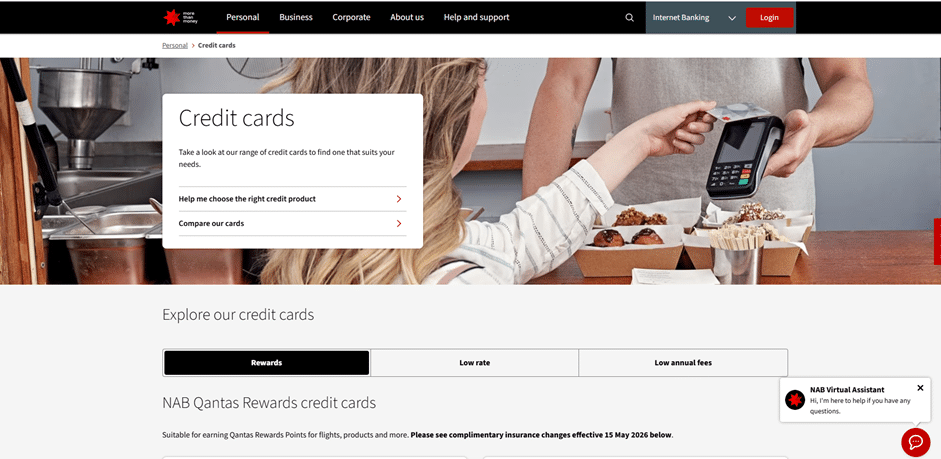

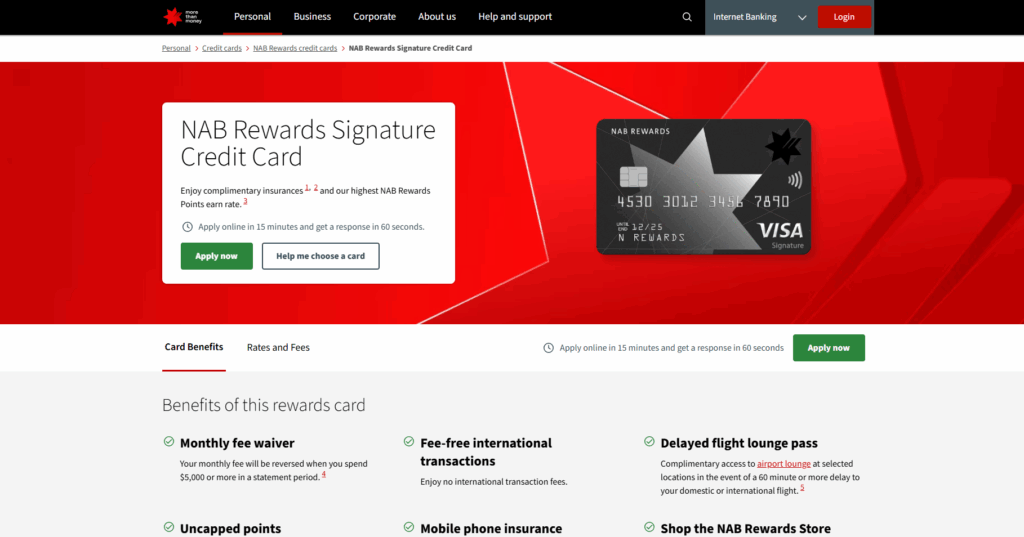

For Australian consumers who are high spenders and frequent travellers, the NAB Rewards Signature Credit Card is a flagship product designed to maximise points earnings and provide premium lifestyle and travel benefits. Offered by the National Australia Bank (NAB), this card places a strong emphasis on valuable rewards, complimentary insurances, and a $0 international transaction fee structure, making it a compelling choice in the competitive premium segment.

NAB Rewards Signature

This comprehensive, guide details how to apply for the NAB Rewards Signature Credit Card in Australia, covering everything from minimum eligibility and required documentation to the features that define its premium status.

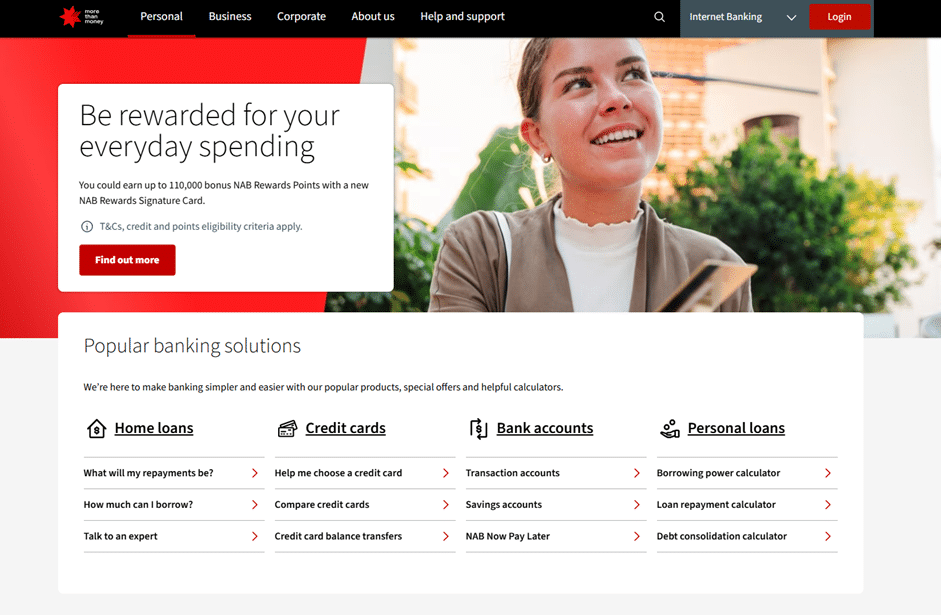

Overview of National Australia Bank (NAB)

The National Australia Bank (NAB) is a vital component of the Australian financial system, consistently ranked among the nation’s “Big Four” leading banks. With a history stretching back over 160 years, NAB is a trusted financial partner for millions of Australians, from individuals and small businesses to large corporations.

Anúncios

Credibility and Operations in Australia

- Market Reliability: NAB’s deep roots in the Australian banking sector underscore its reliability. It operates an extensive network of branches and offers robust financial services, encompassing banking, loans, and investment products.

- Digital Platforms: The bank’s digital infrastructure, including NAB Internet Banking and the NAB App, is highly developed, offering secure access and advanced card management features, such as real-time tracking of rewards and easy payment options.

NAB Bank

- Rewards Program Leadership: NAB is a major player in the rewards card market, with its proprietary NAB Rewards program offering flexible redemption options, including direct transfers to frequent flyer partners (such as Velocity, Cathay, and AirpointsTM) and various gift card and cash back options.

Choosing the NAB Rewards Signature Card means associating with a stable, credible institution that provides sophisticated financial products tailored for high-net-worth clients and high spenders.

Anúncios

Everything People Need to Know to Apply for the Card – A Detailed and Didactic Guide

The NAB Rewards Signature Card is a premium product, and as such, it carries specific requirements, particularly concerning the minimum credit limit and the applicant’s financial standing. A successful application hinges on meeting the bank’s strict credit assessment criteria.

1. Key Card Features, Fees, and Rewards

Understanding the unique features of the NAB Rewards Signature is the first step in the application process.

Rewards and Benefits:

- Uncapped Earning: Points earnings are uncapped.

- Tiered Points Structure: Earn 1.5 NAB Rewards Points per $1 spent on eligible purchases, up to $15,000 per statement period, and then 0.5 points per $1 thereafter. Earn an enhanced rate of 3 points per $1 for purchases made through Webjet.

- Bonus Points Offer: Attractive sign-up offers, such as up to 110,000 bonus NAB Rewards Points upon meeting specific spend criteria (e.g., spending $5,000 on everyday purchases within the first 90 days and keeping the card open for over 12 months).

- Complimentary Insurances: Includes comprehensive International and Domestic Travel Insurance, Mobile Phone Insurance (covering accidental damage and theft), Purchase Protection, and Extended Warranty (eligibility criteria, terms, conditions, and exclusions apply).

- Travel Perks: Access to airport lounge access in the event of a flight delay of 60 minutes or more (at selected locations) and the NAB Concierge Service (a 24/7 personal assistant service).

- 0% Balance Transfer Offer: Promotional offers frequently include 0% p.a. on balance transfers for 12 months (a one-off 3% fee typically applies).

2. Eligibility Criteria and Financial Requirements

Due to the high minimum credit limit of $15,000, NAB focuses its assessment on the applicant’s capacity to manage substantial credit.

Core Eligibility Requirements:

- Age: Be 18 years or older.

- Income: Must be receiving a regular income. While NAB does not publish a minimum dollar income requirement for the Signature card, the high $15,000 minimum limit necessitates a strong, verifiable income stream to meet responsible lending criteria.

- Residency: Must be an Australian or New Zealand Citizen, an Australian Permanent Resident, or a non-resident holding an acceptable Temporary Residency Visa. Must be an Australian resident for tax purposes.

- Creditworthiness: Must have a good credit rating and be able to satisfy NAB’s creditworthiness assessment (i.e., demonstrated ability to comfortably repay the debt).

Essential Documentation and Information:

Applicants must be prepared to provide detailed financial information to meet Australian responsible lending obligations:

- Identity Verification: Australian Driver’s License or Passport (for new customers).

- Income Verification: Recent payslips (e.g., two most recent) or bank statements that clearly show regular salary credits. Self-employed individuals will require more extensive business financial documentation.

- Employment Details: Full details of employment for the past three years.

- Financial Position: Comprehensive details of your assets (homes, vehicles, savings) and liabilities (all existing debts, including home loans, personal loans, and other credit cards).

- Living Expenses: A detailed breakdown of general living expenses (groceries, utilities, recreation, rent/mortgage, etc.) to allow NAB to calculate your disposable income.

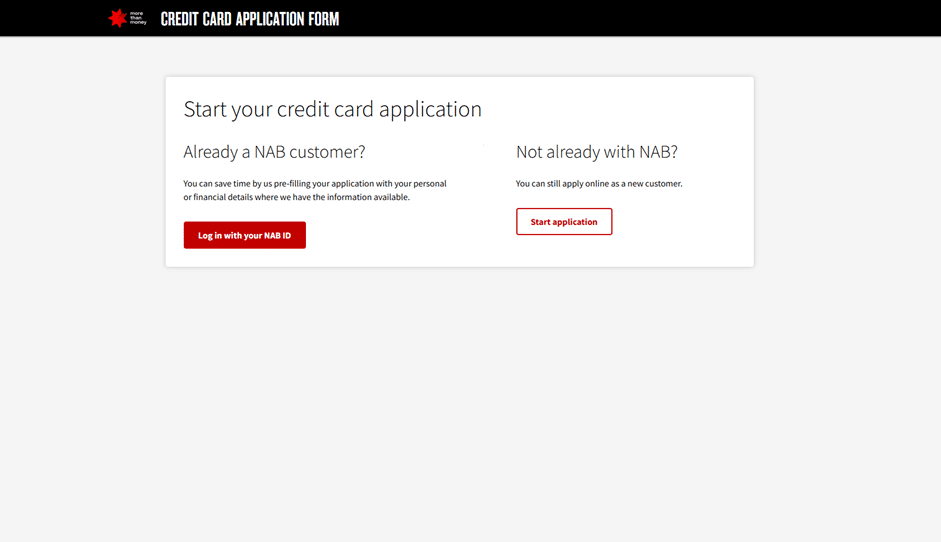

3. The Digital Application Process: Detailed Walkthrough

NAB strongly encourages online applications, offering a streamlined, quick decision process, especially for existing customers.

Step 1: Prepare and Access

- Preparation: Gather all necessary documents (ID, payslips, expense records) to complete the application swiftly and accurately.

- Access: Navigate to the NAB Rewards Signature Credit Card page on the official NAB website and click “Apply Now”.

Step 2: Customer Identification

- Existing NAB Customers: Use your existing NAB ID to log in. This allows NAB to pre-fill much of your personal and NAB-held financial information, significantly speeding up the process.

- New Customers: You will proceed through a secure form, providing your basic personal information and initial identification documents.

Step 3: Financial Disclosure (The Critical Step)

This is the most critical stage for a premium card application.

- Income Declaration: Accurately declare your gross and net income.

- Expense and Debt Declaration: Disclose all liabilities and a detailed breakdown of your living expenses. NAB uses this information to determine your Household Expenditure Measure (HEM) and overall serviceability, ensuring the $15,000 credit limit is appropriate under their lending criteria.

- Credit Limit Request: Specify a desired credit limit (starting from $15,000). The final approval will depend on the credit assessment.

Step 4: Review, Consent, and Submission

- Review: Carefully check all details, especially the financial declarations. Any discrepancies may delay or lead to the rejection of the application.

- Consent: Provide consent for NAB to perform a credit check on your credit file (required for all credit card applications in Australia).

- Submission and Response: Submit the form. NAB aims to provide a response in 60 seconds for many online applications. However, the application may be referred for further review and manual verification of documents, especially if your financial profile is complex or if verification documents are required.

Step 5: Final Verification and Card Management

- Verification: If referred, NAB will contact you to request the upload of supporting documents (e.g., payslips).

- Approval and Delivery: Once conditionally approved and verified, the credit card agreement is finalized. The physical card is mailed, and upon receipt, it must be activated via the NAB App or Internet Banking.

- Maximising Rewards: Immediately utilize the NAB App to track your spending toward the bonus points minimum spend requirement and manage your card security controls.

❓ FAQ – Frequently Asked Questions about the NAB Rewards Signature Card in Australia

Q: What is the annual cost of the NAB Rewards Signature Card?

A: The card has a monthly fee of $35 AUD, which equates to $420 AUD per year. This monthly fee is reversed/waived if you spend $5,000 AUD or more in the statement period (month).

Q: Does the NAB Rewards Signature charge a fee for international transactions?

A: No. One of the main benefits of this card is that it offers a 0% international transaction fee, making it ideal for overseas online purchases or use during international travel.

Q: What is the minimum credit limit for the NAB Rewards Signature?

A: The mandatory minimum credit limit for this premium card is $15,000 AUD.

Q: How can I redeem NAB Rewards Points?

A: Points can be redeemed in various ways: transfer to partner frequent flyer programs (Velocity Frequent Flyer, Cathay Membership Programme, AirpointsTM), redemption for cashback into your NAB account, gift cards from popular retailers, and travel bookings through Webjet.

Q: Does the card include travel insurance?

A: Yes. The NAB Rewards Signature Card includes International and Domestic Travel Insurance and Mobile Phone Insurance (covering theft and accidental damage) as complimentary benefits. Terms, conditions, limits, and exclusions apply, and the insurance is only activated when eligibility criteria are met.

Q: What is the interest-free period?

A: The card offers up to 44 interest-free days on purchases, provided the total closing balance is paid in full by the statement due date.

Conteúdo criado com auxílio de Inteligência Artificial