Want to maximize your travel points with flexibility?

You will remain on the same site

The Chase Sapphire card is a popular choice among travelers and shoppers alike, offering a range of benefits that provide peace of mind and financial protection. One of its most significant advantages is its comprehensive purchase protection, which safeguards your purchases against damage or theft.

In addition to purchase protection, the Chase Sapphire card also offers robust travel insurance features. This includes coverage for trip cancellations, interruptions, and delays, as well as medical emergencies while traveling.

Key Takeaways

- The Chase Sapphire card offers comprehensive purchase protection.

- It includes robust travel insurance features, such as coverage for trip cancellation and medical emergencies.

- Cardholders can enjoy peace of mind when shopping or traveling.

- The card’s benefits are designed to provide financial protection.

- Chase Sapphire remains one of the most popular choices among travelers and frequent shoppers

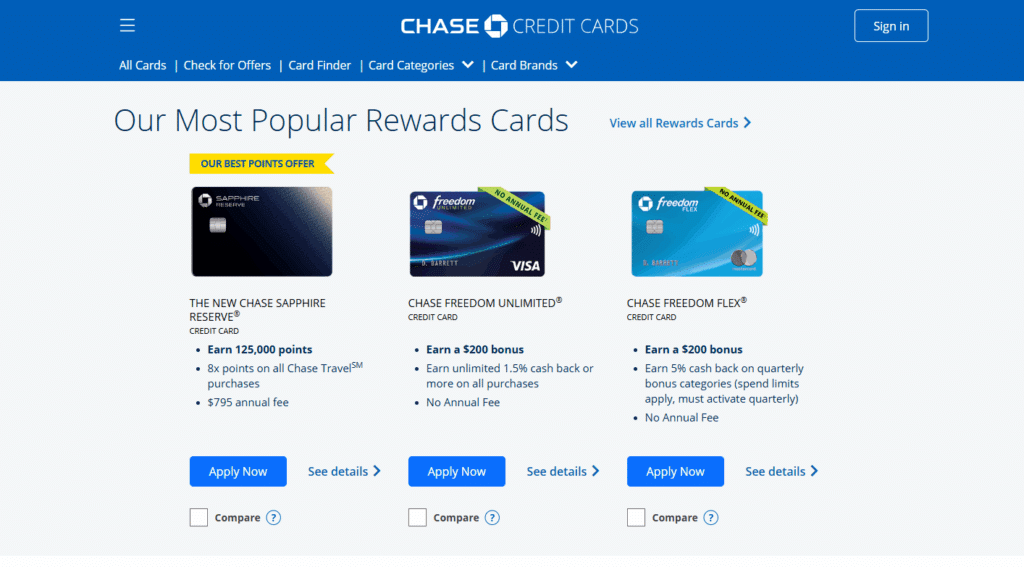

Comparison: Chase Freedom Unlimited, Chase Sapphire Preferred, and Chase Visa Platinum

The Chase Bank offers a variety of credit cards to meet the needs of different consumer profiles. Among the most popular options are the Chase Freedom Unlimited, Chase Sapphire Preferred, and Chase Visa Platinum. Below is a comparison of these three cards, highlighting their main features and benefits.

1. Chase Freedom Unlimited

- Annual Fee: $12.90/month (R$ 154.80/year)

- Benefits:

- International acceptance

- Points program that can be redeemed for cashback or discounts with partners

- Installment payment option with reduced interest

- Target Audience: Consumers looking for a card with basic benefits and an affordable cost.

2. Chase Sapphire Preferred

- Annual Fee: $19.90/month (R$ 238.80/year)

- Benefits:

- International acceptance

- Points program with more redemption options

- Installment payment option with reduced interest

- Exclusive offers with selected partners

- Target Audience: Consumers who want a card with additional benefits and greater flexibility.

3. Chase Visa Platinum

- Annual Fee: $29.90/month (R$ 358.80/year)

- Benefits:

- International acceptance

- Points program with a wide range of redemption options

- Installment payment option with reduced interest

- Access to exclusive offers and special discounts

- Priority customer service

- Target Audience: Consumers seeking a premium card with exclusive benefits and personalized service.

Quick Comparison

Chase Freedom Unlimited has an annual fee of R$ 154.80 per year and offers key benefits such as points, cashback, and low-interest installment payments, making it more suitable for people with moderate spending. Chase Sapphire Preferred costs R$ 238.80 per year and provides advantages like points, cashback, and partner offers, making it ideal for consumers seeking greater flexibility. Finally, Chase Visa Platinum has an annual fee of R$ 358.80 per year and stands out for offering premium rewards, exclusive benefits, and VIP customer service, being recommended for high-income users.

Choosing between the Chase Freedom Unlimited, Chase Sapphire Preferred, and Chase Visa Platinum depends on your spending profile and the benefits you value most.

- If you want a card with basic benefits and low cost, Chase Freedom Unlimited is ideal.

- For consumers seeking a card with additional benefits and more flexibility, Chase Sapphire Preferred is a good choice.

- Chase Visa Platinum is best suited for those looking for premium benefits and personalized service.

Before making a decision, it’s important to evaluate your needs and compare the available options to select the card that best fits your profile.

Understanding Chase Sapphire Cards

The Chase Sapphire ecosystem offers a duo of powerful credit cards: the Preferred and Reserve, each with its unique set of features. These cards are designed to cater to different needs, whether you’re a frequent traveler or an occasional shopper.

Chase Sapphire Preferred Card Features

The Chase Sapphire Preferred card is an excellent choice for those looking for a balance between benefits and affordability. It offers 60,000 bonus points after spending $4,000 in the first 3 months, which can be redeemed for $750 in travel. Additionally, it provides 2X points on travel and dining purchases and a 25% bonus when redeemed for travel through Chase Ultimate Rewards.

The card also includes trip cancellation/interruption insurance and auto rental collision damage waiver, providing peace of mind for travelers. With no foreign transaction fees, it’s an ideal card for international travel.

Chase Sapphire Reserve Card Features

The Chase Sapphire Reserve card is geared towards frequent travelers and those who value luxury benefits. It offers 100,000 bonus points after spending $4,000 in the first 3 months, redeemable for $1,250 in travel. Cardholders enjoy 3X points on travel and dining, making it a great choice for those who travel frequently.

Other notable benefits include a $300 travel credit, $100 credit towards Global Entry or TSA PreCheck, and airport lounge access through Priority Pass. The card also includes comprehensive travel insurance and assistance services.

Key Differences Between Sapphire Cards

The primary differences between the Chase Sapphire Preferred and Reserve cards lie in their rewards earnings, benefits, and annual fees. The Reserve card offers higher rewards earnings on travel and dining, more comprehensive travel credits, and luxury travel benefits, but it comes with a higher annual fee.

When choosing between the two, consider your travel habits, spending patterns, and the value you place on premium benefits. For those who travel frequently and can maximize the luxury benefits, the Reserve may be the better choice. For others, the Preferred card offers a more affordable entry point into the Chase Sapphire ecosystem with still robust benefits.

Chase Sapphire Preferred: An Honest Review of Pros and Cons

The Chase Sapphire Preferred credit card has long been a favorite among travel enthusiasts and rewards maximizers. Known for its versatile points system, premium travel benefits, and a generous sign-up bonus, it often secures a top spot in credit card rankings.

Based on the official card details, we offer an honest, comprehensive breakdown of the genuine advantages and potential drawbacks of the Chase Sapphire Preferred card.

✅ Pros (The Strengths)

The Chase Sapphire Preferred truly shines in its rewards structure and travel protections, making its annual fee highly justifiable for the frequent traveler.

1. Exceptional Welcome Offer

- Generous Bonus: Earn 75,000 bonus points after you spend $5,000 on purchases in the first three months from account opening.

- High Value: These points are extremely valuable, especially when redeemed for travel through the Chase Travel℠ portal (where they are worth 25% more) or transferred to airline/hotel partners.

2. Excellent Reward Earning Rates

The card offers some of the best multipliers for everyday spending categories:

- 5x total points on travel purchased through Chase Travel℠.

- 3x points on dining (including eligible delivery services and takeout).

- 3x points on select streaming services.

- 3x points on online grocery purchases (excluding certain major retailers).

- 2x points on all other travel purchases.

3. Ultimate Rewards Redemption Versatility

- 1:1 Point Transfer: This is the card’s killer feature. Transfer your points at a 1:1 ratio to over a dozen leading frequent traveler programs, including United, Hyatt, and Marriott.

- Anniversary Bonus: Each year, you receive bonus points equal to 10% of your total purchases from the previous year.

4. Premium Travel Benefits and Protections

- Annual Hotel Credit: Receive up to $50 in statement credits each year for hotel stays booked through Chase Travel℠, offsetting a portion of the annual fee.

- No Foreign Transaction Fees: Essential for international travel, saving you about 3% on all purchases made abroad.

- Comprehensive Travel Insurance: Includes Trip Cancellation/Interruption insurance (up to $10,000 per traveler), Baggage Delay insurance, and Primary Auto Rental Collision Damage Waiver.

❌ Cons (Points of Caution)

While the card is excellent, there are specific rules and costs that potential applicants must carefully consider.

1. The Annual Fee is Unavoidable

- Recurring Cost: The card charges a $95 annual fee. While lower than its premium competitors, it is a recurring cost that must be justified by the benefits you actually use.

2. Strict Rules for the Sign-Up Bonus

- High Minimum Spend: To earn the 75,000-point bonus, you must spend a substantial $5,000 in three months. This can be a challenge for those with more moderate monthly spending.

- Eligibility Rules: You are ineligible for the bonus if you currently hold any personal Sapphire card or have received a sign-up bonus for any personal Sapphire card in the last 48 months.

3. Reward Category Limitations

- Highest Rate is Portal-Dependent: The maximum 5x travel rate is only earned when booking through the Chase Travel℠ portal, which limits booking flexibility on other sites.

- Grocery Exclusions: The 3x online grocery category explicitly excludes purchases from major big-box stores and wholesale clubs (like Target and Walmart), limiting the overall utility of this category.

4. High APR

- Interest Rates: Like most rewards cards, the Annual Percentage Rate (APR) is high (variable 19.74%–27.99%). This card only provides value if you pay your balance in full every month to avoid interest charges that quickly negate any rewards earned.

Chase Sapphire Purchase Protection & Travel Insurance Benefits

With the Chase Sapphire card, users gain access to a suite of purchase protection and travel insurance benefits that provide peace of mind. These benefits are designed to protect cardholders from unforeseen events that could impact their purchases and travels.

What Makes Chase Sapphire Protection Unique

Chase Sapphire’s purchase protection and travel insurance benefits stand out due to their comprehensiveness and flexibility. For instance, the purchase protection benefit covers items against theft or damage for a certain period, typically up to 120 days. Additionally, the travel insurance includes trip cancellation, interruption, and delay insurance, providing a wide range of coverage scenarios.

- Trip cancellation insurance reimburses prepaid travel expenses if a trip is cancelled due to covered reasons.

- Travel delay insurance provides reimbursement for expenses incurred due to delayed travel.

- Baggage insurance covers loss, theft, or damage to luggage.

Annual Fees vs. Protection Value

While the Chase Sapphire cards come with annual fees, the value provided by their purchase protection and travel insurance benefits often outweighs these costs. For frequent travelers and shoppers, the peace of mind and potential savings from these benefits can be significant. For example, the cost of trip cancellation insurance alone can save cardholders hundreds or even thousands of dollars in the event of a cancelled trip.

Activation Requirements for Coverage

To activate the purchase protection and travel insurance benefits, cardholders typically need to use their Chase Sapphire card to pay for the relevant expenses. For instance, to be eligible for trip cancellation insurance, the trip must be booked using the Chase Sapphire card. Understanding these activation requirements is crucial to maximizing the benefits.

By leveraging these benefits, Chase Sapphire cardholders can enjoy enhanced protection and peace of mind, making the card an invaluable tool for both everyday purchases and travel planning.

Purchase Protection Details

Purchase protection is a valuable benefit offered by Chase Sapphire cards, providing peace of mind for cardholders. This feature helps safeguard purchases against damage or theft, offering a significant advantage for those who value security in their credit card benefits.

Coverage Limits and Duration

The coverage limits and duration for purchase protection vary between the Chase Sapphire Preferred and Reserve cards. Understanding these differences is crucial for maximizing the benefits of your card.

Preferred Card Limits

The Chase Sapphire Preferred Card offers purchase protection that covers eligible purchases up to $10,000 per item and up to $50,000 per year. This coverage lasts for 120 days from the date of purchase.

Reserve Card Limits

The Chase Sapphire Reserve Card provides more comprehensive coverage, with purchase protection covering eligible purchases up to $10,000 per item and up to $75,000 per year. The coverage duration remains 120 days from the date of purchase.

Eligible Purchases and Items

To be eligible for purchase protection, items must be bought with your Chase Sapphire card and must be tangible personal property. This includes most goods purchased, but there are specific exclusions that cardholders should be aware of.

Exclusions and Limitations

While Chase Sapphire’s purchase protection is comprehensive, there are certain exclusions and limitations. For instance, purchases that are not made with the Chase Sapphire card, or items that are damaged due to misuse or neglect, are not covered. Additionally, certain types of purchases like consumables, traveler’s checks, or tickets are excluded.

Travel Insurance Coverage Explained

Traveling can be unpredictable, but with Chase Sapphire, you’re protected against a range of unforeseen events. The travel insurance coverage provided by Chase Sapphire cards is comprehensive, covering various aspects of your trip.

The benefits include trip cancellation and interruption insurance, travel accident insurance, auto rental collision damage waiver, and baggage delay and lost luggage reimbursement. Understanding these benefits can help you make the most of your travel plans.

Trip Cancellation and Interruption Insurance

Trip cancellation and interruption insurance reimburses you for prepaid travel expenses if your trip is canceled or interrupted due to covered reasons such as illness, severe weather, or other unforeseen events. This benefit can be a significant cost saver if you need to cancel or cut short your trip.

Key aspects of trip cancellation and interruption insurance:

- Reimbursement for prepaid, non-refundable expenses

- Coverage for trip cancellations or interruptions due to specified reasons

- Typically includes coverage for additional expenses to return home early

Travel Accident Insurance

Travel accident insurance provides financial protection in the event of an accident during your trip. This insurance can offer peace of mind, especially when traveling by air or other common carrier.

Travel accident insurance typically covers:

- Accidental death and dismemberment

- Medical expenses due to accidents

- Coverage is usually limited to specific modes of transportation, such as commercial flights

Auto Rental Collision Damage Waiver

The auto rental collision damage waiver benefit covers damage to or theft of a rental vehicle. This can save you money on additional insurance fees when renting a car.

Baggage Delay and Lost Luggage Reimbursement

Baggage delay and lost luggage reimbursement helps if your luggage is delayed, lost, or stolen during your trip. This benefit can reimburse you for essential items you need to purchase while waiting for your luggage.

Key features include:

- Reimbursement for essential items if luggage is delayed

- Coverage for lost or stolen luggage

- Typically has a limit on the amount that can be claimed

Emergency Medical and Evacuation Benefits

Traveling with a Chase Sapphire card means having access to extensive emergency medical benefits and evacuation services. Whether you’re dealing with a sudden illness or an unexpected injury, these benefits are designed to provide financial protection and logistical support.

Emergency Medical Coverage Details

The Chase Sapphire card offers robust emergency medical coverage for cardholders and their families. This includes expenses related to hospital stays, doctor visits, and other medical treatments while traveling.

Coverage Limits

The coverage limit for emergency medical expenses is a key consideration. For the Chase Sapphire Reserve card, for example, the coverage can extend up to $50,000 per person. Understanding these limits is crucial for maximizing the benefits.

Qualifying Medical Emergencies

Not all medical situations qualify for coverage. Typically, emergency medical benefits cover sudden and unforeseen conditions that require immediate attention, such as severe injuries or acute illnesses.

Emergency Evacuation Terms and Limits

In cases where medical treatment is not locally available, emergency evacuation benefits can cover the cost of transportation to the nearest adequate medical facility. This can include air ambulance services and other forms of emergency transport.

The terms and limits of evacuation coverage vary by card, but they generally include provisions for arranging and paying for evacuations due to medical emergencies.

How to File Claims for Chase Sapphire Benefits

Understanding how to file claims for Chase Sapphire benefits is crucial for maximizing your card’s value. Whether you’re filing a claim for purchase protection or travel insurance, the process is designed to be straightforward and efficient.

Purchase Protection Claims Process

Filing a claim for purchase protection involves a few simple steps. You can initiate the process either online or over the phone, depending on your preference.

Online Claim Submission

To file a claim online, log in to your Chase account, navigate to the “Services” tab, and select “Purchase Protection.” You’ll need to provide details about the purchase, including the date, amount, and a description of the item. Ensure you have the necessary documentation ready, such as receipts and police reports if applicable.

Phone Claim Submission

If you prefer to file a claim over the phone, you can call the Chase customer service number provided on your card or on the Chase website. Be prepared to provide the same information required for online submission. The representative will guide you through the process and inform you of any additional documentation needed.

Travel Insurance Claims Process

Filing a claim for travel insurance benefits follows a similar process. You’ll need to provide documentation supporting your claim, such as receipts for expenses incurred due to trip cancellations or interruptions.

Required Documentation and Timeframes

Regardless of the claim type, it’s essential to submit the required documentation within the specified timeframe. Typically, you have between 30 to 60 days to file a claim after the incident. Ensure you have all necessary documents ready to avoid delays in processing your claim.

Real-World Scenarios: Protection in Action

Real-life scenarios demonstrate how Chase Sapphire’s purchase protection and travel insurance provide peace of mind. Cardholders have experienced the benefits of these protections in various situations, from damaged or stolen items to trip cancellations and medical emergencies.

Purchase Protection Success Stories

Chase Sapphire’s purchase protection has been a lifesaver for many cardholders. For instance, when a cardholder’s newly purchased laptop is damaged, Chase Sapphire’s purchase protection can help cover the cost of repairs or replacement.

Damaged Item Claims

A cardholder purchased a high-end smartphone using their Chase Sapphire card, only to accidentally drop it, causing significant damage. They filed a claim under the purchase protection benefit and received reimbursement for the repair costs.

Stolen Item Claims

During a trip, a cardholder’s luggage was stolen, containing a brand-new camera purchased with their Chase Sapphire card. They filed a claim and received compensation for the stolen item, helping them replace it quickly.

Travel Insurance Claim Examples

Chase Sapphire’s travel insurance benefits have also been instrumental in helping cardholders during travel-related mishaps. Whether it’s trip cancellation due to unforeseen circumstances or medical emergencies while abroad, Chase Sapphire has got cardholders covered.

Trip Cancellation Examples

A cardholder booked a trip to Europe using their Chase Sapphire card, but had to cancel due to a family emergency. They filed a claim under the trip cancellation insurance and received reimbursement for the non-refundable expenses.

Medical Emergency Examples

While on a trip, a cardholder experienced a medical emergency that required immediate attention. Chase Sapphire’s travel insurance covered the medical expenses, ensuring the cardholder received the necessary care without financial stress.

Comparing Chase Sapphire Purchase Protection & Travel Insurance to Competitors

The Chase Sapphire card stands out in the market, but how does its purchase protection and travel insurance stack up against other premium credit cards? To understand the relative advantages, we’ll compare these benefits with those offered by American Express, Capital One, and Citi Card.

Chase vs. American Express Protection

American Express is renowned for its comprehensive credit card benefits. When comparing purchase protection, both Chase Sapphire and American Express offer robust coverage, but Chase Sapphire’s coverage duration is slightly longer. For travel insurance, American Express provides extensive trip cancellation and interruption insurance, yet Chase Sapphire’s travel accident insurance is more comprehensive. Key differences include:

- Chase Sapphire: Up to 120 days of purchase protection

- American Express: Up to 90 days for most cards

Chase vs. Capital One Protection

Capital One’s purchase protection is competitive, but Chase Sapphire’s travel insurance benefits surpass Capital One’s offerings. For instance, Chase Sapphire provides auto rental collision damage waiver, which is not a standard feature with Capital One. The main distinctions are:

- Chase Sapphire offers more extensive travel insurance coverage

- Capital One focuses on purchase protection and identity theft protection

Chase vs. Citi Card Protection

Citi Card offers solid purchase protection, but Chase Sapphire’s travel insurance is more comprehensive, covering trip cancellations, interruptions, and delays. Citi Card’s travel insurance is more limited in comparison. Notable differences include:

- Chase Sapphire: Covers trip cancellation and interruption for various reasons

- Citi Card: More restrictive trip cancellation policies

In conclusion, while all these premium credit cards offer valuable benefits, Chase Sapphire’s combination of purchase protection and travel insurance is among the most comprehensive. When choosing a credit card, understanding these differences can help you make an informed decision.

Conclusion

The Chase Sapphire credit card combines strong purchase protection and travel insurance, making it an excellent option for travelers and everyday shoppers alike. Understanding its benefits allows cardholders to maximize rewards, minimize risk, and enjoy greater financial peace of mind.

FAQ

What is the purchase protection coverage limit for Chase Sapphire Preferred and Reserve cards?

Are there any specific items or purchases that are excluded from Chase Sapphire purchase protection?

How do I file a claim for purchase protection or travel insurance benefits with Chase Sapphire?

What is the process for activating travel insurance coverage with Chase Sapphire?

How does Chase Sapphire’s travel insurance compare to that offered by other credit card issuers, such as American Express or Citi?

Can I use my Chase Sapphire card to rent a car and receive collision damage waiver benefits?

What is the time limit for filing a claim for purchase protection or travel insurance benefits with Chase Sapphire?

Conteúdo criado com auxílio de Inteligência Artificial