The Lloyds Bank Ultra Credit Card is a premium financial product designed for everyday spending and special occasions, offering a range of benefits in one convenient package.

Practical Guide: How to Apply for the Lloyds Ultra Credit Card

The Lloyds Ultra card is designed for everyday spending and offers several benefits in a single package. Follow this step-by-step guide to complete your application online:

1. Access the Lloyds Bank Official Website

The first step is to enter the bank’s portal at www.lloydsbank.com. On the homepage, scroll down to the section called “Our products” and click the “Credit cards” button.

Anúncios

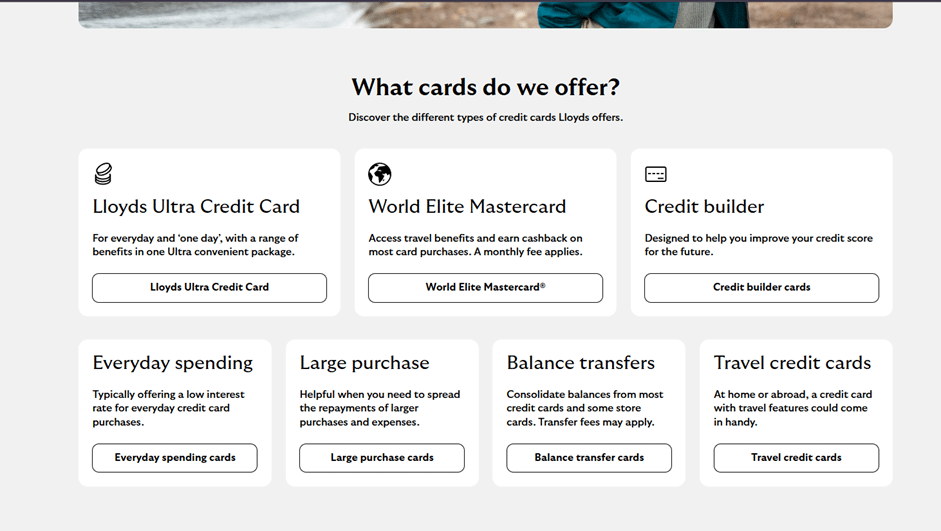

2. Locate the Lloyds Ultra Option

On the credit cards page, you will see various available types (such as World Elite or Builder). Scroll down the page, find the “Lloyds Ultra Credit Card” section, and select the first option by clicking the corresponding button.

Anúncios

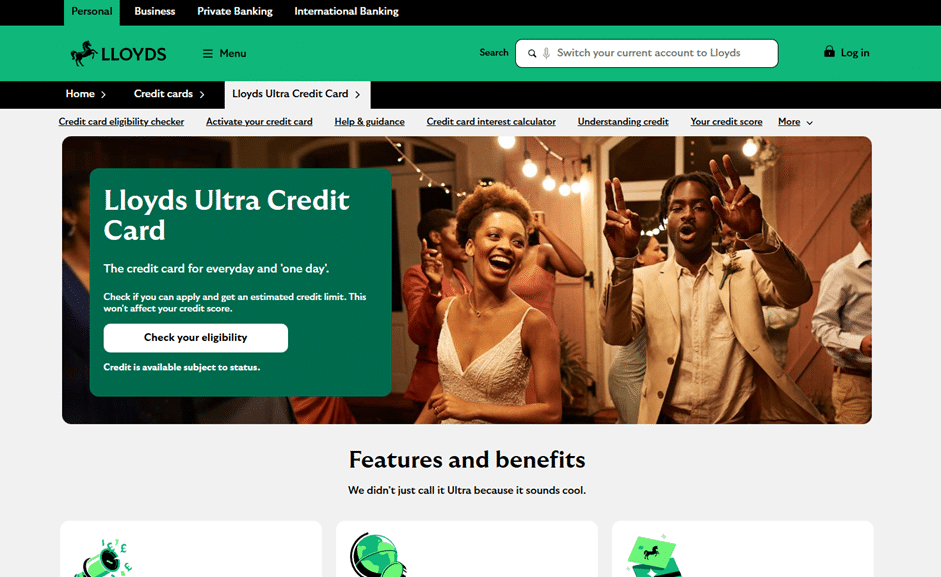

3. Check Your Eligibility

Once on the specific Ultra card page, you will find detailed information about the product. To start the request, click the white button labeled “Check your eligibility”. This step is important to find out if the card can be approved for you before proceeding to the final application.

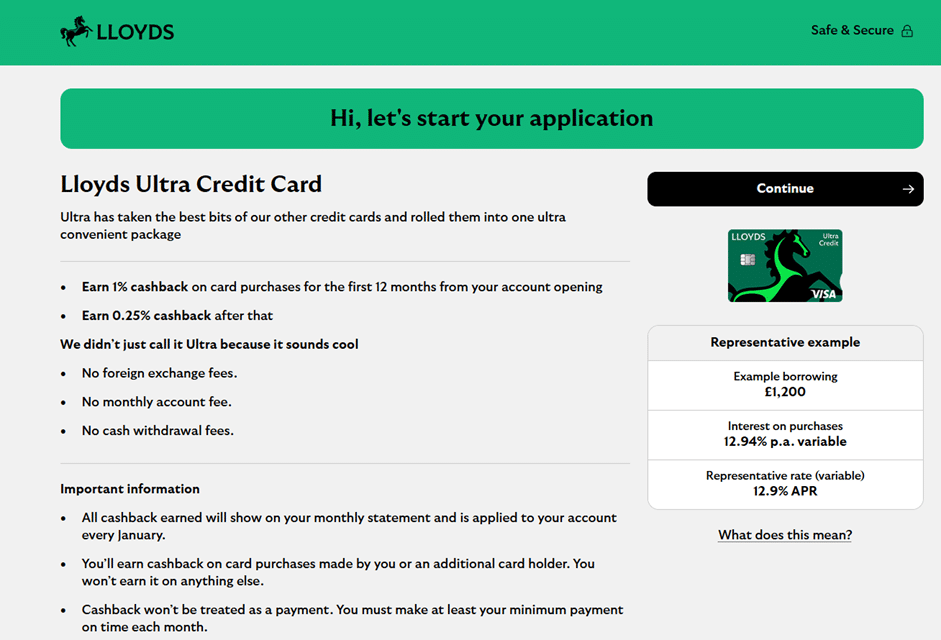

4. Complete the Application Form

You will be redirected to the bank’s secure area. Follow the on-screen instructions, fill in your personal and financial details, and finalize the process. If everything is correct and approved, you will receive your Lloyds Ultra card at your address shortly.

Educational Tip: Remember that the eligibility check (“Check your eligibility”) is a vital step because it allows the bank to perform a “soft search” that does not impact your credit score unnecessarily before a formal analysis.

Everything you need to know to apply for the card

Applying for the Lloyds Ultra Credit Card is a structured process that combines digital convenience with rigorous eligibility standards. To ensure a smooth application, it is essential to understand the steps, from the initial check to the final approval.

Accessing the Application

You can start your application for the Lloyds Ultra card through two main channels:

Lloyds Ultra

- Official Website: Visit the Lloyds Bank credit cards page and select the Ultra Credit Card option.

- Mobile Banking App: Existing customers can apply directly through the Lloyds Bank app, which often provides a faster experience by using already known information.

Eligibility and Initial Requirements

Before proceeding with a full application, you must meet the bank’s core criteria:

- Residency and Age: You must be a UK resident aged 18 or over.

- Financial Status: You must have a regular income and not be subject to bankruptcy or CCJs.

- Account Tenure: To be eligible for certain Lloyds credit cards, you may need to have held a Lloyds Bank current account for at least 3 months.

- Income Threshold: A minimum yearly income, often around £6,000 or more, is typically required for credit approval.

The Approval Process: One Check Eligibility

Lloyds Bank uses a “One Check” eligibility tool that allows you to see if you are likely to be accepted before you officially apply.

- Soft Search: This initial check does not affect your credit score.

- Estimated Limit: You will receive an estimated credit limit based on the information provided.

- Full Application: If the eligibility check is positive and you choose to proceed, a formal application will be submitted, which involves a hard credit check.

Completing the Application

During the online process, you will need to provide detailed personal information, including your full name as shown on your ID, date of birth, marital status, and residential history. Once submitted, the bank will review your data and, if approved, your card will be sent to your registered address within a few working days.

Overview of Lloyds Bank

Lloyds Bank is a cornerstone of the UK financial sector, with a history spanning over 250 years. As one of the major retail banks in the United Kingdom, it is widely recognized for its reliability, extensive branch network, and robust digital banking platforms.

The bank operates under strict regulation by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA), ensuring high standards of customer protection and financial integrity. Lloyds is dedicated to providing diverse products—from savings and investments to current accounts and specialized credit cards—tailored to the evolving needs of UK consumers.

Lloyds

FAQ: Frequently Asked Questions

1. Does the initial eligibility check affect my credit score? No, the “One Check” eligibility tool is a soft search and will not impact your credit rating.

2. Can I apply if I am not an existing Lloyds customer? While some cards require a prior 3-month relationship with the bank, you can check specific eligibility for the Ultra card on the official website.

3. What information do I need for the application? You will need your NIF (or equivalent UK tax info), address history, employment details, and annual income figures.

4. How long does the application take? The initial eligibility check typically takes about 5 minutes.

5. How is the credit limit determined? Your credit limit is determined based on your individual financial circumstances and credit history during the approval process.

Conteúdo criado com auxílio de Inteligência Artificial