Love movies, dining, and entertainment? Want a low-fee card that earns Scene+ points?

You will remain on the same site

The Scotiabank Scene+ Visa is a co-branded rewards card designed for Canadians who love the cinema and need practical grocery rewards Canada. Built around Scene+ points, the card earns on Cineplex purchases and everyday spending, making it a clear movie rewards credit card for frequent moviegoers and families.

Scene+ points accumulate at Cineplex for tickets and in-theatre concessions, and they also work with participating partners, including major grocery chains and restaurants. That means the Scene+ Visa blends Cineplex rewards with daily savings, so your popcorn runs and grocery trips both help you reach free movies faster.

This article will walk through how the card earns points, where Scene+ points redeem across Cineplex and partner retailers, fees and interest to watch for, and tips to squeeze more value from every purchase. If you shop at Loblaws, Sobeys, Metro or other large grocers and visit Cineplex regularly, the Scotiabank Scene+ Visa aims to deliver entertainment value and everyday utility.

Scotiabank Scene +

Key Takeaways

- Scotiabank Scene+ Visa pairs Cineplex rewards with grocery rewards Canada for everyday value.

- Earn Scene+ points on movie tickets, concessions, and purchases at participating grocery chains.

- Points redeem for movie tickets, in-theatre items, and partner retail rewards.

- Best for Canadians who split spending between entertainment and household grocery shopping.

- Review fees, interest rates, and promotions to confirm the card fits your monthly budget.

Scotiabank Credit Cards Compared: Scene+ Visa, Passport Visa Infinite & Momentum Cash Back

Scotiabank Scene+™ Visa Card

Ideal for everyday spending, this card offers:

- Rewards: Earn Scene+ points on eligible purchases.

- Annual Fee: No annual fee.

- Perks: Access to select discounts and insurance options.

This card is perfect for those seeking a straightforward rewards program without an annual fee.

Scotiabank Passport® Visa Infinite Card*

Designed for frequent travelers, it provides:

- Rewards: Earn Scene+ points on eligible purchases.

- Annual Fee: $150.

- Travel Benefits: No foreign transaction fees, six complimentary airport lounge visits annually, and comprehensive travel insurance.

- Welcome Offer: Up to 45,000 bonus Scene+ points in the first year.

This card is suitable for those who travel abroad and want to earn rewards while enjoying travel perks.

Scotiabank Passport® Visa Infinite Privilege Card*

An enhanced version for premium travelers, offering:

- Rewards: Earn Scene+ points on eligible purchases.

- Annual Fee: $399.

- Premium Travel Benefits: 10 complimentary airport lounge visits per year, exclusive airport perks, and a $250 annual travel credit.

- Welcome Offer: Up to 45,000 bonus Scene+ points in the first year.

This card caters to frequent travelers seeking luxury benefits and extensive travel coverage.

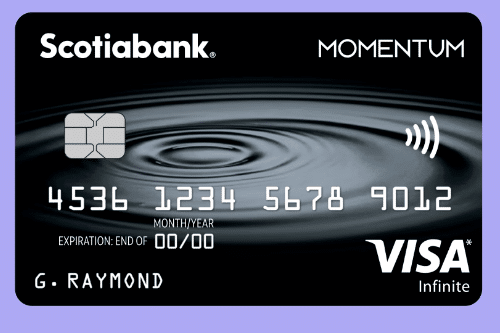

Scotiabank Momentum® Visa Infinite Card*

Tailored for cash-back enthusiasts, it offers:

- Rewards: Earn up to 4% cash back on eligible purchases.

- Annual Fee: $120.

- Cash Back Categories: 4% on grocery store purchases and recurring bill payments, 2% on gas and daily transit, 1% on all other purchases.

- Welcome Offer: 10% cash back on all purchases for the first 3 months (up to $2,000 in total purchases).

This card is ideal for those who prefer cash back over rewards points and want to maximize returns on everyday spending.

Scotiabank Momentum Visa Infinite

Comparison Table

| Card Name | Annual Fee | Rewards Type | Key Benefits |

|---|---|---|---|

| Scene+™ Visa Card | $0 | Scene+ points | No annual fee, basic rewards, select discounts and insurance |

| Passport® Visa Infinite* Card | $150 | Scene+ points | No foreign transaction fees, 6 lounge visits, travel insurance |

| Passport® Visa Infinite* Privilege Card | $399 | Scene+ points | 10 lounge visits, $250 travel credit, exclusive airport perks |

| Momentum® Visa Infinite* Card | $120 | Cash back | Up to 4% cash back, 10% cash back welcome offer, comprehensive insurance |

Conclusion: Choose the Scene+™ Visa Card for a no-fee, straightforward rewards experience. Opt for the Passport® Visa Infinite Card* if you travel frequently and desire travel perks. The Passport® Visa Infinite Privilege Card* is suited for those seeking premium travel benefits. Lastly, the Momentum® Visa Infinite Card* is ideal for individuals who prefer cash back and want to maximize returns on everyday spending.

Scotiabank Scene+ Visa: Earn Points at Cineplex & Grocery Stores

The Scotiabank Scene+ Visa is a credit card built to help Canadians earn Scene+ points when they buy movie tickets at Cineplex and shop for essentials at eligible grocery stores. This card turns everyday spending into rewards that work across entertainment and retail, so a night out or a weekly grocery run both add value.

Overview

The core offering is simple: use the Scotiabank Scene+ Visa and you earn Scene+ points on purchases. Cineplex points come from ticket and concession buys, while grocery points Canada accrues through partner grocers. Scene+ is a unified loyalty currency that you can redeem with Cineplex or with other Scene+ partners for food, retail items, and services.

Why this card matters

Moviegoers benefit because points stack on tickets and snacks, plus cardholders often see exclusive Cineplex promotions that lower the out-of-pocket cost for outings. Grocery shoppers benefit because groceries are recurring, high-volume spending. That steady pace of purchases helps you build a meaningful Scene+ balance faster than occasional discretionary buys.

How points tie together

Points post to a single Scene+ account, whether they come from Cineplex or a grocery purchase. You can combine Cineplex points with grocery points Canada to redeem for free tickets, concessions, in-store items, or offers from Scene+ partners. Earning rates can vary by merchant and may require linking your Scene+ account or enrolling in specific promotions to capture the best everyday rewards.

| Spending Type | What You Earn | Typical Use |

|---|---|---|

| Cineplex tickets & concessions | Cineplex points that convert to Scene+ points | Free tickets, concession discounts, seat upgrades |

| Groceries at eligible stores | grocery points Canada added to Scene+ balance | Everyday rewards toward household purchases or entertainment |

| Other Scene+ partners | Bonus points and partner-specific offers | Retail items, dining, services with Scene+ redemption |

Key benefits of the Scotiabank Scene+ Visa for movie lovers

The Scotiabank Scene+ Visa stands out for moviegoers who want more from every trip to the theatre. Cardholders often earn higher Scene+ points on purchases made at Cineplex compared with regular spending. These Scene+ movie benefits make it easier to save toward free tickets, seat upgrades, or discounted snacks.

Points earning on Cineplex tickets and concessions

Purchases of movie tickets and in-theatre concessions typically earn Scene+ points at an elevated rate versus general purchases. Exact earning rates depend on the card version and current promotion, so check your card details for the latest multiplier. You can collect movie ticket points and concessions points both at the box office and online when logged into a Scene+ account.

Exclusive Cineplex offers and promotions

Cineplex often provides member-only perks tied to Scene+, such as early access passes, discounted concession bundles, and special screenings. Seasonal or tentpole-film promotions sometimes boost Cineplex rewards or add promotional codes for bonus points. Keep an eye on in-app offers and email alerts to catch time-limited deals.

Using points for movie discounts, free tickets, and upgrades

Scene+ points redeem for discounted or free tickets, concession deals, and select seat upgrades where available. Point thresholds for a free ticket vary by theatre, format, and showtime, so values change by location and film. For real-time values, consult the Cineplex app or Scene+ redemption charts before booking to get the best use of your movie ticket points and concessions points.

How points are earned on grocery purchases

Grocery spending is a simple way to build Scene+ balances. Cardholders earn higher returns when purchases are made at participating stores. That makes routine shopping a steady source of rewards for movies, dining, and everyday treats.

Eligible grocery stores and retailers in Canada

Major Canadian grocers commonly in Scene+ partner lists include Loblaws banner stores such as Real Canadian Superstore, No Frills, and Zehrs. Metro and Sobeys locations may appear depending on current agreements. Grocery-adjacent retailers like Costco and wholesale clubs can qualify when coded as grocery, while some drugstores such as Shoppers Drug Mart may count for food and household items.

Partnerships change over time, so confirm eligible grocery partners on the Scene+ site before big purchases. Merchant coding matters; some in-store services or gift card buys can be coded differently and fail to earn grocery rewards Scene+.

Points-per-dollar breakdown for grocery spending

Grocery purchases often earn a boosted grocery points-per-dollar rate compared with general spending. Cards may offer tiered rates: a higher rate for grocery merchants, a base rate for everyday purchases, and promotional boosts for limited periods.

Exact grocery points-per-dollar depend on the card’s current terms and promos. Expect variations like 1–3 points per $1 at eligible grocery partners, then a lower rate elsewhere. Review the cardholder agreement for precise math and promotional windows.

Tips to maximize grocery-related point earning

- Put all regular grocery bills on the Scene+ card to concentrate rewards and maximize grocery points.

- Time large grocery buys to match welcome bonuses or targeted category promotions for extra points-per-dollar.

- Use in-store promotions, loyalty flyers, and Scene+ offers to stack merchant deals with card earnings.

- Avoid transactions coded as cash-like, such as certain gift card purchases or money orders, since they may not earn grocery rewards Scene+.

- Track recurring grocery subscriptions—meal kits and bulk deliveries—and pay with the card to boost monthly totals at eligible grocery partners.

Bonus categories, welcome offers, and limited-time promotions

Credit cards often pair core rewards with promotional boosts to speed up point earning. For Scotiabank, that means a mix of permanent bonus categories and short-lived perks that can add serious value when timed right.

Typical welcome bonus structures and eligibility

Most welcome offers grant a set number of Scene+ points after you meet a minimum spend within the first few months. These limited-time Scene+ promotions usually target new cardholders only and require the account to be open and in good standing. Scotiabank’s terms also outline residency and age rules that must be met before bonus points post.

Seasonal and partner promotions to watch for

Seasonal boosts appear around holiday releases, Black Friday, and summer blockbusters. Cineplex often coordinates campaigns with movie launches to increase point earning or redemption value. Retail and restaurant partners run parallel promos that raise returns at grocery stores, fast-casual chains, and entertainment venues.

How to stack offers for faster point accumulation

Stacking rewards starts with understanding bonus categories tied to your card. Combine the base Scene+ earn rate with merchant-specific Scene+ offers, retailer loyalty programs, and coupons where allowed. Use targeted email or app promos and time big purchases to match elevated-earning windows.

Look for Scotiabank cross-promotions and banking product bundles that raise overall value. Track expiration dates and eligibility rules closely so stacking yields the intended gains rather than voided bonuses.

Redeeming Scene+ points: Movies, food, and more

Scene+ points open a range of redemption channels. You can redeem Scene+ points at Cineplex theatres for tickets and concessions, use them at participating restaurants and retail partners, or apply them online for digital rentals and purchases. Link your Scene+ account to the Scene+ app or website to view balances, start redemptions, and track promotions.

Redemption options

At Cineplex, Cineplex redemption covers standard tickets, concessions, and many upgrades. Participating restaurants accept Scene+ rewards based on partner rules. Digital options include the Cineplex Store for rentals, purchases, and some streaming add-ons. Check the app before you shop to confirm eligibility for in-theatre redemption or online use.

Points value calculation

To find a points value, divide the cash price of an item by the number of points required. For example, a $12 ticket that costs 1,200 points equals $0.01 per point. That simple points value calculation helps you compare redemptions and spot the best value. Typical point value fluctuates, so using points for higher-priced movie tickets or during promotions often yields better returns.

Tips for higher return

- Use points on peak-priced tickets or bundled offers to maximize dollars per point.

- Watch the Scene+ redemption chart for updated conversions and promos.

- Link accounts and apply points at checkout to avoid missing in-theatre redemption options.

Digital and in-theatre purchases

Points may be applied to digital purchases like rentals from the Cineplex Store, with the same points value calculation guiding your decision. In-theatre redemption often covers concessions, small upgrades, and some premium seats. Restrictions can include minimum redemption amounts, partial point payments, or exclusions for IMAX and VIP formats depending on Cineplex and Scene+ rules.

| Redemption Channel | Typical Items | Common Restrictions | Best Use for Value |

|---|---|---|---|

| Cineplex theatres | General admission, concessions, upgrades | Premium formats like IMAX/VIP may be excluded or need top-up | Peak showtimes and bundled ticket + concession deals |

| Participating restaurants | Meals, shareable items, partner offers | Some menu items or limited-time offers may not qualify | Large orders or promotional partner days |

| Cineplex Store (digital) | Movie rentals, purchases, streaming add-ons | Regional licensing and new-release windows can limit use | High-priced rentals or bundles with extras |

| Scene+ app/website | Account-wide redemptions, offers, transfers | Minimum point thresholds and promo-specific rules | Time-limited bonus-value promotions |

Fees, interest rates, and cardholder responsibilities

Choosing the right Scene+ card means weighing costs against perks. Read the fee schedule and compare the annual fee value to the points and exclusive offers you expect to use. Some Scotiabank Scene+ Visa variants have no annual fee. Others charge a fee that may be justified if your yearly point earnings and member benefits exceed that cost.

Annual fees and worth

Start by estimating how many Scene+ points you will earn in a year from movies, groceries, and everyday spend. Convert those points to a dollar value to see if they surpass the annual fee value. Factor in extras like Cineplex discounts and partner offers when deciding if the card makes sense for your budget.

Interest and payment behavior

Credit card interest Canada can erode rewards quickly when balances carry month to month. Most cards post a purchase APR that applies if you do not pay the statement balance in full. Cash advances and some promotional balances usually have higher rates and fees.

Pay the full statement balance each month to avoid interest charges and to preserve the effective value of points. Review the card’s posted APR on Scotiabank terms so you know the cost of carrying a balance before you rely on reward value.

Foreign transaction and other fees

A foreign transaction fee often applies on purchases made in U.S. dollars or foreign currencies. Many Canadian cards charge about 2.5% per foreign purchase unless the product specifically waives that charge. Confirm whether your Scene+ card includes a foreign transaction fee before you travel or shop internationally.

Watch for other costs such as balance transfer fees, late payment fees, returned payment charges, and replacement card fees. Read the cardholder agreement to find exact amounts and billing triggers so there are no surprises on your statement.

Comparing Scotiabank Scene+ Visa to other rewards cards in Canada

The Scotiabank Scene+ Visa is built for people who split their spending between movies, snacks, and weekly groceries. Before picking a card, compare core strengths: cinema and grocery rewards versus flexible travel value. This quick guide helps map the card to real habits in Calgary, Toronto, and Vancouver.

When weighing the Scene+ Visa against travel-focused cards, look at redemptions and perks. Travel credit cards from TD, RBC, and American Express typically deliver higher travel redemption value, airport lounges, and travel insurance. Scene+ vs travel cards is a fair debate: travelers who need flights and elite perks will often get more value from travel cards. Frequent Cineplex visitors and grocery-focused households gain more from Scene+ point rates and partner redemptions.

Compare grocery- and entertainment-focused cards from RBC, CIBC, and TD to see how merchant networks and category multipliers differ. A grocery rewards comparison shows some cards pay stronger earn rates at supermarkets but lack Cineplex tie-ins. Cineplex card comparison narrows the choice: Scene+ points convert directly into movie rewards and concessions, while competitor cards may offer points that are harder to apply for in-theatre.

Regional fit matters. Calgary shoppers who use major grocery banners that partner with Scene+ will extract steady value. Toronto residents with frequent Cineplex outings and shopping at participating grocery chains will see reliable monthly returns. Vancouver cardholders who pair city cinema trips with weekly grocery runs to large-format stores should map local stores to the partner list before deciding.

Use the table below to compare practical differences at a glance. It shows typical point rates, partner variety, and the kind of cardholder who benefits most from each option.

| Card Type | Typical Earn Structure | Key Partners | Best for |

|---|---|---|---|

| Scotiabank Scene+ Visa | Higher points at Cineplex, bonus at partner groceries | Cineplex, selected supermarket banners, dining partners | Frequent moviegoers and grocery shoppers in major Canadian cities |

| Travel reward cards (e.g., Aeroplan, RBC Avion) | Points or miles with higher travel redemption value and travel perks | Airlines, hotels, travel portals, lounge access (card-dependent) | Frequent flyers seeking flight redemptions and travel insurance |

| Grocery-focused cards (various banks) | Elevated earn rates at supermarkets, lower at entertainment | Large grocery chains, select retailers | Households with large grocery spend but rare cinema use |

| Entertainment hybrid cards (bank variants) | Split bonuses across dining, streaming, and entertainment | Movie chains, streaming services, restaurants | Casual moviegoers who want broad lifestyle points |

Match card choice to local routines and spending patterns to decide if Scene+ or a travel card fits better. Conduct a grocery rewards comparison for your nearest stores and test Cineplex card comparison against your cinema frequency before applying.

Eligibility, application process, and approval tips

Before you apply, check the basics of Scene+ Visa eligibility. Scotiabank typically requires Canadian residency, a minimum age of 18, and a record of creditworthiness. Lenders review credit score, credit history, income and debt ratios when assessing applications. Understanding these factors can help you decide whether to apply for Scotiabank Scene+ Visa now or after strengthening your profile.

Minimum credit score and income considerations

Most approvals favor applicants with a solid credit score and steady income. No public score threshold is guaranteed, but higher scores improve chances. Scotiabank will look at recent credit behavior, length of credit history and total debt. Show consistent employment or reliable income to support your application.

Documents needed and how to apply online or in-branch

To complete a credit card application Canada residents can use Scotiabank’s website, call customer service or visit a branch. Typical documents include government-issued ID, Social Insurance Number for the credit check, recent pay stubs, and bank statements if requested. Have employment details and contact information ready to speed up processing.

Improving approval odds and managing multiple applications

Follow credit approval tips to boost your odds. Review your credit report for errors before you apply. Lower current credit utilization by paying down balances. Avoid multiple hard inquiries in a short period. Keep income documentation clear and up to date.

If you must submit more than one request for new credit, space them out. Aim for a 3–6 month gap between credit card applications to reduce the impact of hard inquiries. Track existing credit limits and recent applications so Scotiabank sees a stable borrowing profile when you decide to apply for Scotiabank Scene+ Visa.

Practical tips to maximize everyday earnings with the card

Use the Scotiabank Scene+ Visa as your go-to card for daily spending. Focus on groceries, dining at Scene+ partners, and Cineplex visits to maximize Scene+ points. Put recurring bills on the card and time big purchases during bonus promotions to boost monthly points.

Concentrate discretionary purchases where they earn the most. Charge grocery runs, restaurant tabs, and subscription services that accept the card. Set up automatic payments for phone and utility bills when eligible to ensure steady accrual.

Timing and extras

Watch for limited-time offers and welcome bonuses. Make larger planned purchases during these windows to boost monthly points. Use merchant promos from Cineplex and grocery partners to extract extra value from each dollar spent.

Partner synergy

Link your Scotiabank Scene+ Visa to your Scene+ account and enable targeted offers in the Scene+ app. Combine card earnings with retailer loyalty programs like Sobeys and Metro when allowed to increase effective yield through Scene+ partnerships.

Notifications and alerts

Enable email and app alerts from Scene+ and Scotiabank. Promotional messages often announce short-term boosts and exclusive partner deals. Acting fast on these alerts can significantly boost monthly points.

Tracking rewards

Monitor balances through the Scene+ account and Scotiabank online portal. Check activity monthly to verify points posted after purchases and promos. Keep records of receipts for bonus-category claims or disputes.

Prevent point expiry

Keep your Scene+ account active with small, regular redemptions or occasional purchases at Scene+ partners. Even modest activity resets inactivity timers and helps prevent point expiry. If points near expiry, redeem for snacks, digital rentals, or save a small amount for a future movie.

| Tip | Action | Expected Impact |

|---|---|---|

| Consolidate spending | Use the Scene+ Visa for groceries, dining, and subscriptions | Higher monthly point totals from everyday expenses |

| Auto-pay setup | Enroll recurring eligible bills on the card | Steady accrual and fewer missed opportunities |

| Use partner offers | Activate targeted promotions in the Scene+ app | Extra points during limited-time boosts |

| Combine loyalty programs | Pair card rewards with store loyalty accounts | Improved effective return per dollar |

| Regular tracking | Review Scene+ and Scotiabank statements monthly | Quick corrections and clear earning picture |

| Small redemptions | Redeem a few points periodically at Cineplex or partners | Resets activity and helps prevent point expiry |

Real user experiences and testimonials from Canadian cardholders

Canadian cardholder experiences paint a mixed but practical picture. Many users praise the simplicity of earning Scene+ points during weekly grocery runs and movie nights at Cineplex. Linking a Scotiabank account to the Scene+ app helps track balances and redemptions with little fuss.

Common praises: movies, groceries, and redemption ease

Frequent positives in Scene+ card reviews Canada include steady point accumulation on grocery staples and clear rewards for Cineplex visits. Cardholders note easy redemptions for standard tickets and concessions. Targeted offers for popular chains such as Loblaws and No Frills make bonus point windows useful for families.

Common complaints: fees, redemption limits, and availability

Cineplex card testimonials often mention downsides. Some users find redemption value lower than expected when compared to cash prices. Certain premium screenings and special concessions can be excluded from point use, which frustrates regular moviegoers.

How real users optimize the card for family and solo use

Smart cardholder experiences show families pooling spending onto one primary account to speed up points. Booking group outings during promotional periods boosts value per point. Solo users focus redemptions on peak-time tickets where points stretch further.

Scene+ pros and cons appear across reviews. Pros include convenience and steady earning at grocery stores and Cineplex. Cons center on occasional partner changes and annual fees on higher-tier cards. Readers can weigh those trade-offs when reading Scene+ card reviews Canada and Cineplex card testimonials.

Conclusion

The Scotiabank Scene+ Visa summary is simple: this card turns regular grocery and Cineplex spending into tangible rewards. If you visit Cineplex theatres often and do most of your grocery shopping at participating banners, the card can deliver steady value by converting everyday purchases into movie nights, concession treats, and dining savings.

For decision guidance, choose the card when your lifestyle matches Cineplex attendance and grocery habits. Weigh the annual fee against your expected point earnings and compare earn rates with other cards if you prioritize travel or low foreign transaction fees. Use the comparisons earlier in this article to see whether the math favors the Scene+ card for your annual spend.

Next steps: check Scotiabank and Scene+ official pages for current terms, welcome offers, and partner lists before applying. Use the practical tips and the best use of Scene+ points examples here to estimate your personal return and plan how Cineplex and grocery rewards conclusion will fit into your budget and entertainment routine.

FAQ

What is the Scotiabank Scene+ Visa and who should consider it?

How do I earn Scene+ points with this card?

Which grocery stores are eligible to earn bonus Scene+ points?

How much are Scene+ points worth when I redeem them?

Can I use Scene+ points for both movie tickets and concessions?

Are there welcome bonuses or limited‑time promotions with this card?

What fees and interest rates should I expect?

How do I apply and what are the eligibility requirements?

Can I combine Scene+ offers with retailer loyalty programs and Scotiabank promotions?

Do Scene+ points expire and how can I keep them active?

How does the Scotiabank Scene+ Visa compare to travel or other grocery/entertainment cards?

What practical tips help me maximize everyday earnings with this card?

Are there common limitations or complaints from current cardholders I should know about?

Can I redeem Scene+ points for digital purchases like Cineplex Store rentals?

How should I decide if the annual fee is worth it?

Where can I find the most current details about rates, partners, and promotions?

Conteúdo criado com auxílio de Inteligência Artificial