholders to earn points on their purchases, which can be redeemed for a variety of rewards, including cashback, travel, and merchandise. With Greenbacks, you can make the most of your daily expenses and enjoy tangible benefits.

Security Features and Fraud Protection

Nedbank prioritizes the security of its credit card users, offering advanced security features and fraud protection. Cardholders benefit from real-time transaction monitoring, alerts for suspicious activity, and zero-liability protection in case of unauthorized transactions. This comprehensive security framework provides peace of mind, allowing you to use your card with confidence.

Global Acceptance and Travel Benefits

Nedbank credit cards are accepted globally, making them an excellent choice for travelers. Whether you’re shopping abroad or traveling for business, your Nedbank credit card offers competitive exchange rates and travel-related benefits, such as travel insurance and assistance services. This makes navigating international transactions seamless and hassle-free.

In conclusion, Nedbank credit cards offer a compelling combination of rewards, security, and global acceptance, making them a great choice for individuals seeking a reliable and beneficial credit card solution.

Eligibility Requirements for a Nedbank Credit Card

The eligibility criteria for a Nedbank credit card are designed to ensure applicants can manage their credit responsibly. To apply for a Nedbank credit card, you must meet certain requirements that assess your financial stability and creditworthiness.

Age and South African Residency Requirements

To be eligible for a Nedbank credit card, you must be at least 18 years old and a resident of South Africa. Proof of residency is required, which can be in the form of a utility bill or a rental agreement. Nedbank may also require a valid South African identity document or a passport for identification purposes.

Income and Credit Score Considerations

Nedbank evaluates an applicant’s income level to ensure they can afford monthly credit card payments. A stable income source is crucial for approval. Additionally, Nedbank checks your credit score to assess your credit history. A good credit score can significantly improve your chances of being approved for a credit card.

Required Documentation for South African Applicants

To apply for a Nedbank credit card, South African applicants need to provide specific documents, including proof of income, identification, and address. The required documents may include a salary slip, bank statements, and a valid ID or passport. Ensuring you have all necessary documents ready can streamline the application process.

Nedbank: How to Get Your Credit Card in Easy Steps

Nedbank’s credit card application process is designed to be user-friendly and efficient. To ensure a smooth experience, it’s essential to understand the steps involved and be prepared with the necessary documentation.

Overview of the Application Process

The application process for a Nedbank credit card is straightforward. You can apply online, by phone, or in-person at a Nedbank branch. First, you’ll need to choose the credit card that best suits your needs. Nedbank offers various credit cards, each with its unique features and benefits. Once you’ve selected your preferred card, you’ll need to fill out the application form, providing personal and financial information.

It’s crucial to ensure that the information provided is accurate and up-to-date to avoid any delays in the processing of your application. After submitting your application, Nedbank will review your creditworthiness and verify the information provided.

Preparing Your Documentation

To apply for a Nedbank credit card, you’ll need to provide certain documents. These typically include proof of identity, proof of income, and proof of residence. Ensuring you have all the required documents ready will help streamline the application process.

- Proof of identity (ID document or passport)

- Proof of income (salary slips or bank statements)

- Proof of residence (utility bills or bank statements)

Having these documents readily available will save you time and reduce the risk of your application being delayed.

Setting Realistic Expectations

It’s essential to have realistic expectations when applying for a credit card. Nedbank will assess your creditworthiness based on your credit history, income, and other factors. Understanding that the approval process involves a thorough evaluation will help you prepare.

“The key to a successful credit card application is understanding your financial standing and being prepared with the necessary documentation.”

Once your Nedbank credit card application is approved, your card will be sent to you, and you’ll need to activate it. This final step is crucial to start using your credit card for transactions.

Nedbank: A Bank with Purpose for Your Financial Journey

In the dynamic financial world, choosing a banking partner is about more than just finding a place for transactions. It’s about finding an institution that understands your needs and helps you prosper. Nedbank stands out as one of South Africa’s leading banks, with a clear commitment: to use its expertise and technology to offer innovative financial solutions tailored to your lifestyle.

Nedbank is more than just a bank; it’s a catalyst for your personal and professional growth.

What Nedbank Offers: Solutions for Your Everyday Life

Nebank

Nedbank’s product portfolio is designed to be comprehensive and intuitive. It combines the best of digital technology with a personal touch, ensuring you have complete control over your finances.

- Nedbank Credit Cards: Choose from a variety of cards, such as the popular Nedbank Gold and Platinum, which offer cashback benefits, airport lounge access, travel discounts, and much more.

- Bank Accounts: Nedbank’s current and savings accounts are flexible, providing you with tools to manage your money efficiently, whether on the app or online.

- Loans and Financing: Whether you want to fund a dream trip, buy a new car, or invest in a project, Nedbank’s loan and financing options are transparent and adaptable.

The bank also invests in digital solutions that allow you to open accounts and apply for products quickly and securely, right from your phone.

Why Choose Nedbank?

Nedbank differentiates itself with a customer-centric approach. Its innovative banking platform, including the award-winning Nedbank Money app, offers a seamless user experience with real-time notifications, cutting-edge security, and features to track your spending.

The Greenbacks rewards program is another major highlight, allowing you to earn points on your daily purchases and redeem them for travel, fuel, entertainment, and other valuable rewards. This turns your routine spending into earning opportunities.

At Nedbank, every product is created with the purpose of empowering you, making financial management not only easy but also rewarding.

Nedbank: Four Key Characteristics

- Innovative Digital Banking: Nedbank provides a modern and secure banking experience through its award-winning app and online platform.

- Comprehensive Product Range: The bank offers a full suite of services, including credit cards, loans, savings accounts, and investment products.

- Customer-Centric Rewards: Its Greenbacks program turns everyday spending into valuable rewards like cashback, travel discounts, and more.

- Strong Market Presence: As one of South Africa’s leading financial institutions, Nedbank is a trusted and established partner in the region.

Setting Up Your Nedbank Online Banking

To manage your credit card account effectively, setting up Nedbank online banking is highly recommended. This allows you to:

- Monitor your account balance and transactions

- Make payments

- Update your account settings

You can set up online banking during the card activation process or by visiting the Nedbank website. Nedbank prioritizes the security of your online banking experience, employing advanced security measures to protect your information.

By following these steps, you’ll be able to enjoy the full benefits of your new Nedbank credit card, from making purchases to earning rewards through the Greenbacks program.

What to Do if Your Application is Declined

If your Nedbank credit card application is declined, understanding the reasons and taking corrective steps is crucial. A declined application doesn’t necessarily mean you’re not eligible for credit; it could be due to various factors that can be addressed.

Understanding the Reasons for Decline

Nedbank will typically inform you of the reasons behind the decline of your credit card application. Common reasons include a low credit score, high debt-to-income ratio, or insufficient credit history. Understanding these reasons is the first step towards improving your chances of approval in the future.

Steps to Improve Your Credit Profile

To improve your credit profile, focus on making timely payments, reducing debt, and monitoring your credit report for errors. Here are some specific steps:

- Pay bills on time to demonstrate financial responsibility.

- Reduce outstanding debt to lower your debt-to-income ratio.

- Check your credit report regularly to correct any inaccuracies.

Alternative Nedbank Financial Products

If you’re not eligible for a credit card, Nedbank offers alternative financial products that might suit your needs. These include personal loans, savings accounts, and other banking products. Nedbank’s FlexiPay is another option that allows you to make purchases and pay in installments.

| Product | Description | Benefits |

|---|---|---|

| Nedbank Personal Loan | A loan with flexible repayment terms. | Quick access to funds, competitive interest rates. |

| Nedbank Savings Account | A savings account with competitive interest rates. | Grow your savings, easy access to your money. |

| Nedbank FlexiPay | A product allowing installment payments. | Flexibility in payments, no need for a credit card. |

Conclusion

Applying for a Nedbank credit card is a straightforward process that can be completed in just 3 easy steps. By understanding the types of Nedbank credit cards available, the benefits they offer, and the eligibility requirements, you can make an informed decision and enjoy a seamless application experience.

A Nedbank credit card summary highlights the simplicity of the application process, from completing your application to receiving and activating your card. The credit card application summary emphasizes the importance of preparing your documentation and understanding the credit check process.

With Nedbank, you can enjoy a range of benefits, including the Greenbacks Rewards Program, security features, and global acceptance. By following the steps outlined in this article, you can successfully apply for a Nedbank credit card and start enjoying the rewards and benefits it has to offer.

FAQ

What are the eligibility criteria for a Nedbank credit card?

How do I apply for a Nedbank credit card?

What is the Greenbacks Rewards program?

How long does it take to receive my Nedbank credit card after applying?

How do I activate my Nedbank credit card?

What should I do if my Nedbank credit card application is declined?

Can I manage my Nedbank credit card account online?

What are the benefits of using a Nedbank credit card abroad?

How do I improve my credit score to increase my chances of getting approved for a Nedbank credit card?

Conteúdo criado com auxílio de Inteligência Artificial