The AIB (NI) Student Visa Credit Card is specifically designed to provide students in third-level education in Northern Ireland with financial flexibility and a safe way to manage their spending. It offers one of the lowest representative Annual Percentage Rates (APR) available within the AIB (NI) card range, making it a compelling choice for responsible budgeting and building a positive credit history.

Student Credit Card

This comprehensive, article is based exclusively on the information available on the official AIB (NI) website, guiding prospective applicants through the process and highlighting the unique benefits of this student-focused financial product.

🇮🇪 IRELAND: STEP-BY-STEP TUTORIAL – How to Apply for the AIB (NI) Student Visa Credit Card

Are you a student in full-time third-level education in Northern Ireland looking for a low-rate credit card? Follow this guide to apply for the AIB (NI) Student Visa Credit Card.

Anúncios

Introduction: Why Choose the Student Visa Credit Card?

The AIB (NI) Student Visa Credit Card is specifically designed for students, offering a low Representative APR ($\mathbf{12.9\%}$ variable) and up to 56 interest-free days on purchases. It’s an ideal tool for managing student finances and building a credit history.

Anúncios

Before you start: What you need

- You must already hold a student bank account with AIB (NI).

- You must be aged 18 or over.

- You must be in full-time third-level education and a UK resident.

- Proof of identity (e.g., passport) and current permanent address (e.g., recent utility bill).

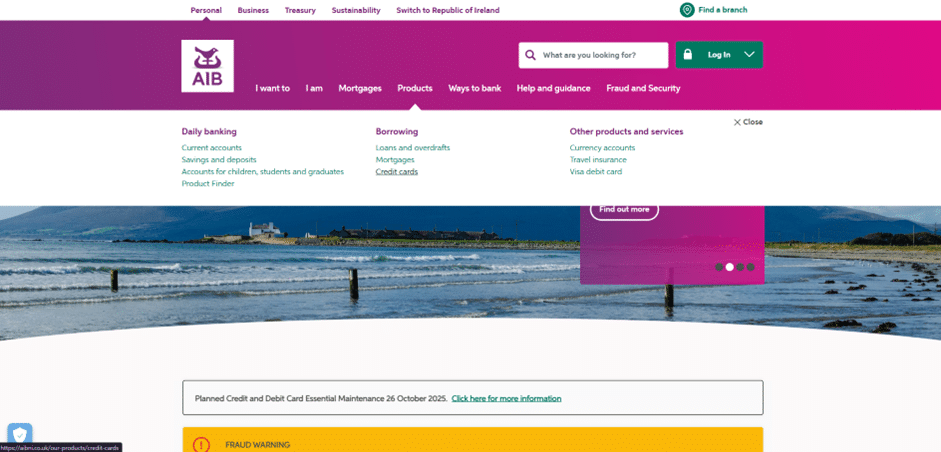

Step 1: Access the AIB (NI) Credit Cards Page

Your application starts on the main AIB (NI) website.

- Access the AIB Bank homepage:

https://aibni.co.uk/ - In the main menu, click the fourth option: “Products”.

- In the ensuing submenu, select the last option in the second column: “Credit Cards”.

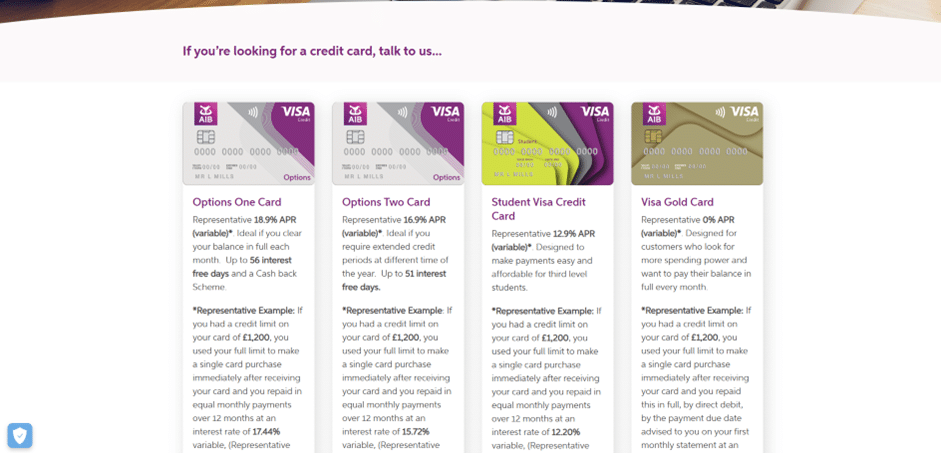

Step 2: Select the Student Visa Credit Card

On the products overview page, locate and select the student card option.

- On this page, you will see various credit card options, such as the Visa Gold Credit Card, Options One, and Options Two.

- Choose the Student Visa Credit Card, which is typically the third option, by clicking on the card image.

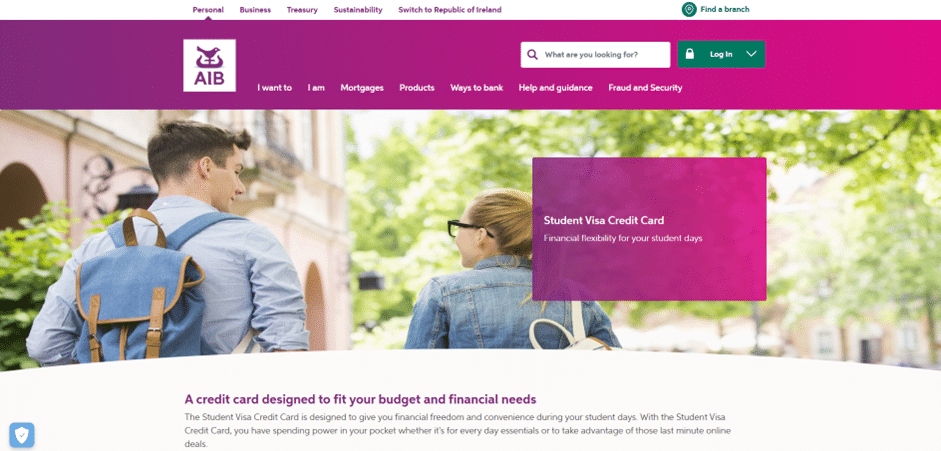

Step 3: Review Card Information

You are now on the detailed product page for the Student Visa Credit Card.

- On this page, you will find all essential information about the Student Visa Credit Card, including the low Representative APR ($\mathbf{12.9\%}$ variable) and the No Annual Fee feature.

- Scroll down to the “How to Apply” section to view the application methods.

Step 4: Choose Your Application Method

AIB (NI) provides several methods for students to apply.

- In the “How to apply” section, you will be directed to:

- Call the customer service number (0345 6005 925) for a smooth application process.

- Download, complete, print, and sign the application form and return it by post, or drop it off at your nearest AIB (NI) branch.

- Visit your nearest AIB (NI) branch to apply in person.

Tip for Students: Since you need to be an existing AIB (NI) student account holder, applying via your local branch or over the phone ensures you receive personalised guidance and helps confirm your student status quickly.

Overview of AIB (NI): Trusted Banking for Students in Northern Ireland

The AIB (NI) Student Visa Credit Card is issued by AIB Group (UK) p.l.c., the entity that trades as AIB (NI) in Northern Ireland. AIB is a well-established and trusted institution, providing a strong foundation of security and reliability for its customers.

AIB

The Institution and its Role in Student Finance:

- Major Financial Player: Allied Irish Banks, p.l.c. (AIB) is a significant commercial bank operating across the Republic of Ireland and the UK. AIB (NI) has a deep-rooted presence in Northern Ireland, previously operating as First Trust Bank, and is known for its commitment to local customers.

- Support for Education: The AIB Group provides dedicated accounts and products for students, recognizing their unique financial needs as they transition into third-level education.

- Regulatory Compliance: As a UK-based financial service provider, AIB (NI) is subject to rigorous oversight by regulatory bodies, ensuring that all products, including the Student Visa Card, adhere to strict consumer protection and lending standards.

- Building a Relationship: For students, the card serves as an excellent opportunity to establish a long-term banking relationship with a reputable institution, which can be beneficial for future financial needs like loans or mortgages.

- Conclusion: Choosing the AIB (NI) Student Visa Credit Card means banking with a stable, established institution that offers products tailored to support students during their academic years.

Everything People Need to Know to Apply for the Card

The AIB (NI) Student Visa Credit Card is intentionally structured with specific eligibility criteria to ensure it is only available to third-level students who are actively banking with AIB (NI).

1. Essential Eligibility Requirements for Students

The Student Visa Card is a specialized product, and applicants must satisfy the following strict criteria:

- Age: Applicants must be 18 years or over.

- Residency: You must be a resident in the UK.

- Education Status (Mandatory): The applicant must be in full-time third-level education.

- AIB (NI) Account Holder (Crucial): Applicants must hold an existing bank account with AIB (NI). This is a non-negotiable prerequisite for applying for this specific card.

- Income/Funding: The application is subject to status and affordability checks. The bank will look for evidence of regular payments from a student loan or a part-time salary to demonstrate the ability to make repayments.

2. Key Benefits of the Student Visa Credit Card

The card is structured to offer affordability and flexibility, making it an ideal financial tool for students learning to manage credit responsibly:

- Lowest Representative APR: The card offers one of the lowest rates in the AIB (NI) range, with a representative 12.9% APR (variable). This is crucial for students, as it makes carried balances more affordable than on standard credit cards.

- Extended Interest-Free Period: Students benefit from up to 56 days of interest-free credit on purchases, cash advances, and balance transfers, provided the balance is paid in full and on time each month.

- No Annual Fee: There is no annual fee for the card, minimizing the cost of ownership.

- Credit Limit: The card has a reasonable minimum credit limit of £300, which is appropriate for a first credit card, helping students manage their spending responsibly. The maximum limit is subject to status, up to £5,000.

- Flexible Repayments: The card is designed with flexible repayment options, allowing students to pay off the full balance or the minimum required payment by Direct Debit. The Student Visa Card must be paid by Direct Debit.

- Worldwide Acceptance: As a Visa card, it provides spending power and emergency cash access at home and abroad wherever Visa Credit is accepted, offering security for students travelling or studying overseas.

3. Step-by-Step Guide to the Application Process

The application process is handled directly through AIB (NI), emphasizing security and a personalized assessment.

Step 1: Confirm Eligibility and Gather Documentation

Ensure you meet all the eligibility criteria, especially holding an AIB (NI) account and being in full-time third-level education. You will need:

- Proof of Identity and Address: Standard documentation like a passport, driving licence, and a recent utility bill to verify your identity and current address, especially if the bank cannot confirm your details electronically.

- Proof of Student Status: Documentation from your third-level educational institution to confirm your full-time student status.

- Proof of Funds/Affordability: Details of your income, such as student loan disbursements or payslips from a part-time job, to prove your repayment capacity.

Step 2: Choose Your Application Method

The AIB (NI) currently offers three traditional methods for applying for the Student Visa Credit Card:

- In Branch (Recommended): Visit your nearest AIB (NI) branch. This is often the quickest way to verify documents and discuss your application with a bank advisor who understands student needs.

- By Phone: Contact the bank directly by phone. The bank will guide you through the process and will advise if additional documentation needs to be mailed to them.

- By Post: You can download the application form from the AIB (NI) website, fill it out, sign it, and return it to the central AIB (NI) address or your local branch.

Step 3: Credit and Affordability Assessment

- Submission: Submit your completed application and all supporting documents.

- Assessment: AIB (NI) will conduct a credit check and an affordability assessment. This is done to ensure that the credit limit assigned is suitable for a student’s financial circumstances and that the applicant can manage the debt responsibly.

- Decision: Following the assessment, the bank will notify you of their decision and the assigned credit limit, which will be subject to status and affordability.

Step 4: Card Receipt and Management

- Delivery: Once approved, you will receive your Student Visa Credit Card and PIN separately for security.

- Activation and Repayments: The card must be activated before use. Remember that repayments must be made by Direct Debit. The card is intended for short-term borrowing, and only making the minimum repayment will increase the total cost and time it takes to clear the balance.

FAQ – Frequently Asked Questions about the AIB Student Visa Card

Q: What is the representative APR for the AIB Student Visa Credit Card?

A: The representative rate is a low 12.9% APR (variable).

Q: Is there an annual fee for the Student Visa Card?

A: No, the card does not have an annual bank fee.

Q: How long can I receive interest-free credit?

A: You can receive up to 56 days of interest-free credit on purchases if you pay the full statement balance on time each month.

Q: What is the minimum and maximum credit limit for the card?

A: The minimum credit limit is £300, and the maximum credit limit is typically £5,000, subject to the bank’s status and affordability checks.

Q: Do I need to be a full-time student to apply?

A: Yes, you must be in full-time third-level education to be eligible for this card.

Q: Is it mandatory to have an AIB (NI) account to apply?

A: Yes, you must hold an existing bank account with AIB (NI) to be eligible for the Student Visa Credit Card.

Q: Does the card come with any rewards or cashback features?

A: No. The AIB (NI) Student Visa Card is a low-rate, no-fee card focused on affordable credit and does not include a cashback or loyalty rewards scheme.

Q: Is there a fee for using the card abroad?

A: Yes, non-sterling transactions, whether in the EU or the rest of the world, are typically subject to a foreign usage charge. Please refer to the specific fees and charges for the exact rate (e.g., 2.75% of the transaction amount).

Conteúdo criado com auxílio de Inteligência Artificial