The UK offers various options for managing credit card debt, and the HSBC UK Balance Transfer Credit Card is one of the most popular and efficient solutions. Moving outstanding balances from other cards to one with 0% interest can provide significant financial relief, allowing more time to pay off the debt without the burden of high-interest charges. This SEO-optimised article provides a detailed and professional guide on how to apply for this crucial card, as well as an overview of the credibility of the institution behind it.

Balance transfer

🇬🇧 UK: STEP-BY-STEP TUTORIAL – How to Apply for the HSBC Balance Transfer Credit Card

Take control of your finances! Learn how to apply for the ideal card to consolidate your debts with a 0% interest period. A clear and results-focused guide.

Introduction

The HSBC Balance Transfer Credit Card is a powerful tool for those looking to reduce interest costs by moving balances from other card debts. Follow this detailed tutorial to begin your application in the United Kingdom.

Anúncios

Requirements and Key Advantages

- Target Audience: People with debt on other credit cards who are seeking lower interest rates (often 0% for a promotional period).

- Key Advantage: The ability to consolidate debts and save on interest payments.

- What You Need: Internet access and subsequently a smartphone to finalise the application via the app.

Step 1: Navigating the Official HSBC UK Website

Start by accessing the bank’s online platform.

Anúncios

- Access the HSBC UK homepage at:

https://www.hsbc.co.uk/ - Locate the main navigation menu (usually easy to find at the top).

- Click or hover over the menu and select the third option: “Credit Cards”.

Step 2: Locate the Balance Transfer Card

The credit cards page will present the available options.

- On this page, you will find information about various credit cards, such as: Premier Credit Card, Premier World Elite Mastercard, Student Credit Card, among others.

- Choose the HSBC Balance Transfer credit card, which is typically positioned as the first option on the list, due to its popularity and usefulness for debt management.

Step 3: Beginning the Application and Key Details

When you click on the card, you will see all the essential information.

- On this page, you will have access to all the details of the HSBC Balance Transfer credit card, including the duration of the 0% interest offer and the transfer fees (Balance Transfer Fee).

- Read the terms and conditions carefully.

- To proceed, click on the prominent button, usually red: “Start application”.

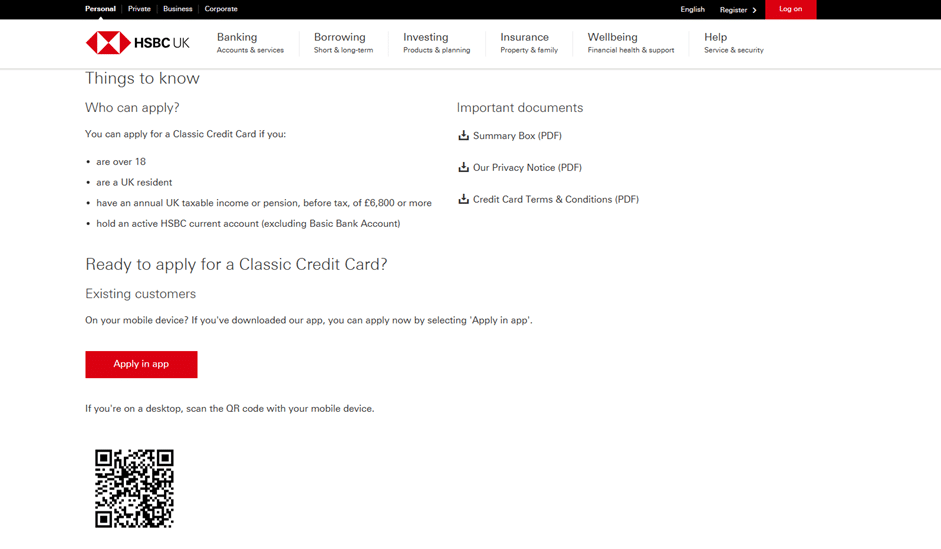

Step 4: Secure Completion via Mobile App

HSBC directs you to a more secure and efficient process finalisation.

- After clicking “Start application”, you will receive detailed instructions to apply for your card via the HSBC UK bank app on your mobile phone.

- Follow the instructions to download or use the app. The application will guide you through filling in your personal and financial details, ensuring secure completion.

User Tip: Using the app is the quickest and safest method to get a decision on your eligibility.

Next Steps

Complete the application in the app and await HSBC’s response regarding your eligibility. Once approved, you will receive your HSBC Balance Transfer Credit Card and can begin consolidating your debts and saving on interest!

Overview of HSBC UK Bank: Credibility and Operations in the United Kingdom

HSBC UK Bank plc is one of the four major clearing banks in the United Kingdom (UK), and a wholly-owned subsidiary of HSBC Holdings plc, one of the world’s largest banking and financial services organisations, headquartered in London with a multinational footprint.

Leadership and Stability:

HSBC Holdings plc is often cited as the largest bank based in Europe by total assets, with trillions of dollars in assets, demonstrating its global scale and stability. In the UK, HSBC UK is a solid institution, known for maintaining a loan-to-deposit ratio where deposits are higher than loans, which is seen by investors and customers as an indicator of a less risky proposition compared to other major market banks.

HSBC Bank

Regulation and Scope:

HSBC UK Bank plc is authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA itself, ensuring it operates under the UK’s rigorous financial standards. Headquartered in Birmingham, the bank serves millions of retail and business customers, offering a vast range of products, from current accounts, credit cards, and mortgages to wealth management. The bank operates a significant network of branches across England and Wales, in addition to having a strong presence in digital services, including its acclaimed mobile banking app. Its long history, global credibility, and solidity in the UK market position it as a trustworthy choice for financial products, such as the Balance Transfer Credit Card.

Everything People Need to Know to Apply for the Card – A Detailed, Instructional Guide

The HSBC UK Balance Transfer Credit Card is a powerful tool for debt consolidation, offering a promotional 0% interest period on balance transfers. The application process and transfer management are designed to be accessible for both new and existing HSBC customers.

Basic Eligibility Requirements

Before starting the application, it is essential to check if you meet the minimum eligibility criteria set by HSBC UK:

- Age: Must be 18 or over.

- Residency: Must be a UK resident.

- Annual Income: Must have an annual UK taxable income or pension, before tax, of £6,800 or more.

- Account Exclusion: Must not hold an HSBC Basic Bank Account.

- Recent History (HSBC Cards Only): You must not have opened a new HSBC credit card or received a credit limit increase within the past 6 months, and you must not be applying for a credit card that you already hold.

Credit Card Eligibility Checker:

HSBC UK provides a no-obligation eligibility checking tool on its website. Using this tool is highly recommended, as it performs a soft search on your credit history (based on information from Experian and HSBC’s lending criteria) and tells you your likelihood of approval without affecting your credit score. To use the tool, you will need to provide:

- Your address history for the last 3 years.

- Income and salary information.

- Details of any other spending commitments.

The Detailed Application Process

HSBC offers different ways to apply to suit your customer status.

1. Website/App Access and Online Application:

The fastest and most recommended way to apply for the card is through HSBC’s digital channels:

- Existing HSBC Customers:

- Via Mobile App (HSBC UK Mobile Banking app): This is the easiest way. Log on to the app, tap on ‘Cards’, and select the credit card. Then, find and select the option to “Apply for a credit card” or similar. The process is streamlined as much of your data will already be pre-filled.

- Via Online Banking (Browser): Log on to your HSBC online banking account. In the credit card or products section, you will find the option to apply.

- New HSBC Customers:

- Via Website (Browser): Go to the official HSBC UK Balance Transfer Credit Card page and select “Apply now” or “Apply in browser”. You will need to complete an online form with your personal details, employment status, and salary.

2. Application In Branch:

Although the digital application is easier, you can apply in person, especially if you are a new customer. HSBC suggests booking an appointment. For new customers, the branch will typically ask for documents such as identification, proof of address, and a recent bank statement.

The Approval Process and the First 60 Days

Approval Process:

- Hard Search: When you submit the final application, HSBC UK will perform a hard credit search, which will be recorded on your credit history and may temporarily affect your score.

- Decision: Many customers, especially those who already use online banking and are approved, can receive a decision in less than a minute. The actual interest rate (the Representative APR), credit limit, and promotional offers will be confirmed upon approval.

The Importance of the First 60 Days:

The main offer for the HSBC UK Balance Transfer Credit Card is typically tied to a promotional period for balance transfers. For example, the offer might be 0% interest for a specific period on transfers made within the first 60 days of account opening.

- Balance Transfer Fee: A transfer fee usually applies to the amount transferred (e.g., 3.19%, minimum £5). This fee is added to your outstanding balance.

- Minimum Amount and Limit: The minimum amount you can transfer is typically £100. You can make multiple balance transfers, up to 95% of your credit limit (taking into account your existing balance).

How to Make the Balance Transfer:

Balance transfers are usually requested after the card approval and can be included in the application form or requested later:

- Via Mobile App: Log on to the app, tap on ‘Cards’, select the credit card, and look for ‘Balance and money transfers’. Follow the on-screen instructions to input the details of the source credit card you wish to pay off.

- Eligible Cards: You can transfer balances from most other cards, as long as you are the primary cardholder. Cards from other HSBC Group entities (such as first direct and M&S Bank) are excluded.

FAQ – Frequently Asked Questions about the HSBC Balance Transfer Card

Q: Can I transfer the balance from another HSBC Group bank card? A: No. You cannot transfer balances from cards issued by members of the HSBC Group, including HSBC UK, first direct, and M&S Bank.

Q: How long does the balance transfer take to complete? R: Once your balance transfer request is approved by your credit card provider, the money should arrive in your HSBC card account by the next working day. However, it’s advisable to allow up to 3 days.

Q: What happens if I can’t pay off the balance during the 0% interest period? A: At the end of the promotional 0% interest period (e.g., after 34 months), any remaining balance on your credit card account will revert to the card’s standard variable purchase rate.

Q: What is the eligibility checker, and does it affect my credit score? A: The eligibility checker is a tool on the HSBC website that uses a soft credit search to give you an indication of which cards you are likely to be accepted for. It does not affect your credit score. Only the formal card application results in a hard credit search that may affect your score.

Q: Is there a limit to the amount I can transfer? A: Yes. You can make balance transfers up to 95% of your credit limit (taking into account your existing balance). The minimum transfer amount is £100.

Conteúdo criado com auxílio de Inteligência Artificial