Are you looking for a low interest credit card in Australia that offers affordable financing options? The ANZ Low Rate Credit Card is designed to provide customers with a competitive interest rate and flexible payment options.

This card is ideal for individuals who want to manage their finances effectively while still enjoying the benefits of a credit card. With its affordable financing options, cardholders can make purchases and pay off their balance over time without breaking the bank.

In a Nutshell

- Competitive interest rate

- Flexible payment options

- Ideal for managing finances

- Affordable financing options

- Suitable for individuals seeking a low-interest credit card

ANZ Low Rate Credit Card

🇦🇺 AUSTRALIA: STEP-BY-STEP TUTORIAL – How to Apply for the ANZ Low Rate Credit Card

Follow this guide to apply for the ANZ Low Rate credit card, Australia and New Zealand Banking Group’s offering designed for customers who want a lower ongoing interest rate.

Anúncios

Why Choose the ANZ Low Rate Card?

The ANZ Low Rate credit card is ideal for individuals who occasionally carry a balance, as it features one of the lowest ongoing purchase interest rates offered by ANZ. It often includes:

Anúncios

- A low ongoing purchase interest rate (e.g., $13.74\% \text{ p.a.}$, subject to change).

- Introductory offers like a $0$ annual fee for the first year or a competitive balance transfer rate.

- Up to $55$ days interest-free on purchases.

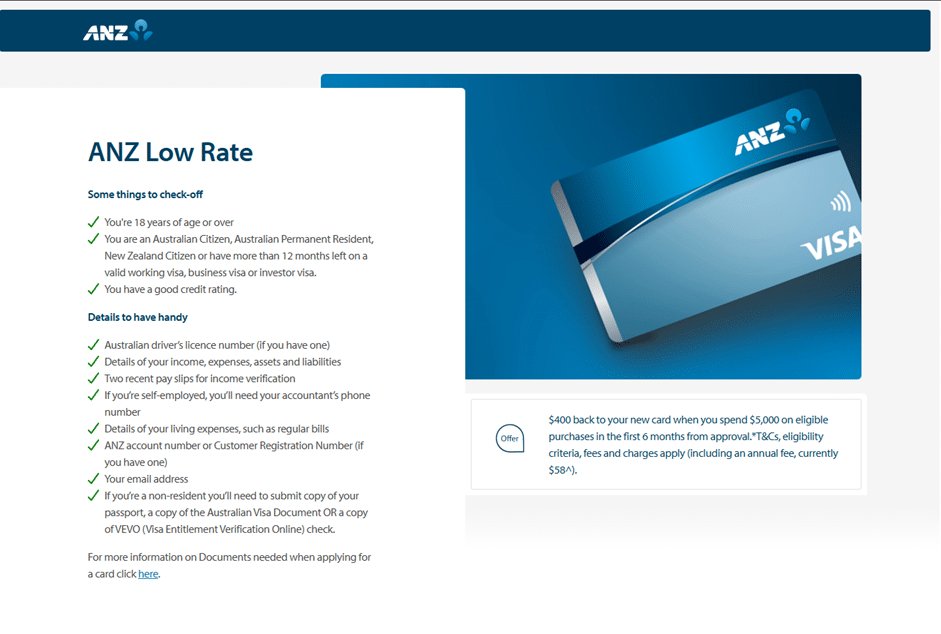

Before You Start: Eligibility Checklist

To apply for an ANZ credit card, you must generally:

- Be 18 years of age or older.

- Be an Australian or New Zealand citizen, a permanent resident, or hold an approved Australian visa with more than 12 months remaining.

- Be ready to provide your income, expenses, liabilities, and asset details.

Step 1: Access the ANZ Homepage and Credit Cards Section

Your application starts on the main ANZ website.

- Access the ANZ homepage:

https://www.anz.com.au/ - In the main navigation menu, click the option for “Credit Cards”.

Step 2: Locate and Select the ANZ Low Rate Card

On the Credit Cards comparison page, find and choose the Low Rate Card.

- On this page, you will see a comparison of various ANZ cards (e.g., First, Platinum, ANZ Rewards).

- Look for the card titled ANZ Low Rate or similar, which will highlight its low interest rate feature.

- Click on “See ANZ Low Rate” or “Learn more” to go to the specific product page.

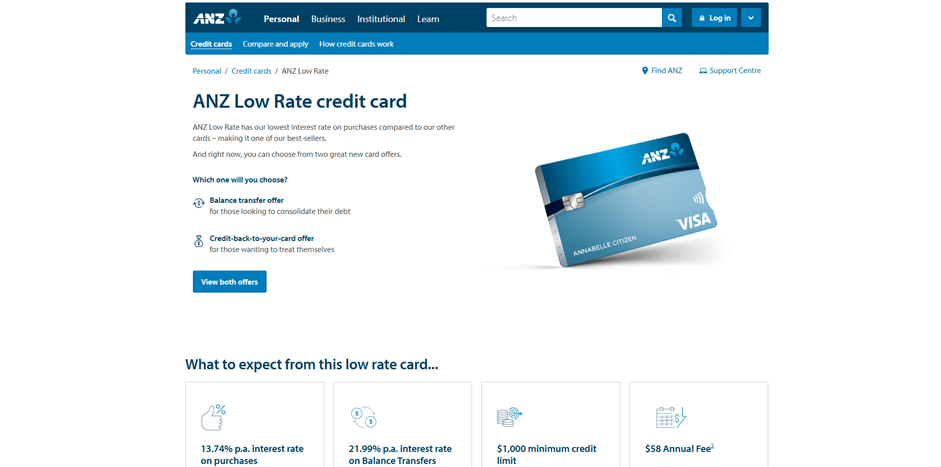

Step 3: Choose Your Offer and Start the Application

You are now on the detailed product page for the ANZ Low Rate Card.

- Here, you will find all the specifics of the card, including the current purchase rate and annual fee.

- The ANZ Low Rate Card often features multiple introductory offers (e.g., a balance transfer deal OR a cash back offer).

- Click the orange button, typically labelled “View both offers” or “Apply now”, to proceed and select the offer that best suits your needs.

Step 4: Complete and Submit the Application Online

You will be redirected to the secure ANZ application portal.

- Select Offer: Choose your preferred introductory offer (if applicable).

- Fill in Details: Complete the multi-step application form. You will need to provide detailed information regarding:

- Your Personal Identity (Proof of ID may be required).

- Income (Salary, bonuses, etc.).

- Expenses (Living expenses, debt repayments).

- Assets and Liabilities.

- Review: Carefully read and accept the terms and conditions, including the Annual Fee and Purchase Interest Rate.

- Submit: Submit your application.

- You will receive a response from ANZ regarding your application and, upon approval, your ANZ Low Rate Card will be mailed to you.

Overview of the ANZ Low Rate Credit Card

The ANZ Low Rate Credit Card is designed for Australians looking for affordable financing options. This card is particularly appealing to individuals who want to minimize their interest charges without sacrificing the benefits of a credit card.

Key Card Features at a Glance

The ANZ Low Rate Credit Card comes with several attractive features. It boasts a low interest rate on purchases, making it an ideal choice for those who may not pay off their balance in full each month. Additionally, the card offers flexible payment options, allowing cardholders to manage their finances effectively. The card also has a competitive fee structure, with no foreign transaction fees, making it suitable for both local and international use.

Some of the key benefits include ANZ credit card benefits such as purchase protection and the ability to earn rewards points, although the latter may not be the primary focus of this card. The low rate feature is particularly beneficial for credit card comparison shoppers who prioritize low interest rates over rewards.

Target Audience for This Card

The ANZ Low Rate Credit Card is tailored for individuals seeking a straightforward, low-cost credit card solution. It’s particularly suited for Australians with good credit history who are looking to minimize their credit card expenses. This card is ideal for those who need a credit card for everyday purchases or for emergencies, without the burden of high interest charges.

When considering a credit card, it’s essential to compare the low interest rate offered by ANZ with other providers to ensure you’re getting the best deal. The ANZ Low Rate Credit Card is a solid choice for those who value simplicity and low costs, making it a great option in the Australian credit card market.

Competitive Interest Rates and Fee Structure

The ANZ Low Rate Credit Card is designed to offer competitive interest rates, making it an attractive option for Australians looking to manage their finances effectively. Understanding the interest rates and fees associated with this card is crucial for potential applicants.

Purchase Interest Rate Details

The ANZ Low Rate Credit Card features a low purchase interest rate of 12.99% p.a., which is competitive compared to other credit cards in the Australian market. This rate applies to purchases made with the card, and interest is charged if the balance is not paid in full by the due date. To avoid interest charges, cardholders can take advantage of the interest-free period, which is typically around 55 days.

Balance Transfer Options

The ANZ Low Rate Credit Card offers balance transfer options with a promotional rate of 0% p.a. for 14 months on balance transfers made within the first 90 days of card ownership. A balance transfer fee of 2% applies to each transfer. This feature allows cardholders to consolidate debt from other credit cards and save on interest charges during the promotional period.

Cash Advance Rates

For cash advances, the ANZ Low Rate Credit Card charges a higher interest rate of 23.99% p.a.. Additionally, a cash advance fee applies, which is typically a percentage of the withdrawn amount or a minimum fee. It’s essential for cardholders to be aware of these rates and fees, as they can significantly increase the cost of using the card for cash advances.

Annual and Other Fees Breakdown

The ANZ Low Rate Credit Card has an annual fee of $58, which is relatively low compared to other credit cards offering similar benefits. There are no foreign transaction fees, making it suitable for international travel. However, late payment fees and other charges may apply if cardholders miss their payment due dates or exceed their credit limits.

Benefits and Advantages of the ANZ Low Rate Card

The ANZ Low Rate Credit Card offers numerous benefits that make it an attractive option for Australians looking for affordable financing. One of the primary advantages is its potential for interest savings, which can significantly reduce the overall cost of using the card.

Interest Savings Potential

The ANZ Low Rate Credit Card features a competitive purchase interest rate, allowing cardholders to save on interest charges. By understanding how interest is calculated and making timely payments, cardholders can maximize their interest savings. For instance, paying more than the minimum payment each month can help reduce the principal amount faster, thereby decreasing the interest accrued over time.

Additionally, the card offers a low interest rate on purchases, which can lead to substantial savings, especially for those who carry a balance from month to month. It’s essential for cardholders to review their statement regularly to ensure they’re taking full advantage of the card’s low-rate benefits.

Flexible Payment Options

The ANZ Low Rate Credit Card provides flexible payment options to accommodate different financial situations. Cardholders can choose to pay their balance in full or make minimum payments, giving them control over their financial management. This flexibility is particularly beneficial for those with variable incomes or unexpected expenses.

Furthermore, ANZ allows cardholders to set up automatic payments, ensuring that they never miss a payment. This feature not only helps in avoiding late fees but also contributes to maintaining a good credit score.

Additional Cardholder Benefits

Beyond interest savings and flexible payments, the ANZ Low Rate Credit Card comes with additional benefits that enhance the cardholder experience. These include advanced security features and convenient payment technologies.

Fraud Protection Features

The ANZ Low Rate Credit Card incorporates robust fraud protection features to safeguard cardholders’ transactions. ANZ employs advanced monitoring systems to detect and prevent fraudulent activities, providing an additional layer of security. In the event of suspected fraud, cardholders are protected through zero-liability policies, ensuring they are not held responsible for unauthorized transactions.

Contactless Payment Technology

Cardholders can also enjoy the convenience of contactless payment technology, allowing for quick and secure transactions. This feature is particularly useful for everyday purchases, making it easy to pay without the need to insert or swipe the card. Contactless payments are encrypted and protected by the same security measures as traditional card transactions, ensuring a safe payment experience.

Eligibility Requirements and Application Process

To successfully apply for the ANZ Low Rate Credit Card, applicants must first understand the eligibility requirements and navigate the application process. This involves meeting specific criteria set by ANZ and following a straightforward application procedure.

Who Can Apply for This Card

The ANZ Low Rate Credit Card is available to eligible Australian residents aged 18 and above. Applicants must have a stable income source and a good credit history. ANZ considers various factors, including employment status, income level, and credit score, to determine eligibility.

Required Documentation

To apply for the ANZ Low Rate Credit Card, applicants typically need to provide identification and financial documents. These may include a valid driver’s license or passport, proof of income such as pay slips, and bank statements. The exact documentation required may vary depending on individual circumstances.

Step-by-Step Application Guide

Applying for the ANZ Low Rate Credit Card can be done online or in-branch. Here’s a step-by-step guide for both options:

Online Application Process

The online application process is convenient and quick. Applicants can visit the ANZ website, fill out the application form, and upload the required documents. The process typically takes a few minutes to complete, and a decision is usually provided within a few business days.

In-Branch Application Alternative

For those who prefer a more personal approach, applying in-branch is a viable alternative. Applicants can visit their nearest ANZ branch, speak with a representative, and complete the application form. The representative can guide them through the process and answer any questions they may have.

Managing Your ANZ Low Rate Credit Card

Effective management of your ANZ Low Rate Credit Card is crucial for maximizing its benefits. By leveraging the available digital tools and understanding the card’s features, you can optimize your financial management.

ANZ Bank

Online Banking Features

ANZ’s online banking platform offers a range of tools to manage your credit card effectively.

Account Monitoring Tools

You can track your spending, view your transaction history, and monitor your account balance in real-time.

Payment Setup Options

The platform allows you to set up automatic payments, ensuring you never miss a payment due date.

Mobile App Functionality

The ANZ mobile app provides similar functionality to the online banking platform but in a more portable and accessible format.

Key App Features for Cardholders

You can check your balance, view transactions, and make payments on the go. The app also offers budgeting tools.

Security Measures

ANZ has implemented robust security measures, including two-factor authentication and encryption.

By utilizing these tools, you can effectively manage your ANZ Low Rate Credit Card, ensuring you get the most out of its features.

Balance Transfer Opportunities with the ANZ Low Rate Credit Card

For individuals carrying high-interest debt on other credit cards, the ANZ Low Rate Credit Card provides a valuable balance transfer opportunity. This feature allows cardholders to consolidate their debt into a single, lower-interest account, potentially saving money on interest charges.

Current Balance Transfer Offers

The ANZ Low Rate Credit Card often comes with competitive balance transfer offers. These can include 0% interest rates for a promotional period, typically ranging from 6 to 12 months. It’s essential to check the current offer, as ANZ may have different promotions available at different times.

Example of Current Offer: ANZ may offer a 0% interest rate on balance transfers for 8 months. This means that during this period, you won’t be charged interest on the transferred amount, allowing you to pay off your debt faster.

How to Make the Most of Balance Transfers

To maximize the benefits of a balance transfer, it’s crucial to understand how to use this feature effectively. Here are some tips:

- Pay off as much as possible during the promotional period to minimize the amount of interest you’ll owe afterward.

- Avoid making new purchases on the card until you’ve paid off the transferred balance to prevent accumulating more debt.

- Consider setting up a regular payment plan to ensure you’re making consistent progress on your debt.

Calculating Potential Savings

To understand the potential savings, let’s consider an example:

Important Terms and Conditions

While balance transfers can be highly beneficial, it’s essential to be aware of the terms and conditions. These may include balance transfer fees (typically around 1-2% of the transferred amount), the duration of the promotional interest rate, and the interest rate that applies after the promotional period ends.

Key Terms to Review:

- Balance transfer fee

- Promotional period duration

- Interest rate post-promotional period

Comparing the ANZ Low Rate Credit Card with Competitors

The ANZ Low Rate Credit Card is one of many credit cards on offer in Australia, but how does it stack up against its competitors? When evaluating credit cards, it’s crucial to consider various factors, including interest rates, fees, and benefits.

ANZ vs. Other Major Australian Banks’ Low Rate Options

The Australian credit card market is dominated by a few major banks, including ANZ, Commonwealth Bank, Westpac, and NAB. Each of these banks offers low-rate credit cards with competitive features.

- ANZ Low Rate Credit Card: Offers a competitive purchase rate of 12.49% p.a. and a low balance transfer rate.

- Commonwealth Bank Low Rate Card: Features a purchase rate of 12.99% p.a. with no annual fee in the first year.

- Westpac Low Rate Card: Provides a purchase rate of 13.09% p.a. and offers a balance transfer option.

- NAB Low Rate Card: Has a purchase rate of 12.99% p.a. and offers a low rate for balance transfers.

Comparing these cards reveals that ANZ’s low rate is competitive, but the best choice for a consumer depends on their individual needs, such as balance transfer requirements or additional card benefits.

Where ANZ Stands Out in the Australian Market

ANZ stands out due to its competitive interest rate and flexible payment options. The card also offers a range of benefits, including free additional cardholders and secure online banking.

Potential Drawbacks to Consider

While the ANZ Low Rate Credit Card has many advantages, there are some potential drawbacks. These include the annual fee, which, although relatively low, can add to the overall cost of the card. Additionally, some users may find the limited foreign exchange capabilities to be a disadvantage, particularly if they travel frequently.

Real Customer Experiences and Reviews

Real customer reviews offer a unique perspective on the benefits and drawbacks of the ANZ Low Rate Credit Card. By examining the experiences of existing cardholders, prospective applicants can make more informed decisions.

Positive Feedback from Australian Cardholders

Many Australian cardholders have expressed satisfaction with the ANZ Low Rate Credit Card, citing its competitive interest rates and low fees as major advantages. For instance, some customers have praised the card’s simplicity and ease of use, particularly when managing their finances online or through the ANZ mobile app.

Cardholders have also appreciated the flexible payment options available, allowing them to manage their cash flow effectively. Overall, the positive feedback highlights the card’s value proposition for those seeking a straightforward, cost-effective credit card solution.

Common Customer Concerns and Issues

While many customers have had positive experiences, some have raised concerns regarding the card’s customer service and foreign transaction fees. A few cardholders have reported difficulties in getting their queries resolved, citing long wait times or unhelpful responses.

Additionally, some users have noted that the card’s foreign transaction fees, although competitive, could be more competitive. Despite these concerns, it’s worth noting that ANZ has been working to improve its customer service and offer more competitive terms to its cardholders.

Conclusion: Is the ANZ Low Rate Credit Card Right for You?

When considering a credit card, it’s essential to evaluate your financial needs and spending habits. The ANZ Low Rate Credit Card offers affordable financing options with competitive interest rates and a straightforward fee structure. This card is ideal for individuals seeking to minimize interest charges on purchases and balance transfers.

The card’s benefits, including low purchase and balance transfer rates, make it an attractive option for those who need to manage their finances effectively. However, it’s crucial to weigh these advantages against potential drawbacks, such as annual fees and cash advance rates.

In conclusion, the ANZ Low Rate Credit Card is suitable for individuals who prioritize low interest rates and straightforward terms. To determine if this card is right for you, consider your financial goals and compare the card’s features with your needs. By doing so, you can make an informed decision that aligns with your financial situation and objectives, ultimately ensuring a positive credit card experience.

FAQ

What is the interest rate for the ANZ Low Rate Credit Card?

Are there any annual fees associated with the ANZ Low Rate Credit Card?

Can I transfer my existing credit card balance to the ANZ Low Rate Credit Card?

How do I apply for the ANZ Low Rate Credit Card?

What are the eligibility criteria for the ANZ Low Rate Credit Card?

How can I manage my ANZ Low Rate Credit Card account online?

Is the ANZ Low Rate Credit Card secure?

Can I have additional cardholders on my ANZ Low Rate Credit Card account?

Conteúdo criado com auxílio de Inteligência Artificial