In today’s world, getting quick and dependable loans in Ireland is vital. Whether it’s for a personal project, sudden expenses, or to cover a financial gap, knowing your options is key. There are many fast and reliable loan solutions out there. It’s important to choose wisely to meet your financial needs.

Bank of Ireland Classic Card

Understanding Personal Loans in Ireland

Personal loans in Ireland are a top choice for many, offering chances to borrow money easily. These loans don’t need you to put up collateral. They give you funds with fixed interest rates and flexible paying back options. You can borrow from €1,000 to €75,000 for different needs.

What is a Personal Loan?

A personal loan is a way to get money without tying it to something you own, like your house. They’re simpler to get for a lot of people. To decide if you can get the loan and what interest you’ll pay, lenders look at your past with money.

Common Uses for Personal Loans

People use personal loans for lots of reasons, which makes them popular. Some common uses are:

- Financing a vehicle purchase

- Funding holidays and travel expenses

- Covering educational fees or courses

- Paying for unexpected medical costs

- Making larger purchases or home improvements

This shows personal loans can help with various personal needs, making them well-liked in the Ireland loans market.

Types of Loans Available in Ireland

In Ireland, people can choose from different loans based on their needs. There are unsecured personal loans, secured loans, and green loans for eco-friendly projects. Knowing what’s available helps make smart choices when borrowing.

Unsecured Personal Loans

Unsecured loans are easy to get because you don’t need to offer anything as security. They’re good for folks without much to use as collateral. However, they often have higher interest rates due to the risk lenders take. It’s wise to think about your financial health before picking this loan.

Secured Loans and Their Benefits

Secured loans offer lower interest rates by using property as security. This safety net for the lender means better terms for the borrower. They are great for larger needs due to possible savings and longer payback times.

Green Loans for Eco-Friendly Initiatives

Green loans are becoming popular for their support of sustainable projects. They offer lower rates for things like solar panels or electric cars. Choosing a green loan helps with immediate needs while also caring for our planet.

How Much Can You Borrow?

When you’re thinking of getting a loan in Ireland, it’s important to know how much you can borrow. The amount depends on your financial situation and the limits put by lenders. We’ll go over usual borrowing limits and help you pick the right loan size.

Loan Amount Limits

In Ireland, how much you can borrow changes a lot. For couples, it’s possible to get loans up to €75,000. If you’re applying alone, you might get between €1,000 and €10,000. These numbers are based on how well you can pay back the loan. By looking at these limits, you make sure you’re not borrowing more than you can handle.

Deciding on the Right Loan Size

Choosing the amount to borrow takes a bit of thought. Keep these points in mind:

- Look at your monthly budget to see what you can afford.

- Try to borrow only what you need, as bigger loans mean bigger bills.

- Remember, big loans might have lower interest rates, but they also mean bigger repayments.

The Cost of Loans in Ireland

It’s important to know the costs tied to loans before you borrow. Interest rates play a big part in how much you’ll pay. By looking carefully at these costs, you can make smarter choices about borrowing.

Understanding Interest Rates

In Ireland, interest rates for loans can change a lot. They usually range between 6.4% and 12.5% APR. The rate affects your loan’s overall cost greatly. Knowing that a lower rate can mean cheaper monthly payments and total cost is key for borrowers.

Factors Influencing the Total Cost of a Loan

Several things decide how much a loan will cost you. These include:

- The total amount borrowed

- The repayment time

- Your credit history

Getting to grips with these factors lets you estimate your loan costs better. Making decisions based on what you can afford becomes easier.

APR Explained

The Annual Percentage Rate (APR) tells you the total cost of borrowing. It includes interest and any possible fees. This gives you a full picture of your expenses. Comparing APRs from different lenders helps you find the most budget-friendly loan.

Quick Loan Approval Process

If you’re looking for quick loan approval in Ireland, it’s key to understand how things work. Most lenders have sped up thanks to tech, especially online. Having a solid credit score can mean getting your loan approved in just a few hours.

Typical Approval Times

How long it takes to get approved depends on the lender and your loan’s details. A lot of banks try to make decisions within one day. The speed can be affected by how much you want to borrow and your financial status. If you apply online with clear info, you could get approved quickly.

Online Application Convenience

Applying online makes borrowing simpler. You can send in your documents fast and do it all from home. This not only cuts down on the wait but also speeds up getting your loan, sometimes by the next day.

How to Get the Best Loan Rates

Finding the best loan rates is important for smart finance choices. There are many ways to get good terms. Using loan comparison tools helps compare different offers easily. This way, you can look carefully at your options.

Using Comparison Tools

Loan comparison tools are very useful for finding top loan rates. By entering what you need, you can see a list of offers. This list makes it easy to choose by showing interest rates, fees, and terms.

Negotiating with Lenders

Talking with lenders could result in better loan terms. Those with strong credit scores may get lower interest rates. Knowing about loan terms helps in these talks. Doing your homework improves your chances to get a good deal.

Your Credit History and Its Impact

Having a strong credit history is vital when you’re looking to get a loan in Ireland. Lenders look at credit scores to get an idea of how you’ve handled money in the past. If your credit score is low, you might face higher interest rates or might not get the loan at all. It’s key for borrowers to know how to look after their credit properly.

How Credit Scores Affect Loan Approval

Credit scores play a huge role in your loan application. Lenders use them to figure out how much of a risk it is to lend you money. A high credit score means you’re good with money, which could get you better loan terms. But, a low score could mean higher interest rates or having your application turned down.

Improving Your Credit Rating

To boost your chances of getting a loan, it’s wise to improve your credit. There are several ways to do this:

- Always pay on time: This shows you’re reliable.

- Work on reducing your debts: A lower debt-to-income ratio can raise your credit score.

- Check your credit reports often: This lets you correct errors or spot fraud that could hurt your score.

By following these steps, you can enhance your credit score. This not only makes it easier to access loans but also secures more favorable loan conditions.

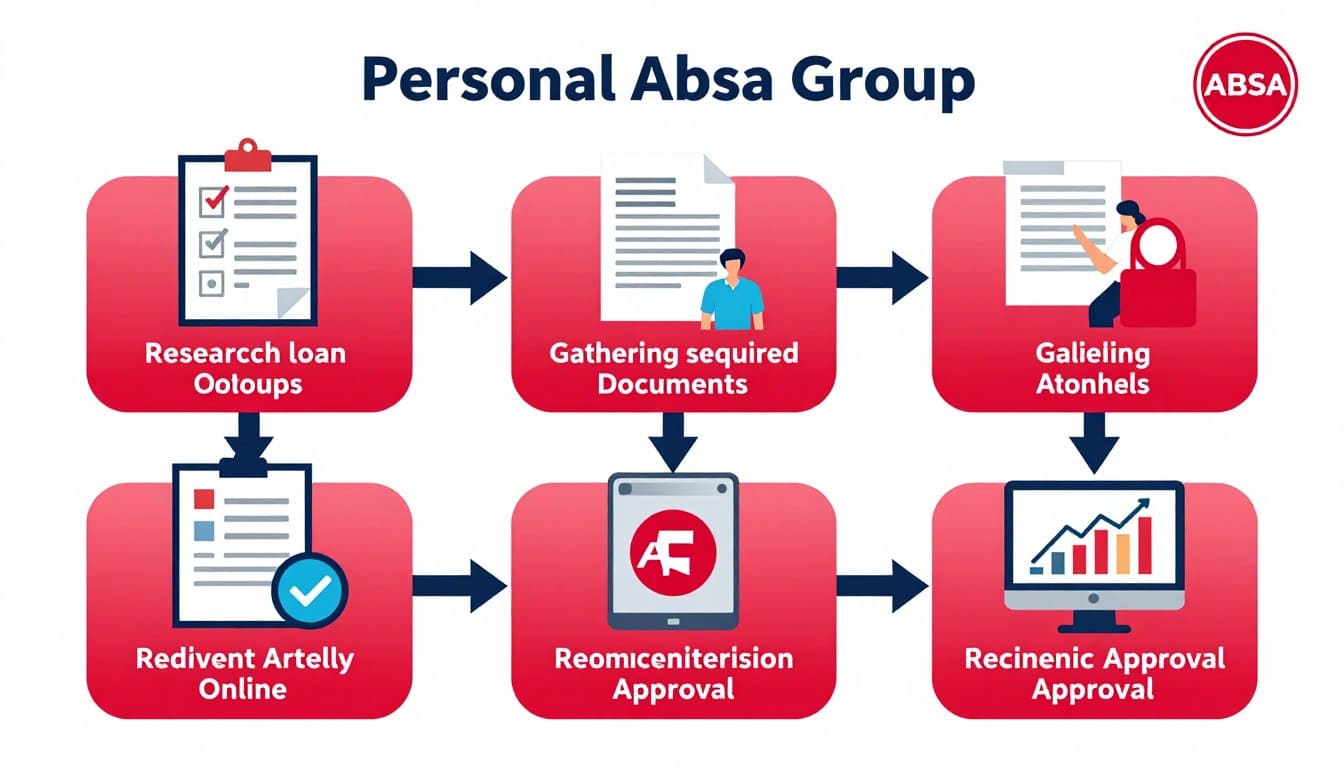

Applying for a Loan in Ireland

Applying for a loan can be easy if you’re ready in advance. Before you go for a personal loan, get all the necessary papers. This makes the process smoother and quicker, whether you apply online or face-to-face.

Required Documentation for Loan Applications

To apply for a personal loan, you need certain documents. These prove who you are and your financial health. You’ll need:

- Proof of identity such as a valid passport or national ID card.

- Proof of residence, which can be utility bills or bank statements dated within the last three months.

- Proof of income, such as recent payslips or tax returns.

Having these papers ready makes applying for a loan faster. It also increases your chance of getting approved.

Application Methods: Online vs In-Person

There are two ways to apply for loans. Online loans are handy. You can fill out forms and upload documents from home. This is often quicker.

Applying in person, though not as common now, allows you to talk directly with a loan officer. It gives a more personal touch. Each way has its benefits, so pick what works best for you.

Alternatives to Personal Loans

Getting a personal loan can be tough for some due to credit or income issues. There are other ways to get the funds you need, though. It’s key to look at these options based on what you need financially.

Credit Cards as a Financing Option

Using a credit card can be a good short-term solution. Some cards have 0% rates at the start for balance transfers, cutting down on costs. But, make sure to pay back in time to dodge high rates later.

Guarantor Loans Explained

Guarantor loans are a fit for those who can’t get regular loans. A third party promises to pay if you can’t, lowering the risk for the lender. This can mean better rates, but think about the guarantor’s risks too.

Conclusion

In summary, it’s vital to know the different loan options in Ireland to make smart money choices. Personal loans give you the flexibility for many needs, like paying off debt, funding house fix-ups, or handling sudden bills. By getting to know these loans well, people can better understand the costs, terms, and how to apply.

Using tools to compare loans can really help you find good deals that fit your financial situation. Also, boosting your credit score is key to getting lower loan rates, a tip you shouldn’t ignore. In short, borrowing wisely is not just about managing your money well; it also helps improve your credit score.

Understanding personal loans and their impact is powerful. It lets people make informed borrowing decisions. This ensures they support their financial health for the future.

FAQ

What should I consider before applying for a personal loan in Ireland?

What are the typical interest rates for personal loans in Ireland?

How can I improve my chances of loan approval?

What documents are required to apply for a personal loan?

Are there alternatives to personal loans if I’m unable to secure one?

What are green loans and who can benefit from them?

How long does it typically take to get loan approval in Ireland?

Can I negotiate the interest rates on my loan?

Conteúdo criado com auxílio de Inteligência Artificial