Obtaining an Absa credit card is a straightforward process that can be completed in a few easy steps. If you’re looking to apply for an Absa credit card, you’re on the right track to managing your finances effectively.

The process involves a simple online application, followed by a quick review of your creditworthiness. Once approved, you can start using your card to make purchases, pay bills, or build your credit score.

By following these simple steps, you can enjoy the benefits of having an Absa credit card, including flexible payment options and competitive interest rates.

Anúncios

Key Takeaways

Absa

- Apply for an Absa credit card online in a few minutes.

- Understand the eligibility criteria before applying.

- Review the benefits and terms of your Absa credit card.

- Manage your credit card account online or through the mobile app.

- Make timely payments to build a good credit score.

Understanding Absa Credit Cards

Absa offers a diverse range of credit cards, each designed to meet different financial needs and preferences. Whether you’re looking for a card with rewarding benefits, a low interest rate, or enhanced security features, Absa has options to suit various lifestyles.

Anúncios

Types of Credit Cards Offered by Absa

Absa’s credit card portfolio includes several types, such as cashback cards, rewards cards, and travel cards. Each type is designed to cater to different spending habits and financial goals. For instance, cashback cards offer a percentage of your spend back as credit, while rewards cards provide points that can be redeemed for goods and services.

Features and Benefits of Each Card Type

The features and benefits of Absa’s credit cards vary, but common advantages include competitive interest rates, robust security measures, and rewards programs. For example, some cards offer zero foreign transaction fees, making them ideal for international travel. Others provide comprehensive travel insurance and purchase protection. The table below summarizes some key features of Absa’s credit cards:

| Card Type | Key Features | Benefits |

|---|---|---|

| Cashback Card | Cashback on purchases, low fees | Earn cashback on daily purchases |

| Rewards Card | Points on purchases, redemption options | Redeem points for goods and services |

| Travel Card | No foreign transaction fees, travel insurance | Travel benefits, including insurance and lounge access |

By understanding the different types of credit cards and their features, you can make an informed decision about which card best suits your financial needs.

Benefits of Having an Absa Credit Card

The advantages of having an Absa credit card are numerous, from rewards programs to enhanced security features. With a range of benefits tailored to different needs, Absa credit cards are designed to provide cardholders with a superior financial management tool.

Rewards and Loyalty Programs

Absa credit cards come with attractive rewards and loyalty programs that allow cardholders to earn points or cashback on their purchases. These rewards can be redeemed for a variety of goods and services, providing a tangible benefit for using the card. The rewards programs are designed to be flexible and rewarding, making every purchase count.

Financial Flexibility and Convenience

One of the key benefits of an Absa credit card is the financial flexibility it offers. Cardholders can manage their finances more effectively with the ability to pay for purchases over time, rather than all at once. This flexibility is particularly useful for larger or unexpected expenses. Additionally, the convenience of not having to carry large amounts of cash is a significant advantage.

Security Features and Protection

Absa credit cards also come equipped with advanced security features to protect cardholders against fraud and unauthorized transactions. Features such as real-time transaction monitoring and alerts help to safeguard accounts. In the event of a disputed transaction, Absa’s customer service is available to assist, providing peace of mind for cardholders.

Eligibility Requirements for an Absa Credit Card

Eligibility for an Absa credit card is determined by several key factors that applicants should be aware of. Understanding these requirements is essential to ensure a smooth application process.

Age and Residency Requirements

To apply for an Absa credit card, applicants must meet specific age and residency criteria. The minimum age requirement is 18 years, and applicants must be South African residents or have a valid residence permit.

Income Thresholds for Different Cards

Absa has different income requirements for its various credit cards. For instance, the Absa Premier Credit Card requires a higher income level compared to the Absa Classic Credit Card. The income thresholds are in place to ensure that applicants have the financial means to manage their credit card responsibilities.

| Credit Card Type | Minimum Income Requirement |

|---|---|

| Absa Classic Credit Card | R 3,000 per month |

| Absa Gold Credit Card | R 6,000 per month |

| Absa Premier Credit Card | R 12,000 per month |

Credit Score Considerations

A good credit score significantly improves one’s chances of being approved for an Absa credit card. Absa considers credit scores when evaluating applications, so maintaining a healthy credit history is crucial.

Complete Tutorial: How to Apply for an Absa Bank Credit Card (Step-by-Step)

Applying for a credit card with Absa Bank is a quick and simple process that you can complete entirely online. Whether you’re looking for a card for your daily purchases, travel, or exclusive benefits, this practical guide will show you the step-by-step process to submit your application.

Follow the instructions below to get started.

Step 1: Access the Official Absa Bank Website

To begin, open your internet browser and go to the Absa Bank homepage. This is the starting point for exploring all their banking products, including the credit cards section.

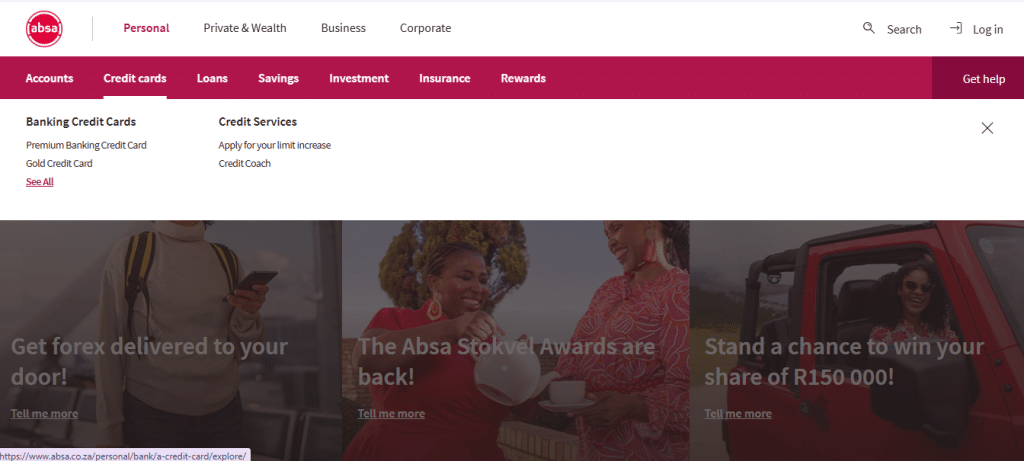

Step 2: Navigate to the Credit Cards Section

On the homepage, you’ll find a search bar or a main menu. The fastest shortcut is to click the second button in the search bar, which is usually labelled “Credit Cards”.

Next, to see all the available card options, look for and click the highlighted “See All” button.

Step 3: Choose the Right Credit Card for You

Now you’re on the comparison page, where you can view all the credit cards that Absa offers. You’ll find a variety of options, including:

- Gold Credit Card (Visa Gold)

- Premium Banking Credit Card (Visa Platinum)

- Private Banking Credit Card (Visa Signature)

- British Airways Credit Card

- …and many more.

Each card has specific benefits and requirements. Review the details to choose the one that best fits your financial profile and needs.

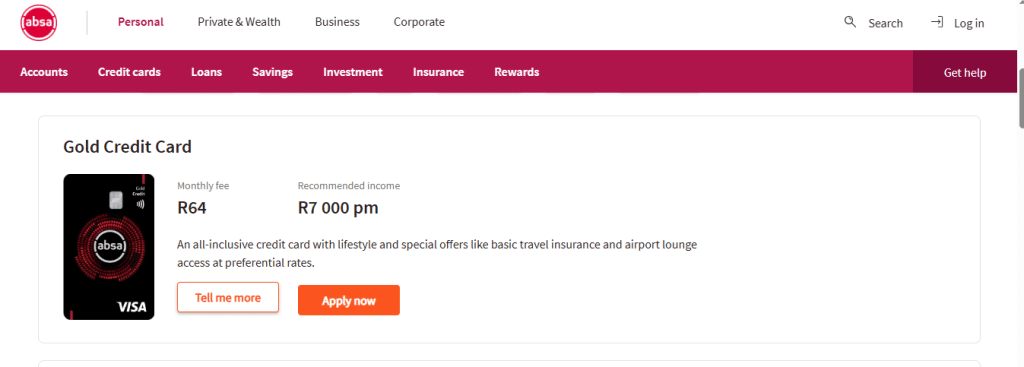

Step 4: Start Your Online Application

After you’ve decided on the right card for you, it’s time to begin the application process.

- On your chosen card’s panel, look for and click the orange “Apply now” button.

This will redirect you to the online application form, which is the final step of the process.

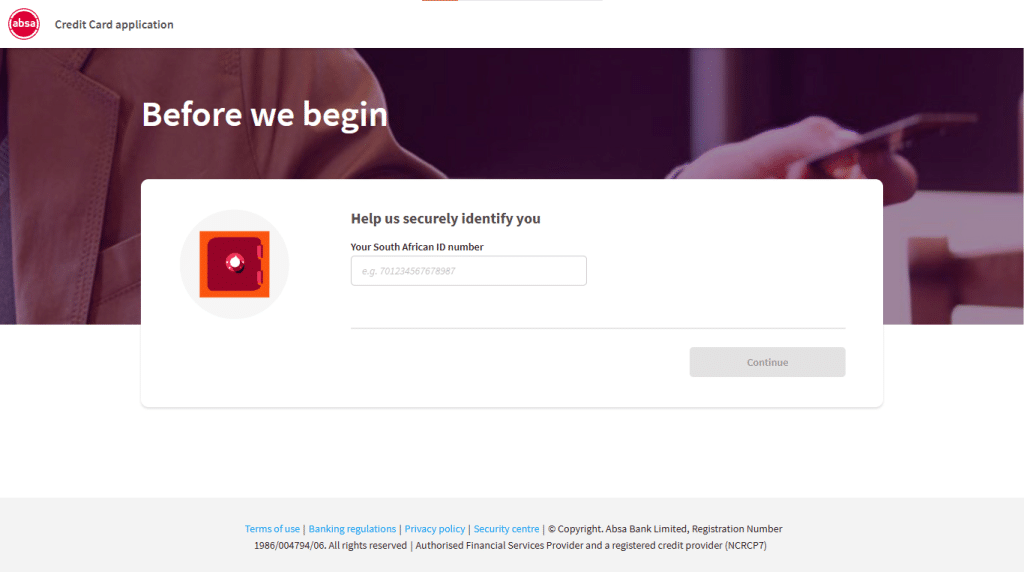

Step 5: Fill in the Application Form

In this final step, you’ll need to provide your personal and financial information. The online form is designed to be intuitive and secure. Carefully fill in all the required fields.

The information typically requested includes:

- Contact details (name, email, phone number)

- Identification information

- Details about your income and employment

After completing the form, review all the information and follow the instructions to submit your application. Absa Bank will then contact you regarding the next steps.

Congratulations! You have completed the process of how to apply for a credit card with Absa Bank.

Documents Required for Your Application

To facilitate a smooth application process, it’s crucial to understand the documents required for an Absa credit card. Having the necessary documents ready will help you complete your application efficiently.

Identification Documents

Absa requires valid identification to process your credit card application. Acceptable identification documents include a South African ID book, ID card, or a valid passport. Ensure your ID is not expired and is in good condition to avoid any delays.

Proof of Income and Employment

You will need to provide proof of income and employment to demonstrate your financial stability. This can be in the form of payslips, a letter from your employer, or your latest income tax assessment. Self-employed individuals may need to provide additional financial documents, such as audited financial statements.

Proof of Residence

To verify your address, Absa requires proof of residence. This can be a utility bill, bank statement, or a lease agreement in your name. The document should be recent, typically not older than three months, and clearly show your name and address.

| Document Type | Acceptable Documents | Validity Period |

|---|---|---|

| Identification | ID book, ID card, Passport | Not expired |

| Proof of Income | Payslips, Employer letter, Tax assessment | Latest available |

| Proof of Residence | Utility bill, Bank statement, Lease agreement | Not older than 3 months |

Ensuring you have these documents ready will significantly streamline your application process. For the most up-to-date information, it’s always a good idea to check Absa’s official website or consult with their customer service.

Absa Bank: Your Trusted Partner for Comprehensive Financial Solutions

At Absa Bank, we believe that financial success starts with the right partnership. As one of Africa’s largest and most innovative financial institutions, we are dedicated to providing the tools and support you need to achieve your goals, whether they are personal or business-related.

Our mission is simple: to build a secure financial future for you. With a solid presence and a deep understanding of the market, we offer banking solutions that fit seamlessly into your lifestyle.

Absa Bank

Our Services: Financial Solutions for You

We offer a full range of products and services to meet all your banking needs.

- Bank Accounts: Smart solutions for managing your everyday money, with flexible options for all ages and profiles.

- Absa Credit Cards: Choose from a variety of cards, including the Absa Gold, Premium, and Private, each with exclusive benefits for travel, purchases, and rewards.

- Loans and Financing: Whether for a new car, a home, or a personal project, our loan options are designed to help you achieve your dreams.

- Investments and Insurance: Protect your future and grow your money with our investment and insurance solutions, created to give you peace of mind.

Why Choose Absa Bank?

Technology and Security: Our online banking platform and mobile app are built with the highest security technology, ensuring your transactions and data are always protected.

Personalised Service: We offer specialised and dedicated support for every client, from managing your accounts to strategic financial advice.

Local Commitment: With a strong presence and a deep understanding of our community’s needs, Absa is more than a bank; we are a partner in your growth.

Join us today. Discover the difference of being a client of a bank that cares about your financial success.

Applying Online for Your Absa Credit Card

Absa’s online platform allows you to apply for a credit card quickly and securely. This method is not only convenient but also saves you time, allowing you to complete the application at your own pace.

Creating an Absa Online Profile

The first step in applying online is to create an Absa online profile. This involves providing some basic information such as your name, email address, and contact details. Creating a profile is a straightforward process that requires you to verify your identity. Once your profile is set up, you can save your progress and return to it later if needed.

Completing the Online Application Form

After setting up your online profile, you’ll need to fill out the credit card application form. This form will ask for personal and financial information, including your income, employment status, and other relevant details. It’s essential to ensure that all information is accurate to avoid any delays in processing your application. The online form is designed to be user-friendly, with clear instructions to guide you through each step.

Uploading Supporting Documents

As part of the online application process, you’ll be required to upload supporting documents. These typically include proof of identity, proof of income, and proof of residence. Ensuring that your documents are in the correct format and meet the specified requirements is crucial. Absa’s online system is designed to securely handle your documents, giving you peace of mind throughout the application process.

By following these steps, you can easily complete your Absa credit card application online. The process is designed to be efficient, allowing you to apply from anywhere and at any time.

Alternative Application Methods

While online applications are convenient, Absa offers alternative methods to apply for a credit card, catering to different preferences and needs. This flexibility ensures that customers can choose the application method that best suits their lifestyle and comfort level.

Applying In-Branch: The Process and Benefits

Visiting an Absa branch to apply for a credit card can be a great option for those who value face-to-face interaction. The process involves speaking with a bank representative who can guide you through the application, answer any questions, and help with submitting the required documents. This method allows for immediate clarification of any doubts and can make the application process feel more secure.

Applying by Phone: Step-by-Step Guide

Applying for an Absa credit card over the phone is another convenient option. You can call Absa’s customer service number, and a representative will walk you through the application process. They will need to verify your identity and discuss your financial information. It’s essential to have your documents ready before calling to ensure a smooth process.

Using the Absa Banking App for Applications

The Absa Banking App offers a user-friendly platform for applying for a credit card. By navigating through the app, you can select the credit card you’re interested in, fill out the application form, and upload the necessary documents. The app is designed to be intuitive, making it easy to track your application status.

The Application Review Process

Understanding the application review process is crucial for a smooth Absa credit card application experience. When you apply for an Absa credit card, your application undergoes a thorough review.

How Long It Takes to Process Your Application

The processing time for Absa credit card applications typically ranges from a few hours to several days, depending on the complexity of the application and the information provided. Efficient processing is ensured through a streamlined system that prioritizes applications with complete and accurate information.

How Absa Evaluates Your Creditworthiness

Absa evaluates your creditworthiness by assessing your credit history, income stability, and debt-to-income ratio. This comprehensive evaluation helps determine your ability to manage credit responsibly. The bank uses advanced credit scoring models to make an informed decision about your application.

What Happens If Your Application Is Pending

If your application is pending, it may be due to the need for additional information or verification. You will be notified by Absa regarding the required next steps. Ensuring that you provide all necessary documentation promptly can help expedite the process.

| Status | Description | Typical Duration |

|---|---|---|

| Processing | Application is being reviewed | 1-3 days |

| Pending | Additional information required | 3-7 days |

| Approved | Application is successful | – |

Tips to Improve Your Chances of Approval

Boosting your chances of approval for an Absa credit card involves a combination of financial health and strategic planning. By focusing on key areas, you can significantly enhance your application’s success.

Maintaining a Good Credit Score

A good credit score is crucial for credit card approval. It reflects your creditworthiness and history of managing debt. To maintain a good credit score, ensure you make timely payments, keep credit utilization low, and monitor your credit report for errors.

Demonstrating Financial Stability

Demonstrating financial stability is vital for credit card approval. Absa looks for applicants with a stable income and a reasonable debt-to-income ratio. Ensure you have a steady job, and consider reducing your debt obligations to improve your financial stability.

Addressing Potential Red Flags

Addressing potential red flags in your credit application can improve your chances of approval. Common red flags include late payments, high credit utilization, and excessive credit inquiries. By rectifying these issues, you can present a stronger application to Absa.

| Tip | Description | Benefit |

|---|---|---|

| Maintain a good credit score | Make timely payments and keep credit utilization low | Increased creditworthiness |

| Demonstrate financial stability | Ensure a steady income and reasonable debt-to-income ratio | Improved application strength |

| Address potential red flags | Rectify late payments, high credit utilization, and excessive inquiries | Enhanced approval chances |

Activating and Managing Your New Absa Credit Card

Activating your new Absa credit card is a straightforward process that unlocks a range of financial management tools. This step is crucial for starting to use your card for transactions, checking balances, and managing your account.

Card Activation Process

To activate your Absa credit card, you can either call the Absa customer service number provided with your card or use the Absa Banking App. The app allows you to activate your card quickly by following the in-app prompts. Activation is a simple process that ensures your card is ready for use.

Setting Up Online Banking Access

Setting up online banking access is essential for managing your Absa credit card account. You can do this by registering on the Absa website or through the Absa Banking App. This allows you to check your balance, view transactions, and make payments online.

Making Payments and Avoiding Fees

Making timely payments is crucial for avoiding late fees and interest charges on your Absa credit card. You can set up direct debit, make online payments, or pay at an Absa branch. Understanding your payment options and due dates helps in managing your credit card effectively.

Security Best Practices

To secure your Absa credit card, it’s recommended to keep your card details confidential, monitor your account regularly, and report any suspicious transactions to Absa. Using strong passwords for online banking and keeping your card in a safe place are also important security measures.

| Task | Description | Benefits |

|---|---|---|

| Card Activation | Activate your card via phone or Absa Banking App | Ready to use for transactions |

| Online Banking Setup | Register on Absa website or through the App | Manage account, check balance, and make payments |

| Timely Payments | Set up direct debit or make online payments | Avoid late fees and interest charges |

Conclusion

Applying for an Absa credit card is a straightforward process that can be completed online, in-branch, or by phone. By understanding the different types of credit cards offered by Absa, their features, and benefits, you can make an informed decision that suits your financial needs.

The application process involves evaluating your financial needs, selecting the right card type, and preparing your financial information. Absa’s online application system allows you to easily upload supporting documents and track the status of your application.

In summary, Absa’s credit card application process is designed to be simple and convenient. By following the steps outlined in this article, you can successfully apply for an Absa credit card and start enjoying the benefits of flexible financial management and rewarding loyalty programs.

Now that you have a clear understanding of the application process, you can confidently apply for your Absa credit card and take control of your financial management.

FAQ

What are the eligibility requirements for an Absa credit card?

What documents are required for an Absa credit card application?

How do I apply for an Absa credit card?

How long does it take to process my Absa credit card application?

How does Absa evaluate my creditworthiness?

What are the benefits of having an Absa credit card?

How do I activate my new Absa credit card?

What are the fees associated with an Absa credit card?

Can I manage my Absa credit card online?

How can I improve my chances of being approved for an Absa credit card?

Conteúdo criado com auxílio de Inteligência Artificial