The Santander All in One Credit Card is a versatile financial product designed for those who want to combine the benefits of cashback on everyday spending with a powerful tool for balance transfers.

How to Apply for the Santander All in One Credit Card: Step-by-Step Guide

The Santander All in One Credit Card is a popular choice for those looking to consolidate debt with balance transfers while earning rewards on daily spending. This tutorial provides a clear, SEO-optimized walkthrough of the application process based on the official UK portal.

1. Access the Santander Credit Cards Page

Start by visiting the Santander UK homepage at santander.co.uk. In the main navigation menu, hover over or click on the second option, “Credit Cards”, and then select “View all credit cards”.

Anúncios

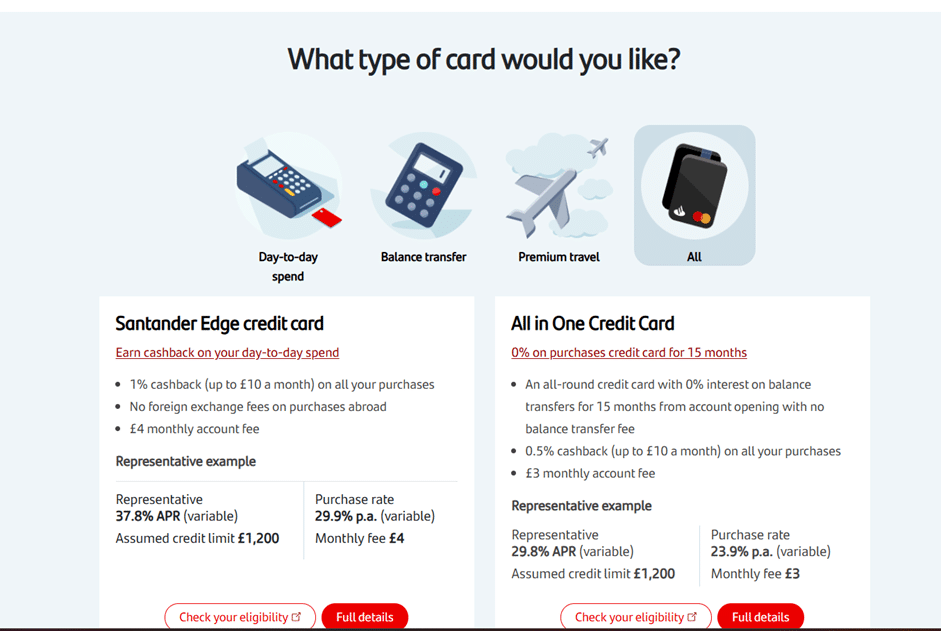

2. Locate the All in One Credit Card

On the overview page, you will see a list of available cards, such as the Everyday and Edge cards. Scroll down to the second option, which is the Santander All in One Credit Card. Click the “Full details” button to learn more about its specific features and fees.

Anúncios

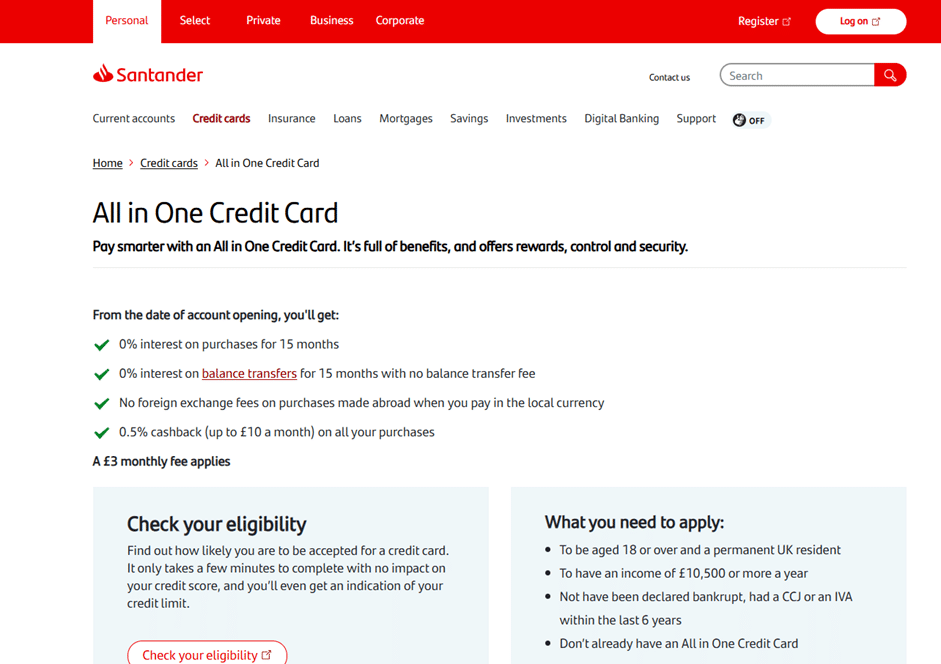

3. Check Your Eligibility

Once on the dedicated All in One page, you will see a summary of the card’s benefits (like 0% interest periods and cashback). To begin your request without affecting your credit score, click the white button labeled “Check your eligibility”.

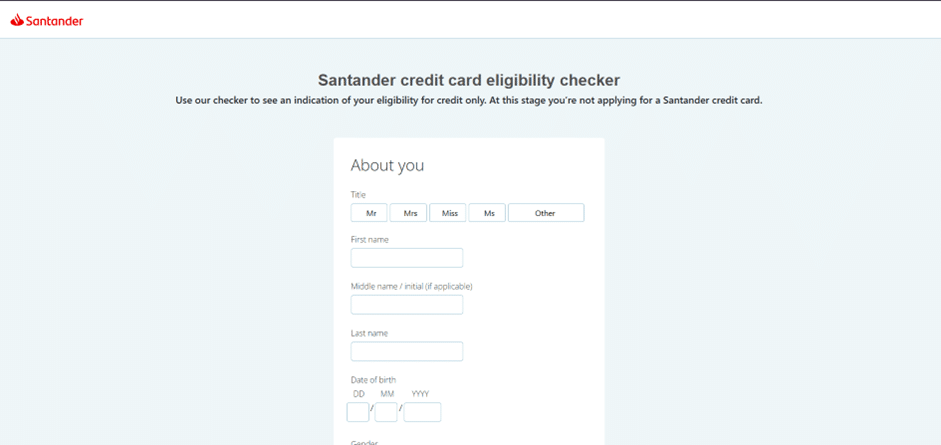

4. Complete the Online Application

You will be redirected to the secure Santander application portal. Follow the step-by-step instructions to provide your personal, residential, and financial information. After submitting your details, the bank will review your application and, if approved, your new card will be dispatched to your address.

Tip: Before applying, ensure you are a UK resident, over 18, and have a steady income. Using the eligibility checker first is highly recommended to protect your credit rating from unnecessary hard searches.

Everything you need to know to apply for the card

Applying for the Santander All in One Credit Card is a structured process designed to be completed entirely online. Because this card offers specialized features like 0% interest on balance transfers and purchases for a set period, the bank requires specific information to ensure the product meets your financial needs.

Santander All in One

Accessing the Application

To start your application, you should visit the official Santander UK website. Navigate to the “Credit Cards” section and select the “All in One” option.

- For Existing Customers: If you already have a Santander current account, applying through the Mobile Banking app or Online Banking is highly recommended. The system will recognize your details, making the form much shorter and the verification process faster.

- For New Customers: You can apply directly on the website by clicking the “Apply now” button. You will need to provide more comprehensive details since the bank does not have your history on file.

Eligibility and Requirements

To be successful in your application, you must meet the following mandatory criteria:

- Residency: You must be a UK resident.

- Age: You must be aged 18 or over.

- Income: You must have a regular gross personal income of at least £10,500 per year.

- Financial Standing: You must have a good credit record and must not have been declared bankrupt, had a CCJ (County Court Judgment), or an IVA (Individual Voluntary Arrangement) in the last six years.

The Step-by-Step Approval Process

- Eligibility Check: Before the full application, use the Santander eligibility tool. This “soft search” tells you how likely you are to be accepted without leaving a mark on your credit file.

- Personal and Financial Details: You will need to provide your 3-year address history, employment status, and details of your monthly income and outgoings.

- The Credit Search: Once you submit, Santander will perform a hard credit search. This is the formal step that stays on your credit report.

- Digital Signature: If approved, you will sign your credit agreement digitally. The bank may ask for digital copies of payslips or ID if they cannot verify you automatically.

Receiving Your Card

Once the process is complete, your Santander All in One card will arrive by post within 7 to 10 working days. You can then activate it via the app to start earning 0.5% cashback on all your eligible purchases.

Overview of Santander UK

Santander UK is one of the “Big Four” retail banks in the United Kingdom and part of the global Banco Santander Group. It established a strong presence in the UK market by acquiring established brands like Abbey National, Alliance & Leicester, and Bradford & Bingley, consolidating them into a single, highly credible institution.

Santander

Regulated by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA), Santander UK is known for its focus on integrated banking. The bank is a leader in digital banking innovation, providing millions of UK customers with secure and accessible financial tools. The All in One card is a testament to their strategy of offering high-value products that simplify the customer’s financial life.

FAQ: Frequently Asked Questions

1. Does the Santander All in One card have a monthly fee? Yes, this card typically carries a £3 monthly fee. You should ensure that the cashback and interest benefits outweigh this cost for your specific usage.

2. How much cashback can I earn? The card offers a consistent 0.5% cashback on all eligible spending, with no cap on the total amount you can earn back.

3. Will the eligibility check affect my credit score? No, the initial “Check your eligibility” tool is a soft search and does not impact your credit rating. Only the final formal application results in a hard search.

4. Can I use this card for balance transfers? Yes, the All in One card is specifically designed for balance transfers, often offering 0% interest for an introductory period with 0% balance transfer fees.

5. What is the minimum income required? To apply for the Santander All in One card, you must have a minimum annual income of £10,500.

Conteúdo criado com auxílio de Inteligência Artificial