Are you looking to simplify your financial management with a credit card from Capitec? The Capitec credit card application process is straightforward and can be completed in just three easy steps. Using the Capitec banking app, you can request a Capitec credit card quickly and efficiently, without the hassle of lengthy paperwork or visits to a physical branch.

This streamlined process is designed to make it easy for you to access the credit you need. By following these simple steps, you can have your Capitec credit card in no time, allowing you to manage your finances more effectively.

Key Takeaways

- Simplified credit card application process through the Capitec banking app.

- Quick and efficient request process.

- No lengthy paperwork or branch visits required.

- Easy financial management with a Capitec credit card.

- Access to credit when you need it.

Capitec Card

Step-by-Step Guide to Applying for the Capitec Credit Card

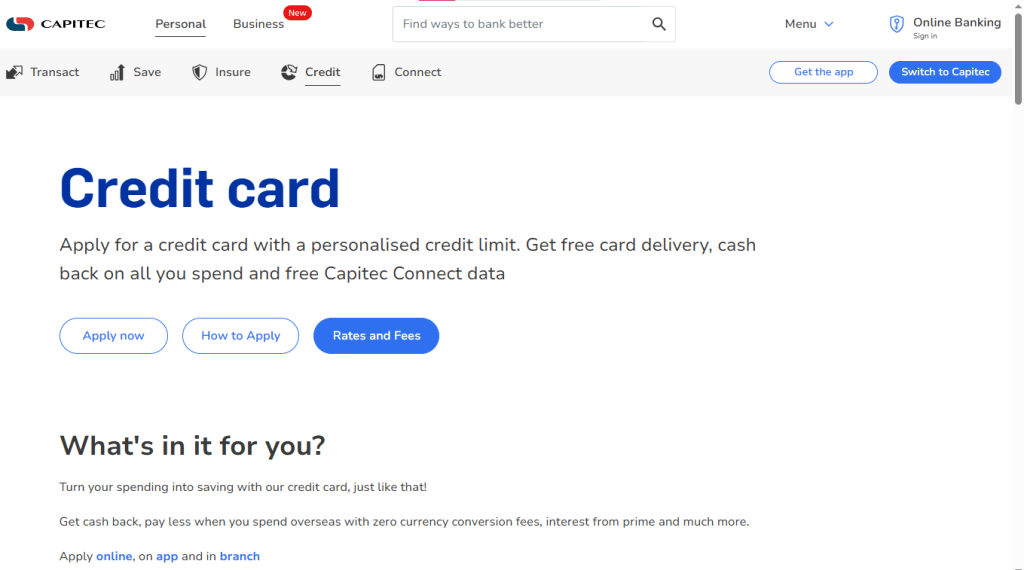

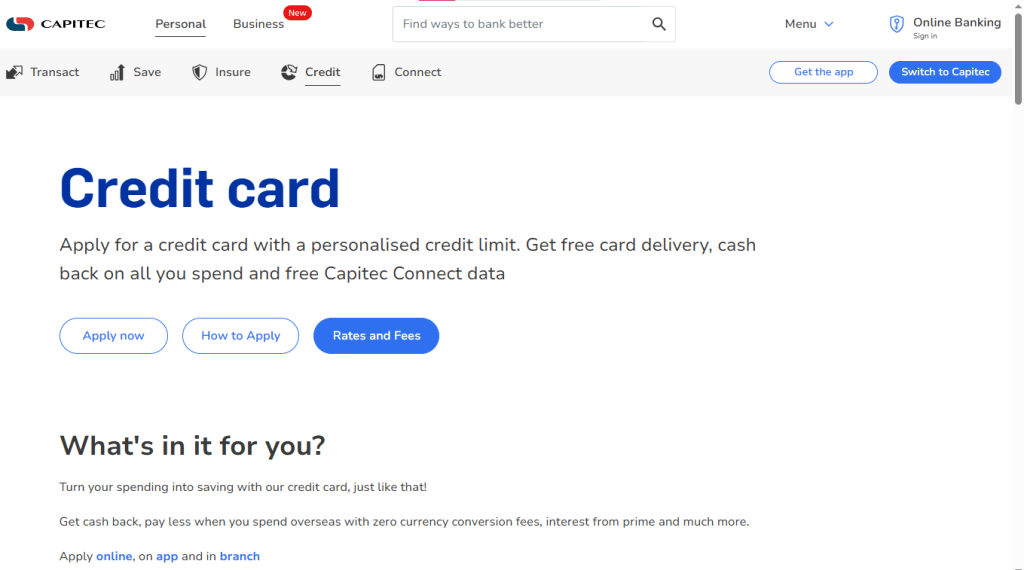

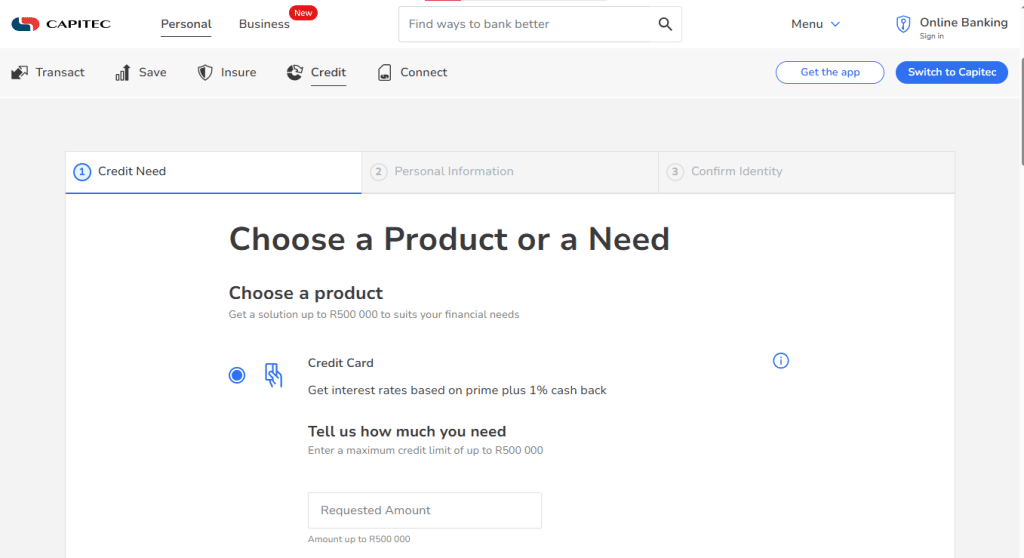

Step 1: Access the Application Page

First, you need to go to the official Capitec credit card page to begin the process.

Anúncios

Click this link to go directly to the page: https://www.capitecbank.co.za/personal/credit/credit-card/

Anúncios

Step 2: Understand the Requirements

Before starting the form, it’s important to know what you’ll need. Have the following documents and information on hand to speed up the process:

- Proof of Identity: Your South African ID or passport.

- Proof of Income: Typically a recent payslip or a three-month bank statement (if you are self-employed).

- Proof of Residence: A document that proves your current address.

Step 3: Start the Online Application

On the main credit card page, look for the application button. It might be labeled “Apply now,” the first button on the left side of the screen.

Clicking on it will direct you to the Capitec online application form.

Step 4: Fill Out the Form and Submit Documentation

The online form will ask for a series of personal and financial details. Fill in the fields carefully, including:

- Personal information (full name, date of birth, ID number).

- Contact details (phone number, email).

- Employment and income information.

You will also be asked to upload the documents mentioned in Step 2. Make sure the files are in an accepted format (like PDF or JPG) and are of good quality for readability.

Step 5: Await Analysis

After filling out the form and submitting your documentation, your application will be reviewed. Capitec will perform an assessment of your credit profile. You will be notified of the result via email or SMS.

The response time may vary, but it’s generally fast, as the process is entirely digital.

If your application is approved, you will receive instructions on how to activate and get your new Capitec credit card.

Understanding Capitec Credit Cards

South African consumers are increasingly turning to Capitec for their credit card needs, drawn by the bank’s commitment to simplicity and transparency. Capitec credit cards are designed to offer a ra-nge of benefits that cater to different financial needs and preferences.

What Makes Capitec Credit Cards Unique

Capitec credit cards stand out in the South African market due to their competitive interest rates and flexible repayment options. Unlike many traditional credit card providers, Capitec focuses on providing a straightforward and customer-friendly experience.

Types of Credit Cards Offered by Capitec

Capitec offers a variety of credit cards, each designed to meet specific customer needs. These include:

- Cards with rewards programs that offer cashback or travel points

- Cards with low-interest rates ideal for large purchases or emergencies

- Cards with no annual fees, perfect for occasional use

How Capitec Credit Cards Compare to Other Banks

When compared to other major banks in South Africa, Capitec credit cards are often praised for their transparent fee structures and user-friendly digital platforms. This comparison highlights Capitec’s commitment to making credit more accessible and manageable for South Africans.

Benefits of Having a Capitec Credit Card

The Capitec credit card is more than just a payment tool; it’s a gateway to a range of financial benefits and rewards. With its comprehensive suite of features, Capitec’s credit card offering is designed to enhance the banking experience for its users.

Lower Interest Rates and Fee Structure

One of the standout benefits of the Capitec credit card is its competitive interest rates and transparent fee structure. Capitec aims to provide affordable credit options to its customers, ensuring that they can manage their finances effectively without incurring unnecessary charges.

Key Features of Capitec’s Fee Structure:

- No hidden fees

- Competitive interest rates

- Clear disclosure of all charges

Rewards and Cashback Opportunities

Capitec credit card holders can enjoy a range of rewards and cashback opportunities. The rewards program is designed to provide value to customers through various incentives, such as cashback on certain purchases or rewards points that can be redeemed for goods and services.

“The rewards program offered by Capitec is a game-changer, providing our customers with tangible benefits that enhance their overall banking experience.” – Capitec Spokesperson

Security Features and Fraud Protection

Security is a top priority for Capitec, and its credit card offers advanced security features and fraud protection. This includes real-time transaction monitoring, secure online transactions, and zero-liability policies for unauthorized transactions.

| Security Feature | Description |

|---|---|

| Real-time Transaction Monitoring | Transactions are monitored in real-time to detect and prevent suspicious activity. |

| Secure Online Transactions | Capitec employs advanced encryption to secure online transactions. |

| Zero-Liability Policy | Customers are not held liable for unauthorized transactions. |

Integration with Capitec Banking App

The Capitec credit card is seamlessly integrated with the Capitec banking app, allowing users to manage their credit card accounts efficiently. Through the app, customers can track their spending, make payments, and monitor their rewards.

The integration with the Capitec banking app enhances the overall user experience, providing a convenient and streamlined way to manage finances.

Capitec Bank: Services, Advantages, and How to Open Your Account

Capitec Bank has become one of the largest retail banks in South Africa and, in recent years, has gained prominence for its innovative and straightforward approach. Unlike traditional banking institutions, Capitec focuses on offering simple, transparent, and low-cost services, making it a popular choice for millions of people.

If you are looking to better understand what Capitec offers and why it is different, this complete guide is for you.

Discovery the Capitec Bank

Capitec Bank’s Philosophy: Simplicity and Transparency

The essence of Capitec Bank is to simplify banking. Its philosophy is based on eliminating hidden fees and complex product structures, offering a set of banking services that are easy to understand and use. This transparency is what attracts clients who seek total control over their finances, with no surprises at the end of the month.

Main Products and Services of Capitec Bank

Capitec does not offer an endless number of products, but rather a focused and powerful set.

Transaction Account (Global One Account)

This is Capitec’s flagship product. The Global One account is a single account that combines daily transactions, savings, and credit. Instead of opening separate accounts, everything is integrated. This allows clients to manage their finances centrally and still earn interest on their savings balance.

Capitec Credit Card

As discussed in our previous analysis, the Capitec credit card stands out for its simplicity. It offers a personalized credit limit and direct advantages, such as:

- 1% cash back on all purchases.

- Zero currency conversion fees for use abroad.

- Up to 55 interest-free days on your purchases.

Credit and Personal Loans

The bank offers personal loans with competitive interest rates that are personalized based on your credit profile. The application process is quick and straightforward, aiming to provide a response within minutes so you can access the credit you need.

Advantages of Being a Capitec Client

Why do millions of people choose Capitec? The main advantages include:

- Low and Transparent Fees: Capitec is known for its affordable fees. The simple fee model makes it easy to track how much you are spending on banking services.

- Comprehensive and Intuitive App: The Capitec mobile app is the heart of the banking experience. It is highly intuitive and allows you to manage your account, pay bills, transfer money, and even apply for products easily and securely.

- Accessibility and Convenience: With extended branch hours and widely available ATMs, in addition to a robust digital platform, Capitec makes accessing its services extremely convenient.

How to Open a Capitec Account

Opening a Capitec account is a quick process and can be done in two ways:

- Via App or Online: Download the Capitec app and follow the instructions to open the account digitally. You will need a valid South African ID and may be asked to submit proof of income and residence.

- At a Branch: Visit any Capitec branch with your ID. A consultant will help you fill out the form and open your account on the spot.

For more information and to start your application, visit the bank’s official website.

In summary, Capitec Bank positions itself as a modern, client-focused alternative, ideal for those who value clarity, convenience, and control over their finances.

Eligibility Requirements for a Capitec Credit Card

To apply for a Capitec credit card, you must meet specific eligibility criteria that ensure you’re capable of managing your credit responsibly. These requirements are designed to help Capitec assess your creditworthiness and ensure that you can afford the credit card payments.

Age and South African Residency Requirements

Applicants must be at least 18 years old and a South African resident to qualify. This is a standard requirement for most financial products in South Africa, ensuring that applicants are legally adults and can enter into a credit agreement.

Minimum Income Thresholds

Capitec requires applicants to have a stable income that meets the minimum threshold set by the bank. This ensures that you have the financial means to repay any credit extended to you. The exact minimum income may vary, so it’s best to check with Capitec directly.

Credit Score Considerations

Your credit score plays a significant role in determining your eligibility for a Capitec credit card. A good credit score indicates a history of responsible credit behavior, improving your chances of approval. Capitec uses credit scoring models to evaluate your creditworthiness.

Employment Status Requirements

Being employed or having a stable income source is crucial for credit card approval. Capitec may require proof of employment or income to assess your ability to repay the credit. This can include payslips or bank statements showing regular income.

Documents Needed for Your Application

When applying for a Capitec credit card, having the right documents ready is crucial for a smooth application process. Capitec requires specific documents to verify your identity, income, and residence to ensure that you can manage your credit responsibly.

South African ID or Valid Passport

A valid South African ID or passport is necessary for identification purposes. This document is essential for verifying your identity and ensuring that your application is processed correctly.

Proof of Income (Payslips or Bank Statements)

You will need to provide proof of income, which can be in the form of recent payslips or bank statements. This documentation helps Capitec assess your ability to repay any credit extended to you.

Proof of Residence (Not Older Than 3 Months)

Proof of residence, such as a utility bill or bank statement, is required and should not be older than three months. This document confirms your current address and is a standard requirement for credit card applications.

Additional Documentation You Might Need

Depending on your specific circumstances, Capitec may request additional documentation. It’s essential to check with Capitec directly or consult their website for the most up-to-date information on required documents.

Preparing for Your Credit Card Application

Ensuring you’re prepared before applying for a Capitec credit card can make all the difference in the approval process. A successful application starts with understanding your financial standing and being ready with the necessary information.

Checking Your Credit Score Through TransUnion or Experian

Your credit score plays a significant role in determining your eligibility for a credit card. Checking your credit score through reputable credit bureaus like TransUnion or Experian can give you an idea of where you stand. A good credit score can significantly improve your chances of getting approved.

Organizing Your Financial Information

Having your financial documents in order is crucial. This includes proof of income, identification, and proof of residence. Being organized will not only speed up the application process but also reduce the likelihood of errors that could lead to rejection.

Setting Your Credit Limit Expectations

Understanding how much credit you’re likely to be approved for can help manage your expectations. Capitec considers various factors, including your income and credit history, to determine your credit limit. Setting realistic expectations can help you plan your finances better.

Timing Your Application Strategically

The timing of your application can also impact your chances of approval. Applying when your financial situation is stable, such as after receiving a salary increment or resolving any outstanding debts, can be beneficial.

| Preparation Step | Description | Benefit |

|---|---|---|

| Check Credit Score | Verify your credit score through TransUnion or Experian | Understand your credit standing |

| Organize Financial Documents | Gather proof of income, ID, and proof of residence | Speed up the application process |

| Set Credit Limit Expectations | Understand factors influencing your credit limit | Manage financial expectations |

| Time Your Application | Apply when your financial situation is stable | Improve chances of approval |

As emphasized by financial experts, “A well-prepared credit card application can significantly reduce the risk of rejection and ensure a smoother process.” Preparing thoroughly for your Capitec credit card application is a step towards achieving your financial goals.

Capitec: Quick Guide to Request Your Credit Card

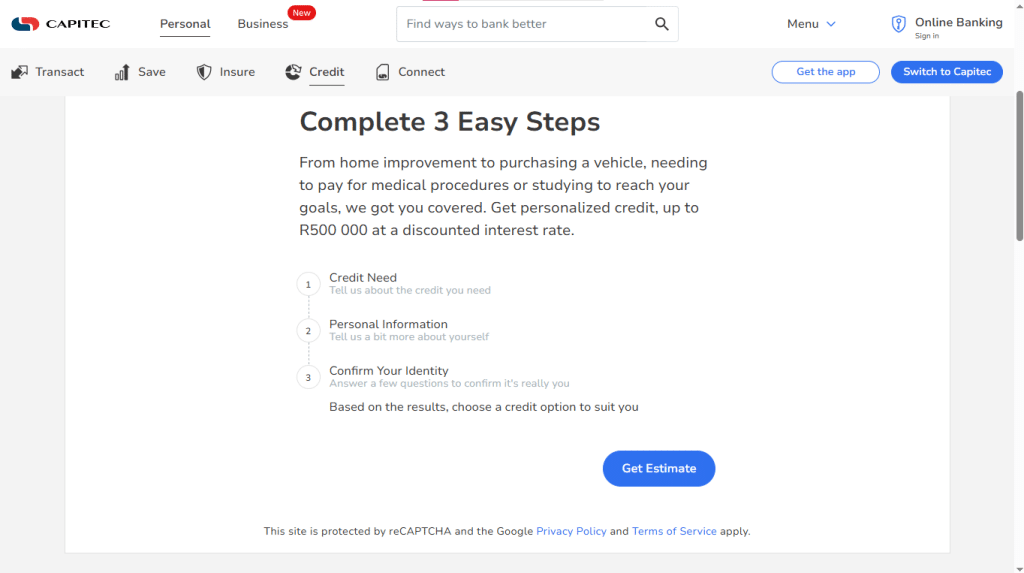

Requesting a Capitec credit card is a straightforward process that can be completed in just three steps. Understanding the application process, the typical timeframes involved, and the various channels through which you can apply is crucial for a smooth experience.

The Three-Step Application Process

The Capitec credit card application is streamlined into three key steps. First, you initiate your application through one of the available channels. Second, Capitec conducts a credit assessment to evaluate your creditworthiness. Finally, you receive a decision on your application and, if approved, finalize the process by accepting the credit offer.

Typical Timeframes from Application to Approval

The time taken for Capitec to process your credit card application can vary. Typically, applications are processed within a few business days, but this can be influenced by factors such as the completeness of your application and the complexity of your credit history.

Comparing Application Channels

Capitec offers multiple channels for applying for a credit card, including online, in-branch, and through their mobile app. Each channel has its advantages and disadvantages.

Pros and Cons of Each Application Method

- Online Application: Convenient and can be done from anywhere, but may lack the personal touch.

- In-Branch Application: Allows for face-to-face interaction and immediate assistance, but requires a visit to a physical branch.

- Mobile App Application: Offers a balance between convenience and ease of use, with the ability to apply on-the-go.

By understanding the different application channels and their respective pros and cons, you can choose the method that best suits your needs and preferences.

Step 1: Initiating Your Credit Card Application

To start your Capitec Credit Card journey, you need to initiate the application process, which is straightforward and convenient. Capitec offers multiple channels to apply for a credit card, catering to different preferences and needs.

Online Application Process Through Capitec Website

Applying online is a quick and efficient way to start your Capitec Credit Card application. Here’s how you can do it:

Creating a Profile and Logging In

First, you need to create a profile on the Capitec website. This involves providing some basic information to register. Once registered, you can log in to your account using your credentials.

Filling Out the Application Form

After logging in, navigate to the credit card application section and fill out the form. Ensure you have all necessary documents ready, such as your ID and proof of income, to make the process smoother.

In-Branch Application Process

If you prefer a more personal touch or have questions, you can visit a Capitec branch to apply. Here’s what you need to know:

What to Bring to Your Branch Visit

When visiting a Capitec branch, make sure to bring the required documents, including your South African ID, proof of income, and proof of residence. This will help the bank representatives assist you efficiently.

Mobile App Application Steps

The Capitec mobile app offers a convenient way to apply for a credit card on the go. Here’s how:

Navigating the Capitec App for Credit Applications

Open the Capitec app, log in to your account, and navigate to the credit card application section. The app will guide you through the necessary steps, making it easy to apply from anywhere.

Regardless of the method you choose, Capitec’s application process is designed to be user-friendly and efficient, ensuring that you can start your credit card journey with ease.

Step 2: Completing the Credit Assessment

The second step in obtaining a Capitec credit card is completing the credit assessment, a crucial process in determining your eligibility. This stage is vital as it allows Capitec to evaluate your financial health and decide on your creditworthiness.

What Happens During Capitec’s Credit Evaluation

During the credit evaluation, Capitec assesses various factors including your income, expenses, credit history, and existing debt obligations. This comprehensive analysis helps them understand your ability to manage credit responsibly.

How Capitec Determines Your Credit Limit

Capitec determines your credit limit based on the information provided during the application process and the credit evaluation results. Factors such as income level, credit score, and repayment history play a significant role in this determination.

Responding to Additional Information Requests

In some cases, Capitec may require additional information to support your application. Responding promptly to these requests can help expedite the assessment process.

Credit Check Process in South Africa

The credit check process in South Africa involves verifying an applicant’s credit history through credit bureaus like TransUnion or Experian. Capitec uses this information to assess the risk associated with lending to you.

| Credit Check Criteria | Description | Importance |

|---|---|---|

| Credit History | Past borrowing and repayment behavior | High |

| Credit Score | Numerical representation of creditworthiness | High |

| Income Level | Ability to repay debt | Medium |

| Existing Debt | Obligations towards other creditors | Medium |

Understanding the credit assessment process can help you prepare and potentially improve your chances of approval. Ensuring you have a good credit score and maintaining a healthy financial profile are key steps in this process.

Step 3: Finalizing Your Credit Card Request

With your creditworthiness verified, it’s time to complete the Capitec credit card application process. This final step involves a few key actions to get your new credit card up and running.

Accepting the Credit Offer Terms and Conditions

The first task is to review and accept the terms and conditions of your credit offer. Capitec will present the details of your credit agreement, including your credit limit, interest rate, and any applicable fees. It’s crucial to read through this information carefully to ensure you understand your obligations and the terms of your credit card.

Setting Up Your Credit Card Account Preferences

After accepting the credit offer, you’ll be able to set up your account preferences. This may include choosing your statement delivery method (digital or postal), setting up your payment due date, and opting for additional services like insurance or rewards programs.

Card Delivery Process and Timeframes

Once your account is set up, Capitec will process the delivery of your physical credit card. The delivery timeframe typically ranges from 7 to 10 business days, depending on your location. You will receive updates on the status of your card delivery via SMS or email.

Digital Card Access While Waiting for Physical Card

While waiting for your physical card to arrive, you can access a digital version through the Capitec Mobile Banking App. This allows you to start using your credit card for transactions immediately. To access your digital card, simply log in to the app, navigate to your credit card account, and follow the prompts to add your card to the app.

By following these steps, you’ll be able to finalize your credit card request and start enjoying the benefits of your new Capitec credit card.

Troubleshooting Common Application Issues

Applicants for Capitec credit cards may experience a range of issues, from pending applications to insufficient documentation. Understanding how to address these challenges can significantly improve the application experience.

What to Do If Your Application Is Pending

If your Capitec credit card application is pending, it may be due to additional verification requirements or high volumes of applications being processed. You can check the status of your application through the Capitec app or by contacting their customer service directly.

Addressing Insufficient Documentation Problems

Insufficient documentation is a common reason for application delays. Ensure you have provided all required documents, including a valid South African ID, proof of income, and proof of residence. If you’ve submitted your application online, double-check that all documents were successfully uploaded.

Handling Credit Score Concerns

Credit score concerns can impact your application’s success. Capitec uses credit scores to evaluate applicants. If you’re concerned about your credit score, you can check it through credit bureaus like TransUnion or Experian. Understanding your credit score can help you address potential issues before applying.

Reapplying After a Rejection (Waiting Periods)

If your Capitec credit card application is rejected, it’s essential to understand the waiting period before reapplying. Generally, you can reapply after 30 days, but it’s crucial to address the reasons for the initial rejection. Reviewing and improving your credit profile or ensuring you meet the eligibility criteria can enhance your chances of approval upon reapplication.

| Issue | Solution | Additional Tips |

|---|---|---|

| Pending Application | Check application status via Capitec app or contact customer service. | Be prepared to provide additional information if requested. |

| Insufficient Documentation | Ensure all required documents are submitted and correctly uploaded. | Double-check document validity and completeness. |

| Credit Score Concerns | Check your credit score through TransUnion or Experian. | Improve your credit score by managing debt and credit responsibly. |

| Reapplying After Rejection | Wait for the specified period (usually 30 days) and address initial rejection reasons. | Review eligibility criteria and credit profile before reapplying. |

Activating and Using Your New Capitec Credit Card

After receiving your Capitec credit card, activating it is the key to unlocking its full potential for your financial needs. Activating your card is a simple process that can be done through multiple channels, ensuring convenience and flexibility.

Card Activation Methods

Capitec offers several methods to activate your credit card, catering to different user preferences. You can activate your card via the Capitec Mobile Banking App, at an ATM, or by visiting a Capitec branch. Each method is designed to be user-friendly and efficient.

- App Activation: Use the Capitec Mobile Banking App to activate your card quickly and securely.

- ATM Activation: Visit any ATM and follow the on-screen instructions to activate your card.

- Branch Activation: For personalized assistance, visit a Capitec branch near you.

Setting Up PIN and Security Features

After activation, setting up your PIN and familiarizing yourself with the security features is crucial. Capitec provides robust security measures to protect your transactions and personal data.

Creating a strong PIN is the first step in securing your card. Ensure it’s unique and not easily guessable.

Making Your First Purchase

With your card activated and security features in place, you’re ready to make your first purchase. Capitec credit cards are accepted at millions of merchants worldwide, both online and offline.

Understanding Billing Cycles and Payment Due Dates

It’s essential to understand your credit card’s billing cycle and payment due dates to manage your finances effectively. Capitec provides clear information on these dates through their app and online banking platform.

Managing Your Credit Limit Effectively

Managing your credit limit is vital to maintaining a healthy credit score. Capitec allows you to monitor and adjust your credit limit as needed, giving you control over your financial commitments.

By following these steps and understanding the features of your Capitec credit card, you can maximize its benefits and enjoy a seamless banking experience.

Conclusion

Requesting a Capitec credit card is a straightforward process that can be completed in three simple steps. By understanding the benefits, eligibility, and required documents, you can efficiently navigate the application process.

A Capitec credit card offers a range of benefits, including lower interest rates, rewards, and advanced security features. With a clear understanding of the application process, you can make informed decisions about your financial options.

In conclusion, applying for a Capitec credit card is a convenient way to enhance your financial flexibility. By following the three-step application process, you can quickly and easily obtain the credit card that suits your needs, providing a valuable summary of your Capitec credit card experience and serving as a credit card application conclusion to your financial journey.

FAQ

What are the eligibility criteria for a Capitec credit card?

How do I check my credit score before applying for a Capitec credit card?

What documents are required for a Capitec credit card application?

How long does it take to get approved for a Capitec credit card?

Can I apply for a Capitec credit card online, in-branch, or through the mobile app?

How is my credit limit determined by Capitec?

What should I do if my Capitec credit card application is rejected?

How do I activate my new Capitec credit card?

What are the benefits of having a Capitec credit card?

How can I manage my Capitec credit card effectively?

Conteúdo criado com auxílio de Inteligência Artificial