Want a loan for all times?

The USA’s real estate scene offers many loan options. These choices greatly affect property prices and financing terms. It’s crucial to understand your options for smart real estate decisions.

There are lots of loan products, each with special details, interest rates, and payback plans. To handle this complexity and find the best loan for you, getting expert advice is key.

Wells Fargo Personal Loan

Understanding the Loan Landscape in the USA

In the USA, there’s a wide range of loan options for consumers. These include mortgages and personal loans, each designed for different financial needs. By understanding these choices, borrowers can make smarter decisions.

The types of loans available come with their own terms and special features. They aim to meet specific financial goals of different people.

The loan market keeps changing due to interest rates, the economy, and what people need. These shifts influence the loan choices out there. Staying updated on these changes helps people find the right loan options for them.

Finding the best loan can be tricky because there are so many options. Getting advice from financial experts can make a big difference. They can guide you to the loan that fits your situation best, ensuring good loan terms.

Types of Loans Available in the USA

In the USA, you can find many kinds of loans, each made for different needs. It’s important for people looking for money help to understand these loans.

Home loans help people buy houses. They usually need an upfront payment and offer different rates. Before choosing a home loan, check if your finances and credit are good.

Personal loans are flexible and can cover many needs, like paying off debt or making big buys. To get one, your income and credit score matter.

Student loans help with school costs, making education more affordable. These loans have special terms, depending on your situation.

To make the right choice, it’s key to know the differences between home, personal, and student loans. This helps match your money needs with the right loan.

Conventional Loans: Features and Considerations

Many people in the U.S. opt for conventional loans when buying a house. These are given out by private companies, not the government. This fact makes them have unique points and things you should think about on your home buying path.

Definition and Characteristics

Since they’re not backed by the government, conventional loans are a fit for those with good credit. They have features like:

- Higher credit score requirements.

- Larger down payments compared to FHA or VA loans.

- Flexible terms that often allow for quicker processing times.

- The option of fixed or adjustable interest rates.

Pros and Cons

Going for a conventional loan can have big benefits. If you can make a large down payment, you might not need mortgage insurance. This can save you money. However, there are downsides to consider, such as:

- Stricter eligibility requirements that could limit access for some individuals.

- Potentially higher interest rates that may elevate monthly payments.

FHA Loans: Accessibility and Benefits

FHA loans are supported by the Federal Housing Administration. They offer a helpful route for many trying to buy a home. These loans are especially good for people finding it tough due to credit scores or down payment needs.

Eligibility Requirements

To get an FHA loan, you usually need a certain credit score. If your score is 580 or more, you can pay less upfront. Those with lower scores can still qualify but must pay more at the start. You also need steady income and job history. This flexibility makes FHA loans appealing to many buyers.

Pros and Cons

FHA loans have several key benefits:

- They often ask for a down payment as low as 3.5%

- Their credit score needs are more forgiving

- They offer competitive interest rates for lower monthly costs

However, there are downsides. Borrowers have to pay for mortgage insurance, adding to the cost. There are also limits on how much you can borrow. These points are important to consider when thinking if an FHA loan matches your financial plans.

VA Loans: Support for Veterans and Their Families

VA loans are key for veterans, active-duty members, and surviving spouses. They offer affordable home financing to honor their service. Understanding how to qualify and the benefits can help you use these loans fully.

Eligibility Requirements

To get a VA loan, you need to show you’ve served in the military. You also need to show your income and that you’re good with money. Usually, veterans must have served for a certain time and left the service honorably. This makes sure the program helps those who have given to their country.

Advantages and Disadvantages

The perks of VA loans are:

- No down payment is needed, making it easier for veterans to buy a home.

- There’s no need for private mortgage insurance, which makes monthly payments less.

- You get competitive interest rates, saving you money over time.

But, VA loans have some downsides too. For example, not all types of property are available, limiting choices for veterans. Also, VA funding fees can raise the total loan cost, even though they can be included in the loan amount.

USDA Loans: Financing for Rural Areas

USDA loans come from the United States Department of Agriculture. They help people buy homes in rural areas. They are great for low-income borrowers, giving them a chance to own a home in certain parts of the country. If you understand how these loans work, making a choice becomes easier.

Eligibility Criteria

Here’s what you need to get a USDA loan:

- Your income can’t be too high. It must be close to the area’s average.

- The home you want must be in a place the USDA says is rural.

- You must have a steady income and good credit.

Benefits of USDA Loans

USDA loans offer lots of perks for buying a house in rural spots:

- You don’t need to pay upfront, so you can finance the whole price.

- They come with low interest, making monthly payments easier to afford.

- They’re not so strict on credit scores, helping more people qualify.

Choosing USDA loans can be a smart move for first-time homebuyers in rural areas. They offer many benefits that make buying a home more accessible and affordable.

Jumbo Loans: High-Value Financing Options

Jumbo loans are special because they help buy expensive homes that cost more than regular loan limits. This makes them perfect for getting into upmarket properties. Since there’s no government support, jumbo loans come with their own rules that buyers should know.

Definition and Characteristics

Jumbo loans are bigger than most because they go past what the Federal Housing Finance Agency says is the max. People who want these loans need good credit and to make enough money. They also need to put down a lot of money at first, which shows they’re serious but can be hard for some.

Pros and Cons of Jumbo Loans

Thinking about getting a jumbo loan? Here’s what’s good and bad about them:

- Pros:

- They let you buy pricey homes.

- They might offer good interest rates if you’re in great financial shape.

- Cons:

- You often need to put down 20% or sometimes even more.

- It’s harder to qualify for these than for regular loans.

Key Factors to Consider When Choosing a Loan

Choosing the right loan requires looking at key factors important for your financial goals. It’s important to know your financial situation well. This helps make good decisions about loans. Things like your credit score, how much money you make, and your debts are key.

Your Financial Goals

Before picking a loan, know exactly what your financial goals are. Think about why you need the loan. Is it for buying a house, paying for school, or bringing debts together? The reason will guide you to the right loan that matches your needs and offers the best terms.

Credit Score and Financial History

Your credit score plays a big part in what you can borrow. Lenders look at your score to see if you’re good at paying back debts. A strong credit score means better loan conditions. Checking your credit report early can help fix any mistakes. A good down payment also helps get better loan choices, which is great for your money future.

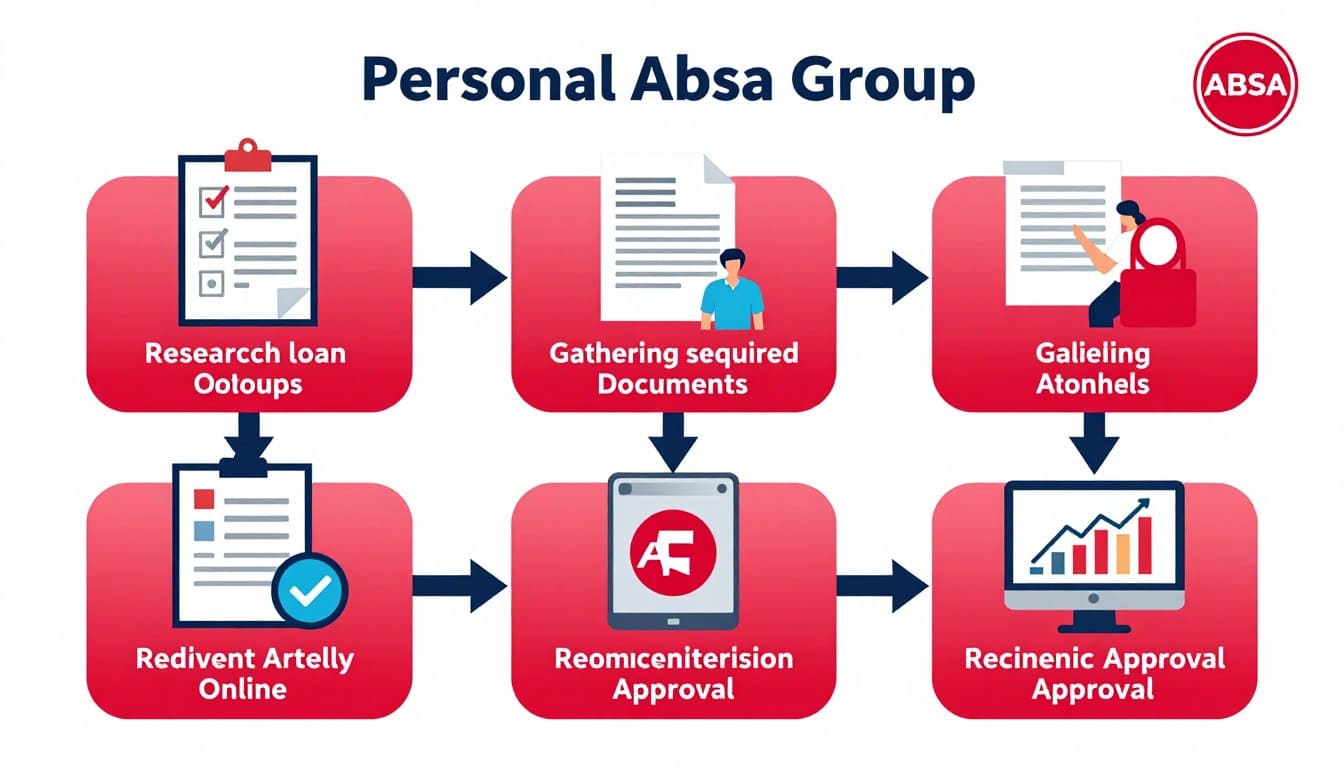

Navigating the Loan Application Process

The loan application process might seem daunting with all its required details. Start by collecting important documents. These include your income proof, credit history, ID, and any existing debts. Getting these ready shows lenders you’re financially stable.

Every step in applying is important for a good outcome. Filling out the application correctly and quickly helps speed up its review and approval. Keeping things organized reduces stress since lenders might ask for more information during underwriting.

Knowing what the application involves helps you stay on top of things. Keep in touch with your lender. A quick response to their questions can boost your chances of getting the loan you want.

Importance of Seeking Expert Guidance

Getting help from experts when looking for a loan is crucial. They help borrowers get good financing deals. Understanding different loan options can be hard. This is where mortgage brokers come in. They guide people in choosing the best loan plans for their needs.

Mortgage brokers know a lot about loans. They help make applying easier, spot possible issues, and keep up with market trends. With their help, borrowers can dodge common mistakes. They make smart choices that fit their money goals.

Having a pro on your side makes the loan process smoother. They help get all the needed paperwork. They also make sure everything in the application is right for the lender. Their support gives borrowers confidence. It makes getting a loan feel less stressful.

How to Identify the Right Loan Expert

Finding the right loan expert is crucial for navigating the complexities of securing financing. To ensure you select a capable professional, start by conducting thorough research. Identify various professionals such as mortgage brokers, loan officers, and financial advisors who specialize in different loan options.

Researching Professionals

When researching professionals, consider the following steps:

- Seek recommendations from trusted friends or family members.

- Look for online reviews and testimonials to gauge client satisfaction.

- Check local listings and professional associations for qualified individuals.

Evaluating Experience and Credentials

Once you have a list, evaluate each candidate’s qualifications. Pay attention to:

- Their experience in the industry and specific loan types.

- Certifications or licenses that demonstrate their expertise.

- Previous client outcomes that showcase their ability to meet borrower needs.

Choosing the right loan expert not only eases the process of finding the best financing options but also helps you make informed decisions regarding your financial future.

Loan USA: Making Informed Decisions

Making the right loan choice in the USA is critical. It’s important to compare different loans, their interest rates, and terms. This helps align your financial goals with your choices. Reviewing various offers from lenders can greatly affect your financial future.

Knowing the fees for different loans is key. This knowledge helps you understand the total cost. Being aware of this is vital for making choices that you’ll be happy with in the long run. Also, keeping up with market trends lets borrowers adjust their plans as needed.

Getting advice from experts offers deep insights into loans. This leads to smarter decisions, reducing risks and increasing happiness with your loan choice. Choosing wisely allows people to start their financial paths with confidence.

Conclusion

Exploring loan options in the USA is both thrilling and intimidating. As we conclude, it’s vital to understand the different loans out there. Each one, from common loans to more specific ones, has its own special traits and benefits. Knowing about these loans helps borrowers make choices that match their financial dreams.

Here’s a final piece of advice: don’t hesitate to seek help from experts. Talking to financial advisors or loan experts can clear up any confusion. It’s crucial to look closely at your financial situation. This ensures the loan you pick will help your financial future.

To sum up, the vast number of loan choices in the USA can be a lot to take in. However, prioritizing learning and getting help from professionals is a smart move. This approach leads to better results and makes borrowing a better experience. Making well-informed decisions is the key to reaching financial goals and feeling secure in the loan process.

FAQ

What are the main types of loans available in the USA?

What are the advantages of conventional loans?

How do FHA loans assist borrowers?

Who is eligible for VA loans?

What are the eligibility requirements for USDA loans?

What makes jumbo loans unique?

Why is credit score important when choosing a loan?

How can borrowers streamline the loan application process?

What role do mortgage brokers play in securing a loan?

How can I identify a knowledgeable loan expert?

What should I compare among lenders before selecting a loan?

Conteúdo criado com auxílio de Inteligência Artificial