The AIB (NI) Visa Gold Card is designed as a high-end credit solution for established customers in Northern Ireland who seek maximum spending power and prefer to manage their finances by clearing their full balance monthly. Distinctively positioned within AIB’s card offerings, the Gold Card provides a representative 0% APR (Variable) and high credit limits, but with a strict full-payment requirement.

Gold

This comprehensive, SEO-optimized guide is built exclusively on the official information from the AIB (NI) website, detailing the stringent eligibility criteria, application process, and specific benefits of this premium card.

🇮🇪 IRELAND: STEP-BY-STEP TUTORIAL – How to Apply for the AIB (NI) Visa Gold Card

Are you an existing AIB (NI) customer looking for increased spending power, travel benefits, and the requirement to clear your balance monthly? Follow this guide to apply for the Visa Gold Card.

Anúncios

Introduction: Why Choose the Visa Gold Card?

The AIB (NI) Visa Gold Card is designed for customers who typically pay their balance in full every month and require increased spending power for travel, entertainment, and other expenses. Key features include a $\mathbf{0\%}$ Representative APR (variable) and no annual fee.

Anúncios

Before you start: What you need

- You must already hold an existing bank account with AIB (NI).

- You must be aged 18 or over and a UK resident.

- Proof of identity (e.g., passport) and address (e.g., utility bill).

- Documentation for stable income (e.g., recent payslips/bank statements).

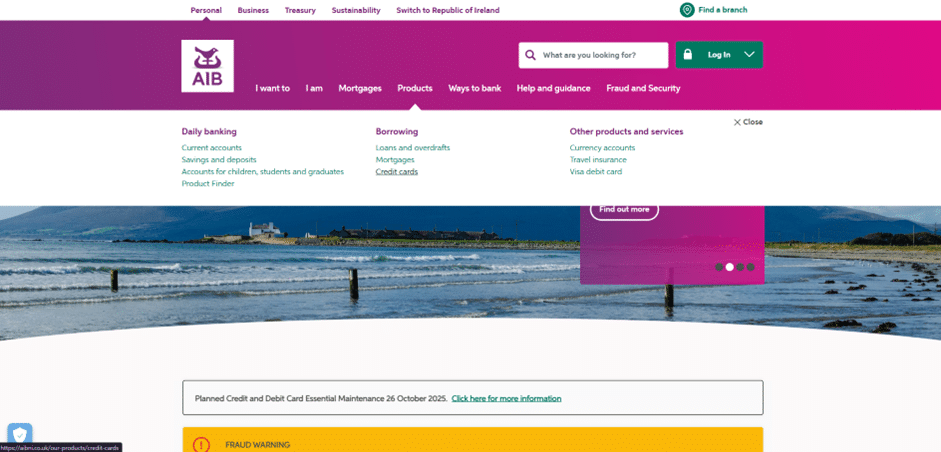

Step 1: Access the AIB (NI) Credit Cards Page

Your application starts on the main AIB (NI) website.

- Access the AIB Bank homepage:

https://aibni.co.uk/ - In the main menu, click the fourth option: “Products”.

- In the ensuing submenu, select the last option in the second column: “Credit Cards”.

Step 2: Select the Visa Gold Card

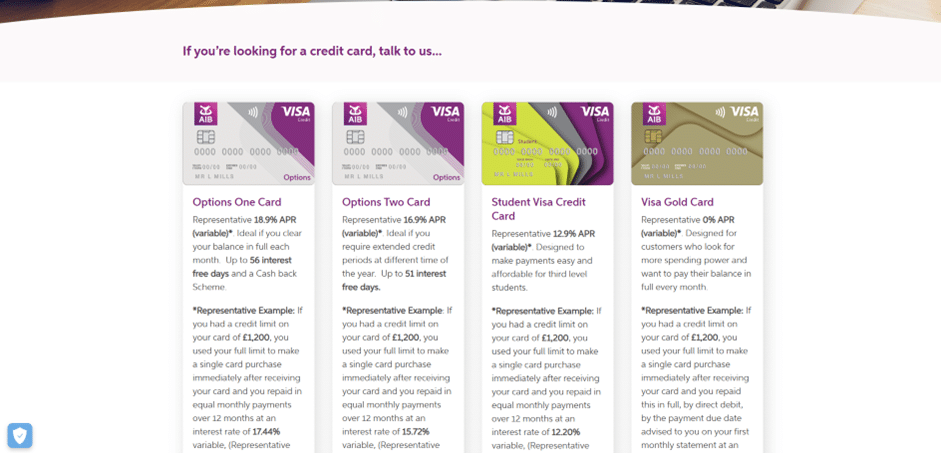

On the products overview page, locate and select the Visa Gold Card.

- On this page, you will see various credit card options, such as the Student Visa Credit Card, Options One, and Options Two.

- Choose the Visa Gold Card, which is typically presented as the second option, by clicking on the card image or the “Find out more” link.

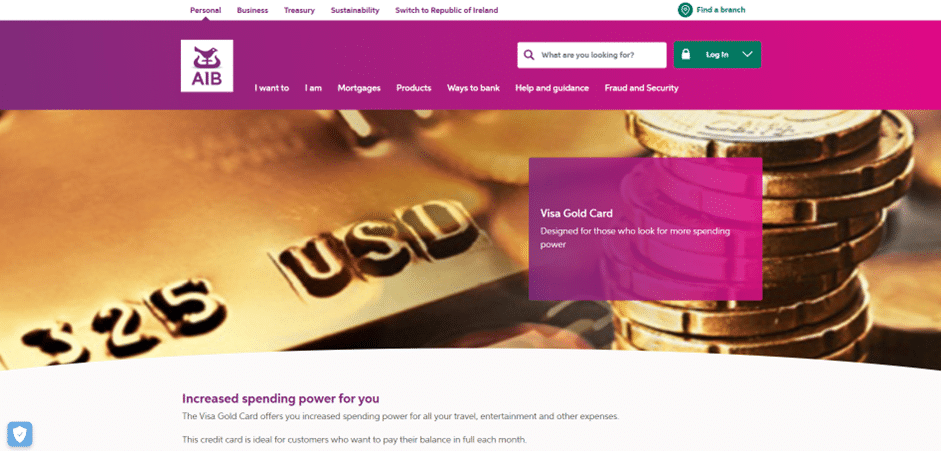

Step 3: Review Card Information

You are now on the detailed product page for the Gold Card.

- On this page, you will find all essential information about the Visa Gold Card, including its features (e.g., no annual fee) and the requirement that the balance is settled in full by Direct Debit each month.

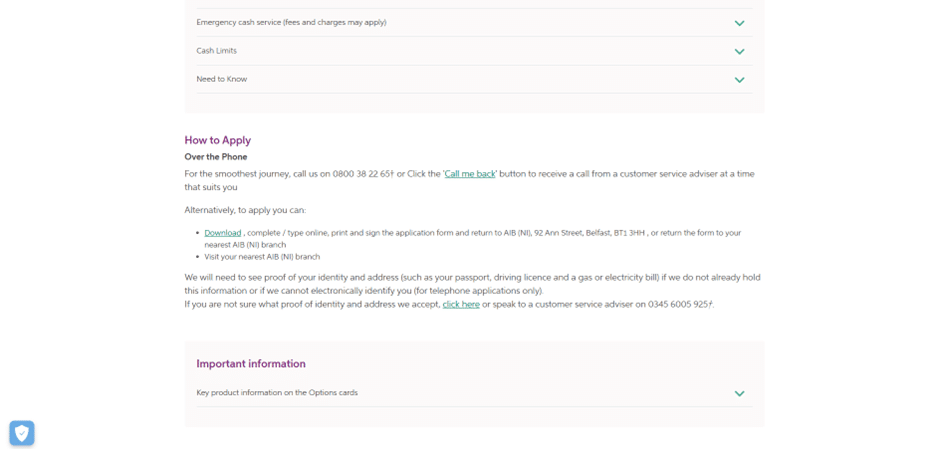

- Scroll down to the “How to Apply” section to view the application methods.

Step 4: Choose Your Application Method

AIB (NI) generally requires a paper or in-person application for this card.

- In the “How to apply” section, you will be directed to:

- Download, complete, print, and sign the application form and return it by post to AIB (NI), or drop it off at your nearest branch.

- Visit your nearest AIB (NI) branch to apply in person.

- You can also call the customer service number (0345 6005 925) for assistance or to request a callback.

Important Note: Since this is a “charge card” (balance must be paid in full monthly), the credit requirements might differ slightly from traditional credit cards. Ensure you have all required documentation (ID, proof of address, income) ready to expedite the process.

Overview of AIB (NI): Credibility and Focus on Established Customers

The Visa Gold Card is a product of AIB Group (UK) p.l.c., operating as AIB (NI), a major and reputable financial institution within the UK and Ireland. Understanding the bank’s standing is crucial for potential Gold Card applicants.

AIB

A Pillar of the Financial Landscape:

- Major Financial Group: AIB is one of the “Big Four” commercial banks in the Republic of Ireland, with significant and secure operations in the United Kingdom. AIB (NI) is the established trading name in Northern Ireland, formerly First Trust Bank.

- Security and Regulation: As a major entity, AIB (NI) is rigorously regulated, offering assurance and stability to its customers. The bank adheres to UK financial regulations and provides security on all transactions.

- Premium Customer Focus: The Visa Gold Card is specifically targeted at high-earning, financially stable customers, signaling AIB’s commitment to providing tailored products for different tiers of its client base. The high minimum income requirement and minimum credit limit reinforce its premium status.

- Digital Convenience: AIB (NI) ensures that even premium products are easy to manage, with full access to their reliable online and mobile banking platforms for day-to-day card management.

- Conclusion: The AIB (NI) Visa Gold Card is issued by a trustworthy and stable bank. It is a premium product aimed at secure, affluent customers who value high credit capacity and disciplined monthly repayment.

Everything People Need to Know to Apply for the AIB (NI) Visa Gold Card

The AIB (NI) Visa Gold Card has some of the most stringent requirements among AIB’s personal credit cards, reflecting its exclusive nature and high credit limits.

1. Essential Eligibility Requirements for the Gold Card

Applicants must satisfy strict criteria to be considered for this premium card:

- Age Requirement: Applicants must be 25 years or over. This is higher than the minimum age for standard credit cards.

- Residency: You must be a resident in the UK.

- Account Status (Mandatory): It is a non-negotiable requirement to hold an existing bank account with AIB (NI). The Gold Card is exclusively available to current AIB (NI) customers.

- Minimum Salary Threshold: Applicants must have a minimum salary of £30,000. This high-income requirement underscores the card’s premium positioning and the high credit limits offered.

- Credit and Affordability: Approval is strictly subject to status, affordability, and terms and conditions. A strong, clean credit history is essential.

2. Premium Features and Benefits of the Visa Gold Card

The Gold Card is designed for maximum purchasing power and disciplined financial management:

- Representative 0% APR (Variable): The card’s standout feature is a representative rate of 0% APR (Variable). This is because the core term of this card requires settlement in full by Direct Debit each month.

- Note on Interest: If the balance is not paid in full by the due date, high interest rates will apply to purchases and cash advances (e.g., 21.00% Annual Rate, though this is only applicable when the mandatory full payment is missed).

- Mandatory Full Monthly Settlement: Unlike the Options series, the Gold Card must be settled in full by Direct Debit each month. This makes it an effective charge card for high spenders who manage their cash flow precisely.

- No Annual Fee: Despite its premium nature and high credit limits, the AIB (NI) Visa Gold Card has no annual bank fee.

- High Credit Limit: The card offers a high minimum credit limit of £5,000, with a maximum credit limit of £30,000 (Subject to Status), catering to significant spending needs for travel, entertainment, and large purchases.

- Easy Access to Cash: The card includes easy access to cash when needed, although fees apply for cash advances.

3. The Detailed Application and Approval Process

The application process for the Visa Gold Card is robust due to the high credit limits involved.

Step 1: Confirm Eligibility and Gather Documentation

Ensure you meet the minimum age (£30,000 salary) and account holding requirements. You will need to prepare:

- Proof of Identity and Address: Passport, Driving Licence, and a recent utility bill (gas or electricity) if AIB does not already hold or cannot electronically verify this information.

- Proof of Income: Documentation supporting your £30,000+ minimum salary.

Step 2: Choosing Your Application Method

The AIB (NI) Visa Gold Card can be applied for via two primary methods:

- In Branch (Recommended): Visiting your nearest AIB (NI) branch is often the most straightforward way. A branch advisor can guide you through the forms and verify the required documentation in person.

- By Post: You can download, complete, print, and sign the application form. This form must then be returned to the designated AIB (NI) address.

Step 3: Credit Assessment and Decision

- Affordability Check: AIB (NI) will conduct a thorough credit check to assess your overall financial health and verify your income and ability to handle the high minimum credit limit.

- Limit Determination: The bank will inform you of your credit limit (between £5,000 and £30,000) upon approval.

Step 4: Card Issuance and Management

- Card Delivery: Once approved, the Visa Gold Card and PIN will be sent to you separately.

- Mandatory Direct Debit: Remember, this card’s usage and interest terms are reliant on the full balance being paid by Direct Debit every month.

- Management Tools: Utilize AIB’s secure digital platforms for managing your high-limit card, including checking balances and making secure online purchases.

FAQ – Frequently Asked Questions about the AIB (NI) Visa Gold Card

Q: What is the representative APR for the AIB (NI) Visa Gold Card?

A: The representative rate is 0% APR (Variable), assuming the full balance is paid by Direct Debit each month.

Q: Is there an annual fee for this card?

A: No, the AIB (NI) Visa Gold Card has no annual bank fee.

Q: Is full monthly repayment mandatory for the Gold Card?

A: Yes. This card is specifically designed for customers who pay the full outstanding balance by Direct Debit each month. Failing to do so will result in high interest and default charges.

Q: What is the minimum salary required to apply?

A: Applicants must have a minimum salary of £30,000.

Q: What is the minimum and maximum credit limit?

A: The minimum credit limit is £5,000, with a maximum of £30,000, subject to the bank’s assessment.

Q: Do I need to be an existing AIB (NI) customer?

A: Yes, the Visa Gold Card is only available to existing AIB (NI) account holders.

Q: Can I use the Gold Card for cash withdrawals?

A: Yes, the card can be used for cash advances globally, but this incurs a fee (e.g., 1.5% minimum £3.00) and interest applies from the transaction date if the full balance is not settled.

Q: Is there an age restriction?

A: Yes, applicants must be 25 years or older.

Conteúdo criado com auxílio de Inteligência Artificial