The Wells Fargo Active Cash® Card is one of the most popular cash back credit cards available in the United States. Offering unlimited 2% cash back on all purchases and a $200 bonus after spending $500 in the first three months, it combines simplicity with rewarding benefits. This comprehensive guide will show you how to apply, explain the card’s features, and provide important details about Wells Fargo as an institution.

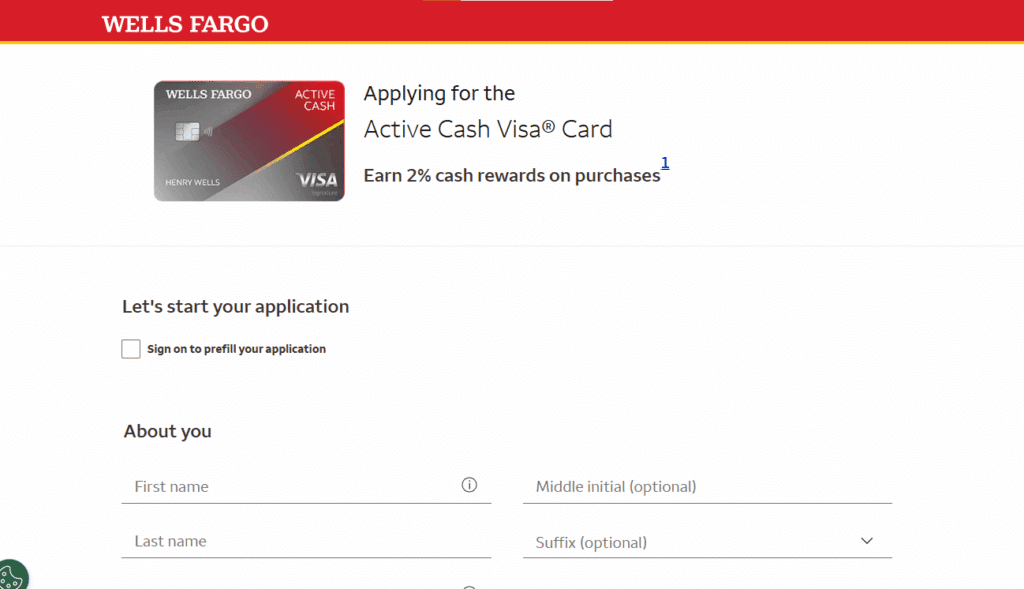

Step-by-Step Guide: How to Apply for the Wells Fargo Active Cash® Credit Card

Applying for the Wells Fargo Active Cash® Card is simple when you follow these steps. This guide walks you through each part of the application process clearly and efficiently.,

Cash Rewards

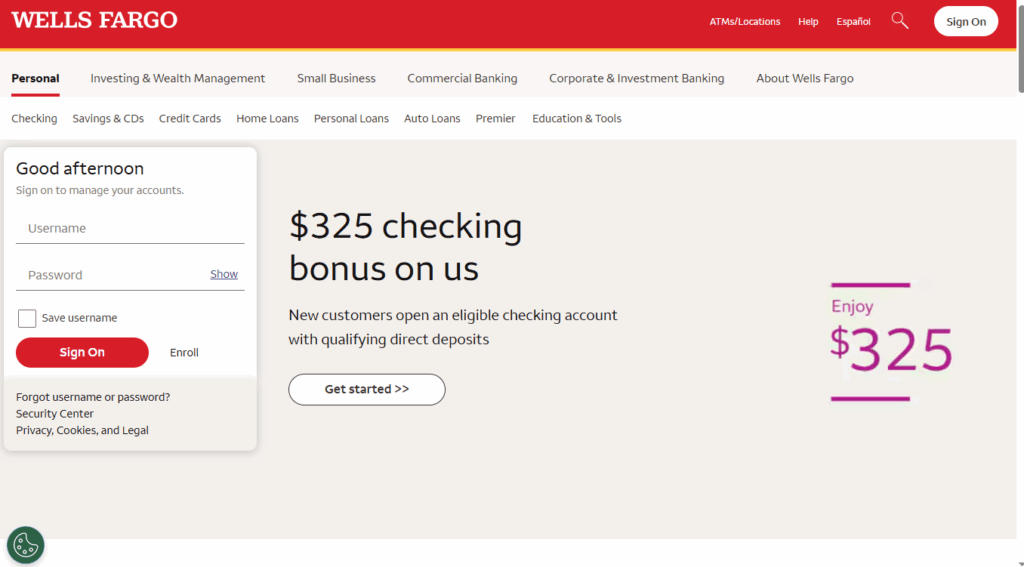

1. Access the Wells Fargo Homepage

Start by visiting the official Wells Fargo website: https://www.wellsfargo.com/

Anúncios

Here, you can explore all the banking services, including credit cards, checking accounts, loans, and more.

Anúncios

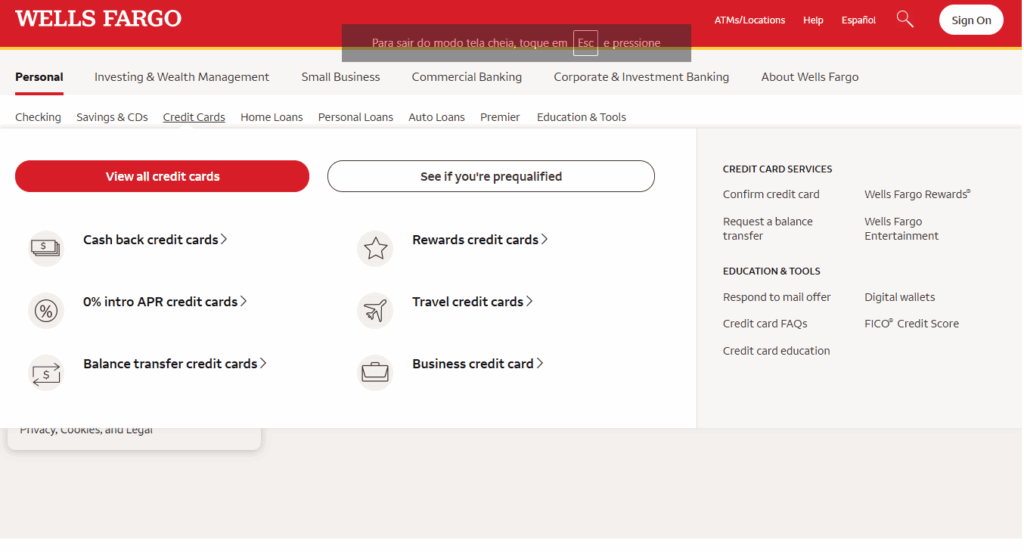

2. Navigate to the Credit Cards Section

- Click on the menu bar at the top of the page.

- Select the third option labeled “Credit Cards”.

- Choose the first sub-option “Cash Back Credit Cards”.

This section displays all cash back credit card options offered by Wells Fargo.

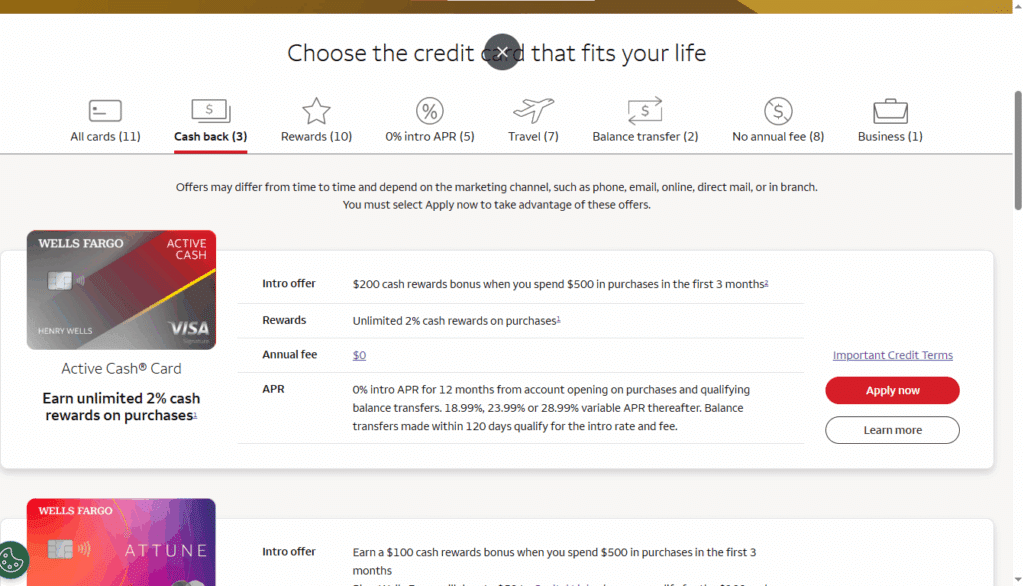

3. Select the Active Cash® Card

On the Cash Back Credit Cards page:

- You will see multiple cards such as Attune® Card and Signify Business Cash® Card.

- Use the filters at the top to sort cards by features:

- All Cards

- Cash Back

- Rewards

- 0% Intro APR

- Travel

- Balance Transfer

- No Annual Fee

- Business

- Click on the Wells Fargo Active Cash® Card, then press the blue button “Apply Now”.

This will redirect you to the application form.

4. Fill Out the Application Form

Complete the online form by providing your personal information, which typically includes:

- Contact Information: Full name, address, phone number, and email.

- Security Information: Social Security Number (SSN) or ITIN, date of birth.

- Financial Information: Employment status, annual income, and housing expenses.

After submitting your application, Wells Fargo will review your information.

Once approved, your Wells Fargo Active Cash® Card will be mailed to your address, usually within 7–10 business days.

Step-by-Step Guide to Applying for the Wells Fargo Active Cash® Card

1. Access the Application

To apply for the Active Cash® Card, visit the official Wells Fargo credit card website. The application can be completed online through the Wells Fargo web portal. Ensure that you select the “Apply Now” option to access the latest offers and terms.

2. Meet Basic Eligibility Requirements

Before applying, ensure you meet these basic criteria:

- Be 18 years or older.

- Have a valid Social Security number or ITIN.

- Be a U.S. resident.

- Have a good to excellent credit score (generally 700+).

- Provide income information for verification and approval purposes.

3. Complete the Application Form

The online application form requires:

- Personal information: Full name, date of birth, and address.

- Financial information: Annual income, employment status, and monthly housing payments.

- Identification details: Social Security number and government-issued ID information.

4. Review and Submit

Carefully review all information before submission. Verify that your details are correct, as errors may delay processing or affect approval. After submission, Wells Fargo will process your application and provide a decision, which can be instant or take a few business days.

5. Approval and Card Activation

If approved, your Wells Fargo Active Cash® Card will be shipped within 7–10 business days. To activate, follow the instructions provided with the card or via the Wells Fargo app. Once activated, you can start earning unlimited 2% cash back on all purchases.

Key Features of the Wells Fargo Active Cash® Card

- Unlimited 2% Cash Back: Earn on all purchases with no categories or quarterly activations.

- $200 Cash Rewards Bonus: Earned after spending $500 in the first three months.

- 0% Intro APR for 12 Months: Applies to purchases and qualifying balance transfers.

- Cellular Telephone Protection: Up to $600 against damage or theft (subject to a $25 deductible).

- Auto Rental Collision Damage Waiver: Reimbursement for eligible rental car damage.

- Travel & Emergency Assistance: Assistance available worldwide for cardholders.

- Zero Liability Protection: Protection against unauthorized transactions when reported promptly.

Additionally, cardholders can enjoy Visa Signature® benefits, including concierge services and access to the Luxury Hotel Collection.

Overview of Wells Fargo

Founded in 1852, Wells Fargo is a leading financial institution in the United States, providing a wide range of banking, investment, and lending services. With thousands of branches and ATMs nationwide, Wells Fargo is known for its customer service, stability, and innovative banking solutions. The bank is regulated under federal and state authorities, ensuring security and credibility for all cardholders and account holders.

Wells Fargo

FAQ: Wells Fargo Active Cash® Card

Q1: Is there an annual fee?

A1: No, the Active Cash® Card has no annual fee.

Q2: How can I earn the welcome bonus?

A2: Spend $500 in purchases within the first three months of account opening to earn the $200 cash rewards bonus.

Q3: Are there foreign transaction fees?

A3: The card’s terms do not explicitly list foreign transaction fees; check your account disclosures before international use.

Q4: How do I redeem cash rewards?

A4: Rewards can be redeemed for purchases, statement credits, gift cards, or travel through Wells Fargo Rewards.

Q5: Can I transfer a balance from another card?

A5: Yes, balance transfers are eligible for the 0% introductory APR if completed within 120 days of account opening.

Conclusion

The Wells Fargo Active Cash® Card is an excellent option for consumers seeking a simple, high-reward cash back card. With unlimited 2% cash back, a $200 welcome bonus, and comprehensive protections, it meets the needs of everyday spenders. Following the steps outlined above ensures a smooth application process, while understanding Wells Fargo’s reputation and features helps cardholders make informed decisions.

This guide provides all the information needed to confidently apply and start enjoying the benefits of the Wells Fargo Active Cash® Card.

Conteúdo criado com auxílio de Inteligência Artificial