The Citi Double Cash® Card is one of the most popular credit cards in the United States, known for offering simple and straightforward cash back rewards. This detailed guide will walk you through the application process step by step, from accessing the official website to the approval process.

Citi Double Cash

Step-by-Step Tutorial: How to Apply for the Citi Double Cash® Credit Card

Learn how to apply for the Citi Double Cash® Card quickly and easily, directly through the official Citi website. This guide is perfect for anyone looking to maximize cashback rewards without complications.

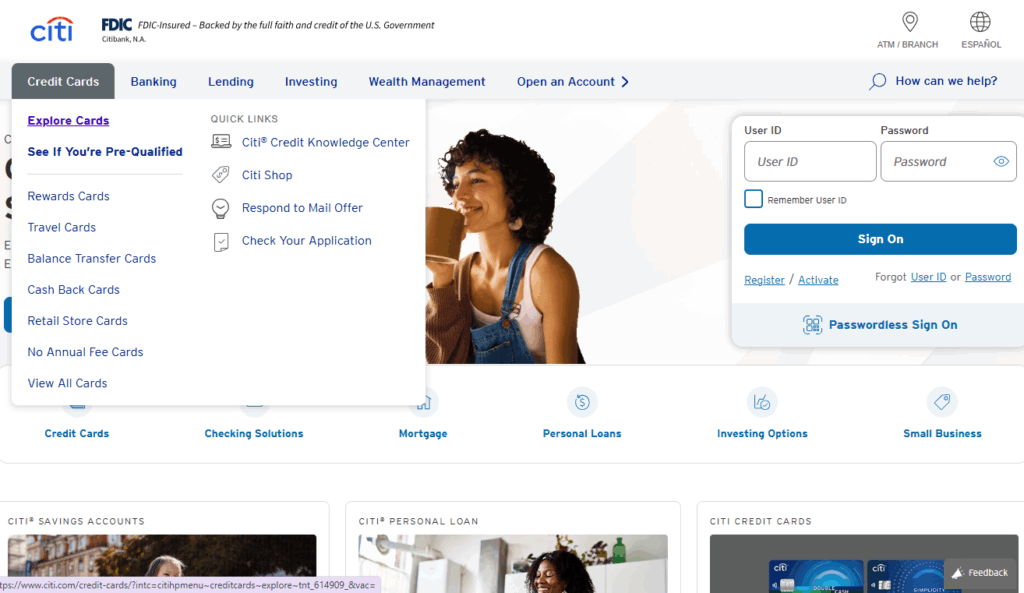

1. Access the Official Citi Website

First, go to the Citi homepage: https://www.citi.com/

In the main menu, select “Credit Cards” and then click “Explore Cards” to view all available card options.

Anúncios

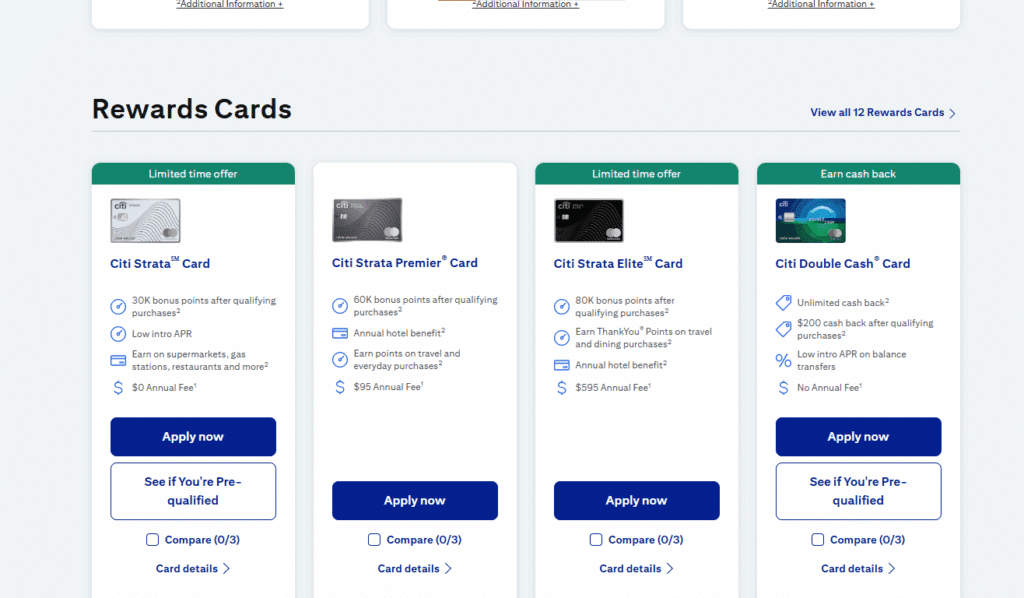

2. Browse the Available Cards

On the cards page, you will find several options, such as:

Anúncios

- Citi® Diamond Preferred® Credit Card

- Citi® / AAdvantage® Platinum Select® World Elite Mastercard®

- American Airlines AAdvantage® MileUp® Card

- Costco Anywhere Visa® Card by Citi

You can also filter cards by specific features:

Balance Transfer, Travel, Rewards, No Annual Fee, Cash Back, Retail.

To apply for the Citi Double Cash®, select the fourth option under “Rewards Cards”: “Citi Double Cash” and click the blue “Apply Now” button.

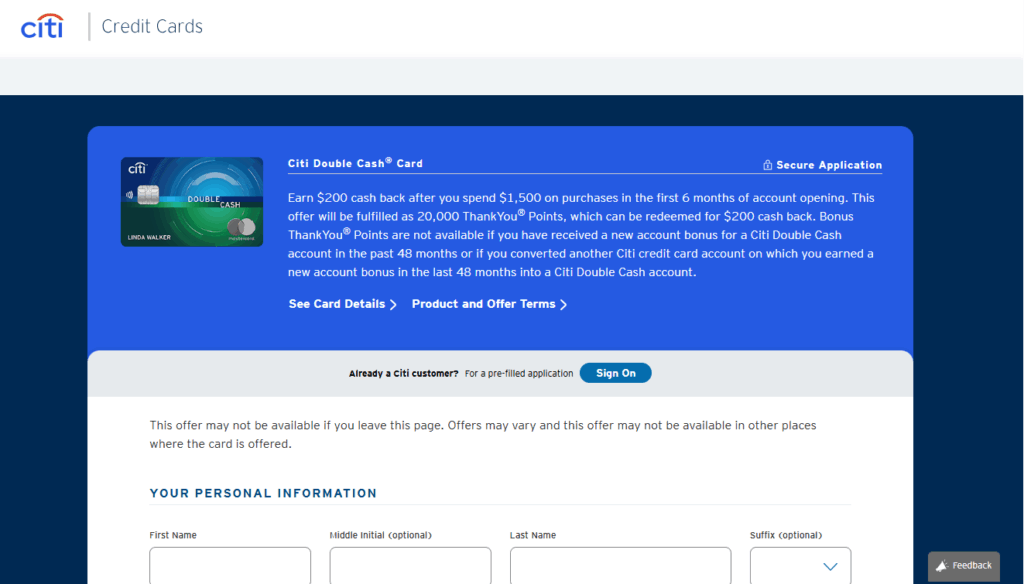

3. Complete the Application Form

After clicking “Apply Now,” fill out your personal information:

- Full name

- Residential address

- Phone number

- Financial information, if requested

Once you submit the form, your application will be processed, and you will soon receive your Citi Double Cash® Card.

1. Accessing the Official Website

To start your application, visit the official Citi Double Cash Card website: https://www.citi.com/credit-cards/citi-double-cash-credit-card. This is the only official channel for applications, ensuring a secure and reliable process.

2. Basic Requirements for Application

Before applying, make sure you meet the following requirements:

- Minimum Age: You must be at least 18 years old.

- U.S. Residency: You must be a resident of the United States.

- Social Security Number (SSN): A valid SSN is required to complete the application process.

- Credit History: While the Citi Double Cash Card is accessible, having a good credit history can increase your chances of approval.

3. Application Process

Step 1: Start the Application

On the official website, click “Apply Now” to begin. You will be redirected to a secure online form.

Step 2: Complete the Form

The application form will request personal and financial information, including:

- Full name

- Residential address

- Date of birth

- Phone number

- Annual gross income

- Social Security Number (SSN)

Make sure all information is accurate to avoid delays in processing.

Step 3: Review and Submit

After filling out all required fields, review your information carefully. Then, submit your application.

4. Approval and Receiving the Card

Approval times may vary. In some cases, you may receive an immediate response, while in others, it may take a few days. If approved, the card will be mailed to your provided address, usually within 10 business days.

Overview of Citi Bank

Citigroup Inc., commonly known as Citi, is one of the largest financial institutions in the world, with a significant presence in the United States and other countries. Founded in 1812, Citi provides a wide range of financial services, including credit cards, banking accounts, investments, and loans.

Citi Bank

Credibility and U.S. Presence

Citi is recognized for its financial stability and innovation in banking. In the United States, it operates a large network of branches and ATMs, as well as a robust digital platform that makes accessing its services convenient.

Commitment to Security

Customer security is a top priority at Citi. The bank employs advanced fraud protection technologies and offers 24/7 monitoring to ensure the safety of transactions.

Frequently Asked Questions (FAQ)

1. What are the benefits of the Citi Double Cash Card?

- 2% unlimited cashback: 1% when you buy and 1% when you pay.

- No annual fee.

- No categories to activate.

- Rewards can be redeemed as a statement credit, direct deposit, or check.

2. What is the credit limit for the Citi Double Cash Card?

The credit limit is determined based on your credit evaluation and financial history. There is no fixed limit set by the bank.

3. How can I check if I’m pre-qualified for the Citi Double Cash Card?

You can use Citi’s pre-qualification tool, available at https://online.citi.com/US/ag/cards/pre-qualify. This process does not affect your credit score.

4. What fees are associated with the Citi Double Cash Card?

The Citi Double Cash Card has no annual fee. However, fees may apply for transactions such as balance transfers or cash advances. It is important to review the full fee details on the official website.

5. How can I contact Citi customer support?

You can call Citi customer service at 1-800-347-4934. The official website also provides live chat and contact forms for support.

This guide was prepared based on information available on the official Citi Double Cash Card website: https://www.citi.com/credit-cards/citi-double-cash-credit-card. It is recommended to visit the site for the most up-to-date and detailed information about the application process and card benefits.

Conteúdo criado com auxílio de Inteligência Artificial