Want a loan for all times?

Loans in the US are key for many important money moves. They help people and businesses achieve their goals. This includes buying houses, paying for school, or growing a business.

Understanding different loans and their rules is vital. It lets borrowers manage their loans wisely and make smart choices. Knowing the details of loans can really affect how borrowing feels for you.

U.S Bank Loan

What is a Loan?

A loan is when a lender gives money to a borrower, who must pay it back with interest over a set time. It’s important to know what a loan is to make smart money choices. Loans come as either secured or unsecured, depending on if there’s collateral.

Definition of a Loan

Loans mean someone borrowing money that will be paid back with interest. The borrower must repay the loan plus interest. This setup helps lenders reduce risk and gives others access to the money they need, whether for personal use or business.

Types of Loans: Secured vs. Unsecured

There are two main kinds of loans: secured and unsecured. Each type affects lenders and borrowers differently.

- Secured Loans: Secured loans have collateral like a car or house. They’re less risky for lenders, which means lower interest rates. If the borrower can’t pay, the lender can take the collateral.

- Unsecured Loans: Unsecured loans don’t require collateral, making them riskier for lenders and causing higher interest rates. Personal loans and credit cards are unsecured and depend on your credit score for approval.

Different Types of Loans

If you’re thinking about borrowing money, it’s smart to know the types of loans out there. Different loans work best for different financial situations and what you need. In the U.S., there are mainly conventional loans, government loans, and some special programs by various institutions.

Conventional Loans

Conventional loans are the most popular. They aren’t supported by the government. This means they’re best for those with good credit and enough for a down payment. You’ll need a credit score of 620 or more. Be sure to check if you can meet the loan’s demands, as the rules can be strict.

Government Loans

For those who might not get conventional loans, government loans are a great choice. This group includes FHA loans, good for those with low down payments or lower credit. VA loans help military veterans and active-duty members. USDA loans are for buying homes in rural areas, offering good terms to encourage homeownership there.

Special Programs

There are also special loan programs beyond the usual types. Many local housing agencies have them for people with lower to middle incomes or first-time buyers. These can help with down payments, lower interest rates, and more. Knowing about these programs can greatly help when looking to buy a home.

Loan in the US: Choosing the Right Type

Finding the right loan is key to meeting your financial goals. It’s important to look at certain things to pick wisely. This includes checking your own needs and knowing the different loans out there.

Key Factors to Consider

When picking a loan, think about several key things:

- Income and Credit Score: These are checked to see how much you can borrow. A good credit score can get you a better deal.

- Loan Purpose and Amount: There are various loans for different needs like buying a house, starting a business, or going to school.

Scenarios to Evaluate

Look at different situations to find the best loan for you. For instance, someone buying their first home might compare FHA loans and conventional mortgages. This depends on their credit and how much they can pay upfront. Choosing wisely makes the borrowing process better.

Understanding Loan Terms

When you’re looking into loans, it’s key to know the different terms. This helps you make smart money choices. A loan agreement shows the deal between the lender and borrower, listing duties and what to expect. These key parts can really change how borrowing feels for you.

Common Loan Terms Explained

Here are a few major loan terms you should know:

- Principal: This is the amount you borrow. It’s the starting point for your repayment plan.

- Interest Rate: This affects how much you have to pay back. A fixed rate means your payments stay the same. An adjustable rate might change, depending on the market.

Getting these terms can help you better understand your options.

The Importance of Loan Duration

How long you take to pay off a loan matters a lot. It affects your monthly payments and the total interest you pay. Short loan periods mean you pay more each month, but you save on interest in the long run.

Longer loan periods lower your monthly payments. But, you end up paying more in interest over time.

The Impact of Interest Rates

Interest rates are key in deciding how much you pay for loans. They affect your monthly bills and long-term money plans. It’s important to know about fixed and adjustable-rate loans before you borrow.

Fixed vs. Adjustable Rates

Borrowers usually see two types of interest rates: fixed and adjustable. Both have their pros and cons.

- Fixed-Rate Loans: The interest rate stays the same for the life of the loan. This means monthly payments won’t change, which helps in planning your budget.

- Adjustable-Rate Loans (ARMs): These loans may start with lower rates than fixed-rate ones. But their rates can go up based on the market after a set time. So, it’s key to be ready for possible rises in payments.

How to Calculate Interest Payments

Learning to calculate interest payments is key if you’re thinking about loans. You can use simple interest or compound interest for different financial needs. Each method affects how much you’ll end up paying back.

Understanding Simple vs. Compound Interest

Simple interest only focuses on the loan’s main amount. This means interest is only paid on the amount borrowed. For short-term loans, this method results in less interest over time.

Compound interest, however, adds interest on top of interest. This increases what you owe since each new interest payment includes the previous ones. Knowing the difference is vital because compound interest means higher costs over time.

Amortization and Loan Payments

Amortization is about making regular payments to clear a loan. Each payment is split into two parts: one for the loan amount and one for the interest. Seeing this breakdown helps you understand your payments better.

How interest is figured out in amortization matters a lot. It influences the total cost of your loan. Being informed helps you pick the right loan, affecting your monthly budget and financial plans.

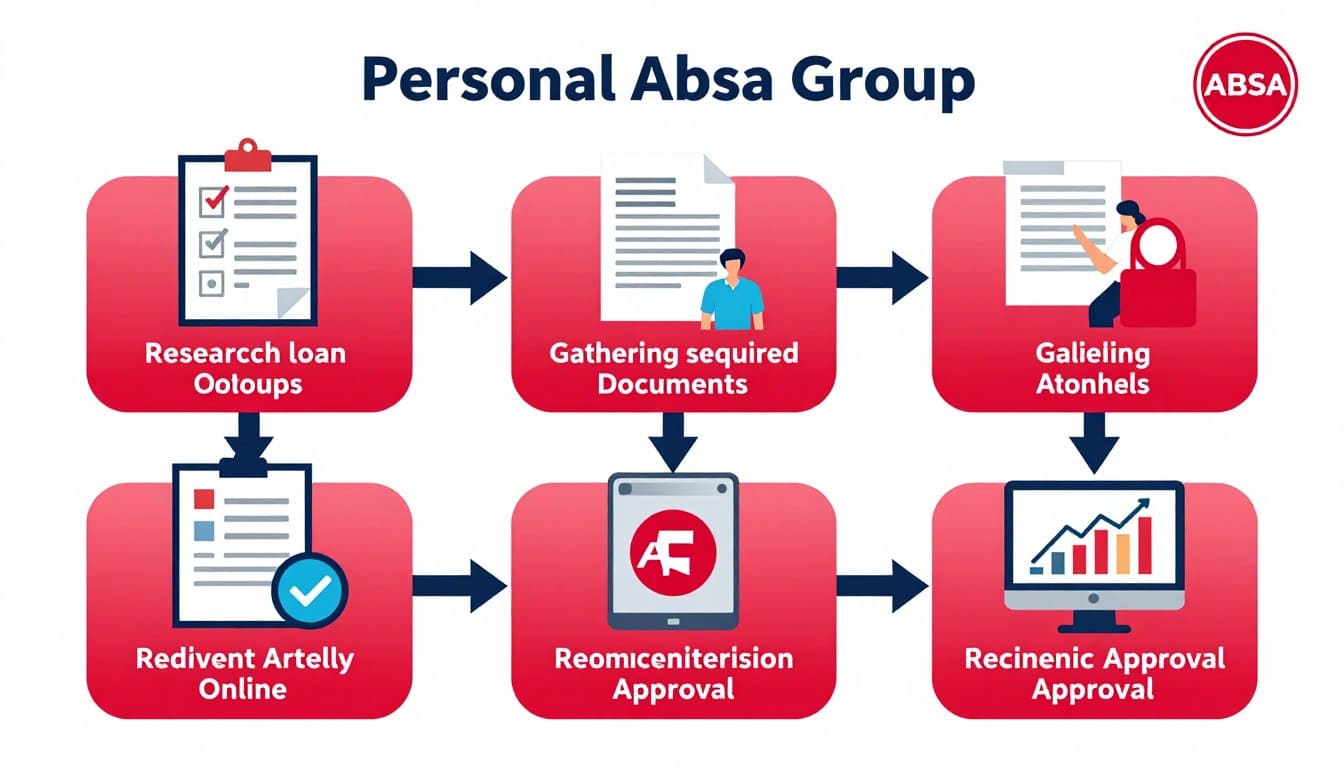

Loan Application Process Overview

Getting a loan is key for personal or business financing. Lenders look for certain documents to see if you can pay back the loan. Knowing what paperwork you need makes getting a loan easier and increases your chances of success.

Documents Needed to Apply

Having the right papers ready is crucial when you start applying for a loan. You will likely need:

- Previous tax returns to verify income history.

- Pay stubs or proof of income showing current earnings.

- Credit reports to assess credit history and financial responsibility.

- Evidence of assets that demonstrate financial stability.

Understanding Your Loan Agreement

Knowing what your loan agreement says is key before you borrow money. Getting to know the parts of a loan agreement helps borrowers make smart choices. When you understand every detail, you know exactly what to expect when paying back the loan.

Key Components of a Loan Agreement

Looking closely at a loan agreement, you’ll find important parts that need your attention. These parts set the rules for your loan and help you understand the contract better.

- Principal Amount: This is the total amount you borrow. It’s used to figure out how much interest you’ll pay and your payment plan.

- Interest Rate and Terms: This shows how much borrowing costs, including the interest rate and when and how you need to pay back the loan.

- Repayment Mandates: These rules tell you how and when to make payments. They also explain the fees for paying late or not following the agreement, which is crucial to know before you sign.

Risks and Pitfalls of Borrowing

It’s key to know the dangers of borrowing money to protect your finances. Many people don’t pay enough attention to the risks of taking a loan. Knowing the risks helps you avoid costly errors and falling for scams aimed at tricking borrowers.

Identifying Risky Features in Loans

Some loan features should raise red flags. Look out for these:

- Balloon payments that ask for a big sum at the end, which can be hard to handle.

- Prepayment penalties that charge you for paying off your loan early, limiting your freedom with money.

- Adjustable rates that may change and grow over time, making your payments uncertain and possibly higher.

How to Avoid Loan Scams

Being alert is key to avoid falling for bad lending practices. Here are ways to steer clear of loan scams:

- Do your homework on lenders to make sure they’re trustworthy and have a good history.

- Watch out for loans with really high fees that seem way off from what’s usual.

- Talk to financial pros or use resources before you agree to any loan deal.

Conclusion

It’s key to know about loans in the US if you’re thinking about borrowing. This article covered the many loan options, their terms, and how to apply. This info helps you make smart choices and plan your finances better.

By learning about all the loans available, people can pick what fits their needs best. Knowing the basic terms of loans means you won’t be confused by your loan agreement.

Being smart about loans reduces risks and helps you steer clear of scams. Making wise financial choices leads to better borrowing in the future.

FAQ

What are the main types of loans available in the US?

What is a conventional loan?

What programs are available for first-time homebuyers?

What factors should be considered when choosing a loan?

How do interest rates affect loan payments?

What documents are required to apply for a loan?

What are common pitfalls to avoid when borrowing?

How is interest calculated on loans?

Conteúdo criado com auxílio de Inteligência Artificial