The American Express Velocity Platinum Card is a popular choice among Australian travellers, offering a range of benefits and rewards.

American Express Velocity Platinum

This card provides an opportunity to earn Velocity Points through various purchases, which can be redeemed for flights, upgrades, and other travel perks.

The Rewards Program is designed to reward cardholders for their loyalty, offering points on eligible purchases and bonus points in specific categories.

Anúncios

With its competitive rates and rewards structure, the card is an attractive option for those looking to maximise their travel rewards.

Anúncios

Key Takeaways

- Earn Velocity Points on eligible purchases with the American Express Velocity Platinum Card.

- The card offers a competitive rewards structure and bonus points in specific categories.

- Cardholders can redeem Velocity Points for flights, upgrades, and other travel perks.

- The Rewards Program is designed to reward loyalty and offer flexibility.

- The card is suitable for Australian travellers looking to maximise their travel rewards.

🇦🇺 AUSTRALIA: STEP-BY-STEP TUTORIAL – How to Apply for the American Express Velocity Platinum Card

Follow this guide to apply for the American Express Velocity Platinum Card, a premium travel card in Australia designed for frequent flyers with Virgin Australia.

Introduction: Why Choose the Velocity Platinum Card?

The American Express Velocity Platinum Card is a top-tier rewards card that focuses on maximizing travel benefits with Virgin Australia’s Velocity Frequent Flyer program. Key features often include:

- Complimentary Virgin Australia flight benefits (e.g., annual return domestic flight).

- Velocity Points earning on purchases.

- Complimentary travel insurance and airport lounge access.

- High Annual Fee and High Minimum Income Requirement.

Before You Start: Eligibility Checklist

To apply for this card, you must generally:

- Be 18 years of age or older.

- Be an Australian citizen or Permanent Resident or hold a long-term visa.

- Meet the minimum pre-tax income requirement (often around $\mathbf{\$75,000}$ or $\mathbf{\$100,000}$).

- Have a good credit history and no history of bad debt.

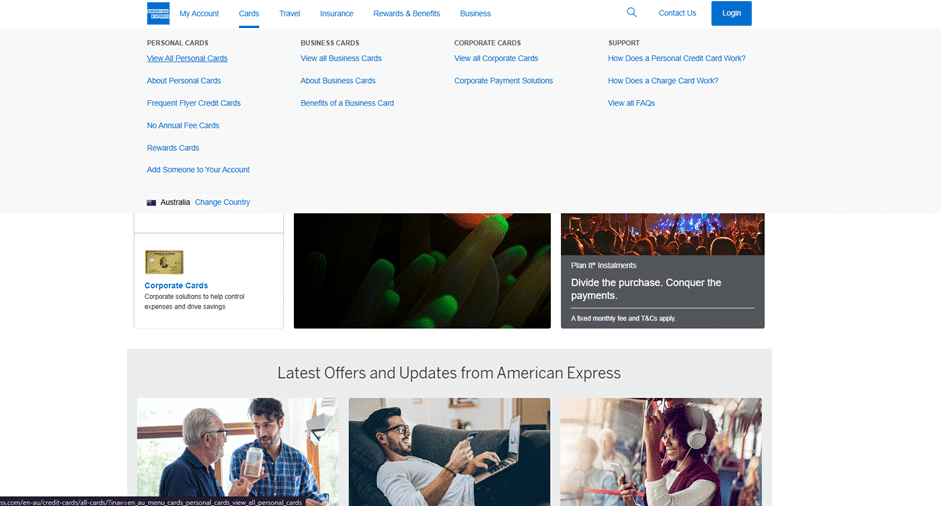

Step 1: Access the American Express Cards Section

Your application begins on the main American Express Australia website.

- Access the American Express homepage:

https://www.americanexpress.com/ - In the main navigation menu, click the option for “Cards” (or “Credit Cards”).

- Click the link under the first column (Personal Cards) that says “View all personal cards”.

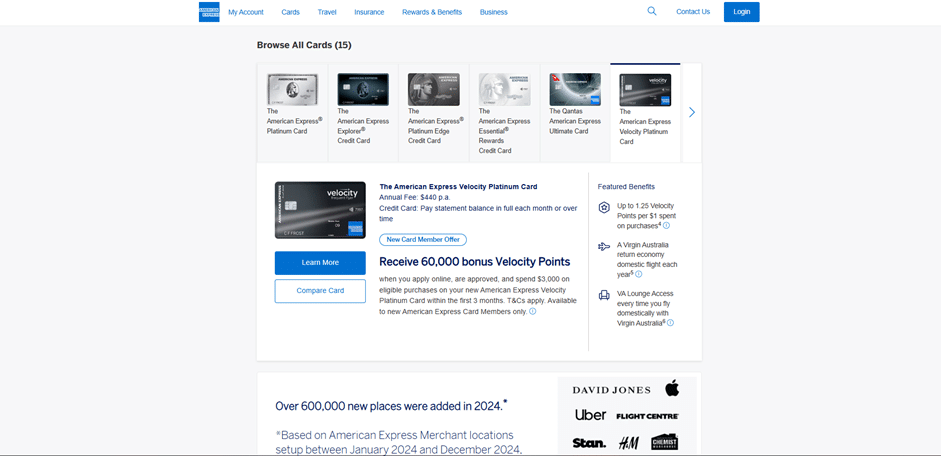

Step 2: Locate and Select the Velocity Platinum Card

On the Personal Cards comparison page, find and choose the Velocity Platinum Card.

- On this page, you will see a large range of cards (e.g., Explorer, Qantas Ultimate, Amex Platinum).

- Look for the American Express Velocity Platinum Card. It will be listed under the travel or frequent flyer category.

- Click on “Learn More” associated with the card to go to the specific product page.

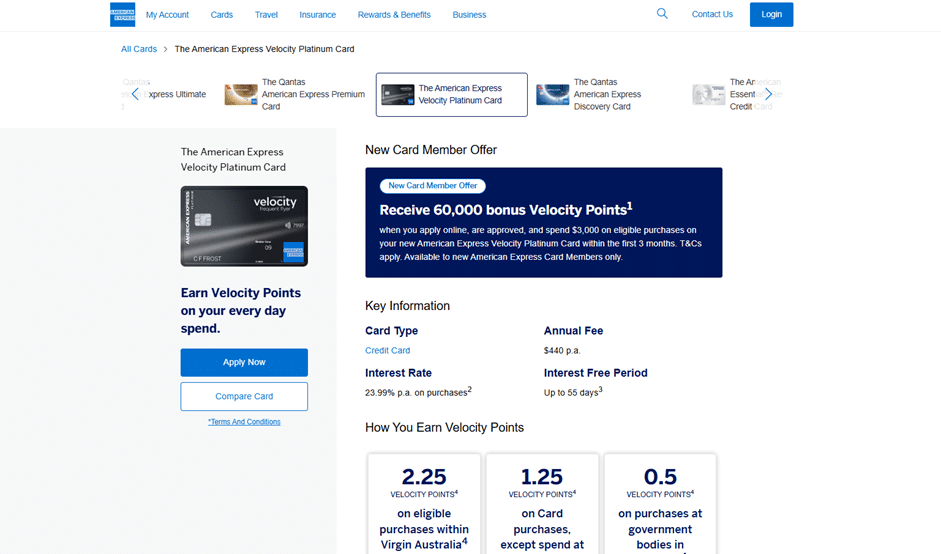

Step 3: Initiate the Online Application

You are now on the detailed product page for the Velocity Platinum Card.

- Here, review all features, including the annual fee, the current sign-up bonus (Velocity Points), and the detailed insurance terms.

- To start your application, click the distinct blue button, labelled “Apply now” or “Apply Online”.

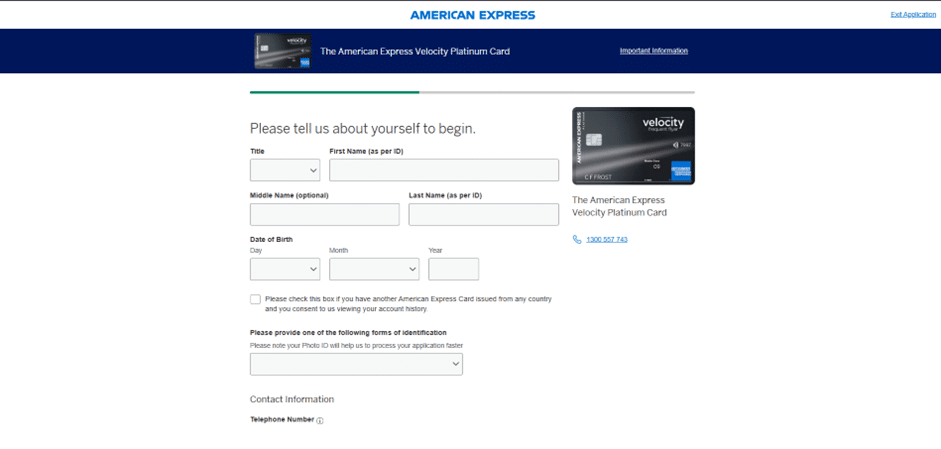

Step 4: Complete and Submit the Application

You will be redirected to the secure American Express online application portal.

- Identity Verification: You will be asked if you are an existing card member. Proceed by confirming your identity.

- Fill in Details: Complete the multi-step form, providing detailed information regarding:

- Personal Identity (Name, Australian Residential Address, Driver’s Licence/Passport details).

- Income (Salary, bonuses, and confirmation that you meet the minimum requirement).

- Financial Details (Assets, Liabilities, and Expenses).

- Velocity Frequent Flyer Number (if you have one).

- Review and Submit: Review the final terms, fees, and the welcome offer conditions, then submit your application.

- American Express will process your request, often providing a decision in minutes. Upon approval, your American Express Velocity Platinum Card will be sent to your mailing address.

The American Express Velocity Platinum Card Overview

With its comprehensive rewards program and travel perks, the American Express Velocity Platinum Card stands out as a top choice for frequent flyers in Australia. This premium Credit Card is designed to offer a range of benefits that enhance the travel experience.

Key Card Features and Benefits

The American Express Velocity Platinum Card comes with a host of features that make it an attractive option for those who travel regularly. Some of the key benefits include:

- Earning Velocity points on eligible purchases

- Complimentary travel insurance

- Airport lounge access

- Travel credits and hotel privileges

A comparison of the card’s benefits is highlighted in the table below:

Who This Card Is Designed For

The American Express Velocity Platinum Card is designed for individuals who frequently travel with Virgin Australia or other Velocity partner airlines. This card is ideal for those who want to maximize their Card Benefits and enjoy a premium travel experience.

To get the most out of this card, cardholders should be aware of the earning structure and redemption options available to them. By understanding how to use the card effectively, Australians can enjoy significant rewards and benefits.

How to Earn Velocity Points with Your Amex Platinum

The American Express Velocity Platinum Card offers a robust points earning structure, allowing cardholders to earn Velocity Points on their everyday purchases and promotional offers. Understanding how to maximize these earnings is key to making the most out of the card’s benefits.

Points Earning Structure in Australia

The Velocity Platinum Card allows cardholders to earn Velocity Points on eligible purchases. The card earns:

- 1 Velocity Point per dollar spent on eligible purchases, with no cap on earnings.

- Bonus points in specific categories, such as travel and dining, which can vary depending on the current promotions.

Bonus Points Opportunities and Promotions

Cardholders can earn bonus points through various promotions and offers. These may include:

- Bonus Points Categories: Earn additional points in specific categories, such as fuel, groceries, or travel.

- Promotional Offers: Participate in American Express’s promotional offers, which can provide bonus points for achieving certain spending thresholds within a specified timeframe.

- Partner Offers: Earn bonus points through partnerships with airlines, hotels, or other retailers.

By leveraging these opportunities, cardholders can significantly boost their Velocity Points earnings, accelerating their path to rewards redemption.

Welcome Bonus and Sign-Up Offers for Australian Cardholders

For Australians considering the American Express Velocity Platinum Card, the welcome bonus is a key incentive to apply. The card offers attractive sign-up offers that can significantly boost your Velocity Points balance.

Current Promotional Offers

American Express frequently updates its promotional offers for the Velocity Platinum Card. Currently, new cardholders can earn a substantial welcome bonus by meeting specific spending requirements within a defined period. It’s essential to check the American Express website for the latest promotional offers, as these can change over time.

Some common promotional offers include bonus points for achieving certain spending thresholds or exclusive benefits for a limited time. For instance, cardholders might receive a bonus of 50,000 Velocity Points for spending $5,000 within the first three months.

Qualifying Criteria and Spending Requirements

To qualify for the welcome bonus, cardholders must meet the specified spending requirements within the given timeframe. Typically, this involves spending a certain amount, such as $3,000 or $5,000, within the first few months of card activation.

It’s crucial to review the terms and conditions of the current promotional offer to understand the qualifying criteria and spending requirements fully.

Annual Fees and Charges Explained

Understanding the annual fees associated with the American Express Velocity Platinum Card is crucial for potential applicants. The card’s annual fee is a significant consideration that must be weighed against its benefits.

Annual Fee Structure and Value Proposition

The American Express Velocity Platinum Card comes with a substantial annual fee. To determine if this fee is justified, it’s essential to examine the card’s benefits and rewards structure. The card offers a range of benefits, including Velocity Points on eligible purchases, travel insurance, and airport lounge access.

Additional Card Costs and Foreign Transaction Fees

Besides the annual fee, it’s also important to consider any additional costs associated with the card, such as foreign transaction fees. The American Express Velocity Platinum Card does not charge foreign transaction fees on purchases made abroad, making it an attractive option for international travelers.

Key Card Costs:

- Annual Fee: $0 first year, then $695 per annum

- Foreign Transaction Fees: Nil

- Late Payment Fees: As per the card’s terms and conditions

Complimentary Travel Benefits for Australian Cardholders

Australian cardholders of the Amex Platinum Card can enjoy a suite of travel perks that make their journeys more comfortable and rewarding. The American Express Velocity Platinum Card is designed to enhance the travel experience with a range of complimentary benefits.

Airport Lounge Access Benefits

One of the standout travel benefits of the Amex Velocity Platinum Card is access to airport lounges. This benefit allows cardholders to relax in comfort before their flight, enjoying amenities such as complimentary food and beverages, shower facilities, and quiet workspaces. With access to a global network of lounges, cardholders can enjoy a more serene travel experience, regardless of their destination.

- Access to over 1,000 airport lounges worldwide

- Complimentary food and beverages

- Shower facilities and quiet workspaces

Travel Credits, Hotel Privileges and Flight Upgrades

Beyond lounge access, the Amex Velocity Platinum Card offers a range of other travel benefits, including travel credits, hotel privileges, and opportunities for flight upgrades. Cardholders can receive credits towards their travel expenses, enjoy hotel stays with added perks like room upgrades and breakfast, and potentially upgrade their flights to a higher class of service.

These benefits combine to make the Amex Velocity Platinum Card a compelling choice for frequent travelers in Australia, offering a comprehensive suite of travel perks that enhance the overall travel experience.

Insurance Coverage and Protection Benefits

The American Express Velocity Platinum Card offers a comprehensive suite of insurance coverage and protection benefits that provide cardholders with peace of mind. These benefits are designed to protect against unforeseen events that may occur during travel or when making purchases.

Travel Insurance Coverage Details

The card includes comprehensive travel insurance that covers various aspects of travel, including trip cancellations, interruptions, and delays. This insurance also covers medical emergencies, evacuation, and luggage loss or damage. For instance, if a cardholder’s trip is cancelled due to illness, the travel insurance can reimburse the non-refundable costs. It’s essential to review the policy details to understand the coverage limits and terms.

As noted by a travel insurance expert, “Having comprehensive travel insurance can make a significant difference when dealing with unexpected travel disruptions.” This underlines the value of the travel insurance provided with the American Express Velocity Platinum Card.

Purchase Protection and Extended Warranty Benefits

In addition to travel insurance, the card offers purchase protection and extended warranty benefits. Purchase protection covers eligible purchases against theft, loss, or damage for a specified period. The extended warranty benefit doubles the manufacturer’s warranty on eligible purchases, providing additional protection. For example, if a cardholder purchases a new laptop, the extended warranty can provide peace of mind against defects or malfunctions beyond the standard warranty period.

According to a consumer protection advocate, “Extended warranty and purchase protection benefits can be invaluable in safeguarding purchases against unforeseen issues.” This highlights the practical benefits of these features for cardholders.

American Express Velocity Platinum Card Eligibility Requirements

To apply for the American Express Velocity Platinum Card, Australians must meet specific eligibility requirements. Understanding these criteria is essential to ensure a smooth application process.

Income and Credit Score Requirements for Australians

A key factor in determining eligibility is the applicant’s income and credit score. American Express typically requires applicants to have a stable income that meets or exceeds their minimum income threshold, which may vary. Additionally, a good credit score is crucial, as it reflects the applicant’s creditworthiness and history of managing debt.

Application Process and Approval Timeline

The application process for the American Express Velocity Platinum Card is straightforward and can be completed online. Applicants need to provide personal and financial information. The approval timeline typically ranges from a few days to a couple of weeks, depending on the complexity of the application and the speed at which the required information is provided.

Once the application is submitted, American Express will review the applicant’s credit history and financial information before making a decision. Being prepared with the necessary documents can help expedite the process.

Velocity Frequent Flyer Program Integration

The American Express Velocity Platinum Card offers seamless integration with the Velocity Frequent Flyer program, allowing cardholders to maximize their rewards. This integration enables cardholders to earn and redeem Velocity Points efficiently, making the most of their card membership.

The Velocity Frequent Flyer program, powered by Virgin Australia, allows members to earn points that can be redeemed for flights, upgrades, and other rewards. With the American Express Velocity Platinum Card, cardholders can accelerate their points earnings through various channels.

Transferring and Redeeming Points with Virgin Australia

Cardholders can transfer their earned points to the Velocity Frequent Flyer program, where they can be redeemed for a range of rewards on Virgin Australia flights. The process is straightforward, allowing for easy redemption of points for flight bookings, upgrades, and other travel perks.

- Earn Velocity Points on eligible purchases with the American Express Velocity Platinum Card.

- Transfer points to the Velocity Frequent Flyer program.

- Redeem points for flights, upgrades, and other rewards on Virgin Australia.

Status Credits, Tier Benefits and Companion Vouchers

Holding the American Express Velocity Platinum Card not only helps in earning Velocity Points but also provides Status Credits that can help cardholders achieve higher tiers within the Velocity Frequent Flyer program. Higher tiers come with tier benefits such as priority check-in, extra baggage allowance, and lounge access.

Additionally, achieving certain tiers can lead to companion vouchers, allowing cardholders to bring a companion on a flight at a reduced rate or for free. This benefit significantly enhances the travel experience, making it more enjoyable and cost-effective.

By leveraging the integration between the American Express Velocity Platinum Card and the Velocity Frequent Flyer program, cardholders can enjoy a more rewarding travel experience. The combination of points earnings, status credits, and tier benefits makes this card particularly appealing to frequent flyers.

Maximising Value from Your Platinum Card in Australia

Maximising the value of your Amex Platinum Card in Australia requires a strategic approach to spending and redemption. To get the most out of your card, it’s essential to understand how to earn and redeem Velocity points effectively.

Strategic Spending Tips for Maximum Points

To maximise your points earnings, focus on using your Amex Platinum Card for daily expenses, such as groceries, dining, and fuel. Additionally, take advantage of bonus categories and promotions offered by American Express. For example, using your card for Virgin Australia flights can earn you bonus points.

Consider using your card for larger purchases or consolidating your spending to meet the minimum spend requirements for sign-up bonuses. This can significantly boost your points balance and help you achieve your rewards goals faster.

Redemption Strategies for Best Value on Flights and Upgrades

When redeeming your Velocity points, it’s crucial to choose the right flights and classes of travel to maximise their value. Booking award flights during off-peak periods or using points for upgrades can provide significant value. Consider redeeming points for business or first-class flights, as these typically offer the best value.

Another strategy is to use your points for companion vouchers or status credits, which can enhance your travel experience and provide additional benefits. By being strategic with your redemptions, you can enjoy more luxurious travel and make the most of your Amex Platinum Card.

Comparing the Amex Velocity Platinum to Other Australian Rewards Cards

In the competitive landscape of Australian rewards cards, the American Express Velocity Platinum Card stands out, but a comparison with other cards reveals its true value. When evaluating rewards cards, it’s crucial to consider the benefits, fees, and earning structures to determine which card best suits your needs.

Versus Other Velocity-Earning Cards in Australia

The American Express Velocity Platinum Card is not the only card that earns Velocity points. Other cards, such as the ANZ Velocity Flyer Card, offer similar benefits. A comparison of these cards reveals key differences:

- Earning Structure: The Amex Velocity Platinum offers 1 point per dollar spent on eligible purchases, while other cards may offer different rates.

- Annual Fees: The annual fee for the Amex Velocity Platinum is competitive, but other cards may offer lower fees with fewer benefits.

- Additional Benefits: Travel insurance, airport lounge access, and other perks vary between cards.

Versus Other Premium Travel Cards Available to Australians

Premium travel cards, such as the American Express Platinum Card and the Westpac Altitude Black Card, offer a range of benefits that may appeal to frequent travelers. When comparing these cards to the Amex Velocity Platinum, consider:

- The value of the rewards points earned and how they can be redeemed.

- The level of travel insurance and protection offered.

- Additional perks, such as lounge access and travel credits.

By examining these factors, Australians can make an informed decision about which premium travel card best meets their travel needs and spending habits.

Conclusion: Is the Amex Velocity Platinum Card Worth It for Australians?

The American Express Velocity Platinum Card offers a compelling rewards program for Australian cardholders, particularly those who frequently fly with Virgin Australia. With its robust points earning structure and range of travel benefits, this card can provide significant value to the right user.

For Australian cardholders who can maximize the card’s benefits, such as earning bonus points on Virgin Australia purchases and enjoying complimentary travel insurance and airport lounge access, the card’s value proposition is strong. However, the high annual fee means it’s essential to weigh these benefits against the costs to determine if it’s worth it for your individual circumstances.

Ultimately, the Amex Velocity Platinum Card is a valuable choice for Australian cardholders who can capitalize on its rewards and travel perks, making it a worthwhile investment for those who travel frequently with Virgin Australia.

FAQ

What is the American Express Velocity Platinum Card?

How do I earn Velocity Points with my Amex Platinum Card?

What is the annual fee for the American Express Velocity Platinum Card?

Can I access airport lounges with the Amex Velocity Platinum Card?

How do I qualify for the welcome bonus on the Amex Velocity Platinum Card?

What insurance coverage is included with the Amex Velocity Platinum Card?

How do I transfer my Amex Velocity Platinum Points to Virgin Australia?

Can I compare the Amex Velocity Platinum Card to other rewards cards?

What are the eligibility requirements for the American Express Velocity Platinum Card?

How can I maximise the value from my Amex Velocity Platinum Card?

Conteúdo criado com auxílio de Inteligência Artificial