In the Australian financial landscape, where credit card interest rates can often exceed 20% per annum, the CommBank Low Rate Credit Card stands out as a strategic choice for consumers who prioritize low borrowing costs over high-end reward points. This card, offered by the Commonwealth Bank of Australia (CommBank), is specifically designed for individuals who sometimes carry a balance, making a low interest rate the most valuable feature.

This article is an essential, resource for potential applicants, detailing how to apply for the CommBank Low Rate Credit Card in Australia, its unique features, and the necessary eligibility criteria.

Low fee

Overview of Commonwealth Bank (CommBank)

The Commonwealth Bank of Australia (CBA), commonly known as CommBank, is one of the largest and most prominent banks in Australia, holding a position as one of the country’s “Big Four” major financial institutions.

Anúncios

Credibility and Operations in Australia

- Market Dominance: CommBank is a pillar of the Australian economy, known for its extensive network of branches and ATMs, and its leading position in providing banking, insurance, and wealth management services.

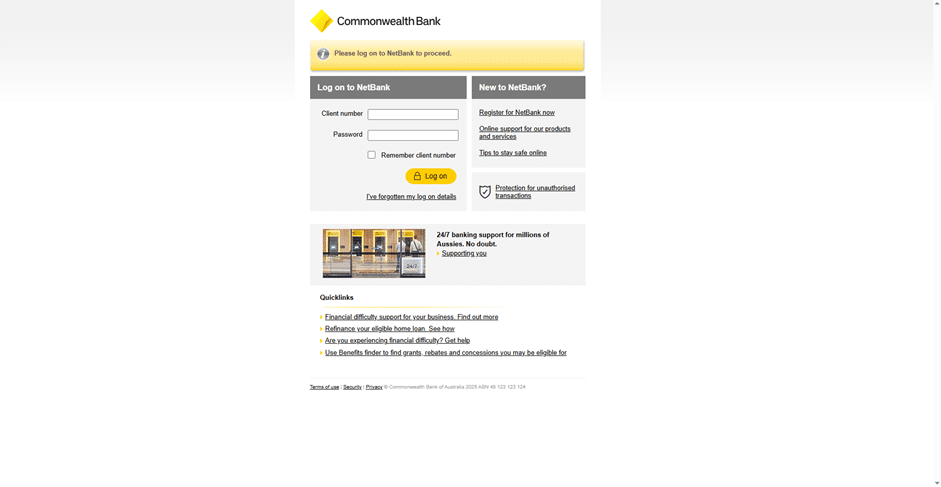

- Technological Leadership: The bank is highly regarded for its digital platform, NetBank (online banking), and the CommBank App, which offers sophisticated features like Lock, Block, and Limit controls, enabling customers to manage their card security instantly.

- Security and Trust: As a major Australian bank, CommBank operates under strict regulatory oversight, providing a high level of security and consumer trust for its credit card products.

Choosing a CommBank Low Rate Card means partnering with a financially solid and technologically advanced institution, providing peace of mind alongside competitive lending conditions.

Anúncios

Everything You Need to Know to Apply for the CommBank Low Rate Card

The CommBank Low Rate Credit Card is tailored for budget-conscious consumers seeking financial flexibility without the burden of high interest. The application process is straightforward, accessible primarily through the bank’s digital channels.

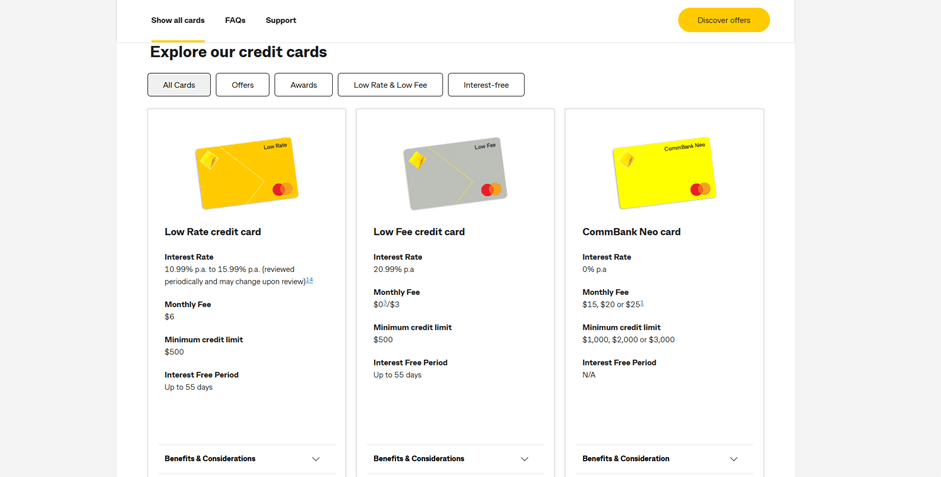

1. Key Features and Costs of the CommBank Low Rate Card

Before applying, it is crucial to understand the defining financial aspects and benefits of the Low Rate card.

Included Benefits:

- CommBank Yello Cashback Offers: Eligible cardholders receive cashback benefits through personalized offers in the CommBank app.

- Complimentary Insurances: Includes Purchase Security and Extended Warranty Insurance provided by Cover-More, offering protection on eligible items purchased with the card.

- SurePay Instalment Plans: Flexibility to set up 0% interest Purchase Plans or Balance/Cash Advance Plans to pay off large balances over a set time (setup fee applies for Purchase Plans).

- Control Features: Ability to Lock, Block, and Limit the card’s usage for international payments, ATM cash withdrawals, and spending limits directly via the CommBank App or NetBank.

Trade-Off Alert: Unlike CommBank’s Awards cards, the Low Rate card does not earn Awards points. It is a choice between lower interest and rewards.

2. Basic Eligibility and Residence Requirements

To comply with Australian lending regulations and CommBank’s internal criteria, applicants must meet specific requirements:

Mandatory Eligibility Criteria:

- Age: Be at least 18 years of age.

- Residency Status: Must be an Australian or New Zealand Citizen, an Australian Permanent Resident, or hold an eligible visa with an expiry date at least six months from the application date.

- Australian Address: Must live in Australia and have an Australian address.

- Financial Health: Must not be currently going through the process of bankruptcy or subject to a Part IX Debt Agreement.

- Credit Assessment: Be able to satisfy CommBank’s strict assessment of the ability to repay the credit limit. This involves a comprehensive review of income, expenses, and existing debt.

Key Documentation for Verification:

CommBank requires verifiable documentation to complete the application, which may include one or more of the following:

- Proof of Income: Your two most recent payslips (showing employer details and net income) or bank statements/transaction listings clearly showing the last three months’ worth of salary credits.

- Identification: Valid form of Australian ID, such as a driver’s license, passport, or Medicare card.

- Expense Details: Detailed information regarding monthly expenses (rent/mortgage payments, utility costs, groceries, transport, etc.) to calculate the disposable income available for credit repayment.

3. The Application Process: Step-by-Step Guide

The most efficient way to apply for the CommBank Low Rate Credit Card is through the bank’s secure digital platform.

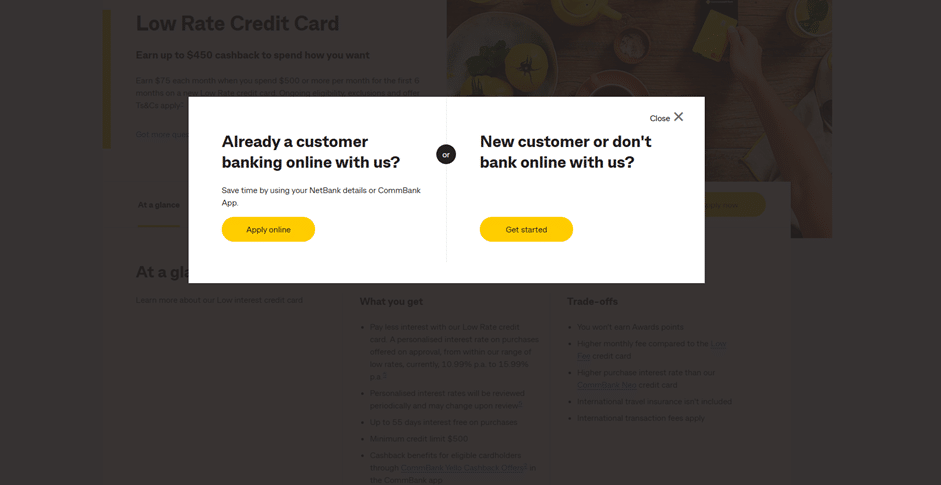

Step 1: Accessing the Application

- Online Portal: Navigate directly to the CommBank Low Rate credit card page on the official website.

- Existing Customers: If you are an existing CommBank customer, logging into NetBank or the CommBank App often allows for a pre-filled and faster application process.

Step 2: Selecting the Credit Limit

- Applicants must choose a desired credit limit. For the Low Rate card, the minimum credit limit is $500.

- The final approved limit will be determined by CommBank’s lending criteria and assessment of your financial situation, regardless of the amount requested.

Step 3: Completing the Digital Form

The online application is divided into several secure sections:

- Personal Details: Name, date of birth, residential status, and contact information.

- Employment and Financial Information: Details about your job, employer, annual gross income, and any other income sources.

- Liabilities and Expenses: You must accurately declare all existing debts (mortgages, loans, other credit cards) and comprehensive living expenses. This step is critical under Australian responsible lending laws.

- Consent and Declaration: Reviewing the terms and conditions, summary of fees, and providing consent for CommBank to perform a credit check with credit reporting bodies (e.g., Equifax, Experian).

Step 4: Submission and Verification

- Document Upload: You may be asked to upload supporting documents (payslips, bank statements) directly through the secure online portal if you are not an existing customer or if your income requires verification.

- Assessment: CommBank’s lending team reviews the application, performing the mandatory credit assessment.

- Notification: The bank will notify you of the application outcome via email or secure message (for existing customers). The assessment time can vary, but instant conditional approval is often available for simple applications or existing customers.

Step 5: Activation and Management

- Card Delivery: Once approved, the card will be mailed to your Australian address.

- Activation: The card must be activated via the CommBank App, NetBank, or by phone before use.

- Secure Management: Utilize the CommBank App to set up AutoPay for minimum repayments, monitor spending, and apply security controls (Lock, Block, and Limit) for maximum financial control.

❓ FAQ – Frequently Asked Questions about the CommBank Low Rate Card

Q: What is the personalised purchase interest rate and how is it determined?

A: The personalized purchase interest rate is the rate offered to you within the available range (currently 10.99% p.a. to 15.99% p.a.). It is determined by CommBank based on your individual credit risk score, your customer profile, and other internal assessment factors.

Q: Does the CommBank Low Rate Card include international travel insurance?

A: No. The CommBank Low Rate Card does not include complimentary international travel insurance. This is a key trade-off for the low interest rate. Users who travel frequently may need to purchase separate travel insurance.

Q: Is there an annual fee for the CommBank Low Rate Card?

A: The card charges a monthly fee of $6, which is equivalent to $72 per year. This fee is charged at the end of each statement period.

Q: Does the card offer an interest-free period?

A: Yes, the card offers up to 55 days interest-free on purchases. To benefit from this, the entire closing balance on the statement must be paid in full by the due date. The interest-free period does not apply to cash advances or balance transfers.

Q: What is the minimum credit limit?

A: The minimum credit limit available on the CommBank Low Rate Card is $500 AUD.

Q: How can I check the status of my credit card application?

A: If you applied online or via the app, you can usually check the status by logging into NetBank or the CommBank App. Alternatively, you can contact the CommBank credit card application center directly by phone.

Q: How does the international transaction fee work?

A: A fee of 3.5% applies to transactions made in a foreign currency or transactions made in Australian dollars where the merchant or the financial institution processing the transaction is located overseas.

Conteúdo criado com auxílio de Inteligência Artificial