Step-by-Step Guide to Apply

This section provides a detailed guide on how to apply for the TD First Class Travel Visa Infinite Card in Canada, including eligibility, required documents, and how to complete your application process.

TD First Class

CANADA – STEP-BY-STEP GUIDE ON HOW TO APPLY FOR THE TD FIRST CLASS TRAVEL® VISA INFINITE CARD*

The TD First Class Travel® Visa Infinite Card* is one of the best travel credit cards in Canada, offering TD Rewards Points on every purchase, flexible redemption options, and premium travel perks.

Follow this detailed guide to learn how to apply for the card directly through the official TD Bank Canada website.

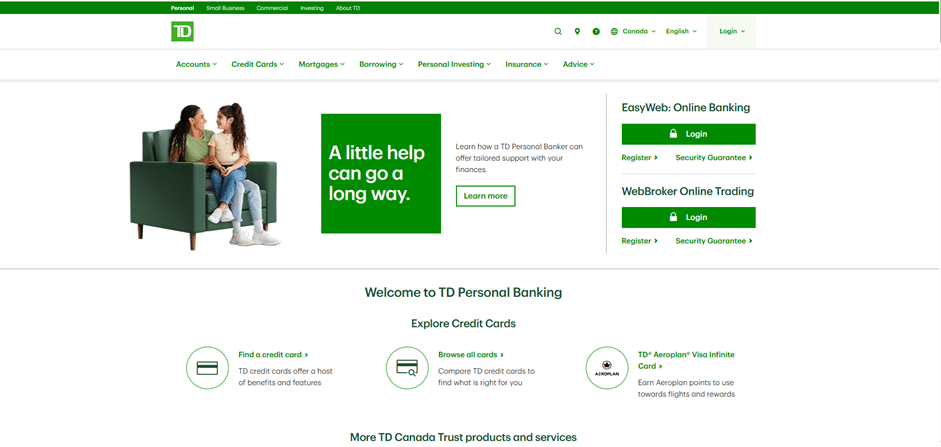

1 – Access the TD Bank Homepage

Start by visiting the official TD website: https://www.td.com/

From the homepage, you can find links to all TD banking products and services.

Anúncios

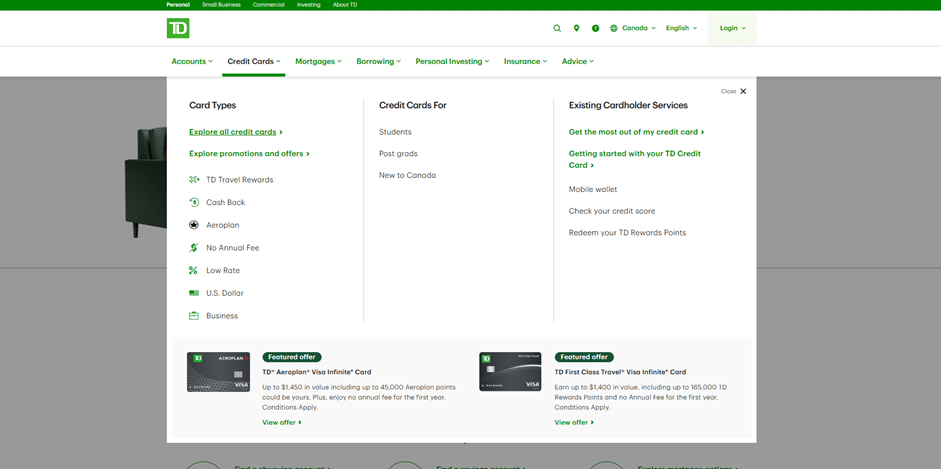

2 – Navigate to the Credit Cards Section

Click on the second option in the top menu, labeled “Credit Cards.”

Next, click on the first option in the dropdown menu: “Explore All Credit Cards.”

Anúncios

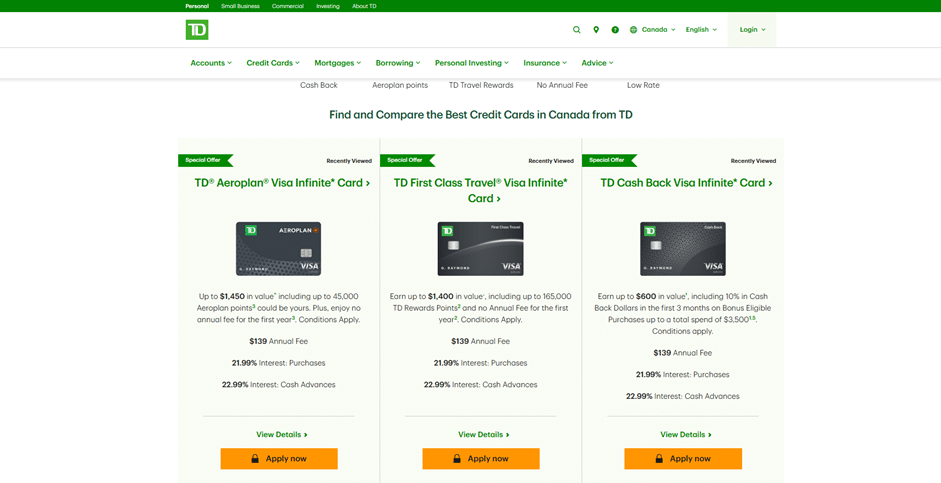

3 – Browse the Available TD Credit Cards

On the credit cards page, you’ll find a variety of TD credit cards, including:

- TD® Aeroplan® Visa Infinite Card*

- TD First Class Travel® Visa Infinite Card*

- TD Cash Back Visa Infinite Card*, among others

Select the TD First Class Travel® Visa Infinite Card*, which usually appears as the second option on the list.

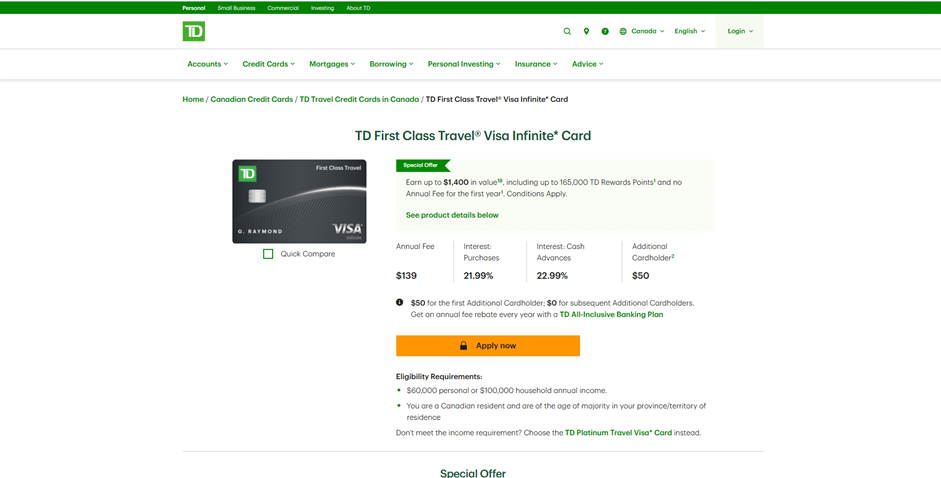

4 – Review the TD First Class Travel® Visa Infinite Card Details*

On this page, you’ll see complete information about the card, including:

- How to earn TD Rewards Points on everyday spending

- Travel benefits and redemption options

- Welcome offers for new applicants

- Annual fees, insurance, and eligibility criteria

Once you’ve reviewed the details, click the orange “Apply Now” button to start your application.

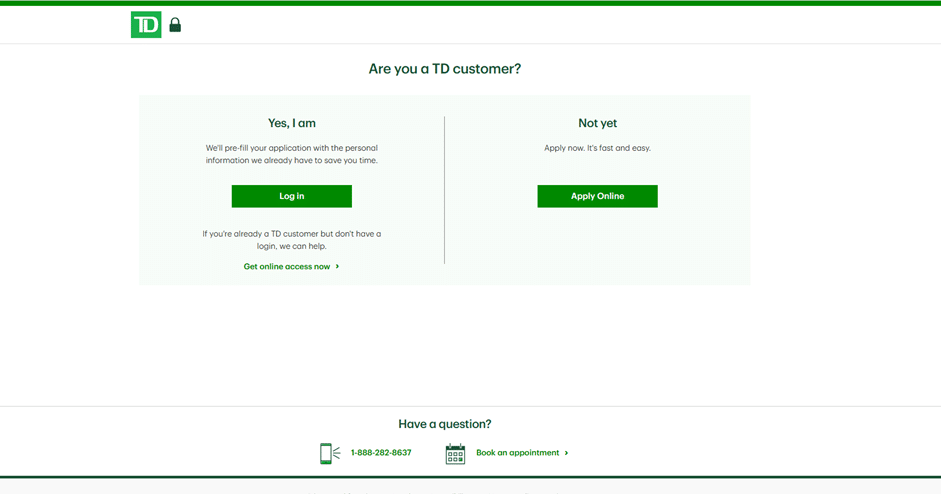

5 – Log In or Apply as a New Customer

After clicking “Apply Now,” you’ll be redirected to the TD login page.

There, you’ll find separate instructions depending on whether you already have a TD Bank account or need to create one.

Follow the on-screen steps carefully, and once your application is approved, you’ll soon receive your TD First Class Travel® Visa Infinite Card* by mail.

Final Notes

The TD First Class Travel® Visa Infinite Card* is ideal for Canadians who want maximum flexibility when redeeming travel rewards.

With the ability to book trips through Expedia® for TD, earn TD Rewards Points quickly, and enjoy Visa Infinite benefits, this card offers everything you need for smarter, more rewarding travel.

The online application is quick, secure, and only takes a few minutes to complete.

Step 1: Access the Application

To apply for this credit card, visit the official TD Canada Trust website and locate the Travel Rewards section. There, you can select the TD First Class Travel Visa Infinite Card and click on Apply Now.

If you are already a TD customer, you can sign in through TD EasyWeb or the TD Mobile App to make the process faster. New users can complete the application online by providing personal and financial information.

Step 2: Eligibility and Basic Requirements

To qualify for the TD First Class Travel Visa Infinite Card, applicants must meet the following criteria:

- Minimum age: 18 years old.

- Residency: You must be a Canadian resident (citizen, permanent resident, or holding a valid visa).

- Minimum income: A personal annual income of at least CAD $60,000, or a household income of around CAD $100,000.

- Credit history: You should have a good credit score and responsible borrowing history.

The bank may require proof of income and perform a credit check before approving the application.

Step 3: Card Features, Rates, and Fees

Before applying, it’s important to understand what the card offers and the potential costs.

- Welcome bonus: Earn up to 165,000 TD Rewards Points — including points after your first purchase and additional points after meeting spending requirements within the first six months.

- Annual fee: CAD $139, usually rebated for the first year.

- Points earning structure:

- 8 TD Rewards Points per dollar spent on travel booked through Expedia for TD.

- 6 points per dollar on groceries, dining, and public transit.

- 4 points per dollar on recurring bills, streaming, gaming, and digital media.

- 2 points per dollar on all other purchases.

- Travel and insurance benefits:

- $100 annual travel credit when booking eligible trips through Expedia for TD.

- Complimentary global airport lounge access via the Visa Airport Companion Program (4 free visits per year).

- Comprehensive travel medical insurance (up to $2 million in coverage).

- Additional protections such as trip cancellation and interruption insurance, lost or delayed baggage, and rental car insurance.

- No expiry of points: TD Rewards Points never expire as long as your account remains open and in good standing.

Step 4: Submission, Approval, and Activation

Once your application is submitted, TD will verify your information and perform a credit assessment.

If approved, your card will be mailed to your address. You can activate it through the TD Mobile App, TD EasyWeb, or by phone.

To qualify for promotional offers, such as bonus points or annual fee rebates, remember to make your first purchase within the required timeframe.

Overview of TD Canada Trust – Strength and Credibility

The Toronto-Dominion Bank (TD Canada Trust) is one of the largest and most respected financial institutions in Canada. Below are key highlights about the bank’s reputation and operations.

- Strong National Presence

TD operates thousands of branches and ATMs across Canada, providing reliable banking and credit services to millions of customers. - Technological Innovation

The bank offers one of the most advanced online and mobile banking experiences in the country, with easy-to-use tools for managing accounts and payments. - Commitment to Customer Service

TD has a strong reputation for excellent customer support, both in-person and digitally, ensuring clients can access assistance at any time.

Toronto-Dominion Bank

- Financial Stability and Global Reach

As one of North America’s major financial institutions, TD Bank maintains a strong capital base and credit rating, making it a trusted choice for Canadians seeking security and convenience.

FAQ — TD First Class Travel Visa Infinite Card

1. What income is required to apply?

A personal annual income of approximately CAD $60,000 or a combined household income of around CAD $100,000 is typically needed.

2. What is the annual fee, and is it rebated?

The annual fee is CAD $139, and it is often rebated for the first year as part of TD’s promotional offer.

3. How many points can I earn?

You can earn up to 8 TD Rewards Points per dollar on eligible travel, 6 points on groceries, dining, and transit, 4 points on recurring payments, and 2 points on all other purchases.

4. Are there airport lounge benefits?

Yes. The card offers global airport lounge access with 4 complimentary visits per year through the Visa Airport Companion Program.

5. Do points expire?

No, TD Rewards Points do not expire as long as your account remains active and in good standing.

6. What insurance benefits are included?

Cardholders receive travel medical insurance, trip cancellation and interruption coverage, baggage insurance, and rental vehicle protection.

7. What is the annual travel credit?

You receive a $100 annual travel credit on eligible bookings made through Expedia for TD.

8. Are there bonus points on birthdays?

Yes. Cardholders can earn up to 10,000 TD Rewards Points as a birthday bonus each year.

9. Can I add supplementary cardholders?

Yes, you can add authorized users to your account. Additional cardholder fees may apply, depending on the offer.

10. Is the TD First Class Travel Visa Infinite Card worth it?

Yes, especially for travelers and frequent spenders. With generous welcome bonuses, flexible rewards, travel insurance, and lounge access, the card provides high value — particularly in the first year when the annual fee is rebated.

Conteúdo criado com auxílio de Inteligência Artificial