The HSBC Classic Credit Card is designed to help individuals build or improve their credit rating. With no annual fee and a straightforward application process, it offers a practical solution for those new to credit or looking to enhance their financial standing.

HSBC Classic Card

United Kingdom: STEP-BY-STEP TUTORIAL – How to Apply for the HSBC Classic Credit Card

Learn the simple and fast way to apply for your HSBC UK Classic card. Guide optimized for your best experience!

Introduction

The HSBC Classic Credit Card is a popular option in the UK, known for its simplicity and as a good starting point. If you are ready to begin your application, follow this detailed guide.

Anúncios

Requirements and Preparation

- Target Audience: UK Residents.

- Estimated Time: 5-10 minutes to start the online application.

- What You Need: Internet access and subsequently a smartphone to complete the application via the app.

Step 1: Access the Official HSBC UK Website

The first step is to navigate to the bank’s homepage.

Anúncios

- Access the HSBC UK homepage at:

https://www.hsbc.co.uk/ - Locate the main menu (usually at the top or side of the page, depending on your device).

- Click or hover over the menu and look for the third option: “Credit Cards”.

Step 2: Find the HSBC Classic Card

On the credit cards page, you will find the various options offered by the bank.

- On this page you will see information about various credit cards such as: Premier Credit Card, Premier World Elite Mastercard, Student Credit Card, among others.

- Scroll down the page and choose the HSBC Classic, which will be the fourth option listed (the order may vary, look for the exact name: HSBC Classic Credit Card).

Step 3: Start Your Online Application

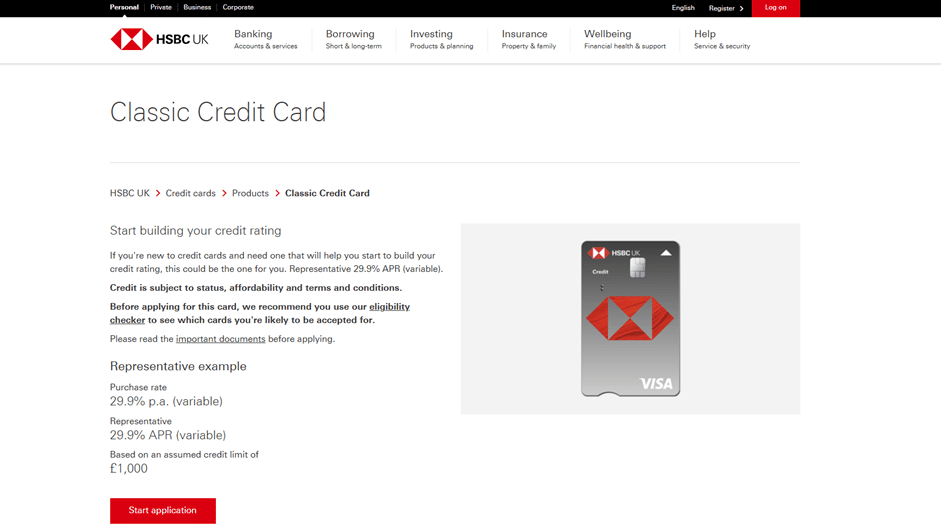

Upon selecting the Classic card, you will be directed to a page with all the specific details.

- On this page you will have all the information about the HSBC Classic card (interest rates, benefits, etc.). Read carefully.

- Locate and click the call-to-action button, which is usually red or highlighted: “Start application”.

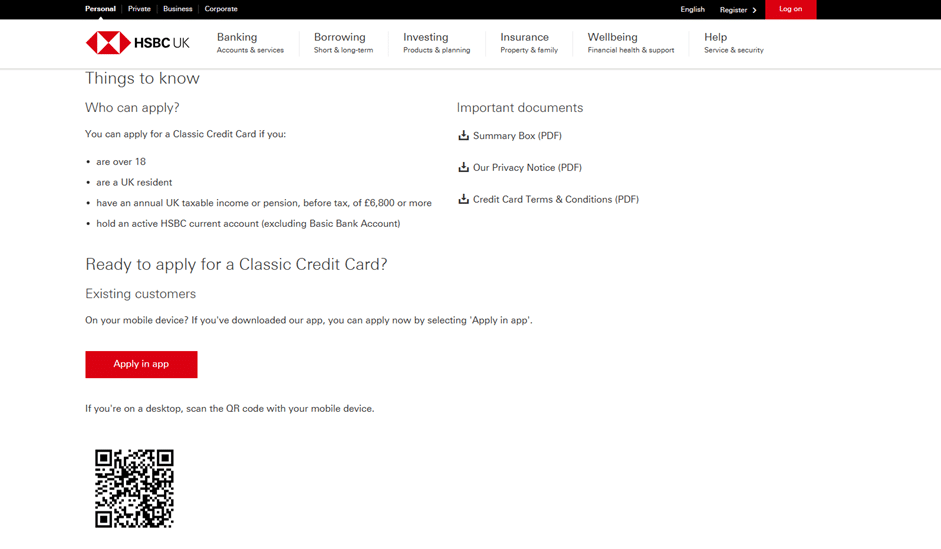

Step 4: Follow Instructions for the App

HSBC UK, to ensure security and the best user experience, usually directs credit card applications to its mobile application.

- After clicking “Start application”, you will receive clear instructions to apply for your card via the HSBC UK bank app on your mobile phone.

- Follow the instructions to download or open the app (if you are already a customer) and continue the application safely and guided.

Tip: Downloading the app guarantees a faster and more secure process!

Conclusion

Follow all instructions in the app. Fill in the requested details (personal, financial, employment information, etc.). After submission, HSBC will evaluate your request and contact you. You will soon receive your HSBC Classic Credit Card!

How to Apply for the HSBC Classic Credit Card

Applying for the HSBC Classic Credit Card is a straightforward process:

- Eligibility Check: Before applying, it’s advisable to use HSBC’s eligibility checker to see which cards you’re likely to be accepted for.

- Online Application: You can apply online through HSBC’s official website. If you’re an existing customer, logging into your online banking account will pre-fill your application form.

- Required Information: Be prepared to provide personal details, employment information, and financial history.

- Instant Decision: In many cases, you’ll receive an instant decision on your application.

- Card Delivery: If approved, your card will be sent to you, and you can start using it immediately.

Key Features and Benefits

- No Annual Fee: Enjoy the benefits of a credit card without the added cost of an annual fee.

- Credit Limit: The card offers a credit limit of up to £1,000, depending on your financial situation.

- Build or Boost Your Credit Rating: By managing your card responsibly, you can improve your credit score over time.

- Purchase Protection: Purchases between £100 and £30,000 are protected under Section 75 of the Consumer Credit Act, providing peace of mind for your purchases.

- Digital Wallet Compatibility: The card is compatible with digital wallets like Apple Pay and Google Pay, allowing for contactless payments.

- Exclusive Offers: Access to a range of discounts and offers through HSBC’s partnerships.

Costs and Interest Rates

- Representative APR: 29.9% (variable), based on an assumed credit limit of £1,000.

- Interest-Free Period: Up to 56 days on purchases when you pay your balance in full and on time.

- Cash Advances: Interest rates for cash advances may be higher, and fees may apply.

- Late Payment Fees: Charges may apply if you miss a payment or exceed your credit limit.

Who Can Apply?

To be eligible for the HSBC Classic Credit Card, you must:

- Be over 18 years old.

- Be a UK resident.

- Have a UK taxable income or pension of £6,800 or more per year.

- Hold an active HSBC current account (excluding Basic Bank Account).

About HSBC UK

HSBC UK stands among the most established and trusted banks in the United Kingdom, serving more than 14 million personal customers and countless small and medium-sized businesses across the country. Headquartered in Birmingham, HSBC UK operates an extensive network of branches and ATMs while maintaining one of the most advanced digital banking systems in the market. Customers benefit from secure and convenient access to online banking, mobile apps, and 24/7 customer support. As a ring-fenced subsidiary of HSBC Holdings plc, the bank focuses on retail and commercial services, ensuring that UK customers enjoy strong financial protection and dedicated service tailored to their needs.

HSBC Bank

In the competitive UK banking landscape, HSBC UK stands out for its long-standing reputation, international reach, and customer-focused approach. The bank consistently earns recognition for its innovation, service quality, and commitment to financial inclusion. From everyday current accounts to savings, mortgages, and credit cards, HSBC UK offers comprehensive solutions that support individuals and businesses at every financial stage. Its solid capital base, adherence to strict UK regulations, and global expertise make it a reliable partner for anyone seeking stability and growth in their personal or professional finances.

Frequently Asked Questions (FAQ)

1. Is there an annual fee for the HSBC Classic Credit Card?

No, there is no annual fee associated with this card.

2. How can I improve my credit rating with this card?

By making timely payments, staying within your credit limit, and managing your account responsibly, you can build or enhance your credit rating.

3. Can I use the card abroad?

Yes, the card can be used internationally; however, foreign transaction fees may apply.

4. What should I do if I miss a payment?

Contact HSBC immediately to discuss your options and avoid potential late payment fees.

Conteúdo criado com auxílio de Inteligência Artificial