The Santander Everyday Credit Card is an excellent choice for those looking for a straightforward credit solution with 0% interest on purchases and balance transfers for an initial period.

How to Apply for the Santander Everyday Credit Card

The Santander Everyday Credit Card is a great option for those looking for 0% interest on balance transfers and purchases without a monthly account fee. Follow this guide to complete your application.

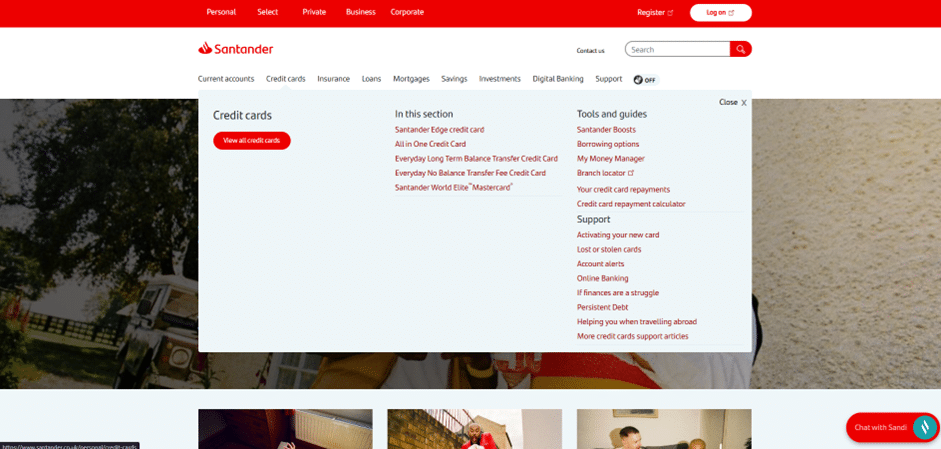

1. Access the Santander UK Website

Visit the official Santander website at santander.co.uk. In the main top menu, click on the second option, “Credit cards”, and then select “View all credit cards”.

Anúncios

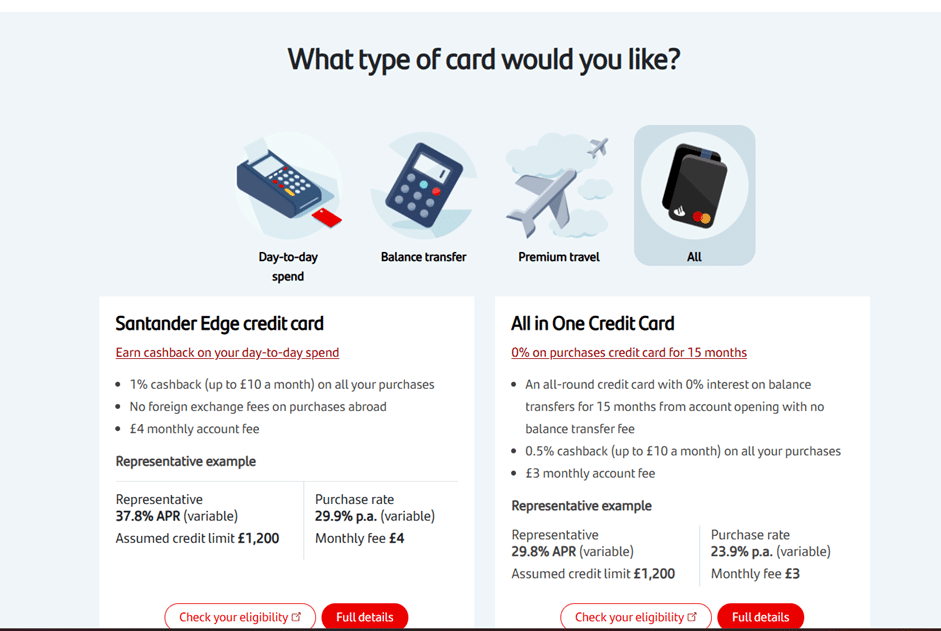

2. Locate the Everyday Credit Card

Scroll down the page to view the different card options (such as the Edge or All in One cards). Find the Santander Everyday card (usually the fourth option) and click the “Full details” button.

Anúncios

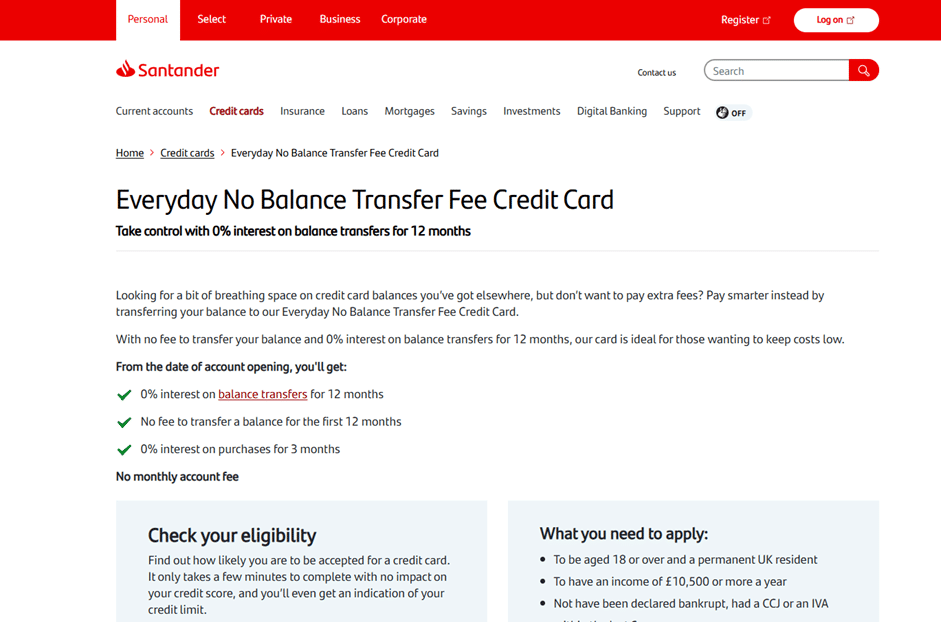

3. Check Your Eligibility

On the specific Everyday card page, review the benefits like the 0% interest periods. Click the white button labeled “Check your eligibility”. This is a “soft search” that won’t affect your credit score but will tell you how likely you are to be accepted.

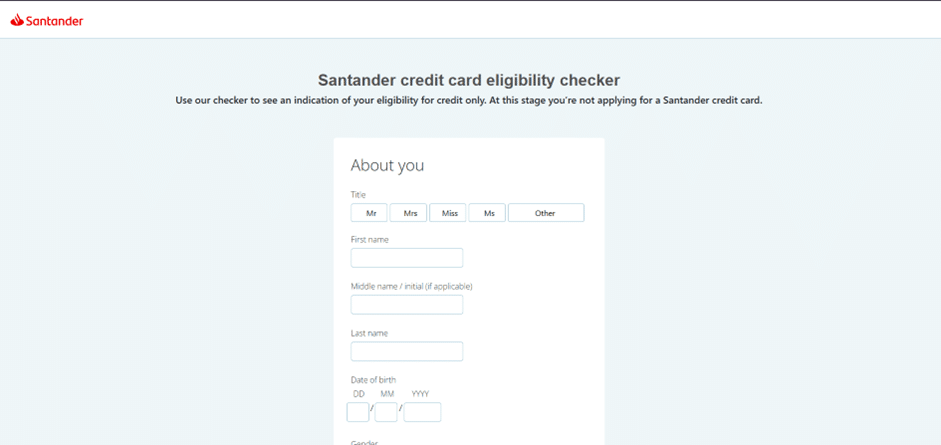

4. Complete the Application Form

You will be redirected to a secure application page. Follow the instructions to enter your personal details, including your full name, birth date, and contact information. Once you submit the form and are approved, your card will be sent to your registered address.

Important Requirements to Remember:

- Age: You must be 18 or older.

- Residency: You must be a permanent UK resident.

- Income: You must have an income of at least £10,500 per year.

- Clean History: You must not have been declared bankrupt or had a CCJ/IVA in the last 6 years.

Everything you need to know to apply for the card

Applying for the Santander Everyday Credit Card is a transparent and digital process. This guide provides a detailed walkthrough of the steps, eligibility criteria, and the approval journey to help you secure your card efficiently.

Accessing the Application Channels

You can initiate your application through Santander’s official digital platforms:

- Official Website: Go to the Santander UK website, navigate to the “Credit Cards” section, and find the “Everyday Credit Card”. Click on “Apply now” to start.

- Mobile Banking App: For current Santander customers, the app is the fastest route. It uses your existing data to speed up the form-filling process and verify your identity securely.

Santander Everyday

Core Eligibility and Requirements

To be considered for the Everyday card, you must meet the following basic UK requirements:

- Residency and Age: You must be a UK resident and at least 18 years old.

- Minimum Income: You need a regular gross annual income of at least £10,500.

- Credit Standing: You must have a good credit history. Applicants with bankruptcy, CCJs, or IVAs in the last six years are generally not eligible.

- Card Specifics: You cannot have a Santander Everyday Credit Card already.

The Step-by-Step Approval Process

- Eligibility Check: Santander offers a “soft search” eligibility tool. This allows you to check your likelihood of approval without any impact on your credit score.

- Personal Information: You will be asked for your 3-year address history, your employment status, and details regarding your annual income and monthly expenses.

- The Hard Search: Once you submit the full application, the bank performs a hard credit check. This will be recorded on your credit file.

- Instant Decision: In many cases, Santander provides an immediate decision online. If further checks are needed, they will contact you within a few business days.

Activation and Delivery

Once your application is approved, your Santander Everyday card will be sent to your registered address via post, typically arriving within 7 to 10 working days. You can activate it through the mobile app or online banking to begin using your credit limit.

Overview of Santander UK

Santander UK is a prominent retail and commercial bank in the United Kingdom, serving millions of active customers. As a subsidiary of the global Banco Santander Group, it combines international strength with a deep understanding of the UK market.

Regulated by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA), Santander is renowned for its stability and customer-centric approach. With a focus on digital innovation and simple banking products, the bank has established itself as one of the most reliable financial institutions in the country, committed to helping people and businesses prosper.

Santander

FAQ: Frequently Asked Questions

1. Does the Santander Everyday Credit Card have a monthly fee? No, the Santander Everyday Credit Card does not have a monthly or annual fee, making it a cost-effective option for daily use.

2. How long does the 0% interest period last? The specific duration of the 0% interest period for purchases and balance transfers can vary based on the current offer. Always check the summary box during your application for the exact number of months.

3. Will checking my eligibility affect my credit rating? No, the initial eligibility check is a soft search and will not be visible to other lenders or affect your credit score.

4. What is the minimum credit limit? The credit limit is determined by Santander based on your individual financial circumstances and credit history.

5. Can I transfer a balance from another Santander card? No, balance transfers cannot be made from other credit cards issued by Santander UK or its subsidiaries.

Conteúdo criado com auxílio de Inteligência Artificial