The Zopa Credit Card is a smart financial tool designed to help UK consumers manage their money with transparency, offering unique features like the “Safety Net” and real-time balance tracking through an award-winning app.

Step-by-Step Guide: How to Apply for a Zopa Credit Card

The Zopa Credit Card is a digital-first card designed to give you more control over your finances through its intuitive app. Follow these steps to complete your application:

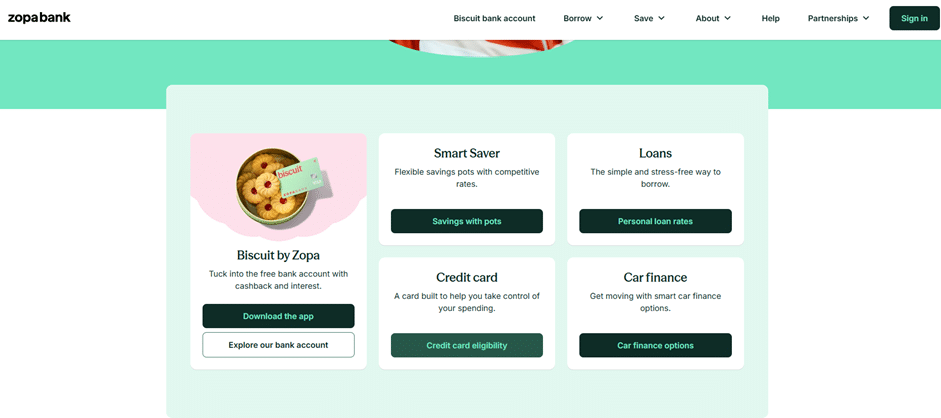

1. Access the Zopa Official Website

Go to zopa.com. Scroll down the homepage to find the product sections. Locate the third option, “Credit cards”, and click the green button labeled “Credit cards eligibility”.

Anúncios

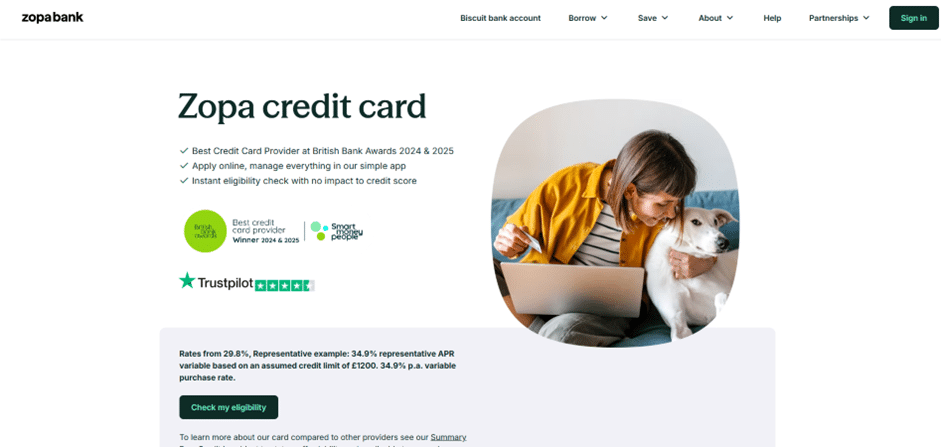

2. Learn About the Card and Start the Check

On the credit card details page, you will find information about the card’s features, such as the “Safety Net”. To see if you qualify without affecting your credit score, click the green “Check your eligibility” button.

Anúncios

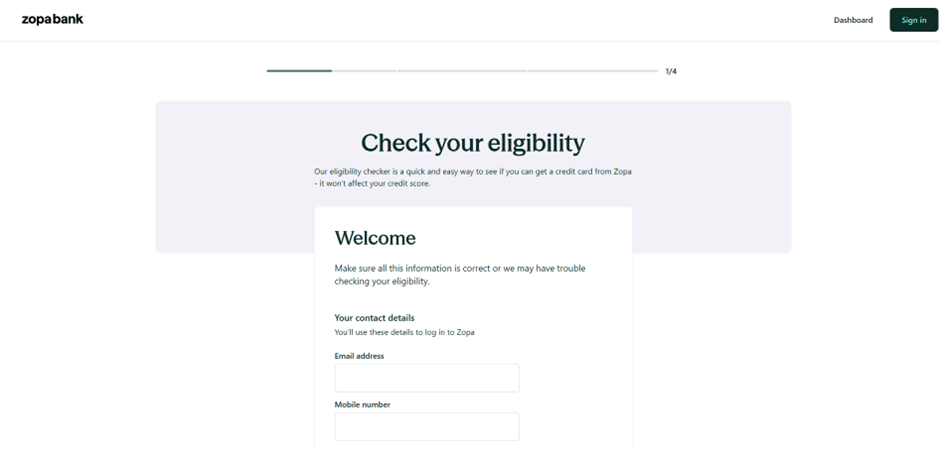

3. Complete Your Application

You will be redirected to the secure Zopa application portal. Follow the on-screen instructions to provide your personal and financial information. After submitting and receiving approval, your Zopa Credit Card will be sent to your registered address shortly.

Tip: Zopa uses a “soft search” for the initial check, meaning you can find out if you are likely to be accepted and see your estimated credit limit before a formal “hard” credit check is performed.

Everything you need to know to apply for the card

Applying for a Zopa credit card is a modern, digital-first experience. Unlike traditional banks, Zopa focuses on a seamless mobile journey, ensuring that applicants can manage every step from their smartphones. Below is a detailed guide on how to navigate the application process and what you need to prepare.

Accessing the Application

There are two primary ways to start your journey with Zopa:

- Official Website: Visit zopa.com and navigate to the credit cards section. You can start the eligibility check directly on your browser.

- Zopa App: The most recommended method is downloading the Zopa app from the Apple App Store or Google Play Store. The app provides a more interactive experience and allows for instant notifications regarding your application status.

Zopa

Eligibility and Basic Requirements

To be eligible for a Zopa credit card, you must meet specific criteria tailored to the UK market:

- Residency: You must be a permanent UK resident.

- Age: You must be at least 18 years old.

- Employment: You must have a regular income, whether through employment or self-employment.

- Credit History: Zopa looks for customers who demonstrate responsible financial behavior. Even if you are building your score, Zopa offers cards suited for different credit levels.

The Step-by-Step Approval Process

- The Quick Check: Zopa uses a “soft search” for its initial eligibility check. This means you can see if you are pre-approved and what your estimated credit limit will be without it appearing on your credit report or affecting your score.

- Information Gathering: You will need to provide your full name, current and previous addresses (usually for the last 3 years), and details about your annual income and monthly outgoings.

- Identity Verification: Using the app, you may be asked to scan a photo ID (like a UK driving license or passport) and take a “selfie” to verify your identity instantly.

- The Final Application: If you decide to proceed after the soft check, you will submit a formal application. At this point, Zopa performs a hard credit search, which will be visible on your credit file.

- Decision and Delivery: Most decisions are made in minutes. Once approved, your physical card is dispatched and typically arrives within 5 to 7 business days. You can often see your card details in the app immediately to start using it for online purchases.

Overview of Zopa Bank

Zopa Bank is a pioneer in the UK fintech sector. Launched in 2005 as the world’s first peer-to-peer lending platform, it transitioned into a fully licensed digital bank in 2020. Based in London, Zopa is authorized by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA).

The bank has earned a strong reputation for customer satisfaction and transparency. Zopa is known for its “feel-good money” philosophy, focusing on fair pricing and innovative digital tools that empower users to improve their financial health. Its commitment to clear communication and no hidden fees has made it one of the most trusted digital banks in the United Kingdom.

Zopa

FAQ: Frequently Asked Questions

1. Does applying for a Zopa card hurt my credit score? Checking your eligibility with Zopa uses a soft search, which does not affect your score. A hard search only occurs if you choose to complete the formal application.

2. What is the Zopa Safety Net feature? The Safety Net is a unique tool that allows you to set aside a portion of your credit limit for unexpected expenses, helping you stay within your budget.

3. Are there annual fees for the Zopa credit card? Zopa typically offers credit cards with no annual fees, though it is important to check the specific terms of the card offer you receive.

4. How can I manage my card? The card is managed entirely through the Zopa app, where you can freeze your card, view your PIN, and track spending in real-time.

5. Can I use the Zopa card abroad? Yes, the Zopa card can be used internationally. However, you should check the current rates for foreign transactions in the app before traveling.

Conteúdo criado com auxílio de Inteligência Artificial