Want to enjoy exclusive premium travel experiences?

You will remain on the same site

The American Express Platinum card is a premium offering that comes with a range of exclusive benefits, including the highly-regarded Membership Rewards points program. Cardholders can earn valuable points on their purchases, which can be redeemed for a variety of rewards, from travel and dining to merchandise and experiences.

With the Amex Platinum card, you can elevate your earning potential by taking advantage of generous earning rates on certain categories, such as travel and dining. Additionally, cardholders can enjoy a range of credit card benefits, including travel insurance, airport lounge access, and concierge services.

Key Takeaways

- Earn valuable points with the Membership Rewards program

- Generous earning rates on travel and dining purchases

- Exclusive credit card benefits, including travel insurance and airport lounge access

- Redeem points for travel, dining, merchandise, and experiences

- Concierge services available to cardholders.

American Express: Comparison of Platinum, Gold, and Blue Cash Preferred

The choice among the Amex Platinum, Amex Gold, and Blue Cash Preferred cards is entirely dependent on your lifestyle and how you spend your money. These cards represent the three pillars of the American Express portfolio: Luxury and Status, Premium Everyday Spending, and Domestic Cash Back.

To facilitate your decision, check the table and profile analysis below:

1. The Platinum Card® from American Express

- Primary Focus: Luxury Travel and Lifestyle.

- Annual Fee (approx.): $895.

- Reward Type: Membership Rewards (MR) Points.

- Best Earning Rate: 5X MR on Flights and Prepaid Hotels (via Amex Travel).

- Best Annual Credits: Includes Global Lounge Access (Centurion, Priority Pass, etc.) and $600 Hotel Credits (prepaid).

- Foreign Transaction Fees: NONE.

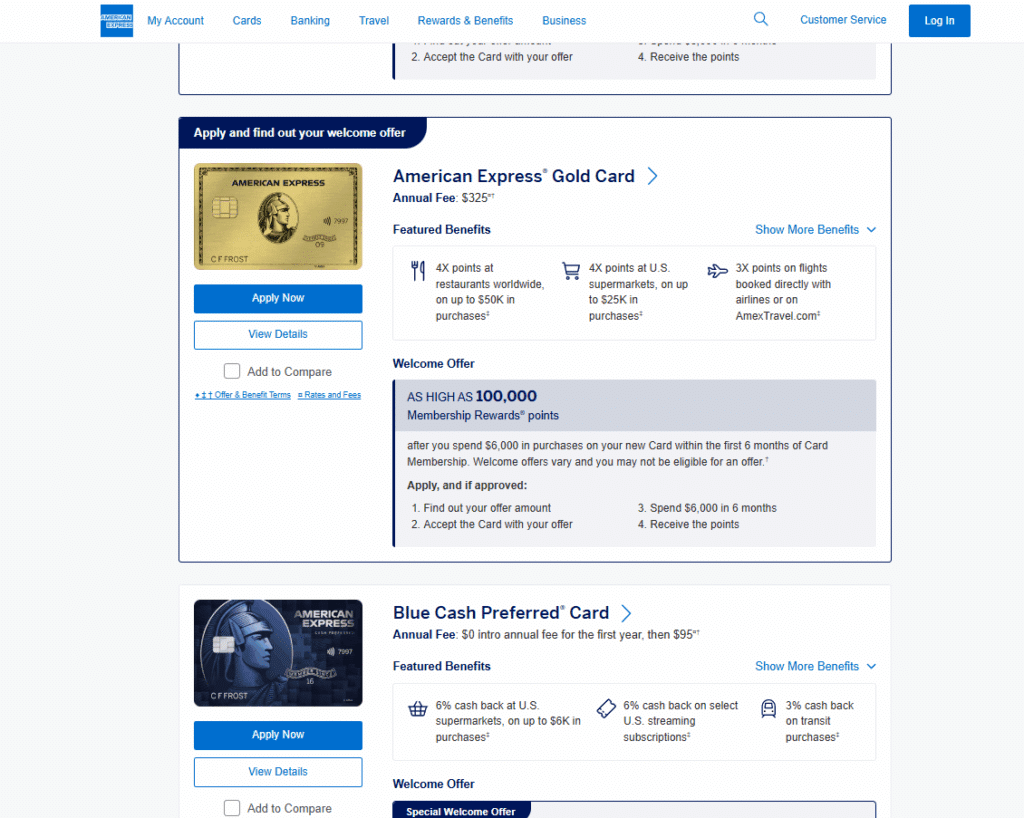

2. American Express® Gold Card

- Primary Focus: Dining/Grocery Spending and Travel.

- Annual Fee (approx.): $325.

- Reward Type: Membership Rewards (MR) Points.

- Best Earning Rates: 4X MR at Restaurants worldwide and 4X MR at U.S. Supermarkets (up to $25,000/year).

- Best Annual Credits: Includes $120 Dining Credits (monthly) and $120 Uber Cash (monthly).

- Foreign Transaction Fees: NONE.

3. Blue Cash Preferred® Card from American Express

- Primary Focus: Cash Back on Groceries/Streaming.

- Annual Fee (approx.): $0 intro first year, then $95.

- Reward Type: Cash Back (in Reward Dollars).

- Best Earning Rates: 6% Cash Back at U.S. Supermarkets (up to $6,000/year) and 6% Cash Back on U.S. Streaming Services.

- Best Annual Credits: Includes $120 Disney Bundle Streaming Credit (monthly).

- Foreign Transaction Fees: 2.7% (Charged).

Who Each Card is Designed For

1. The Platinum Card®: The Luxury Traveler’s Card

The Platinum Card has the highest annual fee because it sells the best travel experience. It is ideal for those who travel frequently and value comfort, status, and premium benefits at the airport and hotels.

- Its Purpose: To offset the high annual fee with high-value services and credits. If you utilize the hotel, Uber, and lounge access credits, the $895 cost becomes justifiable.

- Key Point: The 5X points are only truly rewarding if you already spend thousands of dollars annually on airfare and hotels. You are primarily buying an experience, not just a rewards rate.

2. American Express® Gold Card: The Everyday Points Accumulator

The Gold Card is the best Amex card for those who want to accumulate Membership Rewards Points quickly through recurring spending. Its $325 annual fee is moderate, but its multipliers on food are unbeatable.

- Its Purpose: To be your “primary” everyday card. If the majority of your spending goes toward restaurants and supermarkets (4X on both), you will accumulate points very efficiently.

- Key Point: The annual fee is virtually nullified if you use the $10 monthly dining credits and the $10 monthly Uber Cash credits. This is a card focused on food and point accumulation.

3. Blue Cash Preferred® Card: The Domestic Cash Back Powerhouse

The Blue Cash Preferred does not earn travel points but offers the highest cash back rates on household expenses in the market. It is perfect for those who prefer guaranteed savings over the flexibility of travel points.

- Its Purpose: To give you money back on your biggest household bills. The 6% rate on U.S. supermarkets (up to the annual limit) and 6% on streaming services is the easiest way to cover the $95 annual fee and still put money back in your pocket.

- Key Point: This card is strictly domestic. The foreign transaction fee (2.7%) makes it the worst option to use outside the U.S. Use it for groceries, gas, and streaming—and nothing else!

Conclusion:

- Choose Platinum if you travel extensively, value luxury, and can utilize all the annual credits.

- Choose Gold if you spend heavily on dining and groceries and want to accumulate travel points efficiently.

- Choose Blue Cash Preferred if you want to maximize cashback on domestic expenses and are not concerned with travel points.

Understanding the Amex Platinum Card

With its array of luxury benefits, the Amex Platinum Card stands out in the world of premium credit cards. The card is designed to offer a sophisticated and rewarding experience, particularly for those who travel frequently and enjoy high-end shopping.

The Amex Platinum Card is not just a credit card; it’s a gateway to a range of exclusive benefits and services that enhance the cardholder’s lifestyle.

Premium Card Features Overview

The Amex Platinum Card boasts an impressive list of premium features. Travel-related benefits include access to airport lounges worldwide, which provide a comfortable and quiet space for cardholders to relax before their flights. Additionally, the card offers travel insurance and assistance services, ensuring that cardholders are protected and supported during their travels.

You will be redirected to another site

Other notable features include a personalized concierge service that can assist with a wide range of tasks, from booking restaurants to arranging travel itineraries. The card also offers exclusive event access, allowing cardholders to attend unique experiences that are not available to the general public.

Annual Fee and Value Proposition

The Amex Platinum Card comes with a significant annual fee, which can be a deterrent for some potential applicants. However, when considering the value proposition, it becomes clear that the benefits and rewards offered by the card can far outweigh the costs for many cardholders.

The annual fee covers a wide range of benefits, including the travel credits, dining credits, and other rewards that can be redeemed for travel, merchandise, or statement credits. For frequent travelers and luxury consumers, the rewards and benefits can provide substantial value, making the card a worthwhile investment.

To maximize the value of the Amex Platinum Card, cardholders should take full advantage of the available benefits and rewards, ensuring that they get the most out of their annual fee.

The Membership Rewards Points Program Explained

At the heart of the Amex Platinum Card is the Membership Rewards program, a flexible rewards system that lets cardholders earn points on various purchases. This program is designed to reward cardholders for their spending habits, providing a valuable way to accumulate points that can be redeemed for a variety of rewards.

How Membership Rewards Work

The Membership Rewards program is straightforward: cardholders earn points on eligible purchases, which are then credited to their account. The program allows cardholders to earn points on everyday spending, as well as on specific categories such as travel and dining. For instance, cardholders can earn 5X points on flights booked directly with airlines or through Amex Travel.

Points are earned based on the type of purchase and the cardholder’s eligibility. For example, cardholders may earn bonus points in certain categories or during specific promotional periods. The flexibility of the program means that cardholders can earn points across a wide range of spending categories, making it easier to accumulate a substantial number of points over time.

Point Valuation and Flexibility

One of the key benefits of the Membership Rewards program is its flexibility in redeeming points. Cardholders can redeem their points for a variety of rewards, including travel bookings, gift cards, and statement credits. The point valuation can vary depending on the redemption option chosen, with some options offering more value than others.

For example, transferring points to airline and hotel loyalty programs can often provide a higher value per point compared to redeeming for gift cards or statement credits. This flexibility allows cardholders to maximize the value of their points based on their individual needs and preferences. By understanding the various redemption options and their corresponding point valuations, cardholders can make the most of their Membership Rewards points.

Earning Points with Everyday Spending

The Amex Platinum card offers a robust rewards program that lets you earn points on your everyday spending. This feature is particularly beneficial for individuals who make frequent purchases across various categories.

Standard Earning Categories

The Amex Platinum card provides a standard earning rate for various categories. Typically, cardholders earn 1 Membership Rewards point per dollar spent on eligible purchases. However, certain categories may have different earning rates.

Here’s a breakdown of standard earning categories:

- Groceries: 1 point per dollar

- Gas: 1 point per dollar

- Dining: 1 point per dollar

- Travel: 1 point per dollar

It’s essential to note that some categories might have specific requirements or restrictions. Always check the latest terms on the American Express website.

Bonus Categories and Multipliers

To maximize your earnings, take advantage of bonus categories and multipliers offered by the Amex Platinum card. For instance, you might earn 5 points per dollar spent on flights booked directly with airlines or through Amex Travel.

As noted by a financial expert, “Maximizing bonus categories can significantly boost your Membership Rewards points balance over time.” By understanding and leveraging these categories, you can earn more points with your everyday spending.

Digital and Online Shopping Point Opportunities

Cardholders can maximize their Membership Rewards points by leveraging various online shopping platforms and tools. The American Express Platinum card offers a range of digital benefits that can significantly enhance your earning potential.

Amex Shopping Portals

The Amex Shopping Portal is a valuable resource for earning extra points on online purchases. By accessing your favorite retailers through the Amex portal, you can earn bonus points on top of your standard earnings. With a wide range of participating retailers, you can enjoy shopping at popular online stores while accumulating points.

Retail Partner Bonuses

Amex has partnered with numerous retailers to offer exclusive bonuses to Platinum cardholders. These retail partner bonuses can be substantial, providing a significant boost to your points earnings. By taking advantage of these offers, you can earn more points on your everyday purchases.

Digital Subscription Benefits

In addition to shopping portals and retail bonuses, the Amex Platinum card also offers benefits on digital subscriptions. Cardholders can earn points on services like music streaming, software, and more. By leveraging these benefits, you can maximize your points earnings across various categories.

By combining these digital and online shopping opportunities, you can significantly enhance your Membership Rewards points earnings. Whether you’re shopping online, subscribing to digital services, or taking advantage of retail partner bonuses, the Amex Platinum card provides a range of ways to maximize your rewards.

Travel-Related Earning Opportunities

The Amex Platinum card offers numerous travel-related earning opportunities that can significantly boost your Membership Rewards points. Cardholders can benefit from a range of travel-centric rewards and services designed to enhance their travel experiences.

5X Points on Flights and Hotels

Earning 5X points on flights and hotels booked directly with airlines and hotels is a significant benefit for frequent travelers. This earning potential can be maximized by booking travel arrangements directly with the service providers, rather than through third-party websites. For instance, booking a flight directly with American Airlines or a hotel stay with Marriott can yield 5X points.

To maximize earnings, cardholders should consider the following strategies:

- Book flights and hotels directly with the airlines and hotels to earn 5X points.

- Take advantage of bonus categories and multipliers on travel-related expenses.

- Use the Amex travel portal for bookings that may offer additional rewards or benefits.

Fine Hotels & Resorts Program Benefits

The Fine Hotels & Resorts (FHR) program is another valuable benefit for Amex Platinum cardholders. This program offers a range of luxurious hotel experiences, including room upgrades, complimentary breakfast, and a $100 hotel credit. FHR properties include high-end hotels worldwide, providing cardholders with a curated selection of premium accommodations.

“The Fine Hotels & Resorts program has been a game-changer for my travels. The room upgrades and hotel credits have made my stays feel truly luxurious.”

Airport Lounge Access and Travel Credits

In addition to earning points on travel, Amex Platinum cardholders also enjoy comprehensive airport lounge access and travel credits. The card offers access to a global network of airport lounges, including Delta Sky Clubs and Centurion Lounges. Furthermore, cardholders receive up to $200 in airline fee credits and a $100 credit towards Global Entry or TSA PreCheck application fees.

These travel-related benefits not only enhance the overall travel experience but also provide significant value through credits and lounge access. By leveraging these benefits, cardholders can enjoy a more comfortable and convenient travel experience.

Maximizing Welcome Bonuses and Special Offers

To get the most out of your Amex Platinum card, understanding how to maximize welcome bonuses and special offers is crucial. The card offers a range of benefits that can significantly enhance your rewards earnings.

Current Welcome Bonus Structure

The Amex Platinum card’s welcome bonus is a significant incentive for new cardholders. Currently, the card offers a substantial bonus for meeting a specific spending requirement within the first few months. To maximize this bonus, it’s essential to understand the terms and conditions, including the spending threshold and any associated fees.

Key considerations for maximizing the welcome bonus include:

- Meeting the spending requirement within the specified timeframe

- Avoiding unnecessary purchases that might incur additional fees

- Understanding any rotating categories or bonus multipliers

Amex Offers and Targeted Promotions

In addition to the welcome bonus, Amex Platinum cardholders can benefit from Amex Offers and targeted promotions. These offers can provide significant rewards in the form of statement credits or bonus points. To maximize these benefits, cardholders should regularly check their card accounts for available offers and activate them as needed.

Some popular types of Amex Offers include:

- Category-specific offers (e.g., dining, travel, or retail)

- Merchant-specific offers (e.g., Amazon, Uber, or Starbucks)

- Bonus points for specific transactions or purchases

By leveraging these offers and understanding the current welcome bonus structure, Amex Platinum cardholders can significantly enhance their rewards earnings and overall card value.

Strategic Redemption Options for Maximum Value

With multiple redemption options available, Amex Platinum cardholders must navigate the landscape to achieve the highest value. The Membership Rewards program offers a variety of ways to redeem points, each with its own benefits and potential for value.

Airline and Hotel Transfer Partners

One of the most valuable redemption options is transferring points to airline and hotel partners. Amex has partnered with several major airlines and hotel chains, allowing cardholders to transfer their points at a 1:1 ratio. Some notable transfer partners include:

- Delta Air Lines

- British Airways

- Air France/KLM

- Marriott Bonvoy

- Hilton Honors

Transferring points to these partners can provide significant value, especially when booking high-demand flights or hotel stays. For example, transferring points to British Airways can allow for redemption on premium cabins at a lower cost than booking directly.

Travel Portal Bookings

For those who prefer a more straightforward redemption process, Amex’s travel portal offers a convenient way to book flights, hotels, and car rentals using Membership Rewards points. While the value may not be as high as transferring to partners, the portal provides a user-friendly experience and often offers competitive rates.

Statement Credits and Gift Cards

In addition to travel-related redemptions, Amex Platinum cardholders can also redeem points for statement credits or gift cards. While these options typically offer lower value per point, they can still be useful for offsetting expenses or as a gift.

For instance, redeeming points for a statement credit can provide a straightforward way to offset purchases made with the card. This can be particularly useful for cardholders who have accumulated a large balance or wish to simplify their rewards redemption.

By understanding the various redemption options available, Amex Platinum cardholders can maximize the value of their Membership Rewards points and enjoy a more rewarding experience.

Advanced Strategies for Point Accumulation

To maximize your American Express Platinum Membership Rewards points, consider implementing advanced strategies for point accumulation. By leveraging these techniques, you can significantly boost your rewards earnings.

Authorized Users and Pooling Points

Adding authorized users to your American Express Platinum Card can be a powerful strategy for accumulating points. When you add an authorized user, they can earn points on their card, which can then be pooled with your points.

- Earn additional points without applying for new cards

- Combine points for redemption or transfer

- Help family members or friends build credit

Combining with Other Amex Cards

Combining your American Express Platinum Card with other American Express cards can maximize your point accumulation. By using multiple cards strategically, you can earn points across various categories.

For example, you can use the American Express Platinum Card for dining and travel, while using another card like the American Express Gold Card for groceries and dining.

Timing Your Spending for Promotions

Timing your spending to coincide with promotions can significantly boost your point accumulation. American Express frequently offers bonus categories or multiplier promotions.

To maximize your earnings, keep an eye on your email and the American Express app for targeted offers. You can also use tools like the Amex Offers platform to access exclusive deals.

By implementing these advanced strategies, you can optimize your point accumulation and enjoy greater rewards with your American Express Platinum Card.

Conclusion: Maximizing Your Amex Platinum Membership Rewards Value

The American Express Platinum card offers a robust rewards program that can be maximized with the right strategies. By understanding the Membership Rewards points program, leveraging everyday spending, and taking advantage of digital and travel-related earning opportunities, cardholders can accumulate a significant number of points.

To get the most out of the Amex Platinum benefits, it’s essential to be strategic about earning and redeeming points. This includes maximizing welcome bonuses, using the card for purchases in bonus categories, and transferring points to airline and hotel partners for maximum value.

By implementing these strategies, cardholders can elevate their earning potential and enjoy the full range of benefits that the Amex Platinum card has to offer. Whether you’re a seasoned rewards enthusiast or just starting out, the Amex Platinum Membership Rewards program is a valuable tool for maximizing rewards and achieving your travel and lifestyle goals.

FAQ

What is the annual fee for the American Express Platinum Card?

How do I earn Membership Rewards points with my Amex Platinum Card?

Can I transfer my Membership Rewards points to airline or hotel loyalty programs?

What is the Fine Hotels & Resorts program, and how do I access it with my Amex Platinum Card?

How do I maximize my welcome bonus with the Amex Platinum Card?

Can I use my Amex Platinum Card to earn points on digital subscriptions like Apple Music or Audible?

What is the current welcome bonus structure for the Amex Platinum Card?

How do I redeem my Membership Rewards points for travel on the American Express Travel portal?

Can I add authorized users to my Amex Platinum Card, and how does it affect my Membership Rewards points?

What is the benefit of combining my Amex Platinum Card with other American Express cards?

Conteúdo criado com auxílio de Inteligência Artificial