Want to choose where to earn the most cashback based on your lifestyle?

The Bank of America® Customized Cash Rewards Credit Card is one of the most popular cashback credit cards in the United States. Designed for flexibility, it allows cardholders to choose their own top-earning category and enjoy cash back on everyday purchases.

This comprehensive guide will walk you through how to apply for this card, what the eligibility requirements are, and how to improve your chances of approval.

What the Card Offers

The Bank of America® Customized Cash Rewards Credit Card offers:

Anúncios

- 3% cash back in a category of your choice (such as gas, online shopping, dining, travel, drug stores, or home improvement/furnishings).

- 2% cash back at grocery stores and wholesale clubs.

- 1% cash back on all other purchases.

- The 3% and 2% categories apply to the first $2,500 in combined purchases each quarter; after that, you earn 1%.

- A $200 cash rewards bonus after spending $1,000 within the first 90 days of account opening.

- 0% introductory APR for 15 billing cycles on purchases and balance transfers, followed by a variable APR based on creditworthiness.

- Access to Visa Signature benefits, including extended warranty, travel assistance, and fraud protection.

- Eligibility for Preferred Rewards, which boosts your cashback rate by 25% to 75% depending on your tier.

This combination of features makes it one of the most versatile and customizable cashback cards in the U.S.

Anúncios

STEP-BY-STEP TUTORIAL ON HOW TO APPLY FOR THE CREDIT CARD

Bank of america

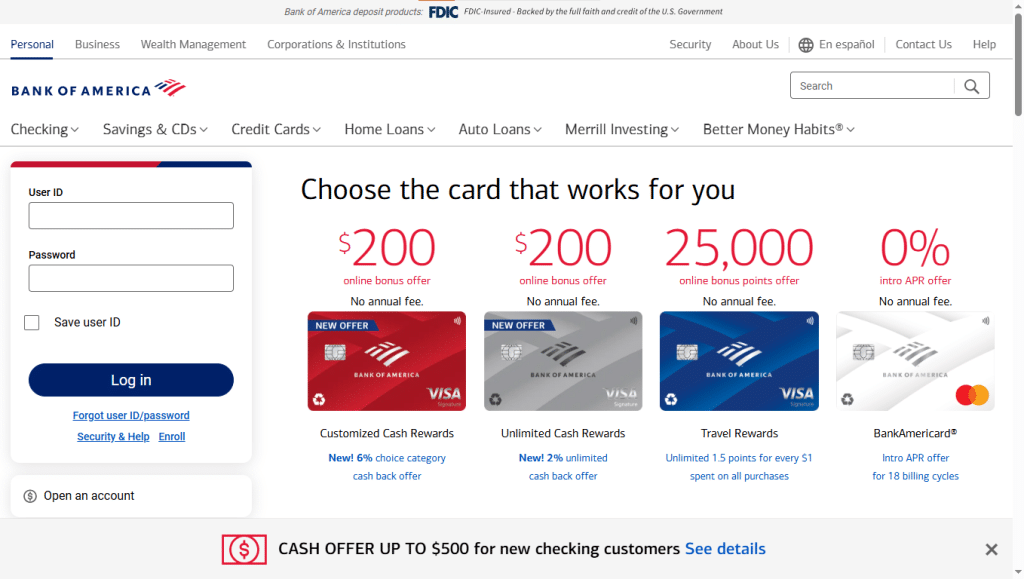

1 – Access the Bank of America homepage

Go to the official bank website: https://www.bankofamerica.com/.

On the homepage, you will find all the products and services offered by the bank, including credit cards, accounts, loans, and investments.

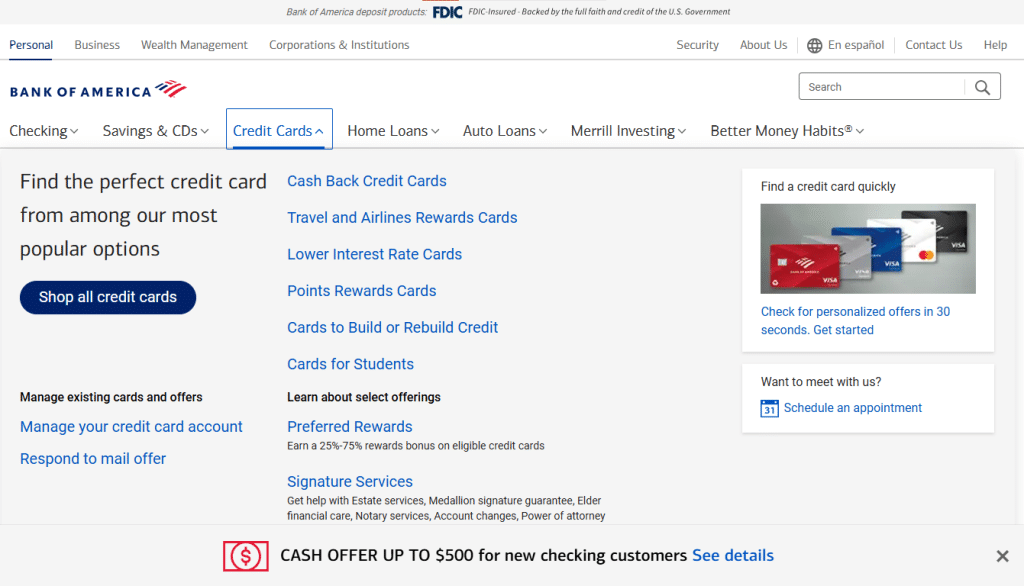

2 – Select “Credit Cards” and then “Cash Back Credit Cards”

In the top menu of the site, locate the third option called “Credit Cards”.

Then click on the first option in the dropdown menu: “Cash Back Credit Cards”.

This section includes all cashback cards, ideal for those looking for convenience and savings on everyday purchases.

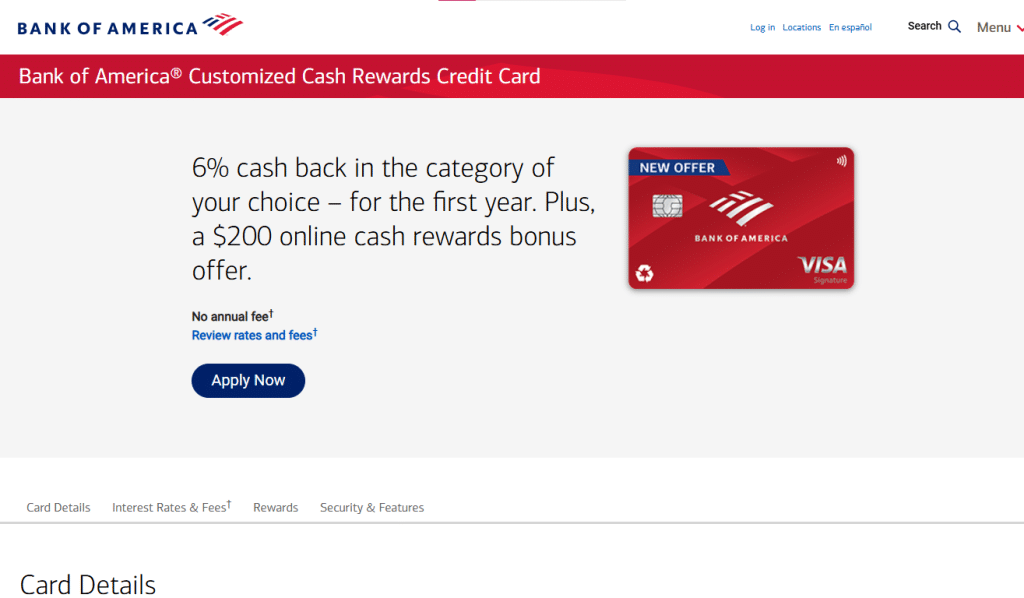

3 – Choose the Bank of America® Customized Cash Rewards card

On this page, you will find several cashback card options, such as:

- Bank of America® Unlimited Cash Rewards

- Bank of America® Customized Cash Rewards

- Bank of America® Customized Cash Rewards for Students, among others.

Look for the Bank of America® Customized Cash Rewards Credit Card and click the blue “Apply Now” button to start the application process.

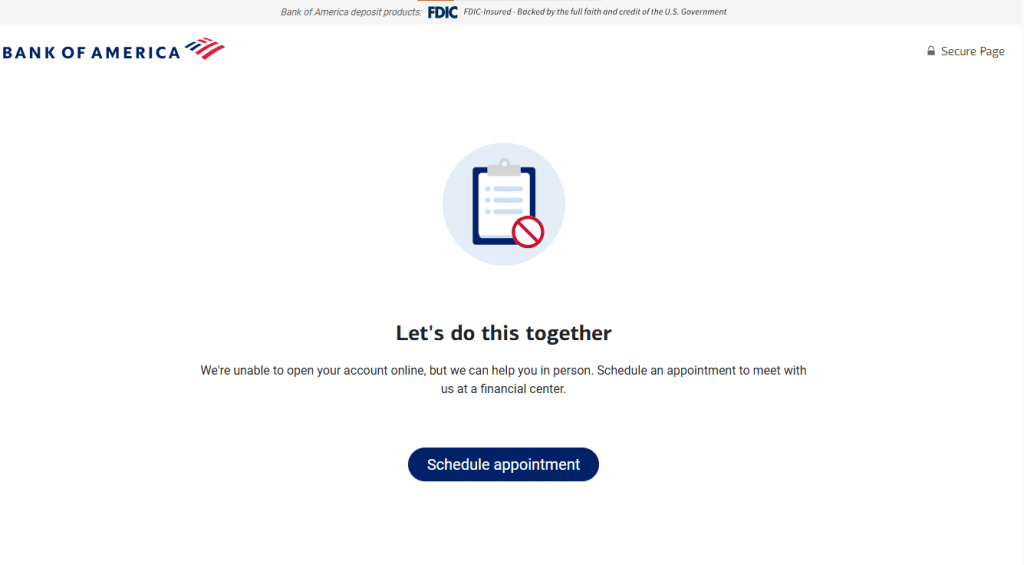

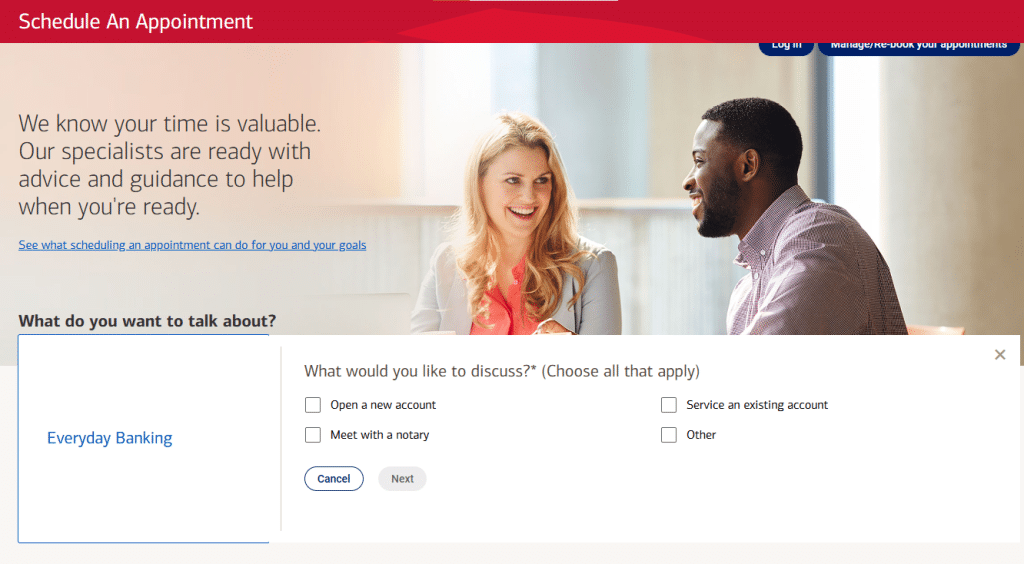

4 – Access the appointment scheduling page

After clicking “Apply Now,” you will be redirected to a page where you can schedule an in-branch appointment if you want personalized support.

Click the blue “Schedule Appointment” button to continue.

5 – Choose the “Everyday Banking” service

On the next screen, select the first option, called “Everyday Banking”, which refers to regular banking services, including credit cards.

This step ensures that your appointment is directed to the correct service and that the bank specialist can assist you effectively.

6 – Fill out the appointment form

Finally, a simple appointment form will appear, where you will need to fill in basic information such as:

- Full name

- Phone number

- Location (to choose the nearest branch)

- Preferred date and time

Once completed, click “Confirm Appointment”.

You will soon receive an email with your appointment details, and after the meeting, you can proceed with the official application for your Bank of America® Customized Cash Rewards Credit Card.

Step-by-Step Guide to Apply for the Bank of America® Customized Cash Rewards Card

Step 1: Access the Official Bank of America Website

Go to the official Bank of America homepage and navigate to the Credit Cards section.

Under “Cash Back Credit Cards,” select Customized Cash Rewards Credit Card.

Once on the card page, review all current offers and terms before applying.

Step 2: Click “Apply Now”

Click the “Apply Now” button to start the application process.

You will be asked to provide personal, financial, and employment details to verify your identity and creditworthiness.

Step 3: Fill Out the Application Form

You will need to provide the following information:

- Personal details: full legal name, date of birth, Social Security Number (SSN), and contact information.

- Address: your current address (and previous one if you’ve lived there for less than two years).

- Employment and income: employer name, occupation, and annual income.

- Financial details: housing payment, existing credit cards, and other financial obligations.

Ensure all data is correct and consistent with your credit report to avoid delays.

Step 4: Review and Submit the Application

Before submitting, double-check that all information is accurate.

Submitting false or inconsistent information can cause your application to be denied or delayed.

Once submitted, Bank of America will perform a hard credit inquiry to evaluate your credit score and history.

Step 5: Receive the Decision

In most cases, applicants receive an instant decision. The possible outcomes include:

- Approved: you’ll receive your credit limit and account information.

- Pending: the bank may request additional documents or time for verification.

- Declined: you will receive a letter explaining the reasons for denial.

If approved, the card will arrive in the mail within 7 to 10 business days.

Step 6: Activate and Start Using Your Card

Once the card arrives, you can activate it through your Bank of America online account, mobile app, or by phone.

After activation, you can start earning cashback on your purchases immediately.

Basic Requirements for Approval

While specific approval criteria vary by applicant, here are the general requirements:

- Credit Score: Good to excellent (typically 690 or higher).

- Income: Sufficient to demonstrate ability to repay.

- Residency: Must be a U.S. citizen or permanent resident.

- Identification: Valid SSN or Tax ID number.

- Credit History: A clean record with no recent delinquencies or excessive applications.

Having an existing Bank of America account (checking or savings) can improve approval odds since the bank already has a relationship with you.

Tips to Improve Your Approval Chances

- Maintain a good credit score. Pay bills on time, reduce credit utilization, and avoid unnecessary applications.

- Lower existing debt. A lower debt-to-income ratio increases your approval odds.

- Apply strategically. Avoid applying for multiple Bank of America cards in a short period, as this can trigger internal limits.

- Build a relationship. If possible, open a checking or savings account with Bank of America before applying.

- Monitor your credit report. Ensure your information is accurate and up to date.

What Happens After You’re Approved

After approval:

- You’ll receive the credit card by mail within 7–10 days.

- You can access your account through online banking or the mobile app.

- Choose your 3% category to start earning rewards right away.

- You can change this category once per calendar month.

- Remember that your bonus cashback (3% and 2%) applies only up to $2,500 in combined quarterly purchases.

Rewards are automatically credited to your account and can be redeemed for:

- Statement credits

- Deposits to your Bank of America account

- Contributions to a Merrill investment account

Overview of Bank of America

History and Reputation

Bank of America (BofA) is one of the largest and most respected financial institutions in the United States. Founded over a century ago, it now serves millions of customers nationwide.

It offers a full suite of services, including checking and savings accounts, credit cards, loans, and investment management through Merrill.

Digital Leadership

Bank of America’s digital platforms are among the most advanced in U.S. banking.

Its online and mobile banking systems are secure, user-friendly, and integrated with other financial tools, allowing customers to manage credit cards, investments, and loans from a single dashboard.

Financial Stability and Credibility

As a publicly traded company (NYSE: BAC), Bank of America is one of the most financially stable institutions in the world.

It operates under strict U.S. regulatory oversight and maintains robust capital reserves, ensuring safety and reliability for consumers.

Preferred Rewards Program

One of the standout advantages of being a Bank of America customer is the Preferred Rewards Program, which offers:

- 25% to 75% bonus on cashback earnings depending on your tier.

- No annual fee increases for being a Preferred Rewards member.

- Waived banking fees and better interest rates on savings or loans.

This program makes the Bank of America® Customized Cash Rewards Credit Card even more valuable for loyal customers.

Consumer Protection and Customer Service

The bank provides comprehensive protection policies, including:

- Zero Liability for unauthorized transactions.

- 24/7 customer support for lost or stolen cards.

- Fraud monitoring to alert you of suspicious activity.

- Extended warranty and travel assistance through Visa Signature benefits.

Bank of America consistently ranks among the top financial institutions for security and customer support.

Frequently Asked Questions (FAQ)

1. Who can apply for the Bank of America® Customized Cash Rewards Credit Card?

U.S. citizens or permanent residents with a verifiable income and valid Social Security Number (SSN) are eligible to apply.

Applicants typically need a good to excellent credit score (around 690 or higher).

2. What credit score do I need for approval?

While Bank of America does not disclose an exact minimum, most successful applicants have a credit score between 690 and 750+.

A solid credit history with on-time payments and low debt will significantly improve your chances.

3. What are the current introductory offers?

New cardholders may qualify for a $200 welcome bonus after spending $1,000 in the first 90 days.

There is also a 0% introductory APR on purchases and balance transfers for the first 15 billing cycles.

4. How does the cashback cap work?

The 3% and 2% cashback categories apply to the first $2,500 in combined purchases per quarter.

After reaching that limit, you earn 1% on all additional purchases until the next quarter begins.

5. Can I change my 3% cashback category?

Yes. You can change your 3% category once per month through online banking or the mobile app.

If you do not choose, the default category is Gas and EV Charging Stations.

6. Does this card charge foreign transaction fees?

Yes. There is typically a foreign transaction fee of around 3% on purchases made outside the United States.

For frequent travelers, a Bank of America travel-focused card may be a better option.

7. What is the APR after the introductory period?

After the 0% intro period, a variable APR applies based on your creditworthiness.

It generally ranges from around 18% to 28%.

8. How do I redeem my cashback rewards?

You can redeem rewards as:

- A statement credit

- Direct deposit into a Bank of America account

- Deposit into a Merrill investment account

Your rewards do not expire as long as your account remains open and in good standing.

9. What is the Bank of America Preferred Rewards program?

Preferred Rewards is a loyalty program for Bank of America customers with combined deposit and investment balances above certain thresholds.

It offers cashback bonuses, fee waivers, and higher rewards rates depending on your tier.

10. Are there restrictions on how many Bank of America credit cards I can hold?

Yes. Bank of America applies internal rules often summarized as the 2/3/4 rule:

- No more than 2 new cards in 2 months

- 3 in 12 months

- 4 in 24 months

Additionally, you cannot receive the same welcome bonus twice within a 24-month period.

11. What can I do if my application is denied?

If denied, review the reason given in your notice.

Common reasons include limited credit history or high debt.

You can reapply later after improving your credit score or lowering your debt-to-income ratio.

Opening a checking or savings account with Bank of America may also help build a relationship before reapplying.

12. How long does it take to receive the card?

Most applicants receive the physical card within 7 to 10 business days after approval.

Some may get instant access to a virtual card number to start making purchases immediately.

Conclusion

The Bank of America® Customized Cash Rewards Credit Card stands out as a top choice for individuals who want flexibility in earning cashback on their own terms.

Its customizable categories, generous welcome bonus, and strong security features make it a practical option for both beginners and seasoned cardholders.

When paired with Bank of America’s Preferred Rewards program, the earning potential becomes even greater—making it one of the most valuable no-annual-fee cashback cards in the U.S. market today.

Whether you’re looking to maximize everyday purchases, build credit responsibly, or enjoy a reliable rewards structure backed by one of the country’s most trusted banks, the Bank of America® Customized Cash Rewards Credit Card is a strong contender worth considering.

Conteúdo criado com auxílio de Inteligência Artificial