The HSBC UK Purchase Plus Credit Card stands out in the British financial market as an all-in-one credit card solution, perfectly designed for those seeking flexibility to make significant purchases while simultaneously managing existing debt. This card, which combines 0% interest periods for both purchases and balance transfers, is the ideal choice for consumers in the UK looking to maximise their repayment time without initial interest costs.

Purchase Plus

UK: STEP-BY-STEP TUTORIAL – How to Apply for the HSBC Purchase Plus Credit Card

Get the all-rounder card! Learn how to apply for the HSBC Purchase Plus card, offering flexibility for both new purchases and balance transfers. A clear and efficient guide.

Introduction

The HSBC Purchase Plus Credit Card is designed for those who want flexibility, providing promotional interest rates for both new spending (purchases) and existing debts (balance transfers). Follow this simple tutorial to start your application in the United Kingdom.

Anúncios

Requirements and Key Advantages

- Target Audience: Consumers who plan to make large purchases and also want the option to transfer existing credit card debt.

- Key Advantage: Promotional interest rates on both purchases and balance transfers.

- What You Need: Internet access and a smartphone to complete the application via the bank’s mobile app.

Step 1: Navigating the Official HSBC UK Website

Begin your application by visiting the bank’s main site.

Anúncios

- Access the HSBC UK homepage at:

https://www.hsbc.co.uk/ - Locate the main navigation menu.

- Click or hover over the menu and select the third option: “Credit Cards”.

Step 2: Locate the Purchase Plus Card

The credit cards page displays the various options available.

- On this page, you will see information about various credit cards, such as: Premier Credit Card, Premier World Elite Mastercard, Student Credit Card, and others.

- Choose the HSBC Purchase Plus, which is typically listed as the second option on the page.

Step 3: Beginning the Application and Reviewing Details

Clicking on the card will take you to its dedicated information page.

- On this page, you will find all the details of the HSBC Purchase Plus card, including the introductory interest-free periods for purchases and balance transfers, as well as any associated fees.

- Review the terms and conditions carefully.

- To proceed, click on the prominent button, usually red: “Start application”.

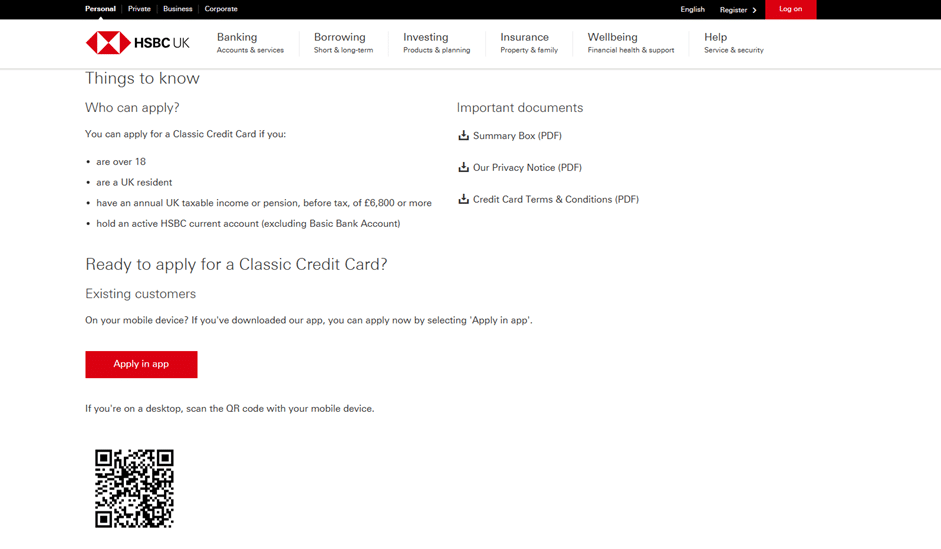

Step 4: Secure Completion via Mobile App

For security and efficiency, HSBC typically directs users to finalise the process via its mobile app.

- After clicking “Start application”, you will receive detailed instructions to apply for your card via the HSBC UK bank app on your mobile phone.

- Follow the instructions to download or use the app. The app will securely guide you through submitting your personal and financial information.

User Tip: Finalising the application through the mobile app is the most convenient way to complete the process.

Next Steps

Once you have completed the application in the app, HSBC will assess your eligibility. Upon approval, you will receive your versatile HSBC Purchase Plus Credit Card!

Overview of HSBC UK Bank: Credibility and Operations in the United Kingdom

HSBC UK Bank plc is a pillar of the UK’s financial system, being one of the four main clearing institutions. As a subsidiary of HSBC Holdings plc, one of the world’s largest banking and financial services groups, HSBC UK benefits from global credibility and strong financial stability.

HSBC Bank

Foundation of Trust and Regulation:

HSBC’s operations in the UK are characterised by robustness, often demonstrated by prudent balance sheet management. The bank is under the regulatory authority of the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA), ensuring that all its offerings, including the Purchase Plus Credit Card, meet the strictest standards for consumer protection and financial security. Headquartered in Birmingham, the institution offers a vast array of retail and wealth management services, supporting millions of customers and businesses across the country through an extensive network of branches and advanced digital platforms. Trust in the HSBC brand is a crucial factor for consumers seeking long-term financial products in the UK market.

Everything People Need to Know to Apply for the Card – A Detailed, Instructional Guide

The HSBC UK Purchase Plus Credit Card is nicknamed the all-rounder due to its dual promotional functionality. It offers one of the longest 0% interest periods for new purchases and a substantial period for balance transfers, providing exceptional financial flexibility.

Key Features of the Purchase Plus Card

This card has no annual fee and is a product focused on giving the customer maximum time to manage their payments:

- 0% Interest on Purchases: Enjoy up to 20 months of 0% interest on purchases made from account opening.

- 0% Interest on Balance Transfers: Enjoy up to 17 months of 0% interest on balance transfers made within the first 60 days of account opening.

Important Note: At the end of each promotional period, interest rates revert to the card’s standard variable rate. A transfer fee (typically 3.49%, minimum £5) applies to each balance transferred.

Basic Eligibility Requirements

To be eligible to apply for the Purchase Plus Credit Card, applicants must meet the following official HSBC UK criteria:

- Age: Must be 18 or over.

- Residency: Must be a UK resident.

- Annual Income: Must have an annual UK taxable income or pension, before tax, of £6,800 or more.

- Account Exclusion: Must not hold an HSBC Basic Bank Account.

- Recent History (HSBC Cards Only): Promotional rates are generally aimed at new HSBC credit card customers. You must not have opened a new HSBC credit card or received a credit limit increase within the past 6 months.

The Detailed Application Process

HSBC UK facilitates the application through multiple channels, with digital methods being the fastest.

1. Website/App Access and Online Application (Preferred Method):

- Eligibility Checker: Use the online tool on the HSBC website first. This performs a soft search on your credit history – requiring your income and address details for the last 3 years – and indicates your likelihood of approval without harming your credit score.

- Existing HSBC Customers:

- The quickest method is via the HSBC UK Mobile Banking app. After logging in, go to the “Cards” section and follow the instructions to apply for the Purchase Plus Credit Card.

- Alternatively, you can log on to Online Banking (browser) and find the application option in the credit cards section.

- New HSBC Customers:

- Access the card’s official page on the HSBC UK website and select “Apply now” or “Apply in browser”. Complete the online form with your personal details, employment details, and finances.

2. Application In Branch:

If you prefer face-to-face support, especially if you are a new customer, you can book an appointment to visit an HSBC branch. It is recommended to bring identification documents, proof of address, and a recent bank statement to facilitate the process.

Post-Approval: Utilising the Dual Features

Approval and Credit Limit:

Following the formal application, HSBC performs a hard credit search. If approved, you will be notified of your credit limit and the final applicable interest rates.

Taking Advantage of Purchases (0% Interest):

The promotional period for purchases starts from the account opening date. Any purchases made during this extended period will not incur interest, provided you meet the minimum required monthly payments.

Making the Balance Transfer (0% Interest):

If you wish to transfer debt (Balance Transfer), you must do so within the first 60 days to benefit from the promotional 0% interest rate.

- The transfer can be requested during the application process or later via the mobile app or online banking.

- Go to ‘Balance and money transfers’ on your card and enter the details of the third-party credit card you wish to pay off.

- Remember the transfer fee of 3.49% (minimum £5) which will be added to your new HSBC balance. You cannot transfer from cards issued by other HSBC Group entities.

FAQ – Frequently Asked Questions about the HSBC Purchase Plus Card

Q: Can I use the 0% interest for purchases and balance transfers at the same time? A: Yes. This is the main advantage of the Purchase Plus Credit Card. It allows you to make new interest-free purchases and manage existing debt (balance transfer) with 0% interest simultaneously, within their respective promotional periods.

Q: What is the Balance Transfer Fee? A: It is a one-time fee charged on the amount you move from another card to your Purchase Plus card (currently 3.49%, minimum £5). For example, if you transfer £1,000, a fee of £34.90 will be charged, and your total balance with HSBC will be £1,034.90.

Q: Is there an annual fee for the Purchase Plus Card? A: No. The HSBC UK Purchase Plus Credit Card has no annual fee.

Q: Does this card have additional benefits? A: Yes. As with all credit cards, purchases between £100 and £30,000 are protected by Section 75 of the Consumer Credit Act, an important legal benefit in the UK if the supplier breaches a contract or misrepresents the goods. The card also offers easy management through online banking and the mobile app.

Q: If I don’t pay off the purchase balance within the 0% interest period, what will the rate be? A: Any remaining purchase balance after the promotional period (up to 20 months) will revert to the card’s standard variable interest rate, which is the Purchase Rate (stated in your agreement and the product summary box, typically the Representative APR).

Conteúdo criado com auxílio de Inteligência Artificial