The TD Aeroplan Visa Infinite Credit Card is an excellent choice for those looking to earn Aeroplan points on everyday purchases and enjoy exclusive travel benefits. If you’re interested in applying for this card, follow this step-by-step guide to understand the application process, eligibility requirements, and what to expect after approval.

TD Aeroplan

CANADA – STEP-BY-STEP GUIDE ON HOW TO APPLY FOR THE TD® AEROPLAN® VISA INFINITE CARD*

The TD® Aeroplan® Visa Infinite Card* is one of Canada’s most popular travel credit cards, offering Aeroplan points for every dollar spent, along with premium travel benefits such as flight rewards, insurance, and airport lounge access.

Below is a simple, step-by-step guide on how to apply for this card directly through the official TD Bank website.

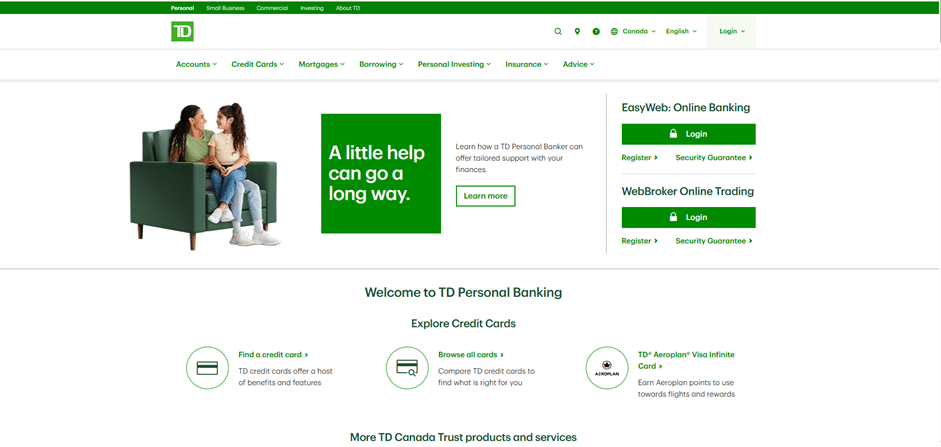

1 – Access the TD Bank Homepage

Go to the official TD website: https://www.td.com/

From the homepage, you can find all banking products, including personal banking, loans, and credit cards.

Anúncios

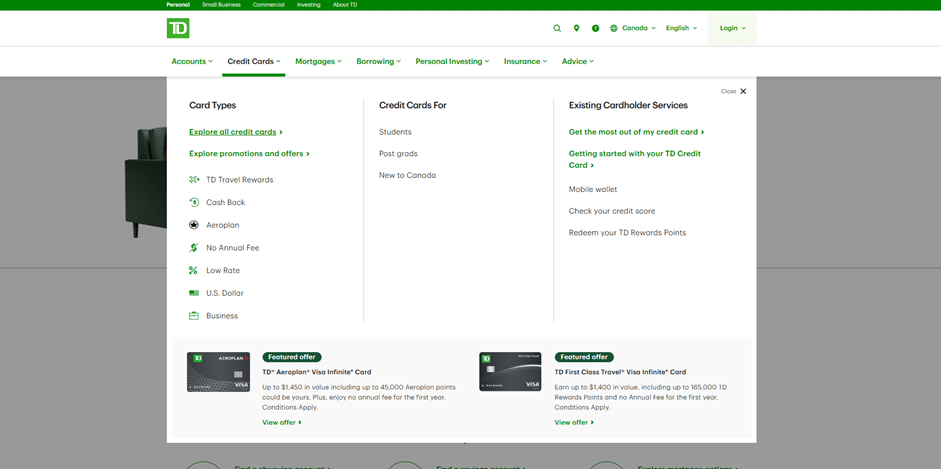

2 – Navigate to the Credit Cards Section

On the main menu, click on the second option, labeled “Credit Cards.”

Then, click the first option in the dropdown menu, “Explore All Credit Cards.”

Anúncios

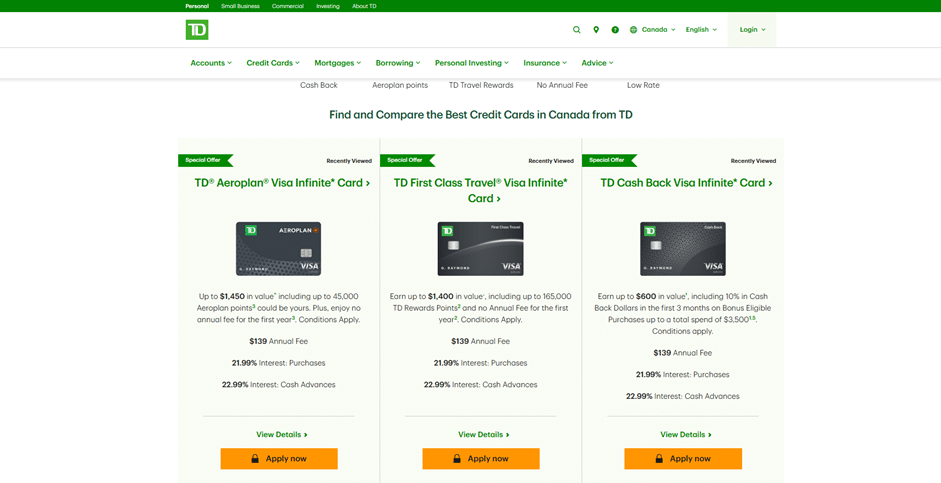

3 – Browse the Available TD Credit Cards

On this page, you’ll find detailed information about various TD credit cards, including:

- TD First Class Travel® Visa Infinite Card*

- TD Cash Back Visa Infinite Card*

- TD® Aeroplan® Visa Infinite Card*, among others

Select the TD® Aeroplan® Visa Infinite Card*, which usually appears as the first option on the list.

4 – Review the TD® Aeroplan® Visa Infinite Card Details*

On the card’s information page, you’ll see all the key details, including:

- How to earn Aeroplan points on everyday purchases

- Bonus offers for new applicants

- Travel perks and insurance coverage

- Annual fees and eligibility requirements

Click the orange “Apply Now” button to begin your application.

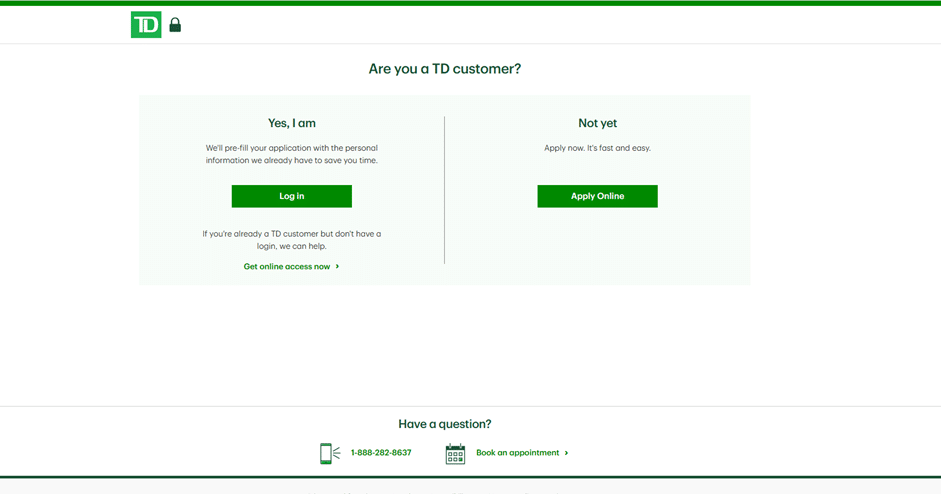

5 – Log In or Apply as a New Customer

After clicking “Apply Now,” you will be redirected to the TD login page.

There, you will find different instructions depending on whether you already have a TD account or need to create one.

Follow the on-screen steps carefully to complete your application. Once approved, your TD® Aeroplan® Visa Infinite Card* will be mailed directly to you.

Final Notes

The TD® Aeroplan® Visa Infinite Card* is ideal for Canadians who love to travel and want to earn rewards faster.

With Aeroplan points, exclusive travel benefits, and the reliability of TD Bank, this card combines everyday convenience with global advantages.

The online application is fast, secure, and can be completed in just a few minutes.

Step 1: Accessing the Application

To start your application:

- Visit the official TD Canada Trust website and navigate to the Credit Cards section.

- If you are already a customer, you can use EasyWeb or the TD mobile app to prefill some personal information.

- If you are a new customer, click “Apply Now” to begin a new application.

Step 2: Basic Requirements

Before applying, make sure you meet the following criteria:

- Minimum age: 18 years old.

- Residency: Canadian citizen, permanent resident, or valid visa holder.

- Credit history: Not under bankruptcy or insolvency.

- Financial capacity: Ability to meet the card’s obligations.

Step 3: Benefits and Features

When applying for the TD Aeroplan Visa Infinite, you will enjoy the following benefits:

- Aeroplan points earning: Earn 1.5 points for every $1 spent on eligible purchases, including gas, groceries, electric vehicle charging, and purchases directly with Air Canada, including Air Canada Vacations.

- Annual fee: $139 CAD.

- Interest rates: 21.99% p.a. on purchases and 22.99% p.a. on cash advances.

- Travel benefits: Includes travel medical insurance, trip cancellation/interruption insurance, travel accident insurance, and more.

- Exclusive Air Canada perks: Access to preferred Air Canada reward pricing, free checked baggage for the cardholder and up to 8 companions, and more.

- Recurring payments: Earn 1 point per $1 on recurring payments set up on your account.

- Points do not expire: As the primary cardholder, your points do not expire as long as your account remains active.

Step 4: Submission, Approval & Activation

After submitting your application:

- TD Canada Trust will perform a credit assessment.

- If approved, the card will be mailed to your Canadian address.

- Once received, activate the card through EasyWeb, the TD mobile app, or by phone.

- Start using the card to earn points and enjoy its benefits.

Overview of TD Canada Trust

TD Canada Trust is one of Canada’s leading financial institutions, offering a wide range of banking products and services, including chequing and savings accounts, loans, investments, and credit cards.

Toronto-Dominion Bank

Credibility and Trust

- History: Founded in 1855, TD Canada Trust has a long-standing reputation for reliability and stability in the Canadian banking sector.

- Regulation: Supervised by the Office of the Superintendent of Financial Institutions (OSFI) and the Canadian Securities Administrators (CSA), ensuring compliance with national financial regulations.

- Innovation: Pioneer in digital banking solutions, providing platforms like EasyWeb and the TD mobile app, recognized for security and ease of use.

National Presence

With an extensive network of branches and ATMs, TD Canada Trust serves customers across Canada, providing convenience and accessibility.

Frequently Asked Questions (FAQ)

1. What is the TD Aeroplan Visa Infinite Credit Card?

The TD Aeroplan Visa Infinite is a credit card that allows you to earn Aeroplan points on your purchases, redeemable for rewards such as flights, accommodations, gift cards, and more.

2. What credit limits are available?

Credit limits vary based on TD Canada Trust’s credit assessment.

3. Are there additional fees?

No. The TD Aeroplan Visa Infinite does not charge additional fees for supplementary cardholders.

4. How can I earn Aeroplan points?

Earn 1.5 points per $1 on eligible purchases, including gas, groceries, electric vehicle charging, and purchases directly with Air Canada.

5. How can I redeem my points?

Redeem your points for rewards including flights, accommodations, gift cards, and more through the Aeroplan program.

6. Can I add an additional cardholder?

Yes, you can add up to three additional cardholders, with applicable fees.

7. What travel insurance is included?

The TD Aeroplan Visa Infinite provides a range of travel insurance, including travel medical insurance, trip cancellation/interruption insurance, and travel accident insurance.

8. How do I activate my card?

Activate your card through EasyWeb, the TD mobile app, or by phone.

9. Can I use the card for international purchases?

Yes, the card can be used internationally, though foreign transaction fees may apply.

10. How do I apply for the card?

Apply online via the official TD Canada Trust website using EasyWeb, the TD mobile app, or by starting a new application as a first-time customer.

Conteúdo criado com auxílio de Inteligência Artificial