The Scotiabank Scene+ Credit Card is an excellent option for those looking to earn rewards points on everyday purchases. With benefits ranging from entertainment to travel, this card offers flexibility and exclusive perks for its users.

Scotiabank Scene +

CANADA – STEP-BY-STEP GUIDE ON HOW TO APPLY FOR THE SCOTIABANK® SCENE+™ VISA CARD*

The Scotiabank® Scene+™ Visa Card* is a popular Canadian rewards card, offering points for everyday purchases that can be redeemed for movies, dining, and entertainment.

Follow this step-by-step tutorial to apply directly through the official Scotiabank website.

1 – Access the Scotiabank Homepage

Visit the official Scotiabank website: https://www.scotiabank.com/ca/en/personal.html

From the homepage, click the second option in the main menu labeled “Credit Cards.”

Anúncios

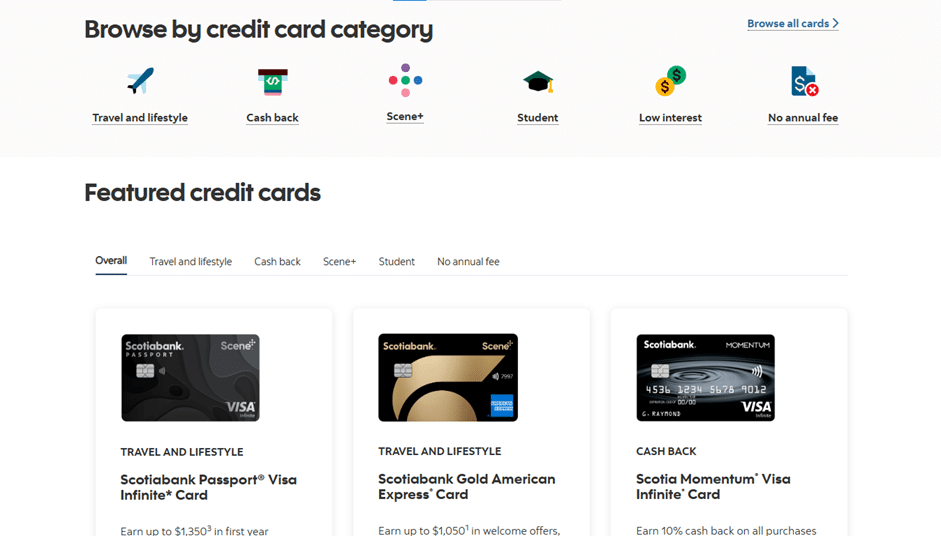

2 – Explore Scotiabank Credit Cards

On this page, you’ll find information about multiple Scotiabank credit cards, including:

Anúncios

- Scotiabank Passport® Visa Infinite Card*

- Scotiabank Gold American Express® Card

- Scotiabank American Express® Card, among others

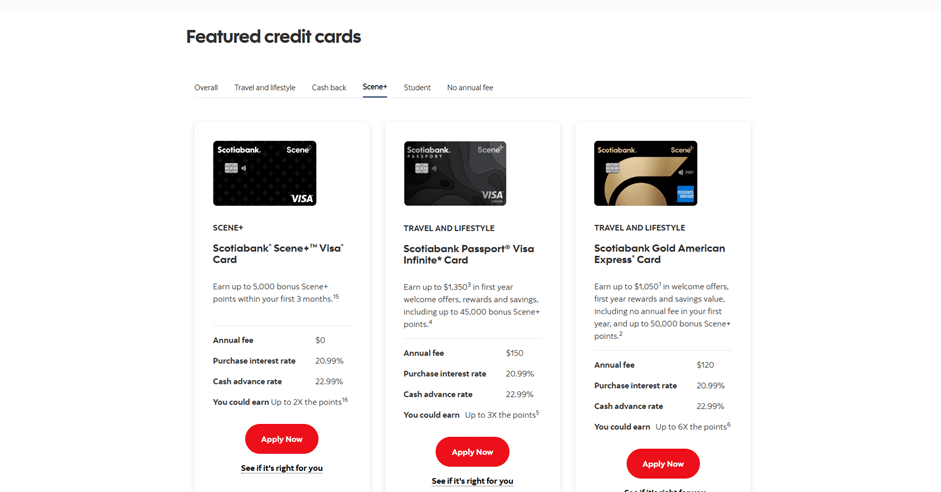

3 – Select the Scotiabank® Scene+™ Visa Card*

Go to the “Scene+” tab, select the first card option, and click the red “Apply Now” button to start your application.

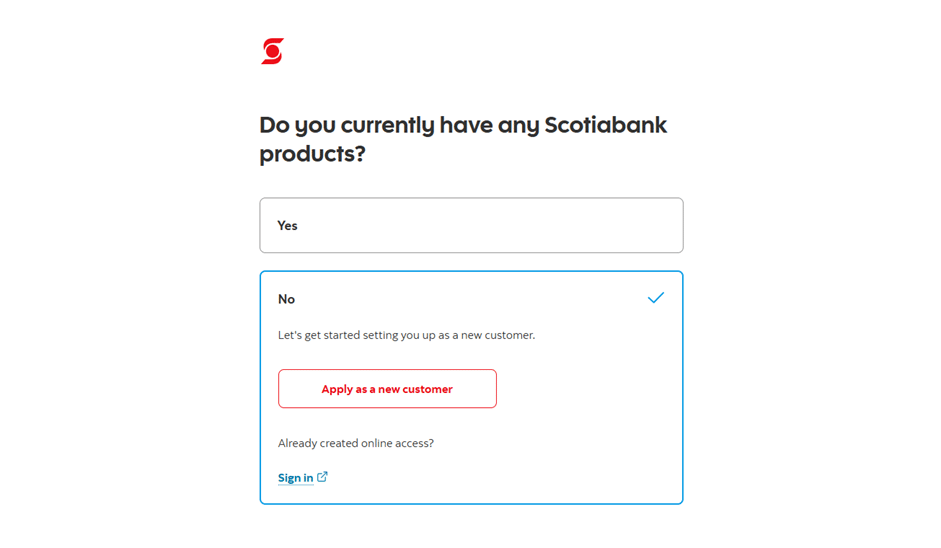

4 – Complete the Application Form

You will be redirected to the application form, which provides different instructions depending on whether you already have a Scotiabank account or need to create one.

Follow the on-screen instructions carefully, submit your details, and shortly after, you will receive your Scotiabank® Scene+™ Visa Card*.

Final Notes

The Scotiabank® Scene+™ Visa Card* is an excellent choice for Canadians who enjoy movies, dining, and entertainment rewards.

With a straightforward online application and access to Scotiabank’s trusted banking platform, it provides a convenient way to earn Scene+ points on everyday spending.

Step 1: Accessing the Application

To start your application:

- Visit the official Scotiabank website and navigate to the Credit Cards → Scene+ section.

- If you are already a customer, you can use NetBank or the Scotiabank app to prefill some information automatically.

- If you are a new customer, click “Get Started” to begin a new application.

Step 2: Basic Requirements

Before applying, ensure you meet the following criteria:

- Minimum age: 18 years old.

- Residency: Canadian citizen, permanent resident, or valid visa holder.

- Credit history: Not under bankruptcy or insolvency.

- Financial capacity: Ability to meet the card’s obligations.

Step 3: Benefits and Features

When applying for the Scene+ Card, you will enjoy several benefits:

- Scene+ points earning: Earn 2 points for every $1 spent on eligible purchases at participating grocery stores like Sobeys, Safeway, Foodland, FreshCo, and Home Hardware. Earn 2 points for every $1 spent at Cineplex. Earn 1 point for every $1 spent on all other eligible purchases.

- No annual fee: The card has no annual fee, making it accessible for all users.

- Competitive interest rates: 20.99% p.a. on purchases and 22.99% p.a. on cash advances.

- Scene+ program: Redeem points for account credits, travel, gift cards, movie tickets, and more.

- Scotia SelectPay™: Flexible payment option for eligible purchases of $100 or more, with low fees and no interest on the plan.

Step 4: Submission, Approval & Activation

After submitting your application:

- Scotiabank will perform a credit assessment.

- If approved, your card will be mailed to your Canadian address.

- Once received, activate the card via NetBank, the Scotiabank app, or by phone.

- Start using your card to earn points and enjoy the benefits.

Overview of Scotiabank

Scotiabank is one of Canada’s leading financial institutions, offering a wide range of banking products and services, including chequing and savings accounts, loans, investments, and credit cards.

Scotiabank

Credibility and Trust

- History: Founded in 1832, Scotiabank has a long-standing reputation for reliability and stability in the Canadian banking sector.

- Regulation: Regulated by the Office of the Superintendent of Financial Institutions (OSFI) and the Canadian Securities Administrators (CSA), ensuring compliance with financial regulations.

- Innovation: A pioneer in digital banking solutions, offering platforms like NetBank and the Scotiabank app, recognized for security and ease of use.

National Presence

With a large network of branches and ATMs, Scotiabank serves customers across Canada, providing convenience and accessibility.

Frequently Asked Questions (FAQ)

1. What is the Scotiabank Scene+ Credit Card?

The Scene+ Card is a credit card that allows you to earn rewards points on your purchases, redeemable for account credits, travel, gift cards, movie tickets, and more.

2. What credit limits are available?

Credit limits vary based on the credit assessment conducted by Scotiabank.

3. Are there additional fees?

No. The Scene+ Card has no annual fee and offers competitive interest rates.

4. How can I earn Scene+ points?

Earn 2 points for every $1 spent at participating grocery stores and Cineplex, and 1 point for every $1 spent on other eligible purchases.

5. How can I redeem my points?

Redeem points for account credits, travel, gift cards, movie tickets, and more through the Scene+ program.

6. Can I add an additional cardholder?

Yes, additional cardholders can be added at no extra cost.

7. What is Scotia SelectPay™?

Scotia SelectPay™ is a flexible way to pay for eligible purchases of $100 or more, with no interest on the plan and low fees.

8. Does the Scene+ Card offer rewards?

Yes, you can redeem points for a variety of rewards, including products, travel, and cashback.

9. Can I use the card for international purchases?

Yes, the card can be used internationally, though foreign transaction fees may apply.

10. How do I apply for the card?

Apply online through the official Scotiabank website using NetBank, the Scotiabank app, or by starting a new application if you are a first-time customer.

Conteúdo criado com auxílio de Inteligência Artificial