The Santander Edge Credit Card is a versatile financial tool designed for customers looking to earn cashback on their daily spending while benefiting from no foreign transaction fees when traveling abroad.

How to Apply for the Santander Edge Credit Card: A Didactic Guide

The Santander Edge Credit Card is designed for those who want to earn cashback while enjoying fee-free spending abroad. Below is the simplified process to secure yours.

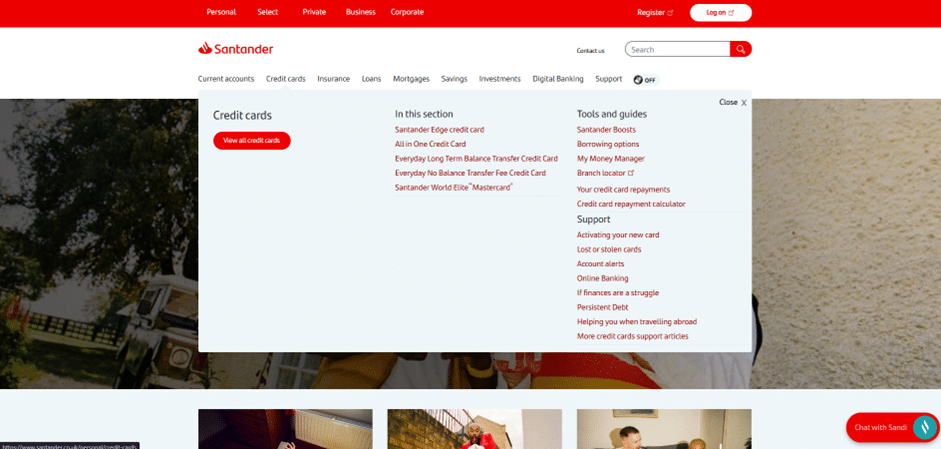

1. Access the Santander UK Website

Go to santander.co.uk. On the main menu, click on the “Credit cards” tab. From the dropdown menu, select “View all credit cards” to see the full range of products.

Anúncios

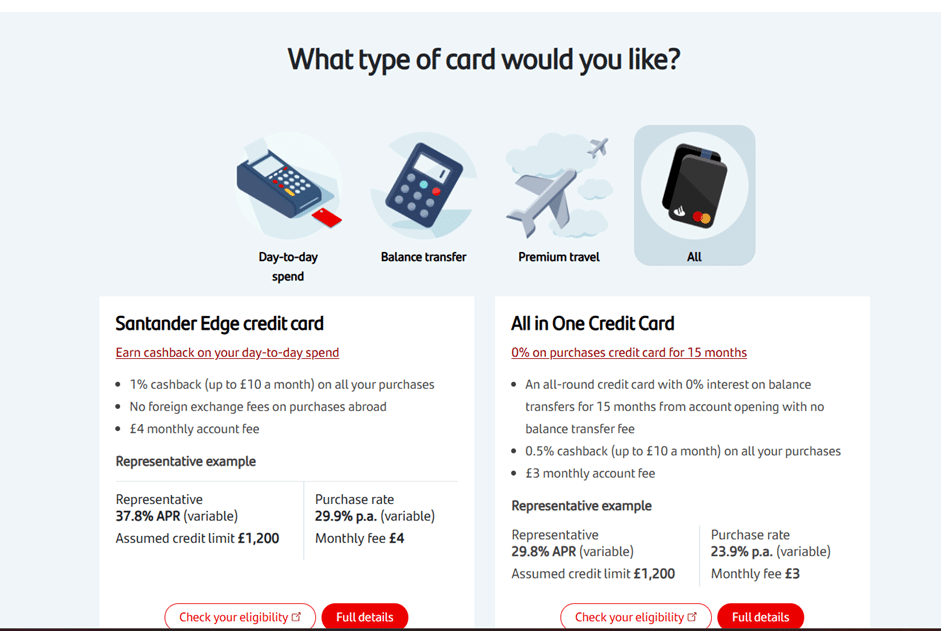

2. Select the Santander Edge Option

Scroll through the card list. The Santander Edge Credit Card is usually featured prominently as a top choice for everyday rewards. Click on the “Full details” button to review the specific benefits, such as the 1% cashback offer.

Anúncios

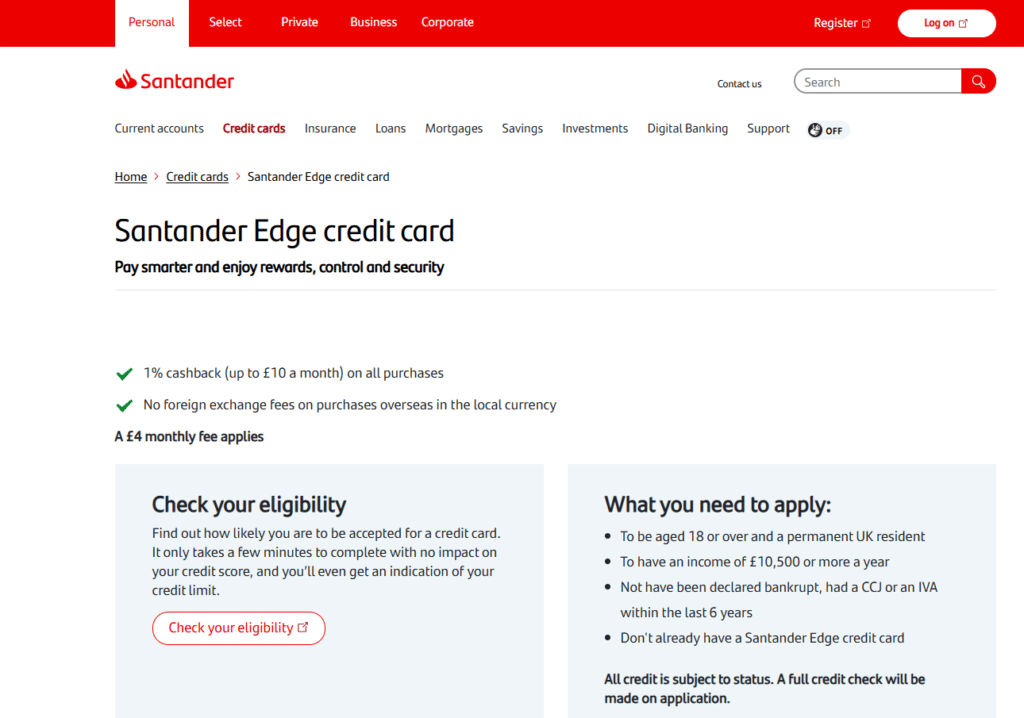

3. Check Your Initial Eligibility

On the Edge card page, look for the white “Check your eligibility” button. This is a vital step: it performs a “soft search” that tells you if you are likely to be accepted without affecting your credit score.

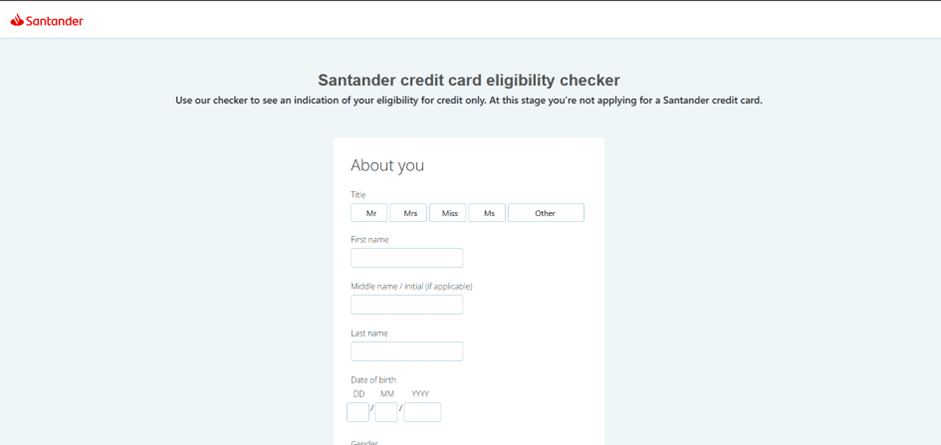

4. Complete Your Personal Profile

Once you proceed, you will be directed to a secure form. You will need to provide your title, full name, address history, and income details. Follow the prompts to submit your application. Once approved, your card will be sent to your home address.

Basic Requirements for Approval

To apply for this card, ensure you meet these criteria:

- Age: You must be 18 or older.

- Residency: You must be a permanent UK resident.

- Income: A guaranteed annual income of at least £10,500.

- Credit History: No bankruptcy or CCJs in the last 6 years.

Everything you need to know to apply for the card

Applying for the Santander Edge Credit Card is a streamlined digital process. However, because this card is part of the “Edge” ecosystem, there are specific steps and criteria you must follow to ensure a successful application. This guide provides a detailed walkthrough of the requirements and the approval journey.

Accessing the Application Portal

Santander offers multiple digital paths to secure the Edge Credit Card:

- Official Website: Visit the Santander UK website, navigate to the “Credit Cards” section, and select the Santander Edge Credit Card. You will find a clear “Apply now” button.

- Mobile Banking App: If you already hold a Santander current account, the most efficient way to apply is through the Mobile Banking app. This method allows the bank to verify your identity faster and pre-fill much of the required information.

Santander Edge

Core Eligibility and Requirements

To be eligible for the Santander Edge Credit Card, you must meet several strict criteria mandated by UK financial regulations:

- Residency and Age: You must be a UK resident aged 18 or over.

- Income Status: You must have a regular annual income of at least £10,500.

- Credit History: You must have a good credit record and not have been declared bankrupt, had a CCJ (County Court Judgment), or an IVA (Individual Voluntary Arrangement) in the last six years.

- Account Requirements: While you don’t always need to be an existing customer, the card is designed to complement the Santander Edge current account.

The Step-by-Step Approval Process

- Eligibility Check: Before a formal application, Santander provides an eligibility checker. This is a “soft search” that allows you to see your chance of approval without impacting your credit score.

- Detailed Information: If you proceed, you will need to provide your 3-year address history, employment details, and a clear breakdown of your monthly income and expenses.

- The Hard Credit Check: Once you submit the final form, Santander will perform a hard credit search. This search will be recorded on your credit report.

- Verification: You may be asked to provide digital proofs of ID or income. Santander often uses secure third-party services to verify these instantly online.

Receiving and Activating Your Card

Once approved, your Santander Edge Credit Card will usually arrive by mail within 7 to 10 working days. For security, the PIN often arrives separately. You can activate the card immediately through the mobile app or online banking to start earning cashback on your eligible purchases.

Overview of Santander UK

Santander UK is one of the leading personal financial services companies in the United Kingdom and is part of the global Banco Santander Group. With a massive presence across the country, it serves millions of customers through a combination of digital innovation and a traditional branch network.

Regulated by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA), Santander is recognized for its reliability and its focus on “Simple, Personal, and Fair” banking. The Edge brand represents the bank’s modern approach to banking, offering integrated rewards across current accounts and credit products, making it a highly credible choice for UK residents seeking competitive cashback and travel-friendly features.

Santander

FAQ: Frequently Asked Questions

1. Is there a monthly fee for the Santander Edge Credit Card? Yes, the Santander Edge Credit Card typically carries a £3 monthly fee. It is important to weigh this fee against the cashback benefits you expect to earn.

2. How does the cashback feature work? The card offers cashback on eligible purchases, capped at a certain amount each month. Usually, this covers a wide range of retail spending, but you should check the current specific terms for exclusions.

3. Can I use this card abroad without extra costs? One of the main benefits of the Santander Edge Credit Card is that it does not charge foreign transaction fees for purchases made abroad in the local currency.

4. Will the eligibility checker affect my credit score? No, the initial eligibility check is a soft search and will not be visible to other lenders or affect your credit rating.

5. How long does the application process take? The online application form usually takes about 10 to 15 minutes to complete. A decision is often provided instantly, though some cases may require a manual review.

Conteúdo criado com auxílio de Inteligência Artificial