For travellers and frequent flyer enthusiasts in Australia, the NAB Qantas Rewards credit card line is the gateway to accelerating the accumulation of Qantas Points—the reward currency of Australia’s main airline, Qantas. These cards, issued by the National Australia Bank (NAB), are specifically designed to turn everyday spending into flights, upgrades, and products on the Qantas Marketplace.

This article is a detailed, SEO-optimised guide that unravels the process of how to apply for a NAB Qantas credit card in Australia, covering eligibility, points-earning benefits, and the necessary steps to secure your approval.

Overview of National Australia Bank (NAB)

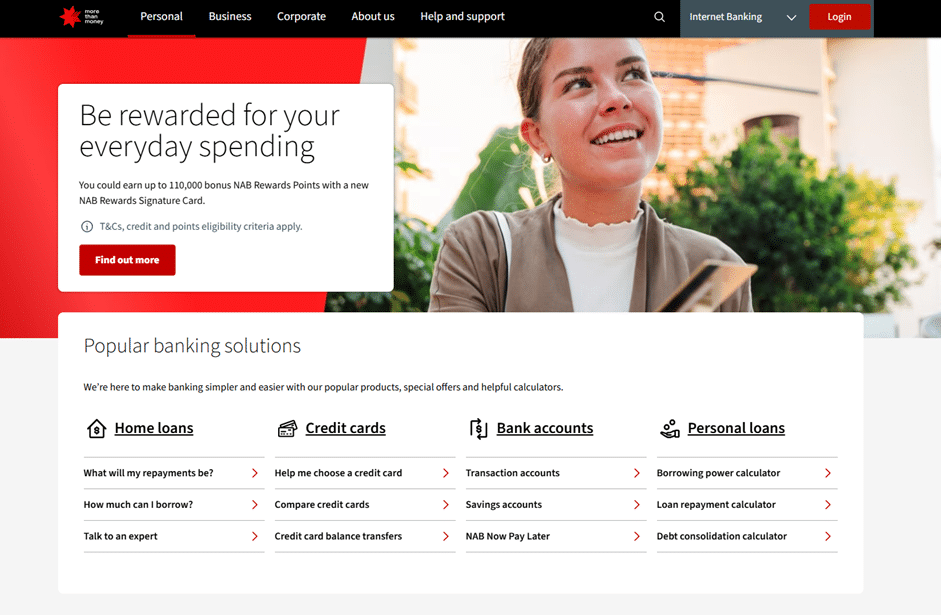

The National Australia Bank (NAB) is one of the largest and most trusted financial institutions in Australia, part of the select group of the nation’s “Big Four” banks. With a trajectory spanning over a century and a half, NAB is a pillar of the Australian economy, providing comprehensive banking services to millions of customers nationwide.

Anúncios

Credibility and Operations in Australia

- Market Strength: NAB is known for its financial solidity and its vast network of branches and ATMs, offering a full range of financial products, from basic accounts to complex loans and premium credit cards.

- Leadership in Payments: The bank invests heavily in digital technology, offering NAB Internet Banking and the NAB App, which provide advanced tools for account management, transaction security, and immediate customer support.

- Qantas Partnership: The strategic partnership between NAB and Qantas, one of Australia’s most iconic brands, reinforces the credibility and value of the NAB Qantas Rewards cards. This collaboration offers customers a direct pathway to the Qantas Frequent Flyer program, with sign-up bonuses and competitive points accrual rates.

NAB Bank

By choosing a NAB Qantas card, the customer associates with a highly credible financial institution, ensuring security and a robust platform for maximising their travel rewards.

Anúncios

Everything People Need to Know to Apply for the NAB Qantas Card

The NAB Qantas Rewards line offers different card levels (such as the NAB Qantas Rewards Signature and the NAB Qantas Rewards Premium), each with varying credit limits, annual fees, and points-earning benefits. The application process focuses on ensuring the applicant meets the eligibility criteria for rewards cards, which generally require a higher income profile.

1. Understanding the Options and Key Features

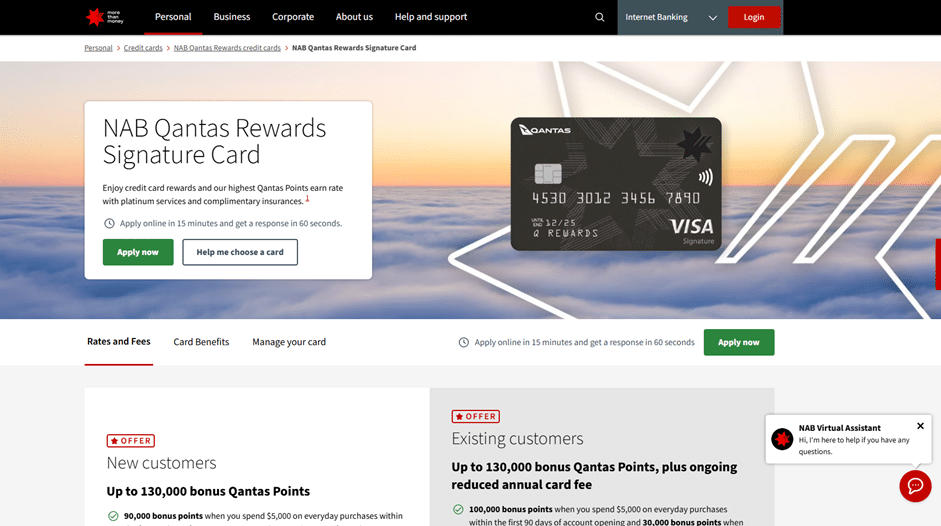

NAB offers Qantas cards for different spending profiles, but the NAB Qantas Rewards Signature Card is often the most sought-after due to its bonuses and premium benefits.

Feature Comparison (Focus on the Signature Card, based on the NAB website):

- Important Note: The international transaction fee on the NAB Qantas Rewards Signature is typically 3.0% or 3.5% (the exact value may vary based on the most current offer and card regulations at the time of application) — a cost that differs from some non-Qantas branded NAB Rewards cards. Always check the PDS (Product Disclosure Statement) on the official NAB website.

2. Basic Eligibility Requirements

The premium nature of the NAB Qantas Rewards card, especially the Signature level, imposes stricter eligibility requirements, focusing on credit capacity and financial stability.

Essential Eligibility Criteria:

- Age: Must be 18 years or older.

- Income and Employment: Must receive a regular and satisfactory income. NAB assesses debt serviceability. Given the high purchase interest rate and the minimum credit limit of $15,000 for the Signature card, a strong income profile is essential to meet responsible lending criteria.

- Residency Status: Must be an Australian or New Zealand Citizen, an Australian Permanent Resident, or hold an acceptable Temporary Residency Visa with more than six months validity remaining.

- Purpose: The card must be used predominantly for personal purposes.

- Qantas Frequent Flyer Member: The applicant must be a member of the Qantas Frequent Flyer program to earn points. If not already a member, membership is generally complimentary for NAB Qantas cardholders.

- Credit History: Having a good credit rating in Australia is fundamental for the approval of a premium card.

Necessary Documentation and Financial Information:

The accuracy and completeness of the information provided are crucial for a quick approval process.

- Identity Verification (ID): Australian Driver’s License or Passport.

- Proof of Income: Recent payslips (typically the two most recent) or bank statements showing consistent salary credits. For self-employed individuals, more detailed business financial information will be required.

- Employment Details: Employment history for the last three years.

- Expense and Debt Assessment (Responsible Lending): NAB requires a comprehensive declaration of all financial commitments, including mortgages, rent, existing loans, other credit cards, and all basic living expenses (groceries, transport, entertainment, etc.). This step is mandatory under Australian responsible lending law.

3. The NAB Online Application Process

The most efficient way to apply for the NAB Qantas Rewards card is through the bank’s online portal, which offers a fast and secure response.

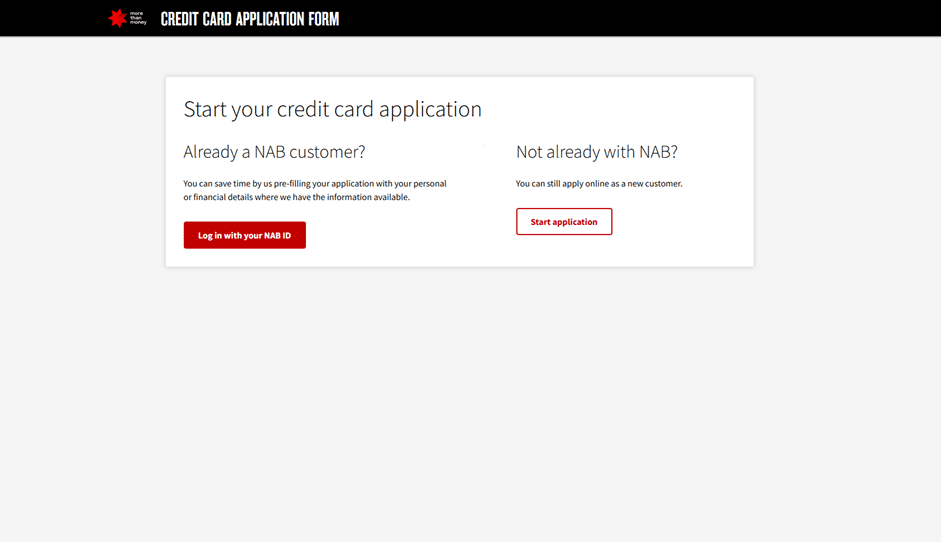

Step 1: Access and Pre-filling

- Access the Official Website: Navigate to the desired NAB Qantas Rewards card page on the NAB website and click “Apply Now”.

- Existing Customers: If you are already a NAB customer, use your NAB ID to log in. This allows the bank to pre-fill personal and financial information, speeding up the process.

Step 2: Detailed Form Completion

The online application form is divided into crucial sections:

- Personal Details: Confirmation of name, date of birth, address, and residency status.

- Qantas Frequent Flyer Information: You will need to provide your Qantas Frequent Flyer number. If you are not a member, NAB usually facilitates the complimentary sign-up process.

- Employment and Income Information: Details about your employer, type of work, and the exact amount of your annual gross and net income.

- Expense and Debt Declaration: This section requires maximum accuracy. Declare all your debts and monthly expenses. NAB will use this data to determine if the requested credit limit ($15,000 AUD or higher) is sustainable for you.

- Limit Request and Terms: Select your desired credit limit (minimum $15,000 for the Signature) and review the summary of fees and terms.

Step 3: Review and Submission

- Final Review: Carefully check all information. Errors or omissions, especially in the expense section, may lead to delays or denial.

- Credit Check Authorisation: You must provide consent for NAB to perform a credit check on your credit file with Australian credit reporting agencies.

- Submission: Submit the application. NAB strives to provide a conditional response in 60 seconds for many online applications.

Step 4: Approval and Document Verification

- Immediate Decision: If approval is conditional, it means your preliminary data has been accepted.

- Document Request: Often, NAB will request the secure upload of supporting documents (payslips, statements) for final verification and compliance with responsible lending regulations.

- Final Approval and Activation: After successful verification, you will receive confirmation. The card will be mailed to your Australian address and must be activated through the NAB App or NAB Internet Banking before use.

- Bonus Accumulation: The Qantas Points bonus is awarded after meeting the required spending target within the stipulated timeframe (e.g., spending $5,000 in 90 days). Monitor this spending closely to ensure you receive the bonus.

❓ FAQ – Frequently Asked Questions about the NAB Qantas Card

Q: Who is ineligible for the NAB Qantas bonus points offer?

A: Sign-up bonus points are typically unavailable to customers who currently hold, or have held, any personal NAB Qantas Rewards Credit Card in the last 12 or 24 months (the exact period varies based on the current promotional offer). It is essential to check the specific offer’s terms and conditions.

Q: Does the NAB Qantas Rewards Signature Card include lounge access?

A: Unlike some other Signature-level Qantas cards, the NAB Qantas Rewards Signature Card generally does not include complimentary Qantas lounge invitations as a standard feature. If this benefit is crucial, you should consider other Qantas partner cards or the Qantas Money cards, which may include invitations.

Q: What does the $20,000 points earning cap per statement period mean?

A: It means that you can only earn Qantas Points on eligible purchases up to $20,000 AUD per month. Any spending above this limit in that month will not earn further Qantas Points.

Q: What is the rate for a Cash Advance?

A: The interest rate for a Cash Advance is typically 21.74% p.a. (variable), and interest is charged from the transaction date. In addition, a cash withdrawal fee applies. This is an expensive transaction and should be avoided.

Conteúdo criado com auxílio de Inteligência Artificial