Getting a credit card from FNB is a straightforward process that can be completed quickly. To start, you’ll need to check your credit score and ensure you meet the credit card eligibility criteria.

The FNB credit card application process is designed to be simple and efficient, allowing you to apply from the comfort of your own home.

By following a few easy steps, you can be on your way to getting the credit card you need.

Anúncios

Key Takeaways

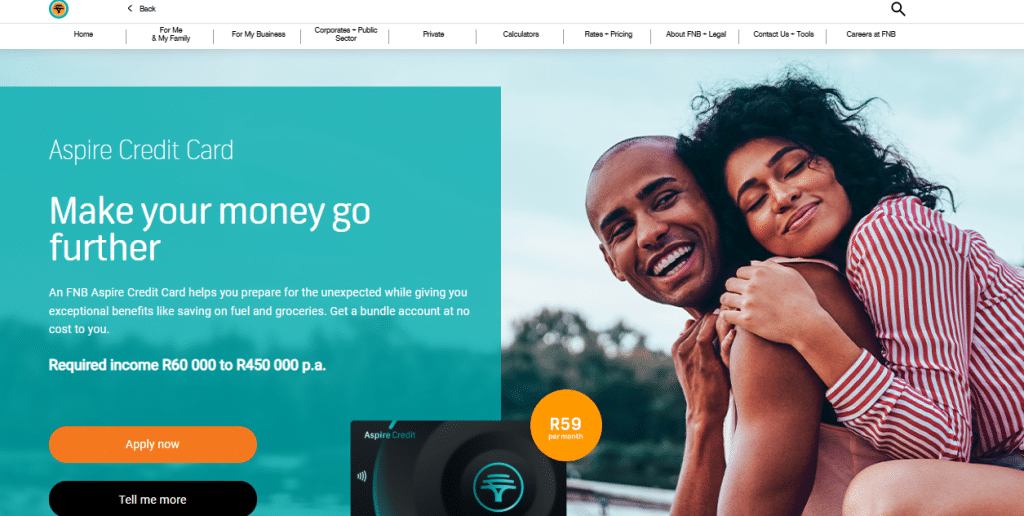

Aspire Credit Card

- Check your credit score before applying.

- Ensure you meet the credit card eligibility criteria.

- The application process is simple and efficient.

- You can apply from the comfort of your own home.

- Follow a few easy steps to get the credit card you need.

How to Apply for an FNB Credit Card: Step-by-Step Guide

If you want to apply for an FNB credit card, follow this detailed guide that will show you each step in a simple and easy way.

Anúncios

Step 1: Visit the Official FNB Website

Go to the official FNB credit cards page:

https://www.fnb.co.za/for-you/borrow/credit-cards/index.html

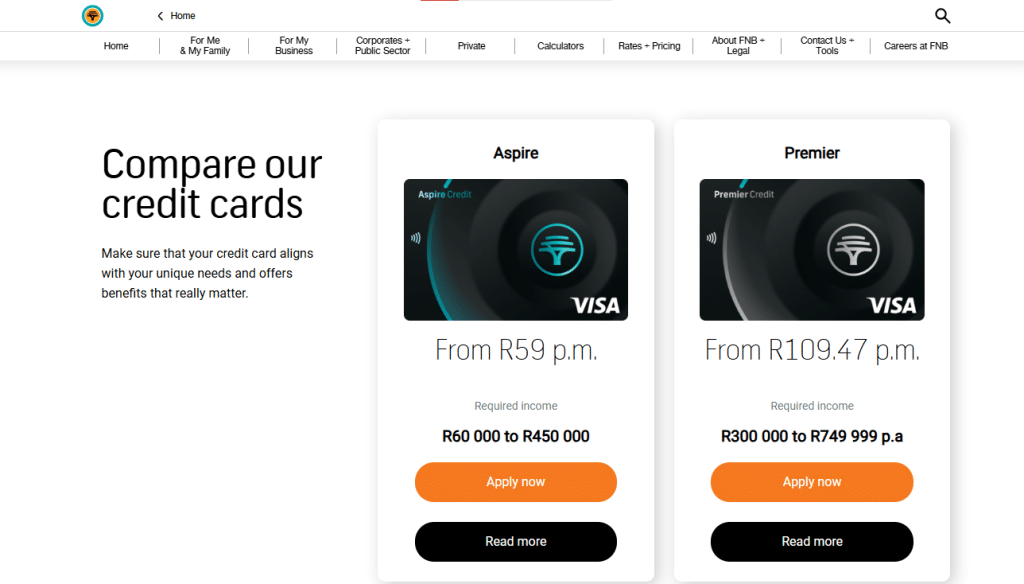

Here you will find several credit card options, including:

- Aspire Card

- Premier Card

- Private Clients Card

- Private Wealth Card

- Petro Card

Tip: Research and compare the cards to choose the one that best suits your financial profile.

Step 2: Choose Your Card

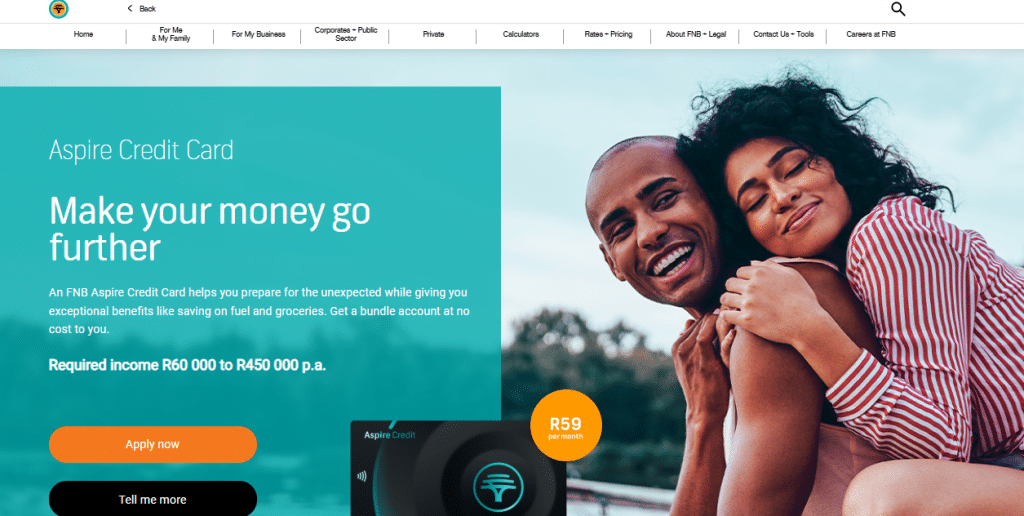

In this example, we will select the Aspire Card.

- Click the black “Read More” button on your chosen card.

- You will be redirected to a page with full details about the card.

Step 3: Check the Card Details

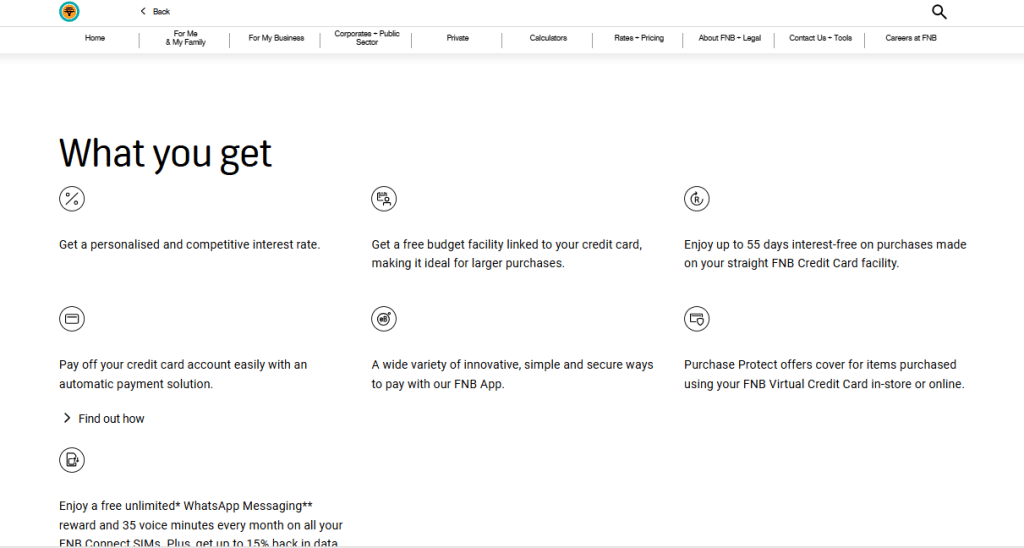

On this page, you can review:

- Available credit limits

- Fees and charges

- Benefits and rewards

- Terms and eligibility requirements

Tip: Carefully read all the information before proceeding with your application.

Step 4: Apply for the Card

If you decide that this card suits your needs:

- Click the “Apply Now” button.

- Complete the application form with your personal and financial details.

- Wait for FNB to review and approve your application.

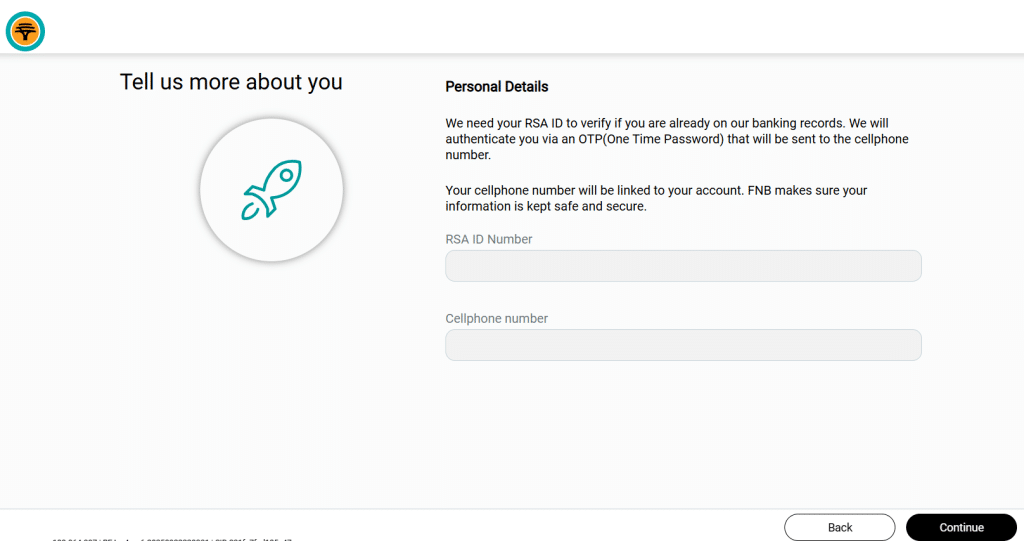

Step 5: Confirm your personal details

After you click “Apply Now” to start the application process, you’ll be taken to a page where you need to provide your personal information so the bank can verify your identity.

On this screen, fill in the following details:

- RSA ID Number: This is your official identification number. FNB will use it to check if you are already registered in the bank’s system.

- Cellphone number: Your cellphone number will be linked to your account and used for authentication via a OTP (One Time Password), ensuring that you are the one making the application.

Tip: Make sure all the information you enter is correct and up-to-date to avoid any delays with your application. FNB guarantees that your information is safe and secure.

Once you’ve filled in the fields, click “Continue” to proceed with your application.

Benefits of Following This Step-by-Step Guide:

- Fast and secure process

- Informed choice of the card that best fits your profile

- Direct access to the official FNB website, avoiding fraud

Understanding FNB Credit Card Options

The world of credit cards can be complex, but FNB simplifies the process by offering a variety of cards with unique features and benefits. With several options available, customers can choose a card that best suits their financial needs and lifestyle.

Types of FNB Credit Cards Available

FNB offers a range of credit cards, including the FNB Cashback Card, FNB Rewards Card, and FNB Visa Card. Each card type is designed to cater to different customer preferences, whether it’s earning cashback, accumulating rewards points, or enjoying global acceptance with a Visa card.

Features and Benefits of Each Card Type

The FNB Cashback Card is ideal for customers who want to earn cashback on their purchases, while the FNB Rewards Card offers rewards points that can be redeemed for various products and services. The FNB Visa Card, on the other hand, provides global acceptance and additional benefits like travel insurance and purchase protection.

Annual Fees and Interest Rates

Annual fees and interest rates vary across FNB credit cards. For instance, cards with more premium benefits may have higher annual fees, while cards with lower interest rates may offer more favorable terms for customers who carry a balance. It’s essential to review these terms to choose a card that aligns with your financial situation.

Rewards Programs and eBucks Benefits

FNB’s rewards programs, including eBucks, allow customers to earn points on their purchases and redeem them for rewards. As one FNB customer noted, “

eBucks rewards make my everyday purchases worthwhile.

” Understanding the rewards structure and benefits can help customers maximize their card’s value.

By considering the types of FNB credit cards, their features, annual fees, and rewards programs, customers can make an informed decision that meets their financial goals.

FNB Bank: Your Partner in Banking, Mzansi-Style

Looking for banking solutions that blend heritage with cutting-edge tech? FNB (First National Bank) is a major player in the financial space, well-known for being a leader in innovation and for offering services that work for both individuals and businesses.

With a history that goes way back—over 160 years, in fact—FNB has become one of the biggest and most trusted banks in Mzansi (South Africa). They’ve also got a presence in other African countries like Namibia, Botswana, and Mozambique.

First National Bank

Why Go with FNB?

FNB stands out because they’re all about the customer and are always pushing the envelope with new ideas. They’ve invested in digital solutions that make your financial life simple and secure.

- Award-Winning Banking App: The FNB App is a game-changer. It’s user-friendly and packed with features. You can manage your accounts, do transfers, pay bills, and even apply for a loan—all from your phone. It’s lekker!

- Top-Notch Security: Your data’s safety is their number one priority. FNB uses advanced encryption and authentication tech to protect your info and your transactions, so you can have total peace of mind.

- Comprehensive Financial Products: Whether you’re looking to open an account, get a credit card, finance a car, or invest for your future, FNB has a wide range of products and services for every stage of your life.

Banking that Grows with You

FNB isn’t just a bank; they’re a partner that adapts to your needs. Through their online platforms and their app, they stay at the forefront of the financial industry, giving you convenience and the tools to make the best financial decisions.

Whether you’re a student, a professional, an entrepreneur, or a family, First National Bank has the right solution for you. See the difference with a bank that really gets your needs and is always a step ahead.

Eligibility Requirements for FNB Credit Cards

Eligibility for an FNB credit card depends on several key factors that applicants should be aware of. Understanding these requirements can streamline the application process and improve your chances of approval.

Age and South African Residency Requirements

To be eligible for an FNB credit card, applicants must be at least 18 years old and a resident of South Africa. Proof of residency is required, which can be in the form of a utility bill or a bank statement.

Income Thresholds for Different Card Types

FNB offers various credit cards, each with its own income requirements. For instance, a basic credit card might require a minimum annual income, while a premium card may demand a significantly higher income. It’s essential to check the specific requirements for the card you’re interested in.

| Card Type | Minimum Income Requirement |

|---|---|

| Basic Credit Card | R120,000 per annum |

| Premium Credit Card | R300,000 per annum |

Credit Score Considerations in South Africa

A good credit score significantly enhances your eligibility for an FNB credit card. Credit bureaus in South Africa, such as TransUnion, evaluate your credit history to determine your credit score. A score above 650 is generally considered good. Ensuring you have a healthy credit score by making timely payments and managing your debt effectively is crucial.

Documents Needed for Your Application

To successfully apply for an FNB credit card, you’ll need to gather specific documents. Ensuring you have all the necessary paperwork will streamline the application process.

Identity Verification Documents

FNB requires valid identity verification documents to process your credit card application. Acceptable documents include a South African ID book, ID card, or a valid passport. If you’re a foreign national, you may need to provide additional documentation, such as a residence permit.

Proof of Income Requirements

You’ll need to provide proof of income to demonstrate your ability to repay the credit. Recent payslips, bank statements, or a letter from your employer can serve as proof of income. The specific requirements may vary depending on your employment status and the type of credit card you’re applying for.

Additional Supporting Documentation

In addition to identity verification and proof of income, you may need to provide additional supporting documentation. This can include proof of address, such as a utility bill or lease agreement. FNB may also require other documents, depending on your individual circumstances.

FICA Compliance Requirements

FNB is required to comply with the Financial Intelligence Centre Act (FICA). As part of this, you’ll need to provide documentation that meets FICA’s requirements.

“FICA requires financial institutions to verify the identity of customers and to report suspicious transactions.”

Ensuring you have the necessary documents will help facilitate a smooth application process.

Preparing Your Financial Information

Before applying for an FNB credit card, it’s essential to get your financial information in order. This step is crucial as it directly impacts your eligibility and the overall success of your application.

Organizing Your Banking Details

Start by gathering all relevant banking documents, including your bank statements and details of your current accounts. Having this information readily available will streamline the application process. Ensure your accounts are up to date to avoid any potential issues during the application.

Understanding Your Credit History

Your credit history plays a significant role in determining your creditworthiness. In South Africa, credit bureaus like TransUnion, Equifax, and Experian collect data on individuals’ credit behavior. “A good credit score can significantly improve your chances of getting approved for a credit card,” says a financial expert. Understanding your credit history will help you identify any areas that need improvement.

Calculating Your Debt-to-Income Ratio

Your debt-to-income ratio is another critical factor considered by lenders. It’s calculated by dividing your total monthly debt payments by your gross monthly income. A lower ratio indicates a healthier financial situation. To calculate yours, gather your debt and income statements, and use an online debt-to-income ratio calculator if needed.

South African Credit Bureau Reports

Credit bureau reports provide a comprehensive overview of your credit history, including your payment history, credit accounts, and public records. You can request a report from the major credit bureaus in South Africa. Reviewing your report will help you understand your credit standing and make necessary adjustments before applying.

FNB: How to Apply for Your Credit Card in a Few Steps

FNB offers multiple convenient methods to apply for a credit card, catering to different preferences.

Online Application Process

Applying online is a quick and easy process. Simply visit the FNB website, navigate to the credit card section, and fill out the application form. This method is ideal for those who value speed and convenience.

In-Branch Application Method

For those who prefer a more personal touch, visiting an FNB branch is a viable option. A representative will guide you through the application process, answering any questions you may have.

Application via FNB Banking App

The FNB banking app allows you to apply for a credit card from the comfort of your own home. The process is user-friendly and straightforward, making it a popular choice among FNB customers.

Estimated Application Processing Times

Processing times may vary depending on the application method. Online applications are typically processed within a few minutes, while in-branch applications may take longer due to the personal verification process.

| Application Method | Processing Time | Convenience Level |

|---|---|---|

| Online Application | A few minutes | High |

| In-Branch Application | Longer due to verification | Medium |

| FNB Banking App | A few minutes | High |

By understanding the different application methods and their respective processing times, you can choose the option that best suits your needs.

Completing the Application Form Correctly

To ensure a smooth application process, it’s essential to complete the FNB credit card form correctly. The application form is your first step towards getting approved for a credit card that suits your financial needs.

Personal Information Section Guide

When filling out the personal information section, ensure that you provide accurate details. This includes your full name, date of birth, and contact information. It’s crucial to double-check your ID number and contact details to avoid any delays in the application process.

Employment and Income Details

Your employment and income details are critical in determining your creditworthiness. Be prepared to provide your employer’s name, your job title, and your monthly income. FNB may require proof of income, so having your latest payslips or salary advices ready can be helpful.

Selecting Your Preferred Credit Limit

Choosing the right credit limit is an important decision. Consider your financial situation and spending habits when deciding on a credit limit. FNB offers various credit limits based on your credit score and income level. It’s also worth noting that you can request a credit limit increase after your card is approved and you’ve established a good repayment history.

Additional Cardholder Applications

If you’re applying for additional cardholders, you’ll need to provide their personal details as well. Ensure that you have their consent and accurate information to avoid any issues with their application.

| Application Form Section | Required Information |

|---|---|

| Personal Information | Full name, ID number, contact details |

| Employment and Income | Employer’s name, job title, monthly income |

| Credit Limit Selection | Preferred credit limit based on financial situation |

By carefully completing each section of the application form, you can ensure a successful application process. Remember, accuracy is key to avoiding delays or rejections.

Tracking Your Application Status

Once you’ve applied for an FNB credit card, there are several methods to track its status. FNB provides multiple channels to keep you updated on your application’s progress.

Using the FNB Online Banking Platform

The FNB online banking platform is a convenient way to check your application status. Simply log in to your account, navigate to the credit card section, and look for the application status update.

Checking Status via the FNB App

The FNB app offers a similar experience to the online banking platform. Download the app, log in, and check the status of your credit card application in the credit card section.

Customer Service Contact Options

If you prefer a more personal touch, you can contact FNB’s customer service via phone or email. The representatives will be able to provide you with an update on your application status.

Understanding Application Status Messages

When checking your application status, you may receive messages such as “In Progress,” “Approved,” or “Declined.” Here’s a breakdown of what these messages mean:

| Status Message | Description |

|---|---|

| In Progress | Your application is being reviewed. |

| Approved | Your application has been approved, and your card will be sent. |

| Declined | Your application has been declined. You may receive a reason for the decline. |

By using these methods, you can stay informed about the status of your FNB credit card application.

Common Reasons for Application Rejection

Being aware of the common reasons for FNB credit card application rejections can significantly enhance your chances of approval in the future. Understanding these factors can help you address potential issues before applying.

Credit Score Issues

One of the primary reasons for credit card application rejections is credit score issues. In South Africa, credit scores are evaluated based on credit history, payment behavior, and other financial factors. A low credit score can indicate a higher risk to lenders.

Key factors affecting your credit score include:

- Payment history

- Credit utilization ratio

- Length of credit history

- Types of credit used

Insufficient Income or Employment History

FNB requires applicants to have a stable income or employment history to ensure they can repay their credit. If your income is deemed insufficient or your employment history is unstable, your application may be rejected.

To mitigate this, ensure you:

- Have a stable job with a reliable income

- Provide accurate income documentation

Existing Debt Concerns

Existing debt can be a significant factor in credit card application rejections. If you have high levels of debt relative to your income, FNB may view you as a high-risk applicant.

To address existing debt concerns:

- Calculate your debt-to-income ratio

- Work on reducing your debt levels before applying

Steps to Take After Rejection

If your application is rejected, don’t be discouraged. You can take several steps to improve your chances of approval in the future.

- Review and improve your credit score

- Reduce existing debt

- Ensure stable income and employment

What Happens After Approval

Getting approved for an FNB credit card is a significant milestone, and understanding the subsequent steps is essential. After approval, several processes unfold before you can start using your new credit card.

Card Delivery Timeframes

FNB typically dispatches credit cards via postal services. The delivery timeframe can vary depending on your location within South Africa, usually taking between 7 to 10 business days. It’s essential to ensure your address is up-to-date to avoid any delivery issues.

Activation Process

Upon receiving your FNB credit card, you’ll need to activate it. This can usually be done by calling the activation number provided with your card or through the FNB online banking platform. Activation is a straightforward process that confirms your receipt of the card and enables its use.

Setting Up Security Features

To secure your new credit card, FNB offers various security features. You can set up these features through the FNB online banking platform or mobile banking app.

Managing Your New Credit Card Online

Managing your credit card online allows you to monitor your transactions, check your balance, and adjust your account settings as needed. FNB’s online platform provides a user-friendly interface to manage your credit card efficiently.

By following these steps, you can ensure a smooth transition to using your new FNB credit card. If you encounter any issues, FNB’s customer service is available to assist you.

Conclusion

Applying for an FNB credit card is a straightforward process that can be completed online, in-branch, or via the FNB banking app. By understanding the eligibility requirements, preparing your financial information, and completing the application form correctly, you can successfully obtain an FNB credit card.

The FNB credit card application summary highlights the simplicity of the process, from tracking your application status to receiving your card. With an FNB credit card, you can enjoy various credit card benefits, including rewards, cashback, and exclusive discounts.

By following the steps outlined in this article, you can take advantage of the benefits offered by FNB credit cards and manage your finances effectively. Whether you’re looking for a card with a low interest rate or one with premium rewards, FNB has a credit card that suits your needs.

FAQ

What are the eligibility criteria for an FNB credit card?

How do I apply for an FNB credit card?

What documents do I need to apply for an FNB credit card?

How long does it take to process an FNB credit card application?

Can I track the status of my FNB credit card application?

What happens if my FNB credit card application is rejected?

How do I activate my new FNB credit card?

Can I manage my FNB credit card online?

What are the benefits of having an FNB credit card?

How do I report a lost or stolen FNB credit card?

Conteúdo criado com auxílio de Inteligência Artificial