The AIB Options Two Credit Card is a popular credit solution offered by AIB (NI) in Northern Ireland, designed for customers seeking a balance between the convenience of paying the balance in full and the flexibility to extend credit during periods of higher expenditure, such as holidays or festive seasons.

Options Two Credit Card

This article is a detailed, based exclusively on the information provided by the official AIB (NI) website, outlining the requirements, application process, and key benefits of this essential credit card.

🇮🇪 IRELAND: STEP-BY-STEP TUTORIAL – How to Apply for the Options Two Credit Card

Are you looking for a flexible credit card in Ireland? Follow this easy-to-understand guide to apply for the Options Two Credit Card from AIB (NI).

Anúncios

Introduction: Why Options Two?

The Options Two Credit Card from AIB (NI) is the preferred choice if you require extended credit periods (up to 51 interest-free days) for use as a revolving credit card when necessary. It features a lower Representative Annual Percentage Rate (APR) than the Options One Card.

Anúncios

Before you start: What you need

- You must already hold a current account with AIB (NI).

- You must be aged 18 or over.

- You must be a resident of the UK (Northern Ireland) (minimum salary £10,000).

- Proof of income and address.

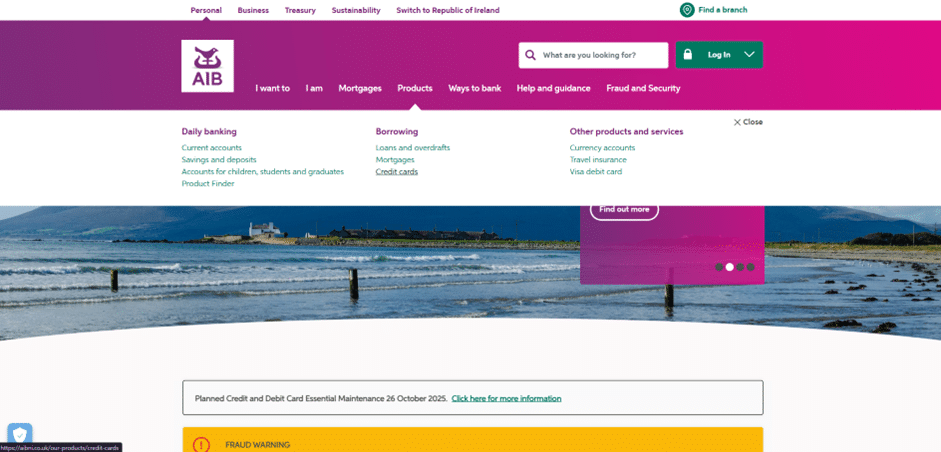

Step 1: Access the AIB (NI) Credit Cards Page

Your application starts on the main AIB (NI) website.

- Access the AIB Bank homepage:

https://aibni.co.uk/ - Click the fourth option in the main menu “Products”.

- In the new column, select the last option: “Credit Cards”.

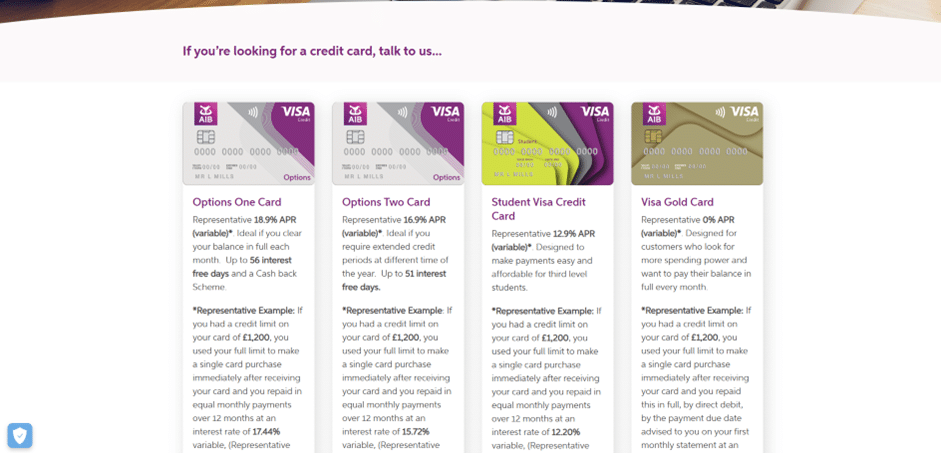

Step 2: Select the Options Two Credit Card

On the products page, find the Options Two selection.

- On this page, you will see information about several credit cards, such as: Student Visa Credit Card, Visa Gold Credit Card, and Options Two Credit Card.

- Select the Options Two Credit Card (the second option), by clicking on the card image.

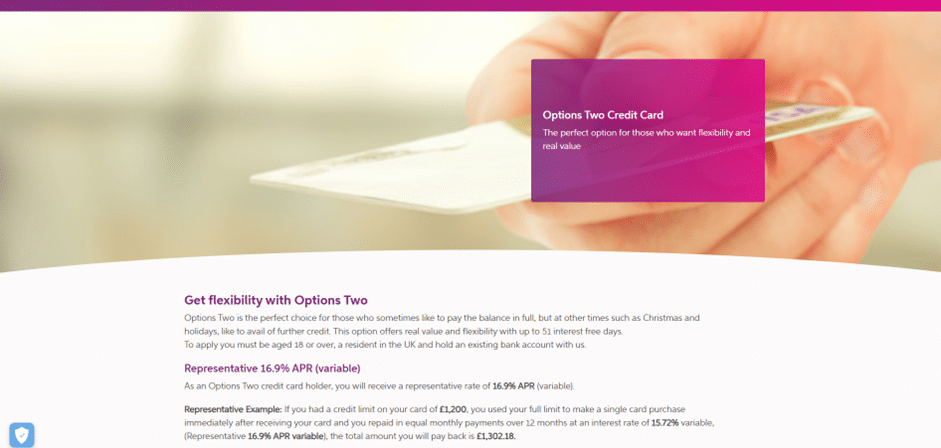

Step 3: Read the Product Information

You are now on the detailed information page.

- On this page, you will have all the information about the Options Two Credit Card, including the Representative APR (16.9% Variable APR) and fees.

- Scroll down to find more information on how to apply.

Step 4: Start the Application (Recommended Method)

In the “How to apply” section, you will find the options. The fastest method is usually by phone.

- In the “How to apply” section, you will see instructions to call the customer service centre (0800 38 22 65) or click the “Call me back” button.

- Alternatively, you can download, print, and mail an application form to an AIB (NI) branch.

- Follow the instructions and provide the necessary income information.

Important Note: To apply for an AIB (NI) credit card, you must provide proof of identity, address (e.g., passport, utility bill), and proof of income (e.g., 3 recent bank statements).

Overview of AIB (NI): Credibility and Operations in Northern Ireland

The Options Two Card is issued by AIB Group (UK) p.l.c., which operates in Northern Ireland as AIB (NI), formerly known as First Trust Bank. Understanding the institution behind the card is crucial for evaluating its credibility and security.

The History and Position of the AIB Group:

- Leading Financial Group: Allied Irish Banks, p.l.c. (AIB) is one of the four largest commercial banks in the Republic of Ireland, with significant operations in the UK. AIB Group (UK) p.l.c. is the entity responsible for operations in the UK, including Northern Ireland.

- UK Presence: AIB (NI) has a strong local presence in Northern Ireland, offering a full range of personal, business, and corporate banking services.

- Regulation and Security: As part of a large financial group operating in the UK, AIB (NI) is subject to strict regulation, which guarantees the security of funds and compliance with financial standards. UK customers are typically protected by the Financial Services Compensation Scheme (FSCS).

AIB

- Customer Focus: Following restructurings, the AIB Group has focused on becoming a more profitable, digital, and customer-centric institution. This is reflected in its credit card products, which offer different ‘Options’ to meet various financial needs.

- Conclusion: Applying for a credit card from AIB (NI) means choosing a product from an established and major financial institution, known for its solidity and commitment to the local Northern Ireland market.

Everything People Need to Know to Apply for the Card

The AIB Options Two is an accessible credit card, but it has specific requirements, the main one being the need to be an existing customer of the bank.

1. Basic Eligibility Requirements

Before starting the application, interested parties must confirm they meet the essential criteria set by AIB (NI):

- Age: The applicant must be 18 years or over.

- Residency: It is mandatory to be a resident in the UK.

- Account Status (Crucial): You must hold an existing bank account with AIB (NI). This is a fundamental requirement for the Options Two Card application.

- Minimum Income: Although the official website does not specify a rigid minimum income, the approval process is always based on an assessment of the ability to repay (‘subject to status and affordability’), ensuring that the credit granted is sustainable.

- Credit History: A satisfactory credit history is necessary, as credit is subject to status and affordability assessment.

2. Key Benefits and Features of the Options Two Card

The Options Two Card is valued for its flexibility and transparent fee structure:

- Up to 51 Interest-Free Days: The main feature is the period of up to 51 days of interest-free credit on purchases, cash advances, and balance transfers if you pay the balance in full and on time each month.

- No Annual Fee: There is no annual fee associated with the card, making it a low-cost option.

- Representative 16.9% APR (Variable): The representative interest rate is 16.9% APR (variable), which is competitive for customers who occasionally choose to extend the balance repayment.

- Minimum Credit Limit: The minimum starting credit limit is £500, with the maximum limit determined by individual credit assessment (Subject to Status).

- Flexibility: The card offers the flexibility to easily switch to another ‘Options’ card from AIB (NI) (such as Options One) if your financial needs change, without the need to open a new account.

3. The Approval Process and Required Documentation

The credit card approval process at AIB (NI) involves a detailed assessment of your identity, address, and financial situation.

Step 1: Preparing Essential Documentation

Although the exact documentation may vary, applicants should be prepared to provide the following if they cannot be electronically identified:

- Proof of Identity: Documents such as a valid passport or driving license.

- Proof of Address: Recent utility bills (gas or electricity) or a bank statement (not from AIB, if applicable).

Step 2: Choosing the Application Method

AIB (NI) offers three methods to apply for the Options Two Card:

- By Phone (Recommended Method): You can apply for the card over the phone. AIB (NI) may perform electronic identification. If this is not possible, supporting documentation will be requested later.

- In Branch (In-Person): Visiting the nearest AIB (NI) branch allows you to fill out the form and submit the necessary documentation directly to your account manager or a consultant.

- By Post (Traditional): The application form can be downloaded, completed (by hand or digitally), and signed. It should then be sent by post to the AIB (NI) headquarters address or delivered to the nearest branch.

Step 3: Credit Assessment and Approval

- Submission: The completed and signed form, along with supporting documentation, is submitted to the bank.

- Credit Check: AIB (NI) will conduct a mandatory credit check, verifying your credit history in the UK and assessing your ability to afford the requested credit. This assessment will determine your final credit limit.

- Decision: After the assessment, the bank will notify you of the approval and your actual credit limit.

Step 4: Receipt and Activation

- Delivery: Once approved, the credit card will be sent to your registered address.

- Usage: The card must be activated before the first use. AIB (NI) offers Internet Banking tools to manage your account, including viewing statements and tracking usage.

It is essential to fully read and understand the terms and conditions and the fees and charges before entering into the agreement, as AIB (NI), as a responsible lender, will only lend based on the customer’s ability to repay.

FAQ – Frequently Asked Questions about the AIB Options Two Card

Q: What is the representative interest rate (APR) for the Options Two Card?

A: The representative rate is 16.9% APR (variable). The actual rate may vary depending on your credit history.

Q: Is there an annual fee for the Options Two Card?

A: No. The Options Two Card has no annual bank fee.

Q: How long is the interest-free period?

A: You can get up to 51 days of interest-free credit on purchases (and other transactions) if you pay the balance in full and on time each month.

Q: Do I need to be an AIB (NI) customer to apply for the Options Two Card?

A: Yes, holding an active bank account with AIB (NI) is a mandatory requirement for the application.

Q: What is the minimum credit limit offered?

A: The minimum credit limit on the Options Two Card is £500, but the maximum limit is set individually, depending on your financial situation and credit assessment.

Q: How can I apply for the card?

A: You can apply for the Options Two Card by phone, by visiting an AIB (NI) branch, or by downloading and sending the completed application form by post.

Q: Does the AIB Options Two card offer a rewards or cashback scheme?

A: The Options Two Card is focused on credit flexibility and low fees, and does not offer a cashback scheme on purchases.

Q: Can I use the AIB Options Two card outside the UK?

A: Yes, the card can be used internationally. However, foreign usage is subject to foreign usage charges.

Conteúdo criado com auxílio de Inteligência Artificial