If you’re seeking a credit card that offers travel benefits, rewards, and no foreign transaction fees, the Scotiabank Passport® Visa Infinite* Card might be the right choice for you. This guide provides a comprehensive, SEO-optimized walkthrough on how to apply for this card, including eligibility requirements, the application process, and an overview of the bank behind it.

Passport Visa Infinite

Canada – Step-by-Step Tutorial on How to Apply for the Scotiabank Passport® Visa Infinite* Card

This guide will show you how to apply for the Scotiabank Passport® Visa Infinite Card* in Canada, with clear instructions for a smooth and successful application process. It’s optimized for SEO with keywords like Scotiabank Passport Visa Infinite, Canada credit card application, and how to apply for a Scotiabank card.

1. Access the Scotiabank Homepage

First, go to the official Scotiabank Canada website: https://www.scotiabank.com/ca/en/personal.html.

In the top menu, click on the second option, “Credit Cards”, to enter the credit card section.

Anúncios

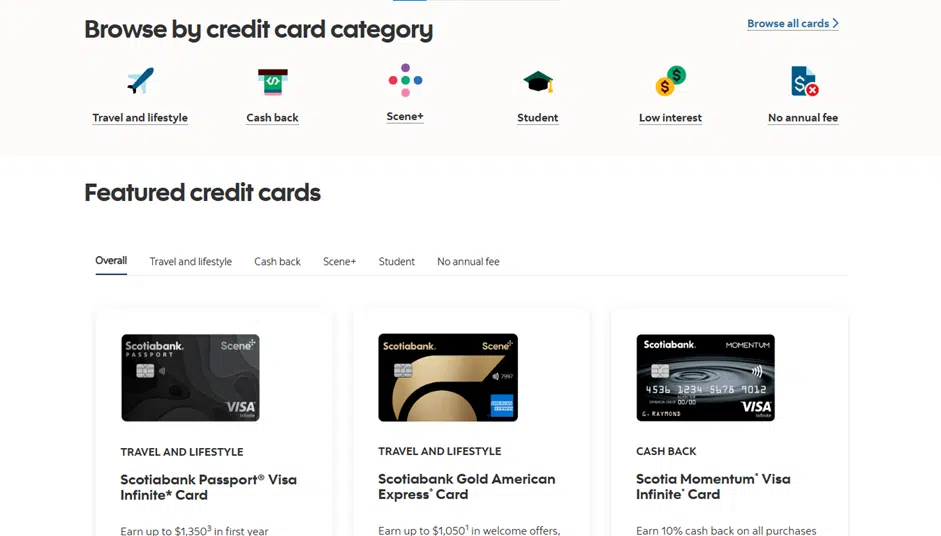

2. Explore the Credit Card Options

On the credit card page, you’ll find information about several Scotiabank credit cards, including:

Anúncios

- Scotiabank Gold American Express® Card

- Scotia Momentum® Visa Infinite Card*

- Scotiabank American Express® Card

- And others

This page provides detailed information on fees, rewards, benefits, and eligibility criteria to help you choose the best card for your financial needs.

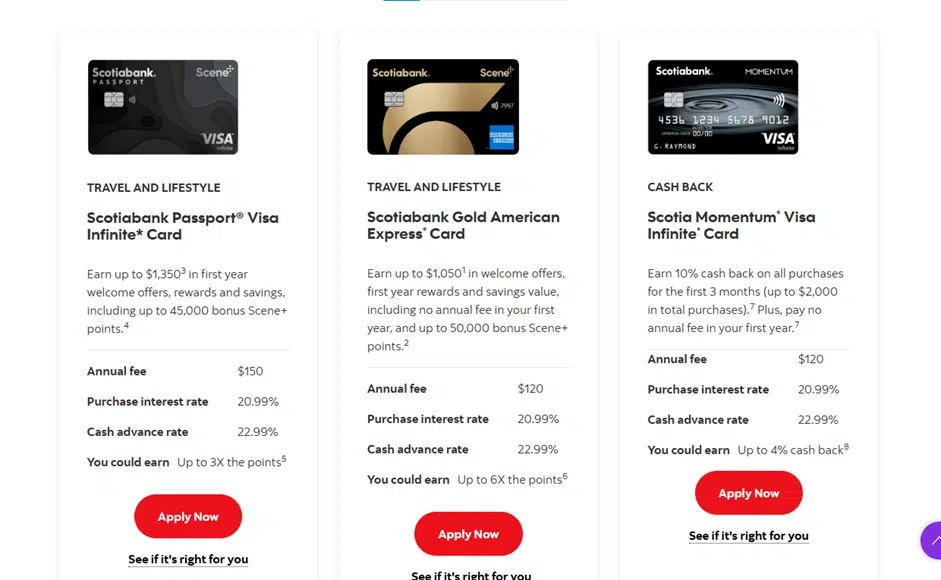

3. Select the Scotiabank Passport® Visa Infinite* Card

Click on the first option, which is the Scotiabank Passport® Visa Infinite Card*, and then press the red “Apply now” button.

This action will take you to the application form to start your request for the card.

4. Complete the Application Form

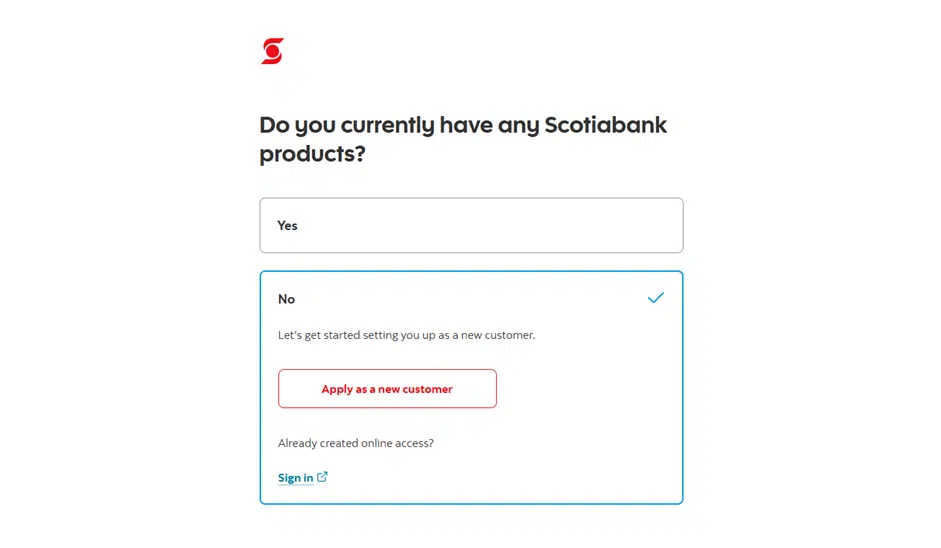

You will be redirected to a secure form with instructions depending on your status:

- If you are an existing Scotiabank customer: you can log in to your account to complete the application quickly and securely.

- If you are a new customer: you will need to create a Scotiabank account and provide personal information, including address, income, and contact details.

Follow the on-screen instructions carefully, submit your application, and soon you will receive your Scotiabank Passport® Visa Infinite Card* by mail.

Additional Tips for a Smooth Application

- Have your personal and financial information ready: income details, address, and employment information.

- Check your credit score: a good credit history increases your chances of approval.

- Review all information before submitting: errors can delay processing.

- Activate your card immediately upon receipt: via Scotia Online or the Scotiabank mobile app.

Key Benefits of the Scotiabank Passport® Visa Infinite* Card

- No foreign transaction fees: ideal for international purchases.

- Scene+ points: earn points on groceries, dining, and travel.

- Travel insurance: coverage includes emergency medical, trip cancellation, and baggage protection.

- Airport lounge access: enjoy VIP lounges worldwide.

This tutorial provides a clear, step-by-step guide for Canadians looking to apply for the Scotiabank Passport® Visa Infinite* Card, making it easy to navigate the application process and enjoy all the benefits this premium credit card offers.

Everything You Need to Know to Apply for the Card

1. Access the Official Application Page

Begin by visiting the official Scotiabank Passport® Visa Infinite* Card page:

https://www.scotiabank.com/ca/en/personal/credit-cards/visa/passport-infinite-card.html

On this page, you’ll find detailed information about the card’s benefits, fees, and features.

2. Review the Eligibility Requirements

Before applying, ensure you meet the following criteria:

- Minimum annual income: CAD $60,000

- Minimum household income: CAD $100,000

- Assets under management: CAD $250,000

These requirements are set to ensure applicants have the financial capacity to manage the credit card responsibly.

3. Compare the Card with Other Options

The Scotiabank Passport® Visa Infinite* Card is particularly beneficial for frequent travelers due to its:

- No foreign transaction fees: Save 2.5% on international purchases.

- Scene+ rewards program: Earn up to 3 points per dollar spent on eligible purchases.

- Travel benefits: Access to airport lounges and comprehensive travel insurance.

If you don’t travel often, consider other Scotiabank cards like the Scotiabank Momentum® Visa Infinite Card*, which offers cashback rewards.

4. Begin the Application Process

Click the “Apply Now” button on the official page. You’ll be directed to an online application form where you’ll need to provide:

- Personal information (name, address, date of birth)

- Financial details (income, employment, assets)

- Credit history information

If you’re already a Scotiabank customer with online banking access, you can apply directly through Scotia Online, which may pre-fill some of your information for convenience.

5. Submit and Await Approval

After completing the application, review all details for accuracy and submit it. Scotiabank will process your application, which may take several business days. If additional documentation is required, the bank will contact you. Upon approval, your card will be mailed to your registered address.

Overview of Scotiabank

Scotiabank, officially known as The Bank of Nova Scotia, is one of Canada’s largest and most reputable financial institutions. Established in 1832, it has a long-standing history of providing a wide range of financial services, including personal and commercial banking, wealth management, and insurance.

Scotiabank

With a strong presence both domestically and internationally, Scotiabank is recognized for its commitment to customer service, innovation, and community involvement. The bank’s robust financial standing and extensive network make it a trusted choice for Canadians seeking reliable banking solutions.

Frequently Asked Questions (FAQ)

1. What are the fees associated with the Scotiabank Passport® Visa Infinite* Card?

- Annual fee: CAD $150

- Purchase interest rate: 20.99%

- Cash advance interest rate: 22.99%

- Supplementary card fee: CAD $50 per year

2. What travel benefits does the card offer?

The card provides:

- No foreign transaction fees: Ideal for international purchases.

- Airport lounge access: Enjoy complimentary access to over 1,200 lounges worldwide.

- Comprehensive travel insurance: Coverage includes emergency medical, trip cancellation, and baggage insurance.

3. How do I earn Scene+ points?

Earn Scene+ points by making eligible purchases with your card. Points can be redeemed for:

- Travel bookings

- Movie tickets

- Gift cards

- Merchandise from participating retailers

4. Is there a welcome bonus?

Yes, new cardholders can earn up to 45,000 bonus Scene+ points in the first year:

- 35,000 points after spending CAD $2,000 in the first 3 months

- 10,000 points annually when spending at least CAD $40,000 on eligible purchases

5. Can I apply if I’m new to Canada?

Yes, Scotiabank offers tailored solutions for newcomers. It’s recommended to visit a local branch for personalized assistance with your application.

Conclusion

The Scotiabank Passport® Visa Infinite* Card is an excellent choice for individuals who travel frequently and seek a credit card that offers valuable rewards and travel benefits without foreign transaction fees. By following this guide, you can navigate the application process with ease and take advantage of the perks this card offers.

If you’re interested in comparing this card with other options like the Scotiabank Momentum® Visa Infinite Card* or the TD Aeroplan® Visa Infinite Card*, feel free to ask for more detailed information.

Conteúdo criado com auxílio de Inteligência Artificial