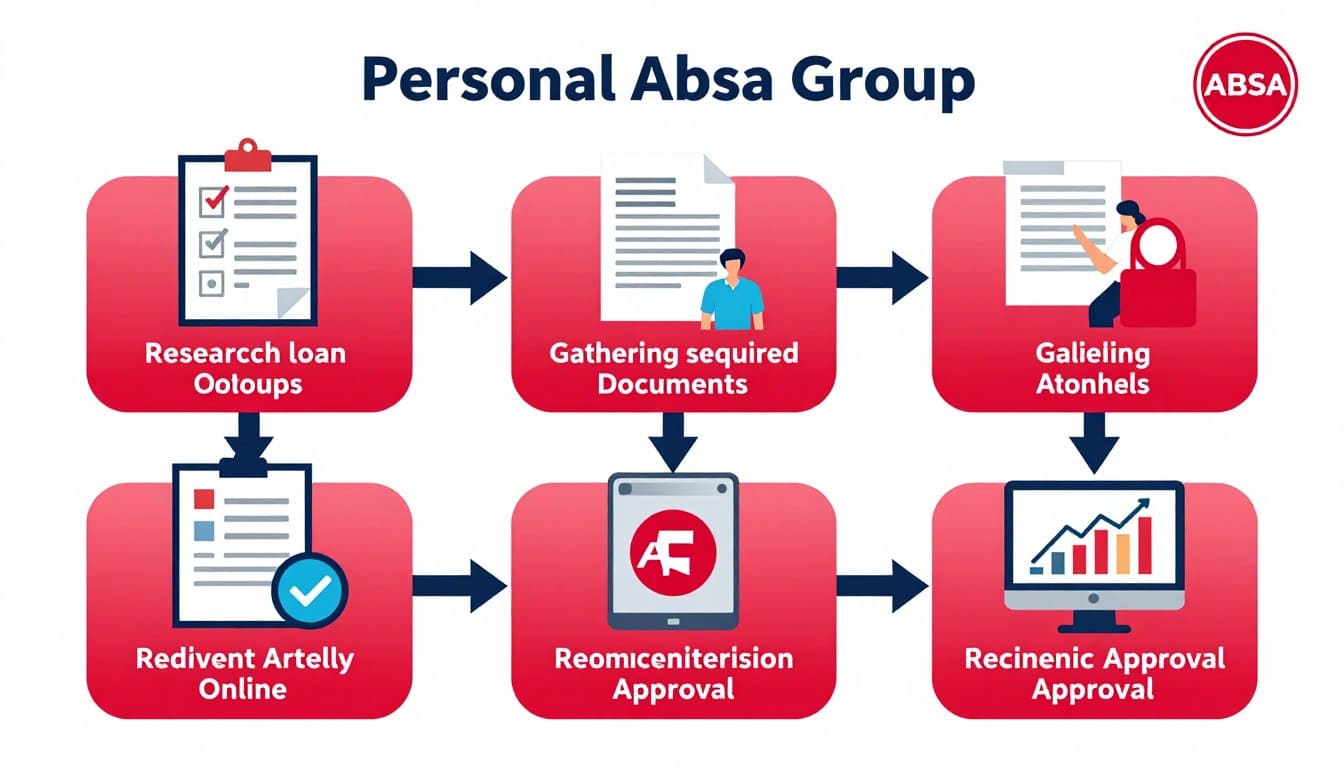

Exploring the different loan options in the USA can feel like a maze. This loan guide aims to simplify things for you. We’ll cover everything from common loans to government-backed ones. You’ll learn about who can get them, what they cost, and how to borrow wisely.

Knowing these details helps you make smart choices. It ensures your financial plans work out without running into trouble. So, let’s get started on your journey to understanding loans in the USA.

Chase Sapphire Preferred®

Types of Loans Available in the USA

In the United States, there are many types of loans for different needs. Knowing about these loans is key for anyone wanting to buy something, like a home. The main categories are conventional loans, government loans, and special purpose loans.

Anúncios

Conventional Loans

Conventional loans are a favorite among many. They follow rules from Fannie Mae and Freddie Mac. These loans need a good credit score and a big down payment.

Anúncios

Because of these strict rules, not everyone can get a conventional loan. This includes those with bad credit or low incomes.

Government Loans

Government loans are a good option for those who can’t meet conventional loan standards. FHA, VA, and USDA loans offer flexible terms and lower down payments. FHA loans help first-time homebuyers.

VA loans are for veterans and active military. USDA loans help people buy homes in rural areas. They offer big benefits for those who qualify.

Special Purpose Loans

Special purpose loans are for specific groups and needs. State and local agencies offer these loans. They help low- to middle-income people.

These loans can help with down payments or for home improvements. They are made to fit the needs of each borrower.

Understanding Conventional Loans

Conventional loans are a big part of the American mortgage world. They offer many options for those who qualify. Knowing what makes you eligible and the costs involved is key.

Eligibility Requirements

To get a conventional loan, you need to meet certain criteria. Lenders look at a few main things:

- Credit score: Most lenders want scores of 620 or higher.

- Employment history: A steady job shows you can handle money.

- Debt-to-income ratio: Lenders prefer a ratio under 43%.

- Down payment: You usually need at least 3%, but 20% can save on insurance.

Costs Associated with Conventional Loans

The costs of conventional loans can change a lot. This affects how much you’ll pay overall. Key things to think about are:

- Down payment: You might need 3% to 20% of the home’s price.

- Private mortgage insurance: Needed for down payments under 20%, raising your monthly costs.

- Closing costs: These include fees for appraisal, title insurance, and more.

- Interest rates: Whether fixed or adjustable, they impact your long-term costs and monthly payments.

Government Loans Overview

Government loans help many people buy homes. They offer FHA, VA, and USDA loans for different needs. These loans have flexible terms and requirements for various applicants.

FHA Loans

FHA loans are for first-time buyers or those with lower credit scores. They have low down payments, making it easier to buy a home. The FHA insures these loans, helping lenders lend to more people.

VA Loans

VA loans help veterans, active-duty service members, and some spouses. They can buy a home with no down payment. Plus, you don’t need private mortgage insurance, which saves money.

USDA Loans

USDA loans are for those in rural areas with lower incomes. They offer low interest rates and lower mortgage insurance costs. These loans help improve life in rural areas by supporting homeownership.

Special Programs for Borrowers

Many borrowers face unique challenges when buying a home. Special loan programs offer much-needed help. State and local housing agencies provide support, especially for first-time buyers or low-income families.

Special Purpose Credit Programs also help economically disadvantaged communities. They offer financial solutions that come with big benefits.

State and Local Housing Agencies

State and local housing agencies are key in helping with housing. They offer:

- Down payment assistance programs

- Housing counseling services

- First-time homeowner incentives

- Affordable mortgage options

These resources help borrowers overcome financial hurdles. They make buying a home easier.

Special Purpose Credit Programs

Private lenders have created financial solutions for underserved groups. Special Purpose Credit Programs include:

- Lower interest rates for eligible borrowers

- Grants to cover closing costs

- Flexible underwriting standards

These programs help ensure fair access to credit. They also boost community development, making housing markets more stable.

Choosing the Right Loan Term

Choosing the right loan term is crucial for your financial future. It depends on interest rates and how much you can pay each month. Knowing how these terms affect you is key to making a good choice.

Short-Term vs. Long-Term Loans

Short-term loans have lower interest rates. This means you pay less in interest and pay off the loan faster. But, you’ll have to make higher monthly payments, which can be tough on your budget.

Long-term loans have lower monthly payments, making them easier to handle if you’re on a tight budget. But, you’ll pay more in interest over time.

Impact on Monthly Payments

The loan term you choose affects your monthly payments. Short-term loans might cost less overall but require more discipline in budgeting. Long-term loans offer easier monthly payments but cost more in interest over time.

Considering your financial situation and these loan terms helps you borrow wisely. It ensures your borrowing fits your long-term financial goals.

Exploring Interest Rate Types

When you’re looking at a mortgage, knowing about different interest rates is key. These rates can change how much you pay each month and the total interest over time. There are mainly two types: fixed rate and adjustable rate mortgages, each with its own features.

Fixed Rate vs. Adjustable Rate Mortgages

A fixed rate mortgage means your interest rate stays the same for the loan’s life. This makes it easier to plan your budget because your payments won’t change. But, an adjustable rate mortgage (ARM) starts with lower rates that can go up later.

This option might save you money at first but could lead to higher payments as rates change. It’s all about what you’re comfortable with and your financial goals.

Understanding Rate Changes

If you’re thinking about an adjustable rate mortgage, it’s important to know how rates can change. ARMs usually start with a fixed rate period, then can adjust based on market conditions. These changes can impact your monthly payments a lot.

So, it’s crucial to think about your financial future and how much risk you’re willing to take. Deciding between a fixed rate and an adjustable rate mortgage depends on your personal situation and what you expect for the future.

Understanding Loan Amounts and Costs

When you’re looking at financing options, it’s key to understand the link between loan amounts, down payments, and costs. Different loans have different down payment needs, which affects how affordable they are. For example, conventional loans usually need a bigger down payment than government-backed loans.

Down Payments and Borrowing Limits

Down payments are crucial in setting borrowing limits. A bigger down payment means you borrow less and might pay less each month. The amount you can borrow varies with the loan type and lender. Putting down a lot can also get you better interest rates.

Mortgage Insurance Costs

Mortgage insurance is a big deal for many, especially with conventional loans and small down payments. It protects lenders if you can’t pay back the loan. Knowing the costs of mortgage insurance is important because it can really affect how affordable the loan is.

How to Avoid Pitfalls in Borrowing

Knowing about borrowing pitfalls is key to keeping your finances stable. When you look for loans, it’s important to watch out for certain features. Some loans have risky features like prepayment penalties or balloon payments. These can cause big financial problems.

Identifying Risky Loan Features

It’s vital to spot loan features that could harm your finances. Some common risky features include:

- Prepayment penalties, which charge fees for early loan payoff.

- Balloon payments, which require a big payment at the loan’s end.

- Interest-only options, which can increase the loan’s principal over time.

Before you agree to a loan, carefully check these features. Ignoring them can lead to big financial troubles.

Importance of Loan Estimates

Loan estimates are key for making smart borrowing choices. They show you the loan’s terms, costs, and features. When looking at loan estimates, pay attention to:

- Interest rates and how they affect the loan’s total cost.

- Fees and closing costs for better budgeting.

- Loan terms to make sure they fit your financial goals.

By focusing on loan estimates, you can understand loan agreements better. This helps you avoid risky loans and make good financial choices.

Conclusion

Understanding your loan options in the USA is key. There are many types of loans, each for different needs. They have their own rules and costs.

By looking into each loan type, you can make better choices. This guide helps you find the right loan for you. Making smart decisions can get you good loan terms.

Being well-prepared and strategic is important. This guide gives you the knowledge to navigate loans confidently. You’ll make choices that help you achieve financial stability.

FAQ

What are the main types of loans available in the USA?

What eligibility criteria are required for Conventional Loans?

What advantages do Government Loans offer?

How do I calculate my down payment requirements?

What are common pitfalls to avoid when taking out a loan?

How do interest rates affect my mortgage payments?

Can I get financial assistance as a first-time homebuyer?

What is the difference between short-term and long-term loans?

Conteúdo criado com auxílio de Inteligência Artificial