The American Express Explorer Credit Card is a premium offering designed for Australians who value flexibility and premium service. This card provides a range of benefits, including a robust rewards program that allows cardholders to earn points on their purchases.

American Express Explorer Card

With its array of credit card benefits, the Explorer Card is ideal for those who travel frequently or enjoy dining out. Cardholders can enjoy benefits such as travel insurance, airport lounge access, and rewards points on eligible purchases.

Key Takeaways

- Earn rewards points on eligible purchases with the robust rewards program.

- Enjoy travel benefits, including travel insurance and airport lounge access.

- Experience premium service with the American Express Explorer Credit Card.

- Flexible rewards program allows cardholders to redeem points as they choose.

- Designed for Australians who value flexibility and premium service.

🇦🇺 AUSTRALIA: STEP-BY-STEP TUTORIAL – How to Apply for the American Express Explorer Card

Follow this guide to apply for the American Express Explorer Card, a popular travel and rewards credit card in Australia known for its flexible points and travel credit.

Anúncios

Introduction: Why Choose the Amex Explorer Card?

The American Express Explorer Card is a robust rewards card designed for those who want flexibility in their points. It offers:

Anúncios

- Flexible Membership Rewards Gateway points that can be transferred to various airline programs (Qantas, Velocity, Singapore Airlines, etc.).

- A substantial annual travel credit (often $\mathbf{\$400}$), which can offset the annual fee.

- Complimentary Smartphone Screen Cover Insurance and travel insurance.

Before You Start: Eligibility Checklist

To apply for this card, you must generally:

- Be 18 years of age or older.

- Be an Australian citizen or Permanent Resident or hold a long-term visa.

- Meet the minimum pre-tax income requirement (often $\mathbf{\$65,000}$ or $\mathbf{\$75,000}$).

- Have a good credit history.

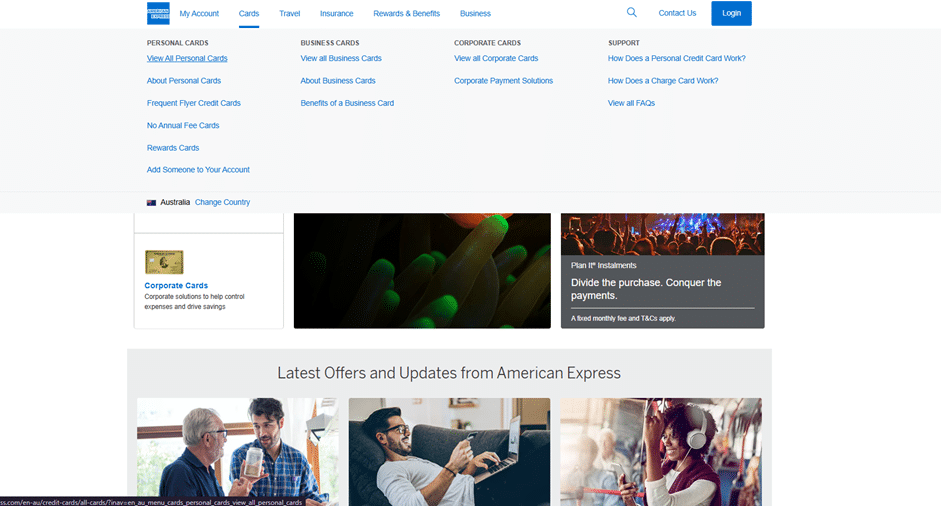

Step 1: Access the American Express Cards Section

Your application begins on the main American Express Australia website.

- Access the American Express homepage:

https://www.americanexpress.com/ - In the main navigation menu, click the option for “Cards” (or “Credit Cards”).

- Click the link under the first column (Personal Cards) that says “View all personal cards”.

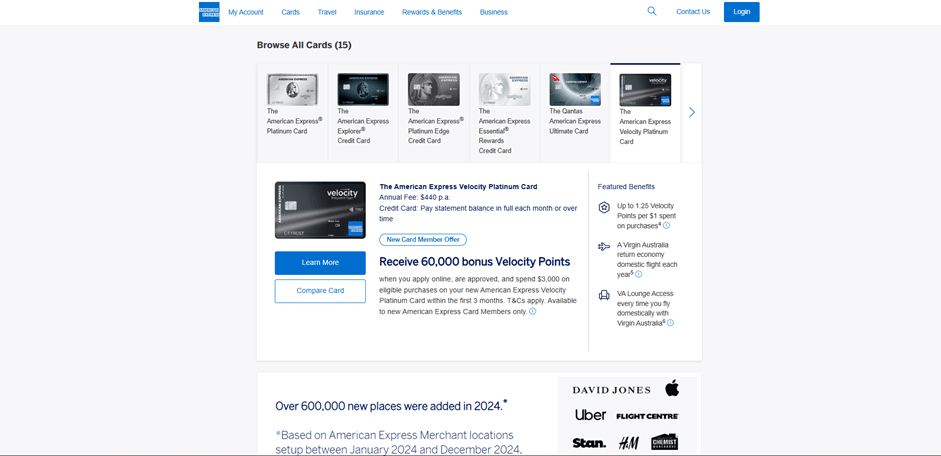

Step 2: Locate and Select the American Express Explorer Card

On the Personal Cards comparison page, find and choose the Explorer Card.

- On this page, you will see a large range of cards (e.g., Velocity Platinum, Qantas Ultimate, Amex Platinum).

- Look for the American Express Explorer Card. It will be listed under the rewards or travel category.

- Click on “Learn More” associated with the card to go to the specific product page.

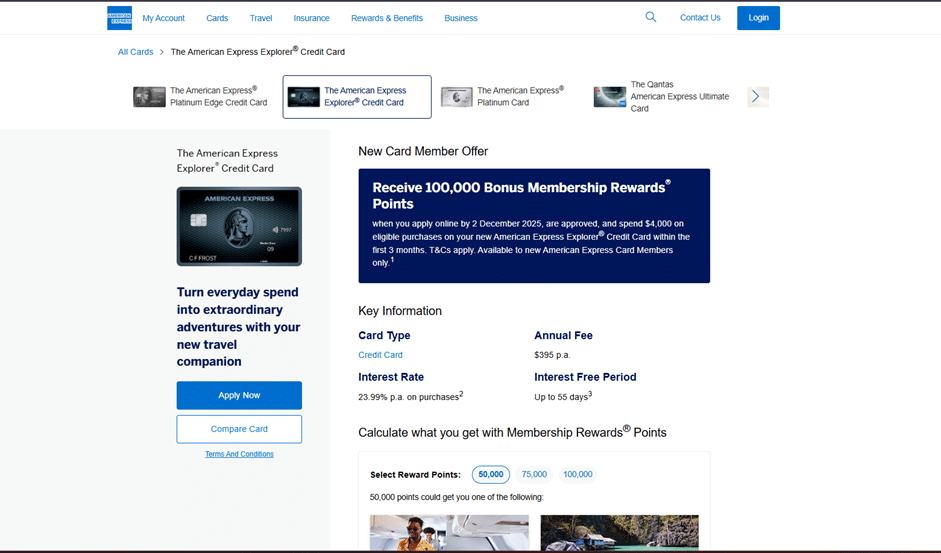

Step 3: Initiate the Online Application

You are now on the detailed product page for the Explorer Card.

- Here, review all features, including the annual fee, the current sign-up bonus (Membership Rewards points), and the detailed insurance terms.

- To start your application, click the distinct blue button, labelled “Apply now” or “Apply Online”.

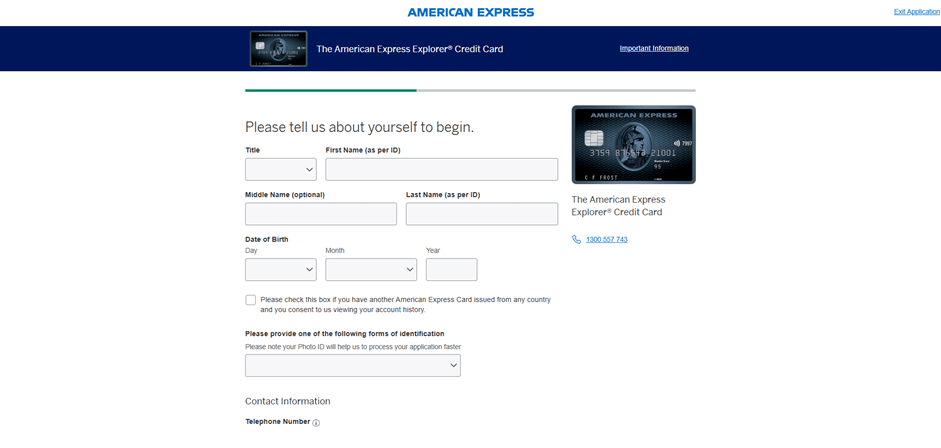

Step 4: Complete and Submit the Application

You will be redirected to the secure American Express online application portal.

- Identity Verification: You will be asked if you are an existing card member. Proceed by confirming your identity.

- Fill in Details: Complete the multi-step form, providing detailed information regarding:

- Personal Identity (Name, Australian Residential Address, Driver’s Licence/Passport details).

- Income (Salary, bonuses, and confirmation that you meet the minimum requirement).

- Financial Details (Assets, Liabilities, and Expenses).

- Review and Submit: Review the final terms, fees, and the welcome offer conditions, then submit your application.

- American Express will process your request, often providing a decision in minutes. Upon approval, your American Express Explorer Card will be sent to your mailing address.

The American Express Explorer Credit Card at a Glance

For those seeking a credit card that offers both style and substance, the American Express Explorer is worth considering. This card is not just about making transactions; it’s about experiencing a premium product that offers a range of benefits tailored to the needs of Australian cardholders.

Card Design and Premium Feel

The American Express Explorer Credit Card boasts a premium design that sets it apart from other credit cards in the market. The card’s sleek design and high-quality materials give it a luxurious feel, making it a desirable accessory for any wallet. The premium feel of the card is not just about aesthetics; it reflects the card’s overall value proposition, including its rewards program and travel benefits.

Ideal Australian Cardholders

The American Express Explorer Credit Card is particularly suited for Australian cardholders who value travel, rewards, and premium service. If you’re someone who travels frequently, whether domestically or internationally, this card offers a range of benefits that can enhance your travel experience. Additionally, if you make significant purchases or have a high monthly spend, the rewards program can provide substantial value. However, it’s essential to consider the annual fee and ensure that the card’s benefits align with your financial habits and lifestyle.

Cardholders who can maximize the card’s features, such as the $400 annual travel credit and travel insurance, will find the American Express Explorer to be a valuable addition to their wallet. It’s also worth noting that American Express often offers attractive sign-up bonuses for new cardholders, making it an even more appealing option for those looking to apply.

Key Features and Benefits

The American Express Explorer Credit Card is designed to offer a premium experience, replete with benefits that cater to the diverse needs of Australian cardholders. With its array of travel perks and purchase protections, the American Express Explorer Card is designed for the modern Australian consumer. Cardholders can enjoy a range of exclusive benefits that enhance their travel and shopping experiences.

Travel Perks for Australian Travellers

The Explorer Card offers a variety of travel-related benefits that make it an ideal choice for Australians who travel frequently. Some of the standout travel perks include:

- Airport lounge access in major Australian airports and internationally

- Travel insurance that covers a range of unforeseen events such as trip cancellations and medical emergencies

- Travel credits that can be redeemed against flights, hotels, and other travel expenses

These benefits are designed to make travelling more comfortable and less stressful. For instance, airport lounge access provides a quiet, comfortable space to relax before flights, while the travel insurance offers peace of mind against unexpected trip disruptions.

Shopping and Purchase Protections

In addition to its travel benefits, the Explorer Card also offers robust protections for cardholders when they shop. This includes purchase protection that covers new purchases against theft, loss, or damage, and an extended warranty that doubles the manufacturer’s warranty on eligible items.

These protections provide cardholders with added security and confidence when making purchases, whether online or in-store.

Membership Rewards Program Explained

The Membership Rewards program is a key feature of the American Express Explorer Credit Card, offering flexibility and value. This rewards program allows cardholders to earn points on their purchases, which can be redeemed for a variety of rewards, including travel, gift cards, and merchandise. Understanding the intricacies of the Membership Rewards program is crucial to maximizing the card’s benefits.

How the Points System Works

The points system is designed to be straightforward and rewarding. Cardholders earn Membership Rewards points on their eligible purchases, which are then added to their account. These points can be redeemed for a range of rewards or transferred to participating airline and hotel loyalty programs. The flexibility of the points system allows cardholders to tailor their rewards to their individual preferences.

Earning and redeeming points is simple: cardholders earn points on eligible purchases, and these points are automatically credited to their account. The points can then be redeemed online, through the American Express app, or by contacting American Express customer service.

Point Earning Rates on Everyday Spending

The American Express Explorer Credit Card offers competitive point earning rates on everyday spending categories. Cardholders earn 2 Membership Rewards points per dollar spent on eligible purchases at eligible restaurants and 1 point per dollar on other eligible purchases. There are no limits to the number of points that can be earned, making it an attractive option for frequent spenders.

Additionally, cardholders can earn bonus points through various promotions and offers available through the Membership Rewards program. These can include bonus points for specific spending categories, limited-time offers, or exclusive deals with partner merchants.

$400 Annual Travel Credit

The $400 annual travel credit is a standout feature of the American Express Explorer Credit Card, providing substantial value to frequent travelers. This credit can be redeemed through American Express Travel, making it easy for cardholders to offset their travel expenses. Whether you’re flying domestically or internationally, this credit can significantly reduce your travel costs.

Redeeming Through American Express Travel

Redeeming the $400 annual travel credit is straightforward when using American Express Travel. Cardholders can book flights, hotels, and other travel arrangements directly through the American Express platform. The credit is automatically applied to eligible travel expenses, making it a hassle-free process.

Key benefits of redeeming through American Express Travel include:

- Easy booking process

- Automatic application of the travel credit

- Wide range of travel options

Maximising Value for Australian Destinations

For cardholders who frequently travel within Australia, the $400 travel credit can be particularly valuable. By booking domestic flights, hotel stays, and car rentals through American Express Travel, cardholders can maximize their savings. Popular destinations like the Gold Coast, Melbourne, and Sydney can be enjoyed with reduced travel expenses.

Insurance Benefits and Coverages

The American Express Explorer Credit Card includes a variety of insurance features designed to protect cardholders. With comprehensive insurance coverage, cardholders can enjoy peace of mind when traveling or making purchases.

Travel Insurance Features

The card offers robust travel insurance features, including coverage for trip cancellations, lost luggage, and medical emergencies. These features ensure that cardholders are protected against unforeseen events that may occur during travel.

- Trip cancellation insurance

- Lost or stolen luggage insurance

- Emergency medical insurance

These travel insurance features provide cardholders with financial protection and peace of mind, making the American Express Explorer Credit Card an excellent choice for frequent travelers.

Purchase Protection and Extended Warranty

In addition to travel insurance, the card also offers purchase protection and extended warranty. Purchase protection covers eligible purchases against theft, loss, or damage for a specified period.

The extended warranty feature doubles the manufacturer’s warranty on eligible purchases, providing cardholders with added protection and value.

Key benefits include:

- Purchase protection against theft, loss, or damage

- Extended warranty on eligible purchases

Fees and Charges Structure

When considering the American Express Explorer Credit Card, it’s essential to understand its fee structure to maximize its benefits and minimize unnecessary costs.

Annual Fee and Its Value Proposition

The American Express Explorer Credit Card comes with an annual fee that, while significant, is offset by the card’s numerous benefits and rewards. The annual fee is a crucial factor to consider, as it directly impacts the card’s overall value proposition. Cardholders can potentially offset this fee through the rewards earned on their everyday spending and travel perks.

For instance, the card offers a $400 annual travel credit, which can significantly reduce the effective cost of the annual fee. Additionally, cardholders earn Membership Rewards points on their purchases, which can be redeemed for travel, gift cards, or other rewards, further enhancing the card’s value.

Foreign Transaction Fees and Other Charges

One of the advantages of the American Express Explorer Credit Card is that it does not charge foreign transaction fees, making it an excellent choice for international travelers. This feature can save cardholders a considerable amount on foreign transactions, as typical foreign transaction fees range from 1% to 3% of the transaction amount.

Other charges to be aware of include late payment fees and interest charges. Cardholders should ensure timely payments to avoid these additional costs. The card’s interest rate and fees are detailed in the card’s terms and conditions, which cardholders should review carefully to understand their obligations fully.

In summary, while the American Express Explorer Credit Card has an annual fee, its benefits and lack of foreign transaction fees make it a competitive choice for Australian cardholders. By understanding the fees and charges associated with the card, cardholders can make the most of its features and rewards.

Sign-Up Bonus and Welcome Offers for New Cardholders

One of the most appealing aspects of the American Express Explorer Credit Card is its lucrative sign-up bonus for new cardholders. This bonus is part of the card’s welcome offer, designed to attract new users with the promise of significant rewards.

The welcome offer is a key incentive for potential cardholders, providing a substantial boost to their rewards balance right from the start. To take full advantage of this offer, it’s crucial to understand the terms and conditions that apply.

Current Australian Promotions

American Express frequently updates its promotions for the Explorer Credit Card in Australia. Currently, new cardholders can enjoy a generous sign-up bonus by meeting the minimum spend requirements within a specified timeframe. It’s essential to check the American Express website or other authorized sources for the latest promotions.

- Earn a significant number of Membership Rewards points as a sign-up bonus.

- Enjoy additional benefits, such as travel credits or shopping discounts, as part of the welcome offer.

Minimum Spend Requirements

To qualify for the sign-up bonus, cardholders typically need to meet a minimum spend requirement within a certain period, usually within the first few months of card membership. For the American Express Explorer Credit Card, this requirement is clearly outlined in the card’s terms and conditions.

For example, cardholders might need to spend a minimum of $X within the first Y months to be eligible for the sign-up bonus. Understanding these requirements is vital to maximizing the benefits of the welcome offer.

Key Points to Consider:

- Check the minimum spend requirement and the timeframe to achieve it.

- Review the terms and conditions for any additional conditions that may apply.

Digital Features and Mobile Integration

With its robust digital capabilities, the American Express Explorer Credit Card offers a modern banking experience. Cardholders can enjoy a range of digital features that enhance their overall experience.

American Express App Functionality

The American Express App is a powerful tool that allows cardholders to manage their accounts efficiently. Through the app, users can track their spending, monitor their rewards, and pay their bills on the go. The app provides a user-friendly interface, making it easy to navigate through various features.

Some key features of the American Express App include:

- Real-time transaction tracking

- Rewards point tracking and redemption

- Customizable account alerts

- Easy bill payments

Digital Wallet Compatibility

The American Express Explorer Credit Card is compatible with popular digital wallets such as Apple Pay and Google Pay. This allows cardholders to make contactless payments using their mobile devices, providing a convenient and secure way to shop.

Redeeming Your Rewards

The flexibility in redemption options is one of the standout features of the American Express Explorer Credit Card. Cardholders can enjoy their rewards in various ways, making the most out of their card usage.

Travel Redemptions and Flight Bookings

One of the most popular redemption options is travel. Cardholders can redeem their points for flights, hotel stays, and other travel-related expenses. The American Express travel portal allows users to book travel arrangements easily, with options to redeem points or pay with a combination of points and cash.

- Redeem points for flights with various airlines

- Book hotel stays and other travel accommodations

- Use the American Express travel portal for easy booking

Gift Cards and Australian Retailers

For those who prefer not to travel, gift cards are a great alternative. American Express offers a range of gift cards from popular Australian retailers, allowing cardholders to redeem their points for something they or their loved ones will truly appreciate.

Some popular retailers include:

- Coles

- Woolworths

- JB Hi-Fi

Transferring Points to Partner Programs

Another option is to transfer points to partner loyalty programs. This allows cardholders to redeem their points with airlines, hotels, and other partners, further increasing the flexibility of their rewards.

By understanding the different redemption options and their value, cardholders can maximize the rewards earned on their American Express Explorer Credit Card.

How the Explorer Card Compares to Other Premium Cards

In the competitive landscape of premium credit cards, the American Express Explorer Card holds its own against other top-tier cards. To make an informed decision, it’s essential to compare it with other premium options available in Australia.

Versus Other Amex Cards in Australia

American Express offers a range of premium cards, each with unique benefits. Compared to the American Express Platinum Card, the Explorer Card is more affordable with a lower annual fee, but it still offers valuable rewards and travel perks. The Explorer Card’s Membership Rewards program allows cardholders to earn points on their purchases, which can be redeemed for travel, gift cards, or other rewards.

Versus Major Bank Competitor Cards

When compared to premium cards from major banks, such as the ANZ American Express Platinum Card or the NAB Rewards Signature Card, the Explorer Card stands out with its comprehensive travel insurance and $400 annual travel credit. The table below summarizes a comparison of key features:

Conclusion: Is the American Express Explorer Right for You?

The American Express Explorer Credit Card presents a compelling option for Australian cardholders seeking premium rewards and benefits. With its comprehensive rewards program, travel perks, and purchase protections, this card is designed to enhance the financial experience of its users.

When considering the American Express Explorer Credit Card, it’s essential to weigh its features against your lifestyle and financial goals. The card’s $400 annual travel credit, insurance benefits, and digital features make it an attractive choice for frequent travellers and shoppers.

Ultimately, the decision to apply for the American Express Explorer Credit Card should be based on a careful evaluation of its benefits and fees. By understanding how to maximise its rewards and features, cardholders can enjoy a premium financial experience that aligns with their needs.

FAQ

What is the annual fee for the American Express Explorer Credit Card?

How do I earn points with the American Express Explorer Credit Card?

Can I redeem my points for travel bookings?

What insurance benefits are included with the American Express Explorer Credit Card?

How do I access the 0 annual travel credit?

Are there any foreign transaction fees associated with the American Express Explorer Credit Card?

Can I use the American Express Explorer Credit Card with digital wallets?

How does the American Express App support the Explorer Credit Card?

Can I transfer my points to partner programs?

What are the minimum spend requirements for the sign-up bonus?

Conteúdo criado com auxílio de Inteligência Artificial