The HSBC UK Premier Credit Card is not a standard reward card; it is a dedicated financial tool designed exclusively for customers who hold an HSBC Premier Account. As part of the bank’s premium offering, this card delivers a compelling blend of reward earning potential, travel benefits, and flexible introductory interest-free periods, all wrapped up in a package with no annual card fee.

Rewards

UK: STEP-BY-STEP TUTORIAL – How to Apply for the HSBC Rewards Credit Card

Start earning points on your spending! Learn how to easily apply for the HSBC Rewards Credit Card. A clear and efficient guide.

Introduction

The HSBC Rewards Credit Card is the perfect choice for customers who want to earn points on their everyday purchases. These points can later be redeemed for various rewards, travel, or vouchers. Follow this simple tutorial to start your application in the United Kingdom.

Anúncios

Requirements and Key Advantages

- Target Audience: Consumers who value loyalty programmes and want to earn rewards points on their spending.

- Key Advantage: Accumulate reward points on eligible purchases.

- What You Need: Internet access and a smartphone to complete the application via the bank’s mobile app.

Step 1: Navigating the Official HSBC UK Website

Begin your application by visiting the bank’s main site.

Anúncios

- Access the HSBC UK homepage at:

https://www.hsbc.co.uk/ - Locate the main navigation menu.

- Click or hover over the menu and select the third option: “Credit Cards”.

Step 2: Locate the Rewards Card

The credit cards page displays the various options available.

- On this page, you will see information about various credit cards, such as: Premier Credit Card, Premier World Elite Mastercard, Student Credit Card, and others.

- Choose the HSBC Rewards, which is typically listed as the third option on the page.

Step 3: Beginning the Application and Reviewing Details

Clicking on the card will take you to its dedicated information page.

- On this page, you will find all the details of the HSBC Rewards card, including the points accumulation rate, any introductory offers, and specific terms.

- Review the terms and conditions carefully.

- To proceed, click on the prominent button, usually red: “Start application”.,

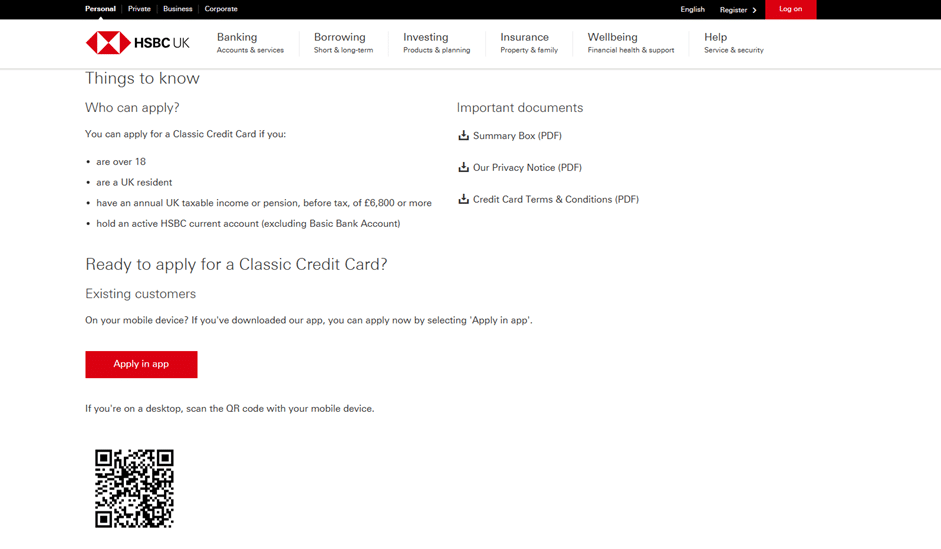

Step 4: Secure Completion via Mobile App

For security and efficiency, HSBC typically directs users to finalise the process via its mobile app.

- After clicking “Start application”, you will receive detailed instructions to apply for your card via the HSBC UK bank app on your mobile phone.

- Follow the instructions to download or use the app. The app will securely guide you through submitting your personal and financial information.

User Tip: Finalising the application through the mobile app is the most convenient way to complete the process.

Next Steps

Once you have completed the application in the app, HSBC will assess your eligibility. Upon approval, you will receive your HSBC Rewards Credit Card and can begin earning points with every eligible spend!

The HSBC Premier Distinction: A Card for the Affluent

The HSBC Premier Credit Card is a core component of the HSBC Premier service, which caters to high-net-worth or high-earning individuals in the UK. This card leverages the bank’s global network to offer enhanced rewards and travel privileges, positioning it above the standard retail credit card offering.

Key Features and Benefits

The card’s appeal lies in its combination of interest-free flexibility and ongoing reward earning:

| Feature | Details |

| Annual Fee | £0 (No annual card fee). |

| Balance Transfer Offer | Up to 18 months 0% interest on balance transfers made within the first 60 days of account opening. A 2.99% fee (minimum £5) applies to each transfer. |

| Purchase Offer | Up to 9 months 0% interest on purchases made from account opening. |

| Earning Rate (Standard) | Earn 1 reward point for every £1 spent in sterling (GBP). |

| Earning Rate (Travel) | Earn 2 reward points for every £1 spent in a foreign currency. |

| Lounge Access | Priority Pass Membership: Access to over 1,700 airport lounges worldwide for a fee of just £24 per person per visit. |

| Protection | Extended Warranty: Up to 2 years extended warranty on selected household appliances (provided by Domestic & General Insurance PLC). |

Rewards Redemption: Maximising Point Value

Points earned on the HSBC Premier Credit Card can be redeemed for various high-value items, with particular appeal to travellers:

- Airline Miles: Points can be converted into frequent flyer miles with multiple global airline partners, including British Airways, Emirates, and Singapore Airlines (usually at a 2:1 or similar ratio).

- Vouchers and Gifts: Redemption for retail vouchers (e.g., M&S, Amazon), fine wines, or charitable donations.

- Mastercard Priceless: Access to exclusive Priceless experiences and ticketed events, including live music shows.

Strict Eligibility: The Requirement of HSBC Premier Status

The most crucial requirement for the HSBC Premier Credit Card is that you must already be an HSBC Premier customer. This credit card is an ancillary product to the premium bank account service.

HSBC Premier Account Eligibility Criteria

To qualify for HSBC Premier status in the UK, you typically need to meet one or a combination of the following criteria:

- Mortgage or Investments: Have a mortgage with HSBC UK of £300,000 or more, or savings/investments of at least £50,000 with HSBC in the UK.

- Income and Deposits: Have an annual UK salary of at least £75,000 and hold an HSBC Premier Bank Account, and have one of the following: a mortgage, investment, life insurance, or protection product with HSBC, or pay your monthly salary into the account.

Note: If you cease to meet the Premier eligibility criteria, your banking and credit card relationship may be downgraded to a standard product.

Application Requirements for the Card Itself

Once you hold Premier status, the specific credit card application requires that you:

- Are over 18.

- Are a UK resident.

- Must not have opened a new HSBC credit card or received a credit limit increase within the past 6 months.

How to Apply for the HSBC Premier Credit Card

As this card is exclusive to existing clients, the application process is highly streamlined through digital channels.

HSBC Bank

- Log In (Mandatory): Access the HSBC UK Mobile Banking app or Online Banking. Applications for Premier products are handled almost exclusively within the secure banking environment.

- Navigate to Products: Go to the ‘Credit Cards’ or ‘Products’ section. The Premier Credit Card will be listed as an available option based on your current account status.

- Complete the Form: The process is typically quick, as most of your personal and financial data is already held by the bank.

- Credit Check: Upon submission, the bank will perform a hard credit search. If approved, your credit limit will be confirmed, along with the Representative APR (e.g., 26.9% APR variable).

Utilising the Introductory Offers:

- Balance Transfer: If you are using the card to consolidate debt, ensure the balance transfer request is made within the first 60 days of your account opening to secure the 18-month 0% interest period.

- Purchases: Make any large purchases you wish to spread the cost of early on to maximise the 9-month 0% interest period.

The HSBC UK Premier Credit Card is a high-value tool that rewards spending both at home and abroad, offering elite privileges and financial flexibility that complements the premium lifestyle of an HSBC Premier customer.

Conteúdo criado com auxílio de Inteligência Artificial